Typically people who are looking to get car finance are at least 18 years old (since this is the legal driving age in most countries). Additionally, most lenders will require that borrowers have a full-time job and a steady income in order to qualify for a loan. So if you’re not employed or don’t have a regular source of income, it may be difficult to get approved for car financing. Ultimately, the best way to determine if you’re eligible for car finance is to speak with a lender directly and see what their requirements are.

What Is The Best Age To Get Car Loan Finance?

What is the best age to get a car loan finance? There are many factors to consider when taking out a car loan, and age is one of them. Here are a few things to think about when deciding if now is the right time for you to finance a new car.

Credit History: A big factor in taking out a loan – whether for a car or anything else – is your credit history. If you have a long and strong history of making payments on time, you’re more likely to get approved for a loan and get better interest rates. So, if you’re young and just starting to build your credit, it may be better to wait until you have a few more years of history under your belt.

Your income and employment stability: Generally speaking, the higher your income and the more stable your employment, the easier it will be to qualify for a car loan. If you’re still in school or just starting out in your career, you may have a harder time qualifying for a car loan than someone who is further along in their career.

Can Students Get a Car on Finance?

Getting a car on finance is definitely an option for students! While there may be some restrictions based on your age and credit score, there are a number of lenders who work with students to help them get behind the wheel.

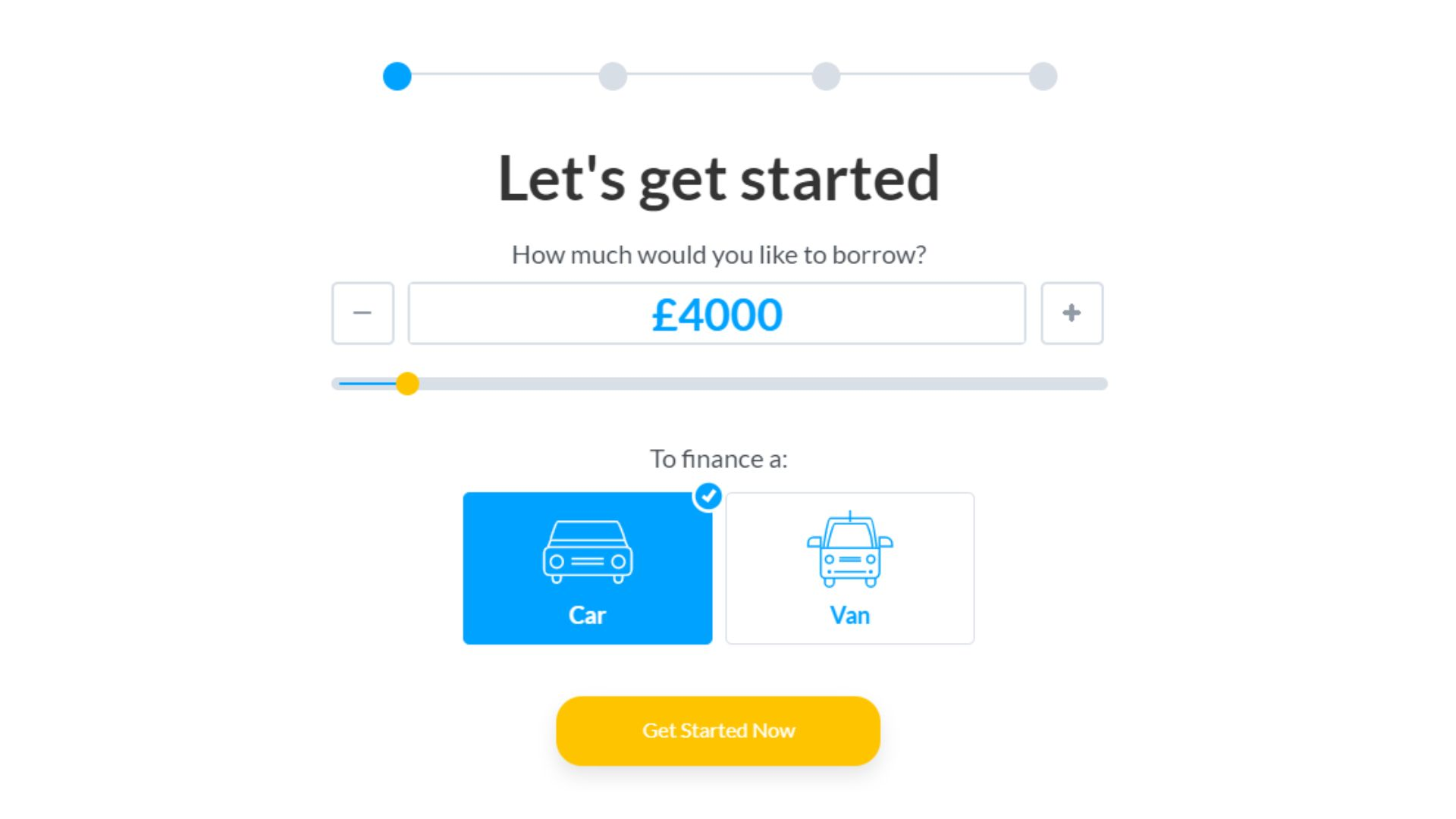

The first step is to research your finance options and compare interest rates, repayment terms, and any other relevant factors. Car finance is also important to calculate how much you can afford to spend each month on car payments – remember to factor in things like fuel, insurance, and maintenance costs. Once you’ve narrowed down your choices, you can start the application process with a lender.

