It’s possible to settle HP finance early, but some penalties may be involved. It’s best to check with your lender to see their policy on an early settlement before making any decisions. Generally speaking, the earlier you pay off the loan, the more you’ll save in interest and fees. However, in some instances, keeping the loan until it’s fully paid off may make more sense. Ultimately, the decision is up to you and should be based on your financial situation.

To pay off your loan early, you must speak with your provider and request a settlement amount. This is the total that you must pay to pay off your debt, including any penalties for making an early repayment. The lender will determine these fees based on the amount you owe.

How Do I End My HP Car Finance Early?

If you want to end your HP car finance agreement early, you will need to pay the entire outstanding balance on loan, plus any early repayment fees that may apply. These fees are typically a few percent of the remaining balance. However, once you have paid the loan in full, you will own the car outright and can do with it as you please.

Remember that you will still be responsible for making all of your regular monthly payments until the loan is paid off in full, even if you pay it off early. So, if you are considering paying off your HP car finance agreement early, ensure you have the funds available.

What is a Hire Purchase Agreement on a Car?

A hire purchase agreement is a type of car finance that allows you to spread the cost of a new vehicle over an agreed period, typically between two and four years. You will make fixed monthly payments during this time, after which the car will be yours to keep.

With a hire purchase agreement, you will usually be required to pay a deposit of around 10% of the car’s value upfront. The remaining balance, plus interest, will then be spread over the term of the agreement. You will own the car outright at the end of a hire purchase agreement. However, you may have the option to make a final ‘balloon’ payment to reduce the interest you pay over the agreement term.

Hire purchase agreements are typically used to finance new cars, although they can also be used to finance used cars.

Can You Pay Off a Hire Purchase Agreement Early?

You can pay off early. However, some penalties may be involved, so it’s best to check with your lender beforehand. Generally speaking, the earlier you pay off the loan, the more you’ll save in interest and fees. However, in some instances, keeping the loan until it’s fully paid off may make more sense. Ultimately, the decision is up to you and should be based on your financial situation before signing the hire purchase contract.

If you want to pay off your hire purchase agreement early, you must speak with your provider and request a settlement amount. This is the total that you must pay to pay off your debt, including any penalties for making an early repayment. The lender will determine these fees based on the amount you owe.

Once you have paid the loan in full, you will own the car outright and can do with it as you please. However, remember that you will still be responsible for making all your regular monthly payments until the loan is paid off in full, even if you pay it off early.

How Do I Get Out of a Hire Purchase Car Agreement?

You must pay the entire loan sum and any early repayment penalties if you want to cancel a hire-purchase car arrangement. Usually, a small percentage of the outstanding balance is charged as these costs. However, after the loan is fully repaid, the car is yours entirely, and you are free to do what you want with it. Therefore, make sure you have the money available until final payment for hire purchase finance if you’re considering paying off your hire purchase car agreement early.

How to Choose Hire Purchase Deals?

To get the best deal on a hire purchase hp car agreement, it’s essential to compare different offers from various lenders. Use an online comparison tool to get an idea of the multiple deals available, and make sure you read the small print carefully before applying.

It’s also important to consider the length of the agreement, as this will affect how much you pay in total. Shorter terms tend to have higher monthly payments but will save you money in the long run.

Finally, make sure you can afford the monthly repayments and that you are comfortable with the idea of owning the car at the end of the agreement. Hire purchase agreements are a great way to finance a new car, but they’re not for everyone.

What Finance Company Offers The Best Car HP Deals in the UK?

Many hire purchase car finance companies offer great deals on car hire purchase agreements in the UK with great hp agreement for car outright. However, comparing different offers is essential, and so is reading the small print carefully before applying. Some of the best deals can be found with online comparison tools.

