There are a few lenders who will offer no deposit car finance to those who are unemployed. However, the interest rates and monthly payments on these loans will be much higher than those offered to people with a job. So it’s important to shop around and compare rates before you commit to any loan.

It’s also important to remember that you should never borrow more money than you can afford to pay back. So make sure you factor in your monthly expenses when calculating how much you can afford to borrow for a car. And be realistic about your ability to make loan repayments, even if you’re currently unemployed.

Remember, it’s always important, to be honest about your credit history and employment status when applying for car finance. This way, you can ensure that you’re applying for the right loan and that you have the best chance of being approved.

How To Secure a Car Finance No Deposit Agreement For Self-Employed?

First and foremost, it’s important to have a good credit score in order to be approved for a car finance no deposit agreement. Additionally, it’s helpful if you can provide proof of income and/or assets. If you’re self-employed, you’ll need to provide your most recent tax return as well as your business registration documents.

Car finance no deposit agreement is a type of loan in which the borrower does not have to put down a cash deposit. This can be helpful for self-employed individuals who may not have the cash on hand to make a down payment.

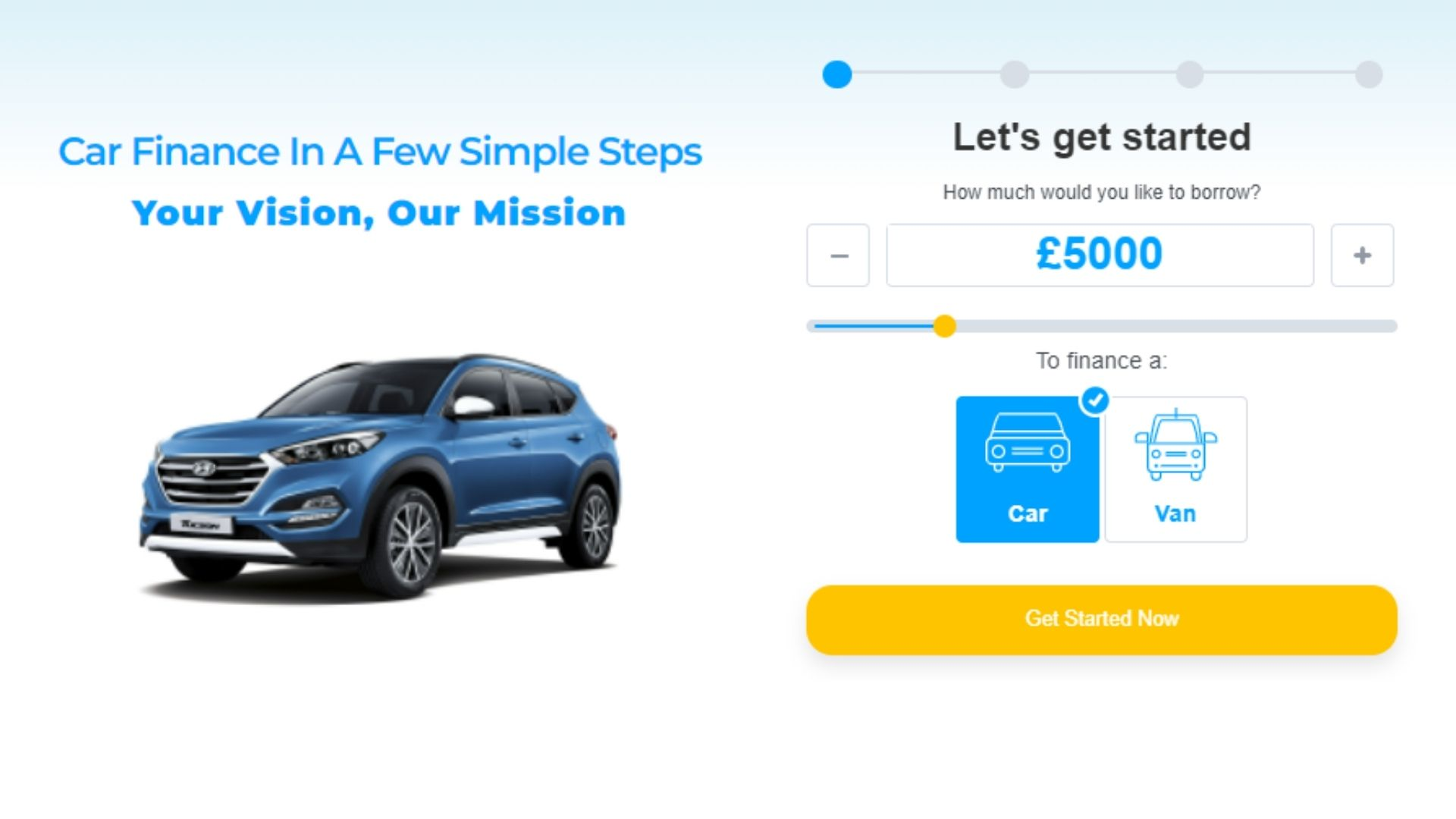

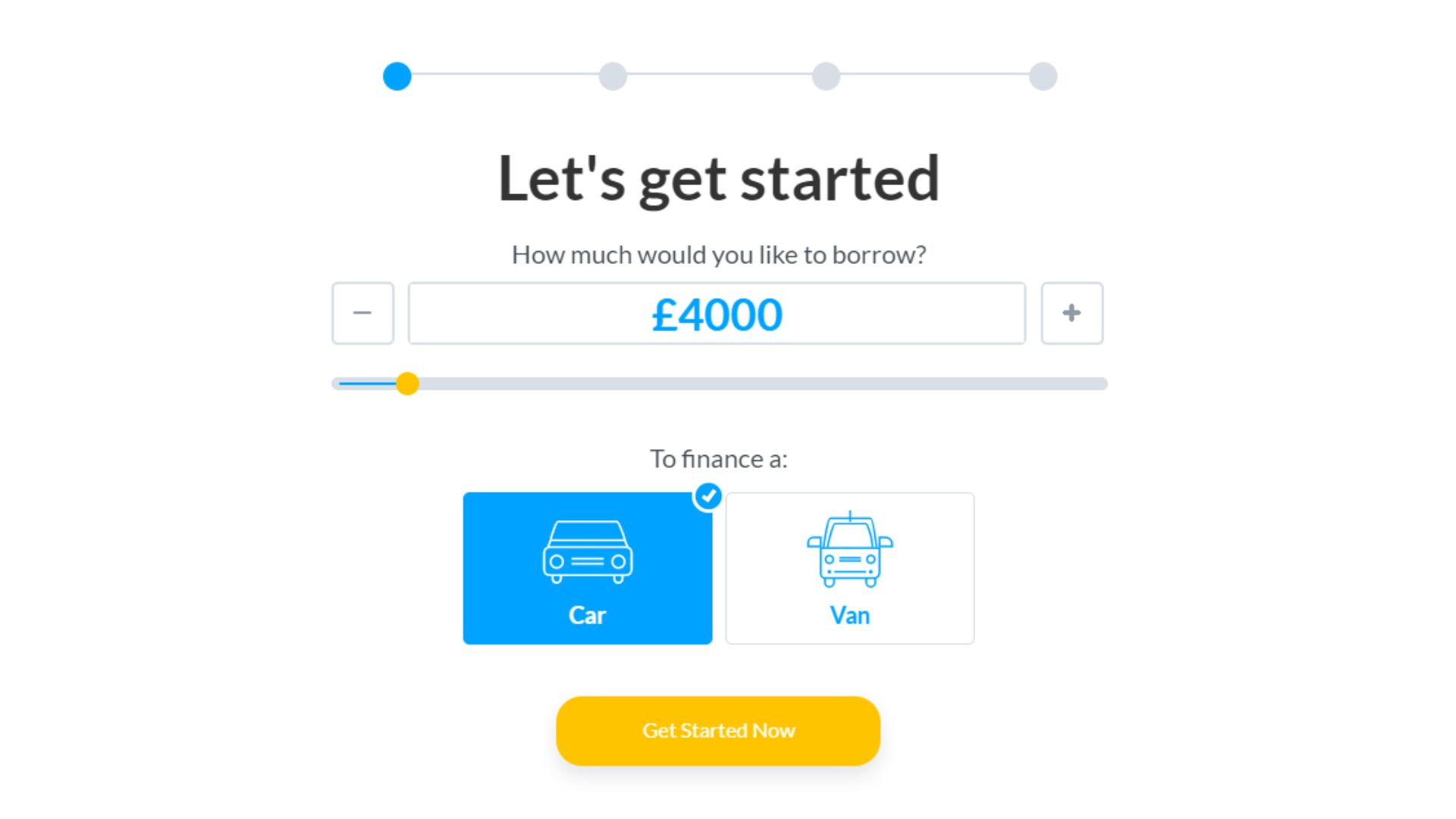

When applying for a car finance no deposit agreement, be sure to compare interest rates and terms from different car finance lenders. Also, be sure to have a clear idea of how much you can afford to pay each month so that you do not get into debt trouble. Comparison shopping and careful budgeting are key when securing any type of loan.

What Credit Score Needed To Get Car on Finance With No Deposit?

