Car finance payments are based on the vehicle’s purchase price, loan term, interest rate, and down payment. Therefore, to calculate your car finance payments, you must know all these factors.

The vehicle’s purchase price is the most critical factor in determining your car finance payments. The loan term is also essential, as it will determine how long you have to make payments. The interest rate is also critical, as it will determine how much interest you will pay on the loan. Finally, the down payment is also essential, as it will reduce the amount of money you need to borrow.

To calculate your car finance payments, you will need to know the vehicle’s purchase price, loan term, interest rate, and down payment. Then, you can use an online calculator to determine your car finance payments.

How is Car Finance interest in UK calculated?

Car finance in UK is typically calculated using the simple interest method. This means that the interest on your loan will be calculated based on the principal or the amount you borrowed. The interest rate will be applied to your loan’s outstanding balance, which will determine how much interest you will pay each month.

To calculate your car finance payments, you must know the vehicle’s purchase price, loan term, interest rate, and down payment. Then, you can use an online calculator to determine your car finance payments.

Can I Finance a Car With No Down payment?

A down payment is a lump sum of money that you pay upfront when you take out a loan. The down payment reduces the amount you need to borrow and, therefore, lowers your monthly payments. In most cases, the down payment is 10% of the purchase price of the car.

A down payment is not always necessary when you finance a car. In some cases, the dealer may offer financing with no down payment. However, your interest rate will be higher, and you will have a longer loan term. Therefore, it is essential to consider all these factors before deciding whether or not to finance a car with no down payment.

How Do Car Finance Companies Cut Off Cars?

Car finance companies typically cut off cars when the borrower stops making payments. The borrower may also voluntarily surrender the car to the lender. When the car is cut off, the lender will repo it and sell it to repay the loan.

If you have difficulty making your car finance payments, you should contact your lender immediately. They may be able to work with you to find a solution. For example, they may allow you to extend the loan term or lower the interest rate.

Making late car finance payments can have serious consequences. If you miss too many payments, the lender may repossess your car. This means they will take back the car and sell it to repay the loan. You will also have a negative mark on your credit report, which can make it challenging to get approved for financing in the future.

How Do You Figure Monthly Payments on a Vehicle Finance Loan?

You’ll need the loan amount, interest rate, and loan length to calculate your monthly payments on a vehicle finance loan. You can calculate your monthly payments using an online calculator. The total amount you borrowed from the lender is the loan amount.

The interest rate is the amount of money you will pay in interest over the life of the car finance. The loan term refers to how long you have to repay the loan. Your monthly payment will be determined by the loan amount, interest rate, and loan term. You can use an online calculator to determine your monthly payments.

When Financing a Car, What Insurance Do I Need?

Car insurance is a type of insurance that covers damage to your car in the event of an accident, theft, or other adverse events. It is typically required by lenders when you finance a car. Full coverage insurance generally is more expensive than liability insurance. However, it is required by most lenders.

You will need to have full coverage insurance when financing a car. This insurance covers damage to your car, regardless of who is at fault. It also covers theft, vandalism, and natural disasters. Full coverage insurance is typically more expensive than liability insurance. However, it is required by most lenders.

You can purchase full coverage insurance from an insurance company or dealership. The dealership may offer insurance at a lower rate than an insurance company. However, comparing rates before purchasing insurance ensures you get the best deal.

How To Get A Car Title From A Finance Company?

The lender will hold the title when you finance a car until the loan is paid in full. The title is a document that proves ownership of the car. Once you have paid off the loan, the lender will send you the title.

You can get a car title from a finance company by paying off your loan. The lender will send you the title once the loan is paid off. You can also get a title from a dealership. The dealership will usually provide the title when you purchase the car. If you finance the car through the dealership, they will send you the title once the loan is paid in full.

