Several financing options are available for used vans, depending on the age and condition of the van. The best choice for financing a used van is usually through a dealership selling used vans. Dealerships typically offer various van financing options, including loans from central banks and credit unions, as well as in-house financing. In some cases, you may also be able to get van financing through a private lender.

If you’re looking to used van finance, looking around and comparing rates from different lenders is essential. Be sure to read the fine print and understand the loan terms before signing anything. And remember, just because you can get van financing for a used van doesn’t mean you should. Make sure you can afford the monthly payments and be prepared for any repairs or maintenance that may be needed down the road.

How to Apply for a Van Loan in the UK?

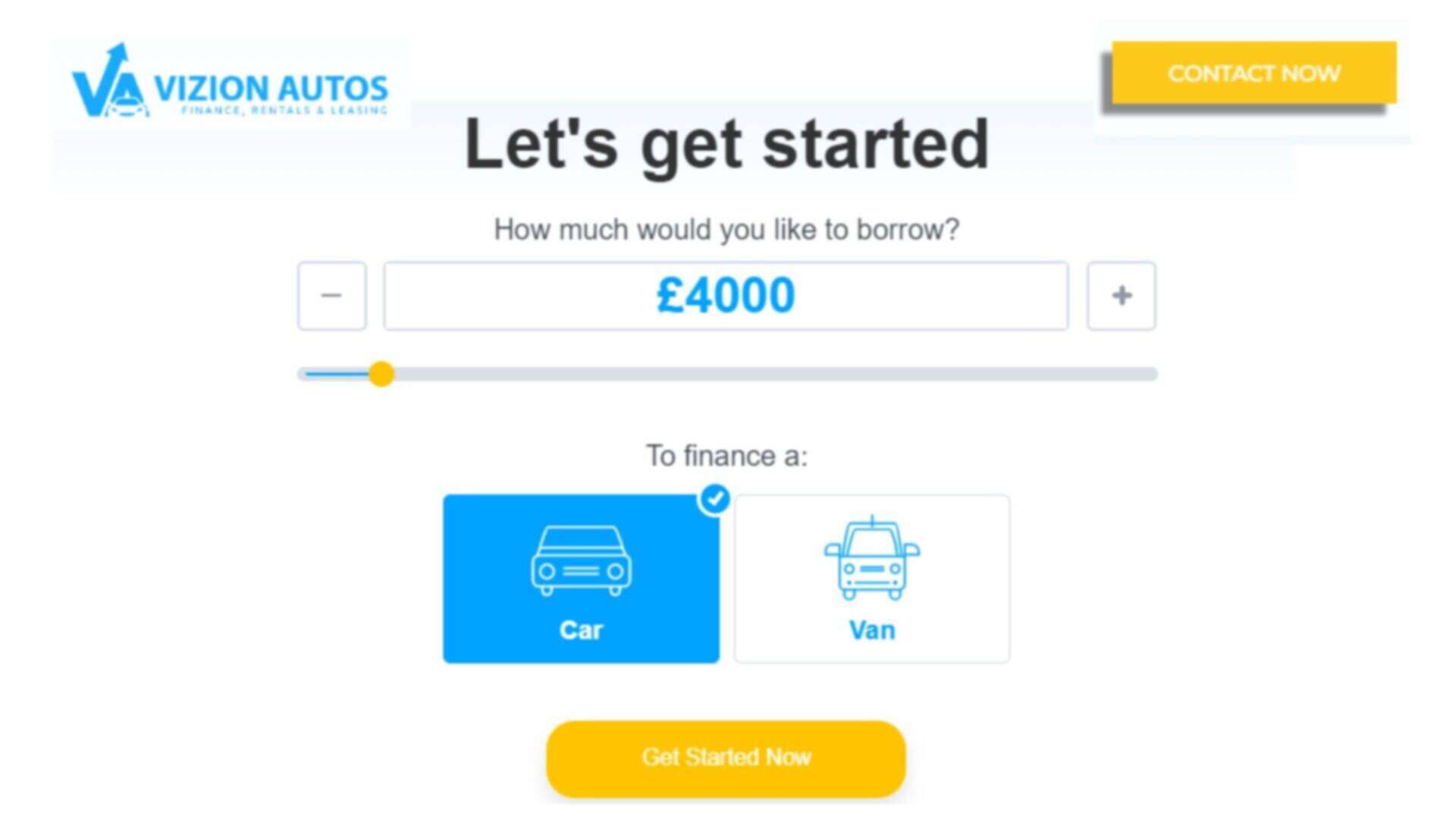

Getting a van loan in the UK is simple and easy, provided that you meet the eligibility criteria set by the lender. The first step is to fill out an online application form with your personal and financial details. Once you have submitted the record, the lender will conduct a credit check and assess your affordability and whether you are self-employed for your monthly installments same with hire purchase.

