You can get car finance on an old car—however, a few things to keep in mind if you’re looking to finance an older vehicle.

First and foremost, your interest rate is likely higher than if you were financing a newer car. Lenders see older cars as a higher risk. They depreciate more quickly and are more likely to need repairs.

That said, plenty of options are still available if you want to finance an old car. First, you can use a traditional lender like a bank or credit union as a finance representative. You can use an online car finance broker.

Brokers are usually a good bet if you’re looking for the best interest rate, as they can access various lenders. However, make sure you compare a few different options before making a decision.

The best way to get car finance for an old car is to shop around and compare your options. Then, with a bit of research, you should be able to find a good deal that suits your needs.

How Old of a Car Can You Finance?

It usually depends on a few factors, such as the type of lender you use and the vehicle’s current market value.

If you finance a car through a traditional lender, such as a bank or credit union, they may restrict how old of a car you can finance. However, other lenders, such as online car finance brokers, may be willing to finance a car of any age. So it depends on the individual lender and the vehicle’s current market value.

Comparing multiple offers is always a good idea when shopping for a car loan to ensure you get the best deal possible. And, if you’re financing an older car, research to ensure you’re getting a loan with favorable terms that suits your monthly budget. You can also avail of monthly payments or monthly instalments with lower monthly repayments in a reputable dealer or panel of lenders in CarFinanceMarket.co.uk. Initial deposit and driving license may be a requirement from some finance providers. Your personal details are needed for your personal contract hire purchase car finance deal. A car finance calculator is being used to calculate or check the best deals and rates of the new or used car loan early. To avoid unsecured personal loan, review the contract up to the end of the agreement and avail only reputable UK dealership of your new car finance deals.

How Old Can a Used Car Be To Get Car Financing?

If you’re looking for used car financing, the age of the vehicle may play a role in how easy it is to get a loan.

Generally, traditional lenders (like banks or credit unions) may be more hesitant to finance older used cars because it tends to depreciate more quickly and may need more repairs.

However, plenty of options are available if you want to finance an older used car. For example, you could use an online car finance broker.

Can I Finance a Vehicle Older Than 10 Years?

It’s possible to finance a vehicle older than ten years, but finding a lender willing to do so may be more difficult.

That said, there are still plenty of options available if you’re looking for vehicle finance. First, you can use a traditional lender like a bank or credit union. Or, you can use an online car finance broker.

Brokers may be a good bet if you’re looking for the best annual interest rate, as they can access various lenders. However, make sure you compare a few different options before making a decision.

The best way to get financing for an older vehicle is to shop around and compare your options. With a bit of research, you should be able to find a good deal that suits your needs.

How Does Financing an Old Car Work?

Financing an old car works in much the same way as financing a newer car. The process will vary depending on your lender, but the basics are typically the same.

You’ll need to fill out an application and provide information about yourself and the vehicle you’re looking to finance. The lender will then check your application and make a decision. Next, you’ll receive a loan agreement outlining the financing terms if approved. Make sure you check this agreement carefully before signing anything.

Once you’ve signed the loan agreement, the lender will expend the funds, and you can use them to purchase the car.

Remember that financing an old car may be more complicated than funding a newer one. That’s because older cars tend to depreciate more quickly and may need more repairs.

Therefore, it’s essential to do your research and compare your options before financing a car. With a bit of effort, you should be able to find a lender that’s willing to give you financing on an older car.

How Can I Get Car Finance Online?

