When you’re in the market for van finance, it’s important to choose a reputable and reliable company. Several van finance companies are out there, so how do you know which one is right for you? Here are a few things to look for when choosing a van finance company:

– A van finance company should be able to offer you a range of van finance options. There should be something to suit your needs and budget.

– The van finance company should have a good reputation. You can check this by reading online reviews or talking to people who have used their services.

– The van finance company should offer competitive rates. Make sure you compare rates from a few different companies before deciding.

– The van finance company should be able to answer any questions you have about van finance. If they cannot answer your questions, it’s probably best to look elsewhere.

Choosing the right van finance company doesn’t have to be complicated. Just make sure you do your research and compare rates before deciding. With the right van or car finance company, you can get behind the wheel of your dream van in no time!

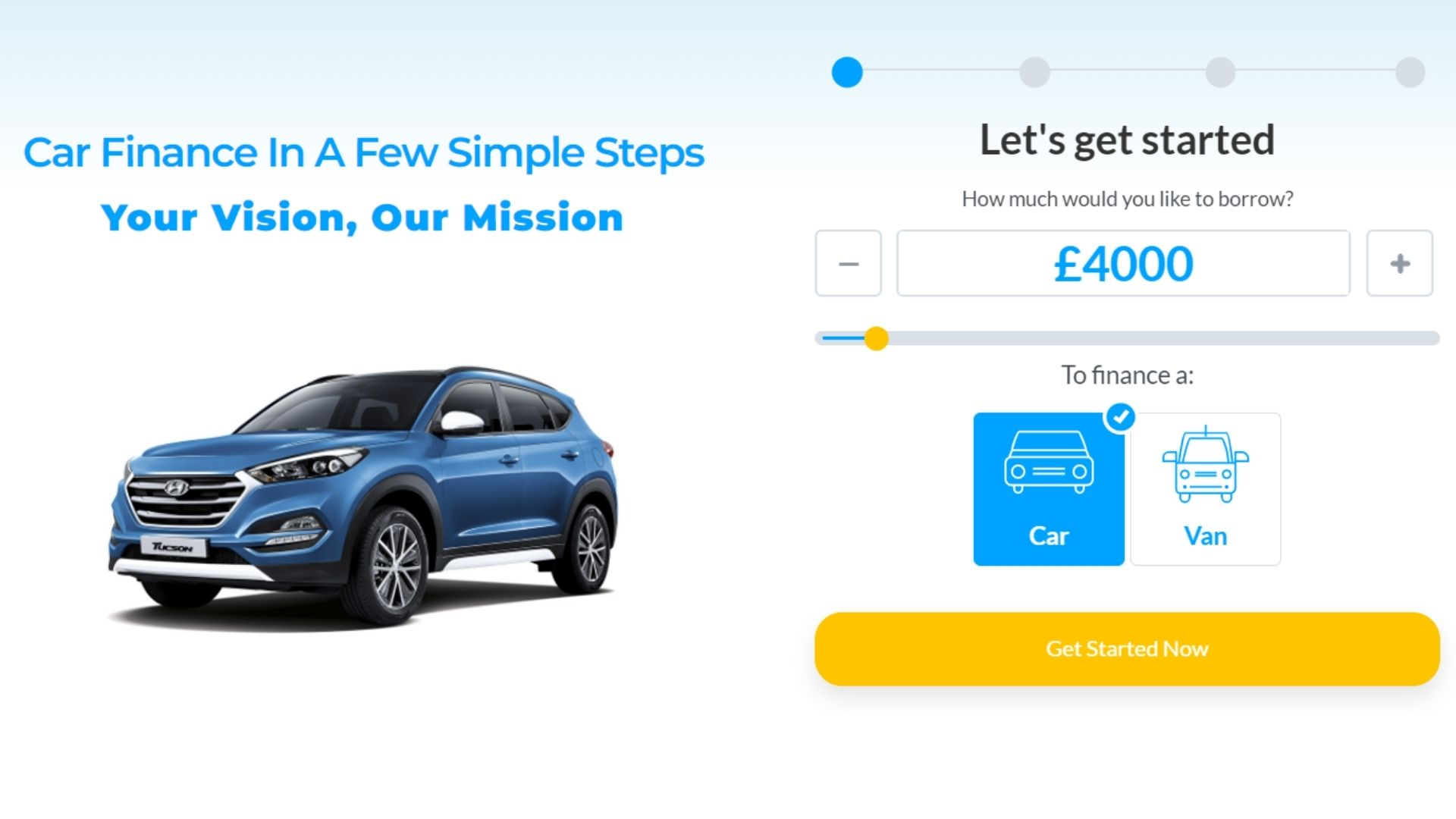

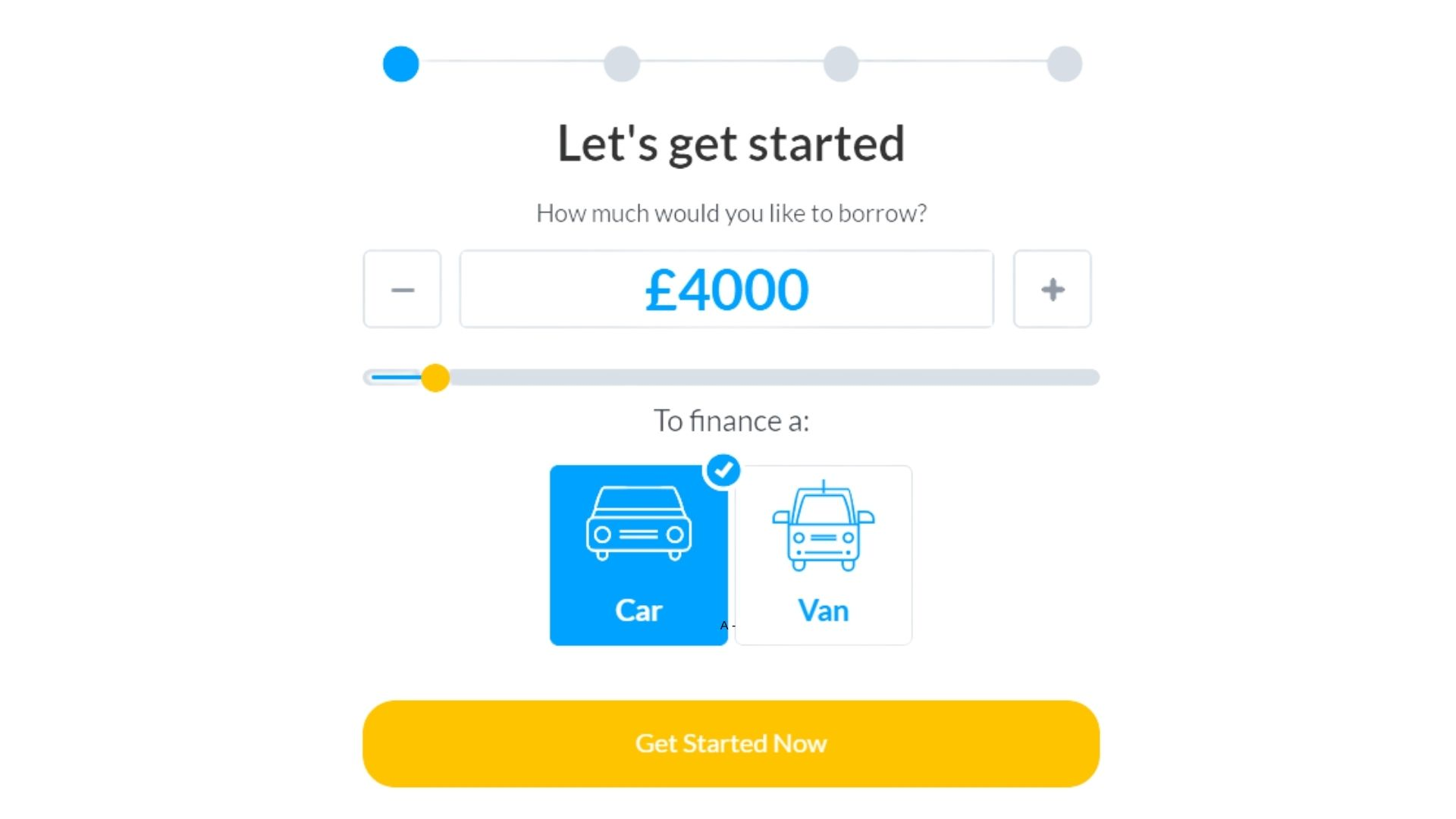

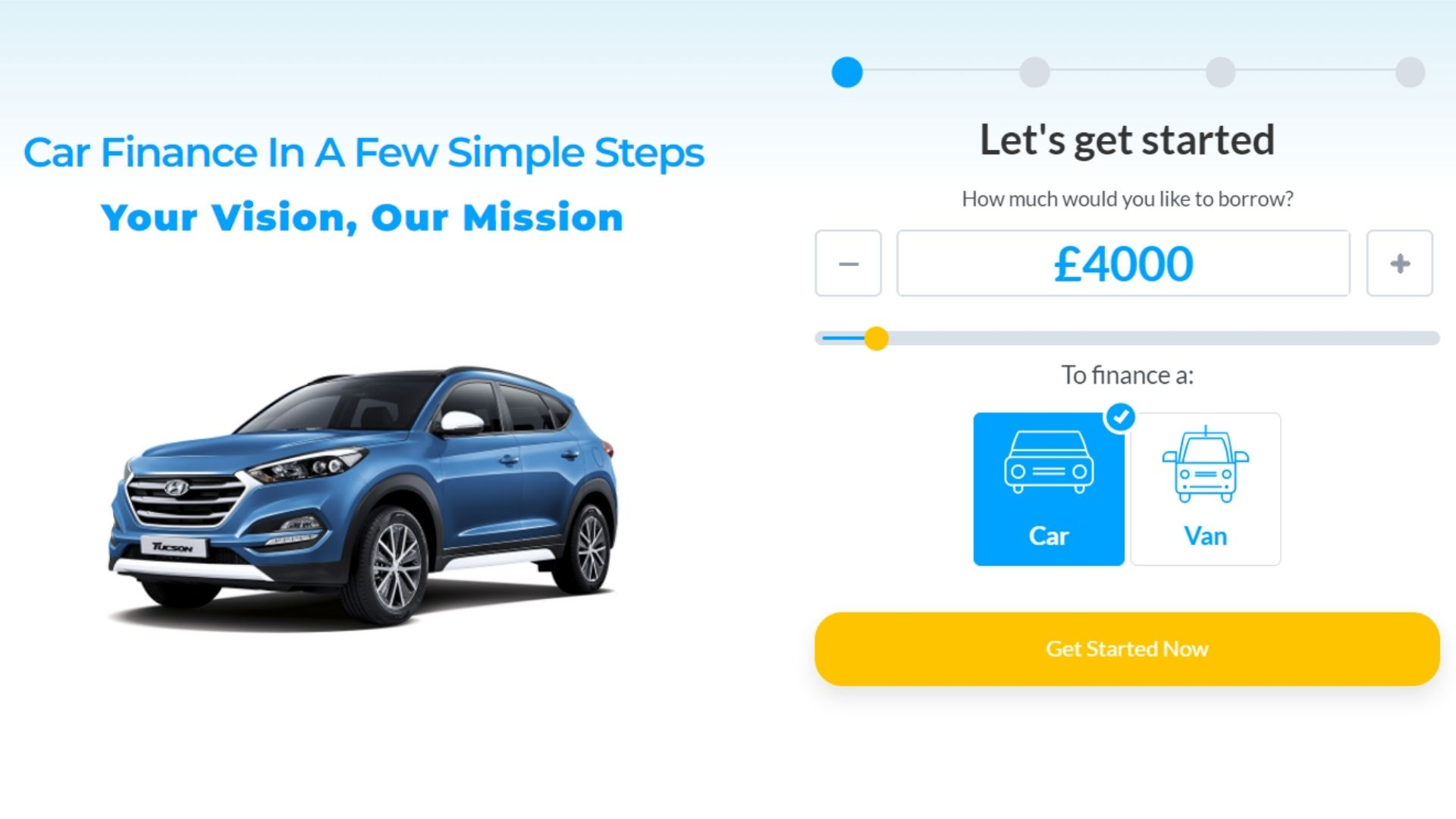

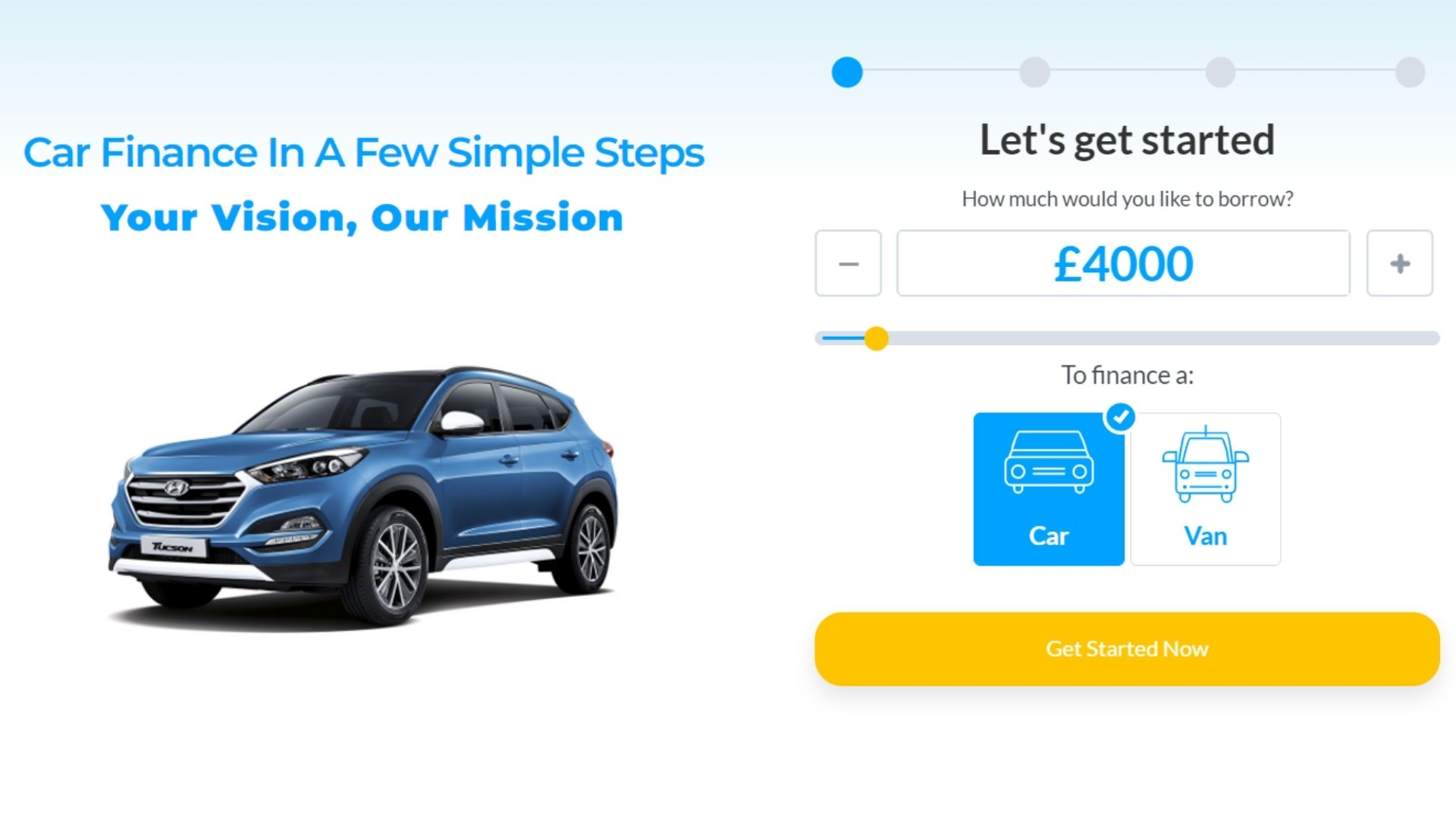

Check CarFinanceMarket.co.uk for the best rates and as one of the guaranteed van finance companies in the UK.