Typically, students will need to provide proof of income, residency, and age as well as a valid driver’s license.

Can I Finance a Used Car Even If I’m 18?

While the minimum age to finance a car through most dealerships is 21, it is possible to find a lender who will work with you if you’re younger. Even if you’re still in high school, you might be able to finance a used car as long as you have a job and can show that you have the ability to make regular payments. Keep in mind, however, that financing a car at a young age can be more expensive in the long run since lenders perceive young borrowers as being at higher risk. If you’re not sure whether or not you should finance a used car, consider speaking with a financial advisor to get unbiased advice.

Lenders typically require that borrowers be at least 18 years old and have a steady income. You’ll also need to have a good credit score and be able to afford the monthly payments. If you can meet these requirements, you should be able to used car finance.

How To Get Car Finance as a Student?

There are a few options available to students who want to finance a car. The best option depends on your credit history and income.

If you have good credit, you can apply for an auto loan at a bank or credit union. You may also be able to get a great interest rate by applying for a car loan through the dealership where you’re buying the car.

Another thing to keep in mind is the terms of the loan. Students often times have limited credit histories, so lenders may be more hesitant to give them loans with long terms or high-interest rates. It’s important to shop around and compare offers from different lenders before settling on one.

What Types of Car Finance Deals Are Available For Students?

There are a few different car finance deals that are available for students. One option is to get a loan from a bank or credit union. Another option is to lease a car. And finally, you could also purchase a car with cash.

Each of these options has its own benefits and drawbacks, so it’s important to carefully consider which option would be the best for you. For example, if you decide to take out a loan to purchase a car, you’ll need to make sure you’re able to afford the payments. On the other hand, leasing a car can be a more affordable option in the short term, but you’ll need to return the car at the end of the lease finance agreement.

The most common type of car finance deal is a personal contract purchase (PCP). With a personal contract, you agree to borrow money from the dealer in order to purchase car finance. You then have to pay back the money that you borrowed, plus interest, over a set period of time. At the end of the monthly repayments period, you can either choose to keep the car and pay off the remaining balance, or hand it back to the dealer and walk away.

How To Improve Your Score For Car Finance Loan as a Student?

There are a few things students can do to improve their odds of securing a car finance loan. First, build up a strong credit score. Providers will typically check this metric before approving a loan, so aim to establish good credit habits for car loans early on. Next, shop around for the best interest rate and final payment terms. Be sure to compare offers from multiple lenders before making a decision. Finally, consider cosigning with a parent or guardian who has good financial standing. This can increase your chances of getting approved for a personal loan and may help you secure a lower interest rate. By following these tips, students can put themselves in a strong position to finance their car loans successfully.

How Can First-time Drivers Find and Secure Car Finance?

There are a few ways to find car finance, but the best way is to go through a reputable broker. A broker will have access to many different lenders and can help you secure the best interest rate and loan terms.

When looking for a broker, make sure you do your research. Read reviews on car finance online and ask friends and family for referrals. Once you’ve found a few brokers you’re interested in, interview them to see if they are a good fit for you.

It’s important to remember that not all brokers are created equal. Make sure the one you choose has your best interests at heart and is willing to work with you to get the best deal possible.

What Is The Best Car Finance For Students?

The best car finance for student drivers would be a plan that offers 0% financing for a certain number of years. This would allow the student to get the car paid off during their college career without worrying about interest payments. Many lenders offer this type of financing, so it is important to shop around and compare rates before making a decision. There are also some private lenders who specialize in student loans, The best car finance option is usually to buy the car outright. so this might be an option to consider as well. Again, it is important to compare rates and terms before making any decisions. There are also some scholarships and grants available that can help with the car finance cost, so it is worth looking into these options as well.

Some of the factors that students should consider when choosing a car finance option include:

-The amount of money they can afford to borrow

-The interest rate and terms of the loan

-The length of the loan term

-The availability of special deals or discounts for students.

Conclusion

The best age for car financing depends on your personal circumstances. However, as a general rule, it is advisable to wait until you are at least 21 years old before applying for car finance near you. This is because most lenders will only offer loans to people who are over the age of 21. If you are a student and need a car for college, there are still options available to you. You can apply for a student car finance deal, which usually has more favorable terms than regular car loans.