If you’re self-employed, it can be difficult to get van finance. Many lenders are hesitant to give loans to people who are self-employed, because there is a higher risk of default. However, there are some lenders who will work with you, as long as you have a good credit score and can provide proof of income. In this blog post, we will discuss the options available to you if you want to get van finance while being self-employed.

What Credit Score Needed to Finance a Van?

If you’re self-employed, the credit score needed to finance a van may be higher than if you were employed by someone else. This is because lenders see self-employment as a higher risk. However, if you have a good credit score and can provide proof of income, you should be able to get van finance from most lenders. In general, lenders prefer consumers in the prime category or higher, therefore a credit score of 661 or higher is required to qualify for most conventional vehicle loans.

If you’re looking for van finance, the first place to start is with your bank or credit union. Many banks and credit unions have programs specifically for self-employed individuals. If you don’t have a good relationship with your bank or credit union, you may want to look into online lenders. There are many online lenders who are willing to work with self-employed individuals.

What Van Finance Deals Can a Self-Employed Person Get?

If you’re self-employed, the van finance deals that you can get will be similar to the deals that anyone else can get. The main difference is that you may have to put down a larger down payment, and your interest rate may be higher. However, if you have a good credit score and can provide proof of income, you should be able to get van finance from most lenders.

How To Get Van Finance in UK Despite Being Self-Employed?

Self-employed persons work for themselves rather than for an employer, and based on the data, a high share of these people are expected to rely on a van to conduct their business. For self-employed employees, the top three occupation types are construction and building trades, road transport drivers, and agriculture and associated trades – all of which need the use of a van.

If you’re self-employed in the United Kingdom, it can be difficult to finance a van. Many lenders are hesitant to give loans to people who are self-employed, because there is a higher risk of default. However, there are some lenders who will work with you, as long as you have a good credit score and can provide proof of income.

You may check your credit score with the three major credit bureaus: Experian, Equifax, and TransUnion. Lenders examine your vehicle finance application based on the information stored by these organizations, so be sure it’s correct.

Your credit report will contain financial information about existing loans, overdrafts, loan defaults, and even finance applications you have made. Examine it thoroughly. Even something as insignificant as a cell phone contract tied to an outdated address might have a negative influence on your credit score.

Make sure you’re on the electoral roll, which means you’re registered to vote, as this can help your credit rating. Unlink any joint accounts that you no longer use, and make sure to pay your loan and credit card bills on time. Setting up direct debits to guarantee you never miss a payment is also a good idea.

Moreover, most lenders will require bank statements for the previous three months and a proof of earnings SA302 form. You will also need to provide evidence of employment history for the last three years. Any self-employed income must go into a bank account in your or your partner’s name.

What is a Good Finance Rate For a Van?

The average van loan interest rate is around eight percent. However, the actual interest rate you’ll get will depend on your credit score, the type of van you’re buying, and the lender you choose.

If you have a good credit score, you should be able to get a van finance with an interest rate of six percent or less. However, if you have a bad credit score, you may have to pay an interest rate of ten percent or more.

There are a few things you can do to get a lower interest rate on your van loan. One is to choose a van that’s not too expensive. The less money you borrow, the lower your interest rate will be.

You can also try to get a van loan from a credit union. Credit unions are nonprofit organizations, so they may be willing to give you a lower interest rate than a bank.

Finally, you can try to negotiate with the lender. If you have a good credit score and a strong income, you may be able to get a lower interest rate by negotiating with the lender.

How Long Can You Finance For a Van?

The maximum van finance term is usually five years, but some lenders will let you finance for longer. The interest rate on a van loan is usually fixed, so you’ll know exactly how much your monthly payments will be.

If you’re buying a used van, you may be able to get a shorter loan term. This is because used vans are usually less expensive than brand new vehicles or vans, so you won’t have to borrow as much money.

Before you apply for van finance in UK, it’s a good idea to compare interest rates and terms from different lenders. This way, you can make sure you’re getting the best deal possible.

What Do Van Finance Company Require For Van Finance?

In order to get van finance, you’ll need to provide the lender with some information about yourself and your van. The lender will use this information to decide whether or not to give you a loan.

First, you’ll need to provide proof of income. This can be in the form of bank statements, tax returns, or pay stubs. The lender will use this information to determine how much money you make and whether or not you can afford the van loan.

You’ll also need to provide proof of employment history. This can be in the form of W-two forms, pay stubs, or tax returns. The lender will use this information to verify that you have a steady income and are likely to be able to repay the van loan.

Finally, you’ll need to provide a down payment. The amount of the down payment on van for finance will vary depending on the lender, but it’s usually between ten and twenty percent of the van’s purchase price. The down payment shows the lender that you’re serious about buying the van and that you have the financial means to do so.

