It will increase your overall debt burden and alter your credit utilization ratio, which could result in a slight decline in your credit score. There is no payment history if the loan has only recently been established, but if you make your first few payments on time, a modest reduction in credit score should be rapidly reversed.

Even if you’re completing your payments on time, having too many credit agreements (including in-store financing or hire-purchase) will harm your credit rating. That’s because when determining whether to lend, lenders may consider the entire credit you have access to and the total amount you owe. In the end, getting a car loan won’t help you develop credit, but you can utilize it to raise your score.

What Are the Advantages and Disadvantages of HP Finance?

There are several advantages to using HP finance when purchasing a car. For starters, it can help spread the cost of the vehicle over a more extended period, making it more affordable. It can also be used to purchase a higher-priced car than you might be able to afford with a traditional loan or cash purchase.

There are also a few disadvantages to consider. One is that you may end up paying more for the vehicle in interest over the life of the loan. Another is that your car could be repossessed if you default on payments. Finally, HP agreements can sometimes be more challenging to get approved for if you have bad credit.

Also, be aware that some hire purchase agreements include a balloon payment at the end of the loan term. This is a lump-sum payment you’ll need to make to own the vehicle outright. If you’re not prepared for it, it could cause financial hardship. Before entering into any loan agreement, be sure to research and understand all the terms and conditions. This will help you avoid any unpleasant surprises down the road.

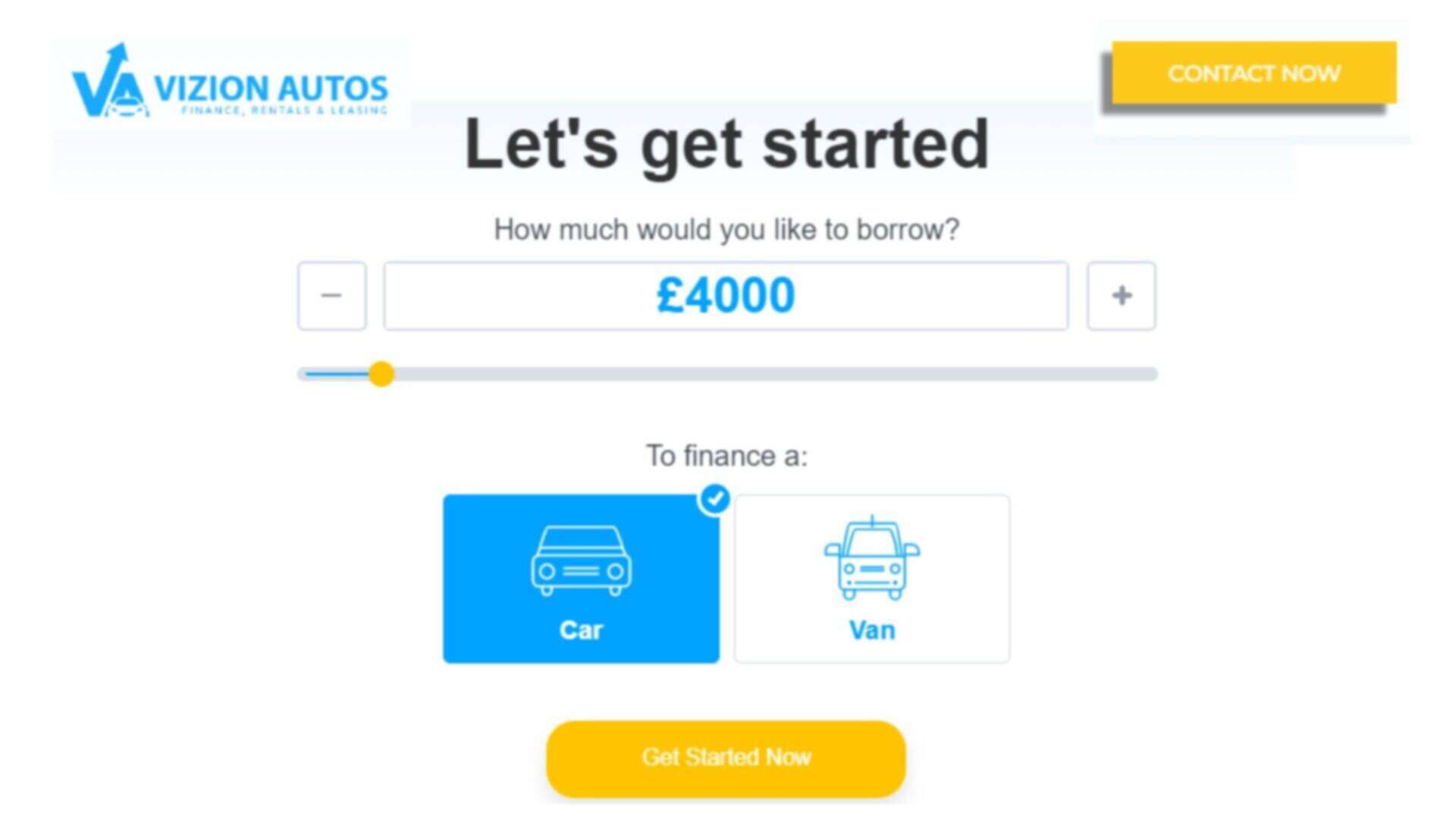

How To Use The HP Car Finance Calculator?