The interest rate on van loans in the UK is usually fixed, which means that your monthly installment repayments will remain the same for the duration of the loan. Most van loans have a repayment period of between 12 and 60 months, although longer terms may be available.

How Long Can You Finance a Used Van?

The length of time you can finance a used van will depend on the lender, the age and condition of the van, and your credit history. Typically, loans for used vans have shorter terms than loans for new vans. This is because lenders view used van finance as more likely to experience mechanical problems or need repairs. As a result, they’re often not willing to finance used vans for more than five years.

When financing a used van, it’s critical to shop around and compare rates from various lenders. Before committing to anything, read the terms and conditions and understand the loan terms. And keep in mind that just because you can finance a used van does not always mean you must. So make sure you can afford the monthly installments and are prepared for significant maintenance or upkeep.

What are the advantages of financing a used van?

There are several benefits to financing a used van. First, it can be easier to qualify for a loan to finance a used van than to finance a new one. This is because the van secures the loan, so the lender has less risk. Second, the monthly payments on a used van loan are often lower than the payments on a new van loan. This is because used vans typically have shorter loan terms than new vans.

When you acquire the vehicle, you can work up your payment schedule with the financing business. You can tailor the length of the contract, the quantity of the payments, and the deposit amount to your specific needs. Furthermore, these accords are adaptable and can be tailored to the driver’s needs as long as they know exactly what they agree to. Finally, used van on finance can help you build up your credit history, which can be beneficial if you plan to finance a more significant purchase in the future.

What are the disadvantages of financing a used van?

There are also some disadvantages to financing a used van:

- The van itself may have more wear and tear than a new van. This can lead to higher repair and maintenance costs down the road.

- Used vans may not have the same features and benefits as new vans.

- If you finance a used van with a variable interest rate loan, your monthly payments could increase if interest rates go up.

It’s essential to weigh the pros and cons carefully before financing a used van. Be sure to compare rates from multiple lenders and read the terms and conditions of the loan carefully. When shopping for good financing deals on a van, whether for personal or professional usage, ensure you thoroughly inspect it and understand what you’re receiving. There are plenty of used vehicles for sale, so don’t make a hasty decision. Instead, take your time to test drive it, look beneath the hood, and look for signs of wear and tear. Similarly, look around for used van financing packages until you discover one that fits your demands and budget.

What is the longest you can finance a used van?

The time you can finance a used van depends on the lender, the vehicle’s age and condition, and your credit history. Used van loans typically have shorter terms than new van loans. This is because lenders believe that secondhand vans are more likely to have mechanical issues or require repairs. As a result, they rarely finance used vans for more than five years. However, the most extended loan term available is usually seven years or 84 months. On the other hand, some lenders will offer used automobile financing for 92 or 96 months or up to eight years.

What is the interest rate on a used van?

The interest rate on a used van loan is determined by the lender, the age and condition of the vehicle, your credit rating history, not having bad credit van finance experience, and the loan term.

Because lenders assume that used vans are more likely to have mechanical faults or require repairs, used van loans often have higher interest rates than new van loans. Some used van finance deals, on the other hand, have cheap interest rates. Therefore, it’s critical to compare rates from several lenders in arranging guaranteed van finance options.

Is it worth it to get financing for a used van?

A used van might be an excellent way to develop your company, but it can also be a costly investment. If you need to finance the purchase of your used van, there are a few things to consider before committing.

Consider all of the charges associated with financing your used van first. This covers the loan’s interest rate and any other expenses related to the van finance. You should also evaluate if you will require insurance coverage for your new vehicle and any maintenance or repair costs that may arise over time. Second, consider how much money you have to spend on this type of purchase to see if it makes financial sense for you. Finally, assess if financing a used van is worthwhile based on how long you expect to keep it and what maintenance bills you might incur over the years.

How To Choose Finance Deals For Used Vans?

There are numerous factors to consider when it comes to financing used vans. The interest rate is the essential element as van finance guides. It also applies for personal contract hire and personal contract purchase van loan.

Before making a decision, make sure to compare rates from several lenders’ panels. It’s also critical to examine the loan’s terms and conditions thoroughly. The loan length, the van’s age, and condition, and your credit history are all considerations to consider. Don’t make a hasty judgment because there are many used cars available. Instead, take your time testing it out, looking under the hood for signs of wear and tear.

Likewise, shop around for used van financing options until you find one that meets your needs and matches your budget.

Thoughts

If you’re considering used van finance, than brand new vehicles, there are a few things to consider. First, view all of the fees associated with the funding of your vehicle. This covers the loan’s interest rate as well as any extra expenses.

You should also consider if you will require insurance coverage for your new vehicle and any future maintenance or repair charges. Second, consider how much money you have to spend on this type of buy to see if it’s feasible. Finally, consider whether financing a used automobile is the best option, depending on how long you plan to keep it and what maintenance costs you expect to pay over time for outstanding finance.