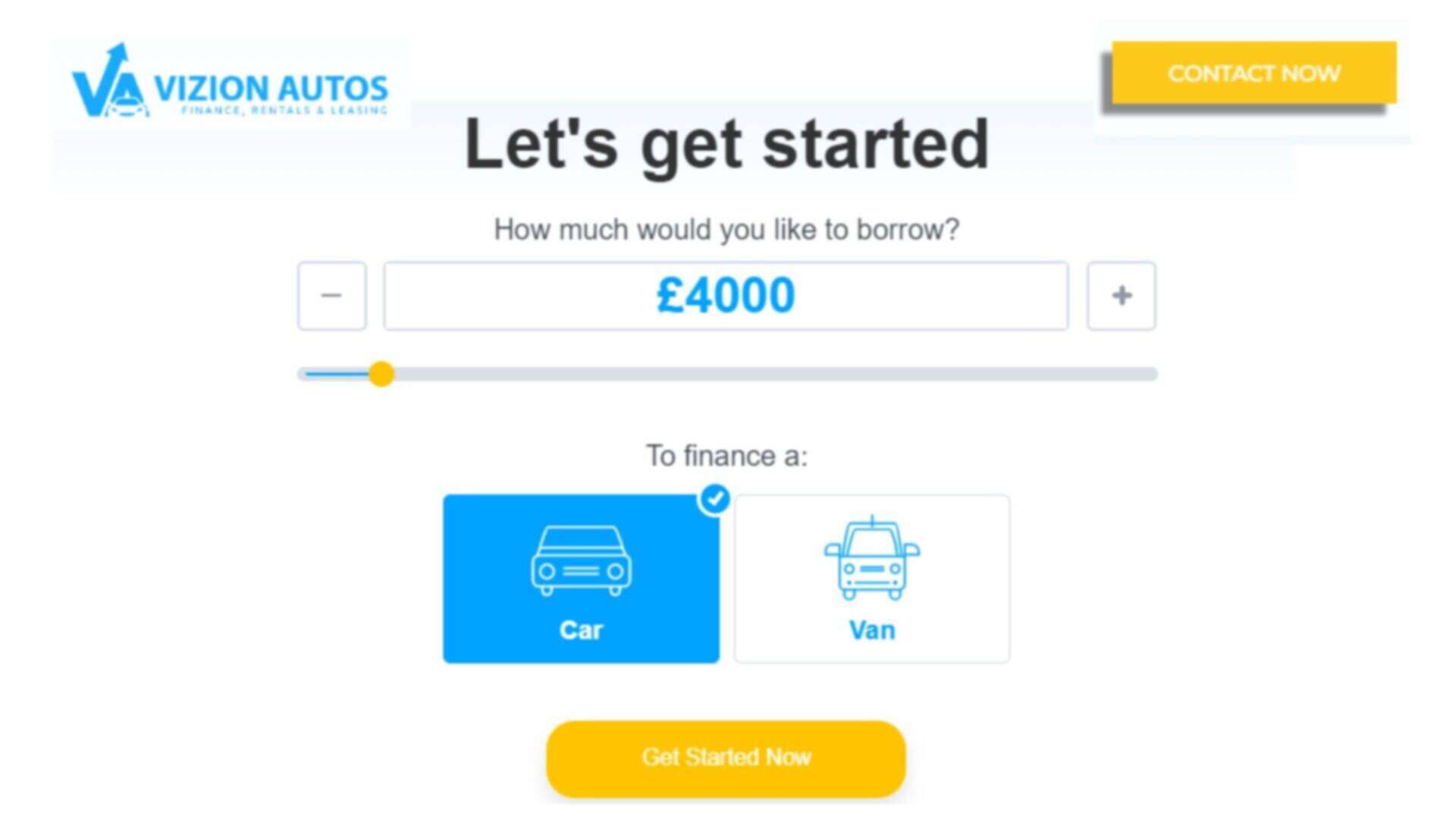

With Car Finance Market, you can get an instant quote on a new or used car hire for the purchase fee and monthly instalments for the purchase finance agreement. Enter your desired monthly budget, and we’ll show you the best deals and compare hire purchase deals from a panel of lenders.

What is an example of hire purchase?

Hire purchases are widespread in industries like manufacturing, engineering, freight, and construction that use expensive equipment. It can also be applied to small-scale assets, such as corporate cars or mobile phones. People can also enter into hire purchase agreements for their use. Cars are the objects of personal use hire purchase agreements most often.

In hire purchase, you agree to acquire the item and pay for it over a specified time in installments of the finance company. If you don’t make your payments as agreed, the lender may take possession of the item as collateral for the loan. Massive purchases like cars or equipment are frequently financed through hire purchase or personal contract purchase.

What Happens at the End of the Hire Purchase Agreement?

A hire purchase or conditional sale agreement can be terminated in writing at any time, and the goods must be returned. If you cannot make the payments or no longer require the items, this may be helpful. However, until the agreement is terminated, you are responsible for paying all owed installments. Therefore, after the contract, you will have completely paid off the car’s balance and own it that is how hire purchase work for personal loan.

You should be able to continue using your car, typically as long as you have paid off the entire debt during the agreement. You will own the car outright at the end of the hire purchase agreement. The final payment is known as the balloon payment,” and it’s usually a lump sum paid at the end of the term.

You can pay this off in one go or roll it into your next finance agreement. However, remember that you will still be responsible for making all your regular monthly payments until the loan is paid in full, even if you pay it off early.

Conclusion

If you’re considering paying off your hire purchase agreement early, make sure you have the money available. It’s also important to consider the length of the contract, as this will affect how much you pay in total. Shorter terms tend to have higher monthly payments but will save you money in the long run.

Finally, make sure you can afford the monthly repayments and that you are comfortable with the idea of owning the car at the end of the agreement. Hire purchase agreements are a great way to finance a new car, but they’re not for everyone. Comparing different offers is essential, and so is reading the small print carefully before applying. Some of the best deals can be found with online comparison tools.

With Car Finance Market, you can get an instant quote on a new or used car hire purchase agreement and show you car finance calculator to show your possible monthly repayments. Enter your desired monthly budget, and we’ll show you the best deals from our panel of lenders.