To use the HP car finance calculator, enter the amount you want to borrow, the interest rate, and the loan term. The calculator will then show you your monthly repayments and the total cost of the loan. You can use the HP car finance calculator to compare different loan options and find the one that best suits your needs. Be sure to enter the same interest rate and term for each loan to compare the options accurately. When you’re ready to apply for a loan, shop around and compare offers from multiple lenders. This will help you get the best interest rate and terms for your loan.

Does HP Finance Require a Credit Check?

Most HP finance companies will require a credit check. This is because they need to assess your creditworthiness before approving you for a loan. A credit check will show the lender your credit history and help them decide if you’re a good candidate for a loan. If you have bad credit, you may still be able to get approved for HP financing. However, you may need to put down a larger deposit or agree to a higher interest rate.

Hire purchase agreements can sometimes be more challenging to get approved for if you have bad credit. Just be aware that some hire purchase agreements include a balloon payment at the end of the loan term. This is a lump-sum payment you’ll need to make to own the vehicle outright. If you’re not prepared for it, it could cause financial hardship. So, before entering into any loan agreement, be sure to research and understand all the terms and conditions.

Is Hire Purchase on Cars Better Than a Loan?

Hire purchase (HP) is a credit agreement where you pay an initial deposit followed by monthly payments. At the end of the contract, you own the car outright. HP agreements are often used to finance car purchases.

On the other hand, loans are lump-sum payments that you repay over time with interest. You own the car outright from the start with a loan.

Both HP finance and loans have their pros and cons. HP may be a good option if you can’t afford to pay for a car outright or if you want to spread the cost of a more expensive car over time. On the other hand, loans may be a better option if you’re sure you can afford the monthly repayments and if you want to own the car outright from the start.

Do You Own the Car After a Hire Purchase?

You fully own the vehicle at the end of a hire purchase arrangement. This means you are free to sell, exchange, or retain the item for as long as you like. Ensure you do your finance agreement work and comprehend all the terms and conditions like the purchase fee, monthly instalments and car dealer purchase cost before signing a hire purchase agreement. By doing this, you can avoid any unpleasant surprises in the future.

Can You Sell a Car on Hire Purchase?

If the loan is a hire purchase, the lender is the legitimate owner of the vehicle until the final payment is completed, so you cannot sell the automobile until the loan is paid off. Such an automobile can only be sold if the loan is paid early.

You can sell a car on hire purchase if you find a buyer who is willing to take on the agreement. The new owner will then make the remaining payments to the finance company. Be sure to check with your hp finance company first to see if they allow this. You may also have to pay a transfer fee.

Selling a car with a hire purchase agreement on it is not a crime in and of itself. But when closing the deal, sellers must make sure they follow the law. This is because a car with a hire purchase agreement does not belong to the legal owner whose name it is in. If payments aren’t made, the loan firm that owns it has the right to take it how to hire purchase work.

Is HP Car Finance the Same as Leasing?

Hire purchase (HP) is a type of car finance that allows you to spread the cost of a new or used car over an agreed period. At the end of the agreement, you own the car outright.

Leasing is another type of car finance that allows you to use a car for an agreed period. However, at the end of the agreement, you will not own the car. Instead, you will have to return it to the leasing company.

So, while both HP finance and leasing allow you to use a car for an agreed period, there are some key differences between the two. With HP, you own the car outright at the end of the agreement, while with leasing, you must return the car to the leasing company.

Why is hire purchase car finance popular?

A hire purchase agreement can be a great way to receive it immediately while spreading the cost out over a pre-determined period of time. When the period is over and all funds have been repaid, this asset financing strategy results in a monthly payback and transfers ownership to you.

By opting for a hire purchase deal when looking to finance a new or used car, you effectively become the owner of that vehicle once all repayments have been made. This is in contrast to taking out a personal loan or entering into a personal contract purchase (PCP) agreement, where the vehicle technically belongs to the finance company until all agreed-upon payments have been made. Additionally, hire purchase deals can be taken out on new and used cars( with mileage restrictions), giving you greater flexibility when choosing your ideal set of wheels.

Conclusion

Hire purchase agreements can be a good way to finance a car purchase, but there are some things to keep in mind before you sign on the dotted line. Your credit score may be impacted if you don’t make the payments on time for your hire purchase. If you’re considering a hire purchase, make sure you do your homework and comprehend all the terms and conditions before signing a contract.

Many consumers decide to finance their purchase with a hire purchase agreement while looking for a new or used car. With this kind of financing, you can spread out the cost of the car over a predetermined length of time, and after the contract, you will have full ownership of the vehicle.

If you don’t make the payments on time, a hire purchase may lower your credit score, but this shouldn’t stop you from checking into it when you want to buy a car.