The credit score needed to get a car on finance with no deposit varies depending on the lender and the specific loan terms. However, in general, you will need a good to excellent credit score to qualify for this type of financing. Additionally, some lenders may require a down payment even if you have good credit, so it’s important to shop around and compare offers before deciding on a loan, or lender. If you have decided that you would like to finance your car without a down payment, start by checking your credit score and then shopping around for lenders that offer this type of financing.

A credit score of at least 580 is typically needed to get a car on finance with no deposit. However, the interest rate you’ll receive will be higher than if you had a higher credit score.

If your credit score is below 580, you may still be able to get a car on finance with a down payment of 10-20%. This will help to lower your interest rate and monthly payments.

How To Improve Score To getting Car Finance With 0 Deposit?

One way to improve your score to get car finance with 0 deposit is to choose a shorter loan term. The longer the loan, the lower the monthly payments, but the greater the total interest you will pay over the life of the loan. A shorter loan will have higher monthly repayments, but you will save money on interest overall. You can also consider a car leasing agreement, which may be more flexible than traditional finance options. Whatever option you choose, make sure you shop around and compare rates before making a decision.

One thing you can do is get a copy of your credit report and review it for errors. You can dispute any errors that you find on the report, and this will help to improve your score.

You can also try to increase your credit limit by asking your creditors for a raise. This will help to boost your score, as it will show that you’re capable of managing more debt.

Finally, make sure that you’re always paying your bills on time and in full. This will help to improve your credit score over time.

What Car Finance No Deposit Options Are Available To Unemployed People in the UK?

There are a number of car finance no deposits options available to unemployed people in the UK. One option is to apply for car finance in the UK through a specialized lender. Many of these lenders offer affordable loans specifically for people who are unemployed. Another option is to find a friend or family member who is willing to act as a guarantor on your loan. This means that they will be liable for repaying the loan if you default on it. Finally, some dealerships may be willing to offer financing to customers with no deposit required. However, this will usually only be available on new cars and may come with a higher interest rate. Ultimately, there are a number of options available for those who are unemployed and looking to finance a car.

How Hard is it To Get No Deposit Car Finance With Bad Credit?

Bad credit car finance can make it difficult to get approval for a car loan, but it is possible to find lenders who will work with you. One option is to look for no-deposit car finance deals, which can be especially helpful if you have a limited monthly budget.

There are a few things to keep in mind when searching for no deposit car finance with bad credit. First, remember that the interest rates will likely be higher than on a traditional loan. You’ll also need to research the terms and conditions carefully, as some lenders may require that you make regular payments or put down a larger deposit before approving the loan.

Can I Tailor My 0 Deposit Car Finance Deal?

When considering whether or not to finance a car, most people think in terms of either putting down a large chunk of cash upfront or borrowing money from a bank or other lender. However, there is a third option worth considering: a 0 deposit finance deal.

Much like traditional financing, 0 deposit car deals allow you to spread the cost of your vehicle over an agreed-upon loan period of time, usually two to five years. The main difference is that with 0 deposit car finance, you don’t need to put any money down when you first purchase your vehicle. That can be a significant advantage if you don’t have a lot of cash available to pay upfront.

Is PCH Arrangement Good For Car Finance With 0 APR and No Deposit?

There are a few things you should consider before signing up for a PCH arrangement. When you are looking for car finance 0 APR no deposit, make sure you understand the terms and conditions of the agreement. Second, be aware that by signing up for a PCH arrangement, you may be sacrificing certain protections offered by other types of car finance agreements. For example, if something goes wrong with your car and it needs repairs, you may not be able to get the same level of assistance if you have a PCH arrangement as opposed to, say, an Hire Purchase agreement. Finally, always shop around to compare deals before committing to any car finance agreement. You may be able to find better terms elsewhere.

Another thing to keep in mind is that most PCH deals come with no deposit, which can be tempting if you don’t have much money saved up. However, this also means you’ll end up paying more for your car over time.

Who Offers Car Finance No Deposit Deal With Insurance?

There are a number of car finance companies that offer no deposit deals, and many of them also include insurance in the overall cost of the loan. So it really just depends on what company you go with and what specific deal they are offering.

One thing to keep in mind is that when you borrow money to purchase a car, you will be paying back not only the cost of the car but also the interest on the loan. So it’s important to shop around and find the best car finance that offers no deposit. Otherwise, you could end up paying quite a lot in interest over the life of the loan.

Conclusion

It is possible to get cheap car finance deals with no deposit even if you are unemployed. However, the terms and conditions of such an arrangement may be less favorable than those offered to people who are in employment. You may also find it harder to secure a car finance no deposit deal if you have bad credit. Nevertheless, there are providers who offer these types of deals so it is worth shopping around for the best offer available to you. Don’t forget that you can always tailor your car finance agreement to suit your needs so don’t be afraid to ask questions about the different car finance options available to you.