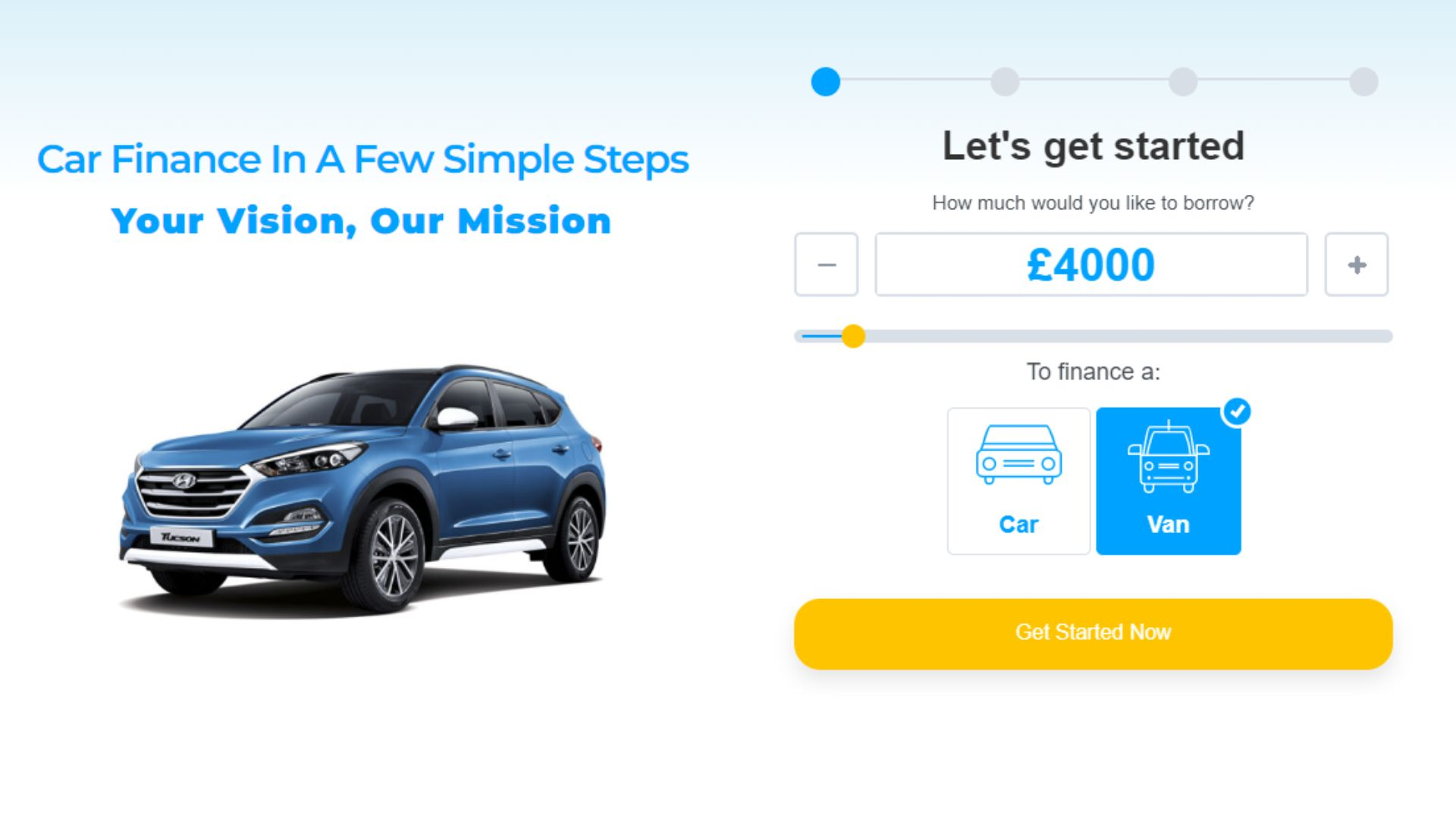

If you’re looking for van finance, Car Finance Market is a great option. We offer competitive interest rates and terms, and we’re here to help you get the van you need. Contact us today to learn more about our van finance options.

What Do You Need to Finance a Used Van?

If you’re looking to finance a used van, there are a few things you’ll need to do. First, you’ll need to gather some documents. The lender will need to see your proof of income and employment history. You’ll also need to provide a down payment.

The down payment to finance a van is usually between ten and twenty percent of the van’s purchase price. This shows the lender that you’re serious about buying the van and that you have the means to do so.

Once you have all of your documents in order, you can start shopping for van finance. It’s a good idea to compare interest rates and terms from different lenders before you choose one. This way, you can make sure you’re getting the best deal possible.

If you have any questions about van finance, Car Finance Market is here to help. We offer competitive rates and terms, and we’re always happy to answer any questions you may have. Contact us today to learn more about our van finance options.

Can I Buy a Van on Finance Even I’m Self-Employed?

Yes, you can buy a van on finance even if you’re self-employed. There are a few things you’ll need to do in order to get van finance, but it’s definitely possible. Car Finance Market offers van finance to self-employed individuals. We understand that it can be difficult to get van finance when you’re self-employed, so we’re here to help.

We offer competitive interest rates and terms, and we’re always happy to answer any questions you may have. Contact us today to learn more about our van finance options and check out our van finance guides. We look forward to helping you get the van you need!

Thoughts

To summarize, even if you are self-employed, there are various options for obtaining van finance. You have the option of applying to lenders, but you must keep certain things in order and pitch yourself to them.

Another alternative is to do PCH (Personal Contract Hire) or lease a van, or you can go with Hire Purchase. If you plan to use the vehicle for both employment and investment, PCP (Personal Contract Purchase) is the best option.

However, if you only intend to use the van for work, a used van will suffice. Vans are diverse and adaptable for work, so select one that is compatible with your business and future objectives.

Van finance is the same as car finance, however acquiring a work vehicle has additional perks. When buying a van on credit to support your business, make sure it’s spacious enough, economical enough to keep costs low, and dependable enough to rely on when you need it. While obtaining bad credit van finance may be more difficult, it is still possible.

Car Finance Market, is not a lender but a group of highly professional brokers and we offer guaranteed van finance, competitive rates, flexible terms, and a variety of financing options. We understand that self-employed people often have a harder time getting van finance. That’s why we work with a number of different lenders to make sure you can get the van you need. Arranging finance with us has never been easier so contact us today to get started.