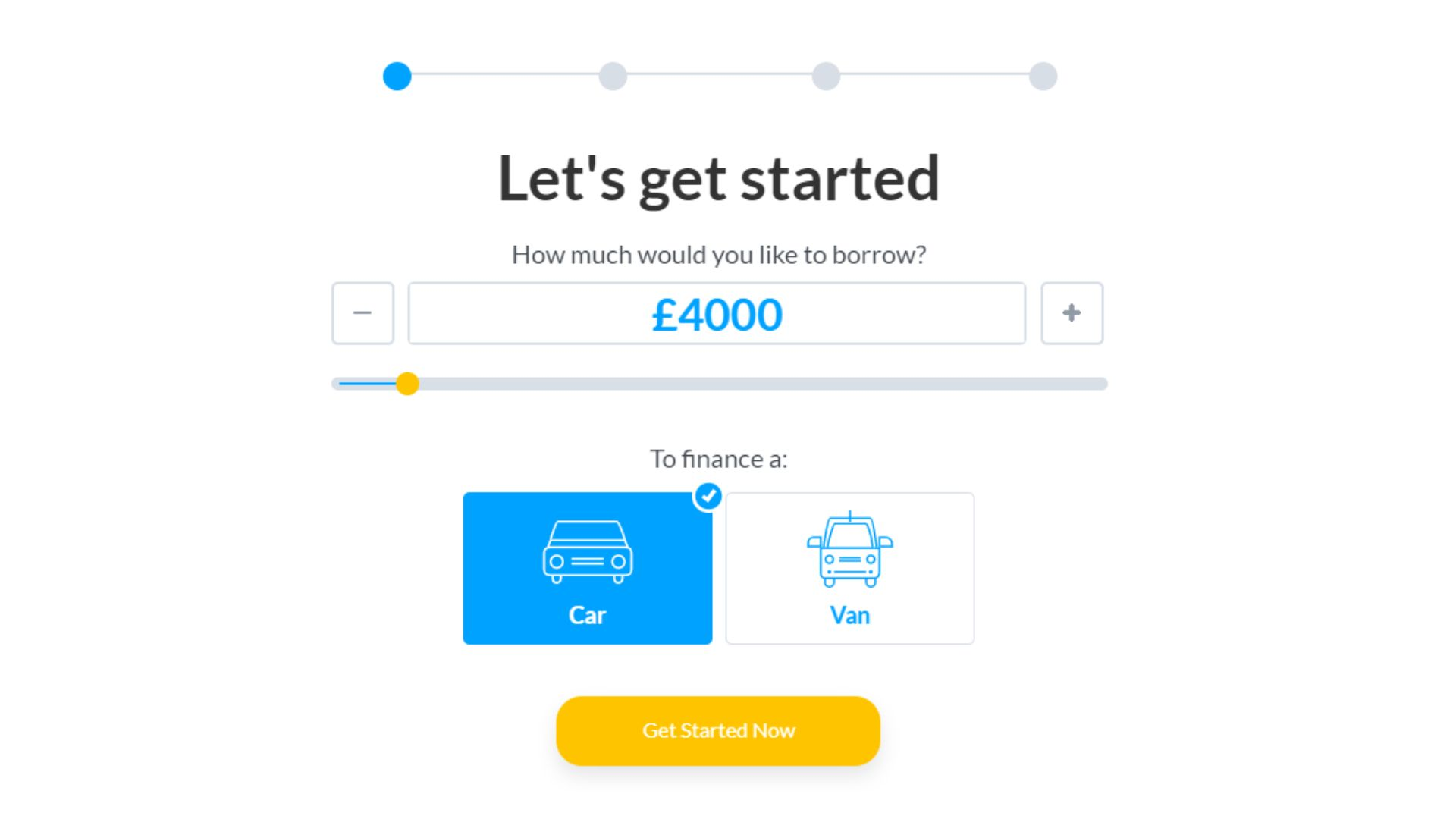

There are a few different ways to get online car finance. One option is to use an online car finance broker.

A broker can help you compare loan offers from different lenders and find the best deal for your needs.

Another option is to apply for a loan directly with an online lender. Many online lenders specialize in car loans, so you should be able to find one that meets your needs.

Once you’ve found a lender, you’ll need to fill out an application and provide information about yourself and the vehicle you’re looking to finance.

The lender will then review your application and make a decision. Finally, you’ll receive a loan agreement drafting the financing terms if approved.

Make sure you scrutinize this agreement before signing anything. Once you’ve signed the loan agreement, the lender will pay the funds, and you can use them to buy the vehicle.

Online car finance is a great way to get a loan for your next car. By shopping around and comparing your options, you can find a great deal that meets your needs. CarFinanceMarket.co.uk is an excellent resource for finding online car finance.

What is the Best Car Financing for Used Cars in UK?

The best car financing for used cars in UK depends on a few factors. First, you’ll need to decide whether you want to finance through a bank, credit union, or online lender.

Each option has its pros and cons, so it’s essential to compare them before deciding.

Once you’ve chosen a lender, you’ll need to fill out an application and provide information about yourself and the vehicle you’re looking to finance. The lender will then review your application and make a decision.

You’ll be given a loan agreement outlining the financing terms if approved. Make sure you review this agreement carefully before signing anything.

What Does Car Finance Company Require for Car Finance in UK?

Car finance company UK based typically require a few things before approving car finance. First, you’ll need to fill out an application and provide information about yourself and the vehicle you’re looking to finance.

The lender will then review your application and make a decision. Finally, if approved, you’ll acquire a loan agreement outlining the financing terms.

Ensure you review this agreement carefully before signing anything. The lender will disburse the funds once you’ve signed the loan agreement, and you can use them to purchase the car.

What Are The Best Car Finance Deals for Used Cars?

The best car finance deals for used cars vary depending on a few factors. You’ll need to decide whether you want to finance through a bank, credit union, or online lender.

Each option has its pros and cons, so it’s essential to compare them before deciding. Once you’ve picked a lender, you must fill out an application and provide information about yourself and the car you’re looking to fund. The lender will then check your application and make a decision.

Thoughts

If you’re looking to finance car near me, CarFinanceMarket.co.uk is an excellent choice. CarFinanceMarket.co.uk is a great resource for finding car finance. You can compare your options and find the best deal for your needs. Review any loan agreement and personal contract purchase PCP before signing to avoid surprises down the road. Then, with careful research, you can find fantastic types of car finance options for your next car.