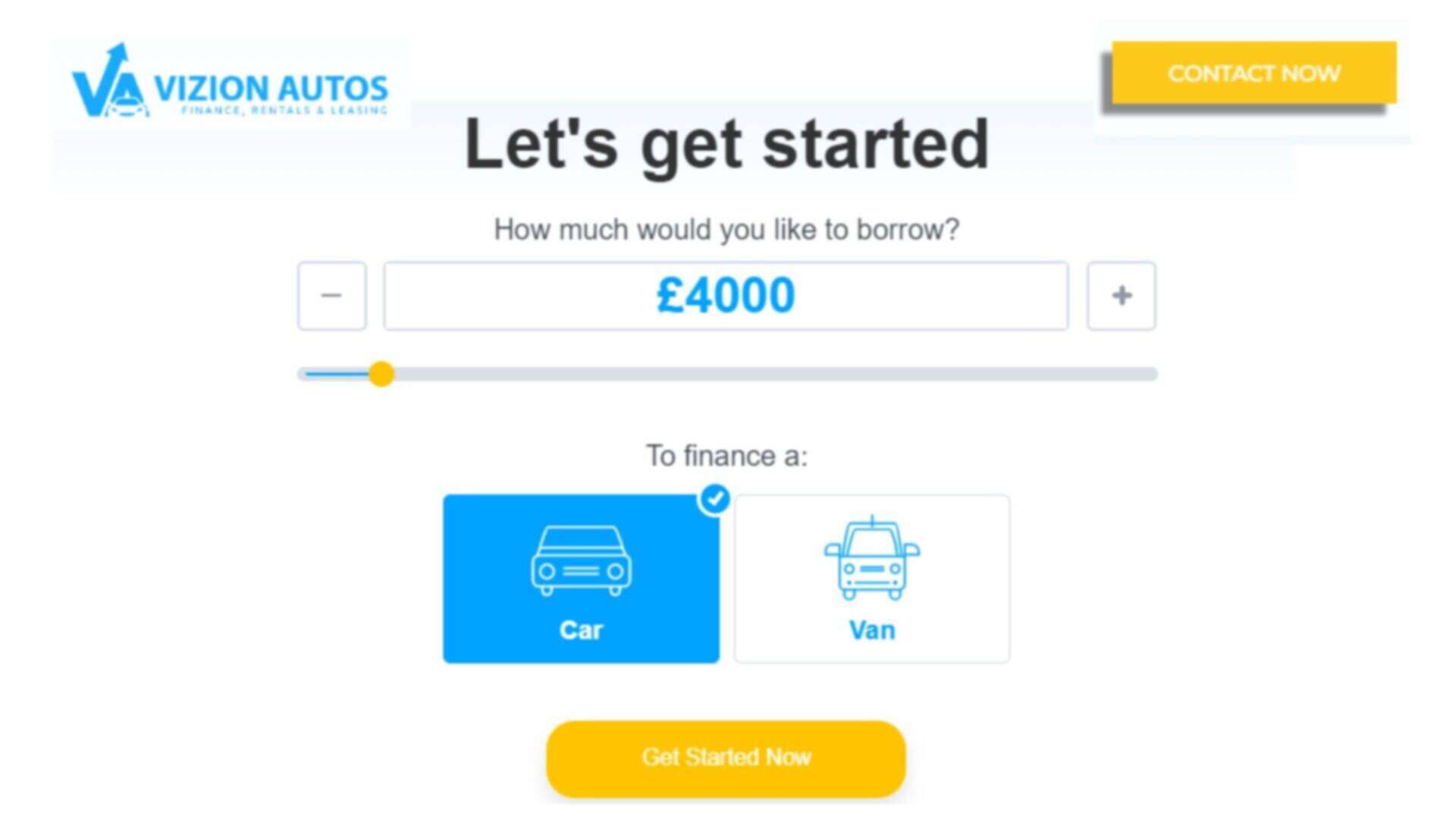

How Can I Get A Quote For Car Finance Online?

You can get a quote for car financing online from several sources. The best way to get a quote is to contact a few different lenders and compare their rates. In addition, some lenders may offer special deals or discounts if you apply for financing online.

When shopping for car finance, comparing rates from multiple lenders is important. This ensures you get the best deal. You can get quotes for car finance online from several sources, such as banks, credit unions, and online lenders. It’s important to compare rates from multiple lenders to ensure you get the best deal. If you decide to get car finance, get a quote at CarFinanceMarket.co.uk now!

What is the best car finance company in UK?

There are many car finance companies in the UK. The best way to find the best company for you is to compare rates and terms from multiple lenders. In addition, some lenders may offer special deals or discounts if you apply for financing online.

Car Finance Market is one of the most reliable car finance companies in the UK, and they offer the best car finance deals with the lowest interest rates. In addition, you can choose your repayment period and make extra repayments without any penalties.

They can provide an auto loan calculator for your monthly car loan payment. The monthly payment is crucial for your auto loans so it will be better if you know it ahead of time as well as with the car price with low interest financing.

Thoughts

Calculating your car finance payments is essential to knowing how much you will need to pay each month. You can use an online calculator to determine your monthly payments. In addition, you should factor in the cost of insurance when financing a car. Full coverage insurance is typically required by lenders and is more expensive than liability insurance. Once you have paid off your loan, you will receive the car title from the lender. You can also get a car title from a dealership. If you finance your car through the dealership, they will usually provide the title once the loan is paid in full. When shopping for car finance, comparing rates from multiple lenders is crucial to ensure you get the best deal. You can get quotes for car finance online from several sources, such as banks, credit unions, and online lenders using auto loan payment calculator. Car Finance Market is one of the UK’s most reliable car finance companies and offers the best car finance deals with the lowest interest rates. In addition, you can choose your repayment period and make extra repayments without any penalties.