What are the Benefits of Van Finance?

There are several benefits to van finance, including:

Lower upfront costs. Since van finance allows you to spread the cost of your van over an extended period, it can help reduce the initial financial burden. It makes van finance an excellent option for businesses and individuals who want to purchase a van but may not have the available funds upfront.

Convenience. A van finance agreement allows you to pay for your van in monthly instalments, making it easy to manage your budget and stay on top of your payments. Additionally, van financing often comes with flexible terms, so you can choose a payment plan that works well with your current financial situation and needs.

Builds credit. Like any other loan, van finance can help you build your credit score if you make your payments on time and in full. In addition, it can be beneficial down the road if you ever need to apply for van finance or a business loan.

Peace of mind. When you purchase a van outright, it’s essential to think about the potential costs of unexpected repairs or maintenance. However, these expenses are often covered with van finance by your regular and affordable monthly payments.

Therefore, it gives you peace of mind and allows you to focus on running your business without worrying about unexpected costs.

Overall, van finance can help streamline the van purchasing process and make it easier for businesses and individuals to get the van they need.

Will I Have to Pass a Credit Check to Finance a Van?

When you finance a van, the finance company will conduct a credit check to see if you’re eligible for financing. You’re more likely to be approved for finance and get better terms if you have good credit.

However, even if you have bad credit, you may still be able to finance a van. The finance company will consider your credit history and other factors to determine if you’re eligible for finance. In some cases, you may need to provide a down payment or get a cosigner to finance a van.

Some factors can influence your chances of getting approved for van finance, including:

- Your credit score and credit history. As you’re seen as a lower risk to the finance company, an excellent credit score will typically make it easier to get approved for finance. However, if your credit is poor or you have a history of missed payments or other financial issues, it may be more challenging to finance a van.

- Your income and debt levels. The finance company will also consider your income level and debt burden when determining your finance eligibility. Generally, they prefer applicants with a steady income and low existing debt levels.

- The type of van you finance. Some vans may be more difficult to finance than others, depending on the finance company’s policies. For example, luxury vans or those considered high-risk may be more challenging to finance.

If you’re considering financing a van, it’s essential to compare rates and terms from multiple finance companies before deciding. It will help ensure you get the best deal possible and improve your chances of getting approved for finance. Then, with the right finance plan, you can get the van you need and start enjoying its many benefits.

Is Van Finance Available for Both Businesses and Individuals?

Van finance is available for both businesses and individuals, as it can help streamline the van purchasing process while making financing more accessible.

For businesses, van finance can offer lower upfront costs, convenience, the ability to build credit, and peace of mind for unexpected repairs or maintenance.

Individuals may also benefit from van finance by lowering their upfront costs, building credit, and enjoying peace of mind. Though van finance companies will conduct a credit check to see if you’re eligible for financing, programs are available for those with bad credit. Therefore, van finance can be a helpful tool for businesses and individuals looking to purchase a van.

Are There Additional Costs to Take Into Account to Finance Van?

When financing a van, there are several potential costs to consider. These include the down payment, finance fees, interest rates, and maintenance and repair expenses. Additionally, it’s essential to consider your monthly budget and ensure that you’ll be able to meet the regular payments.

To finance van successfully, it’s essential to compare rates and terms from multiple finance companies. It will help ensure you get the best deals and avoid unexpected costs.

With this in mind, I would recommend that before buying your next van, take time out for some research as there may still be other factors that could influence what kind of vehicle suits both needs-such as color or panel type -and style preferences; too!

What are the Disadvantages of Cheap Van Finance?

One of the main disadvantages of cheap van finance is that it can be more challenging to get approved for financing, especially if you have a poor credit history. In addition, cheap van financing may come with higher interest rates and fees, making your monthly payments quite costly.

Additionally, cheap vans are often considered riskier by lenders so they may require a higher down payment or charge higher interest rates. Finally, cheap vans may not be as reliable as more expensive models so you could spend more on repairs and maintenance over time.

Despite these disadvantages, cheap van finance can be a good option for those who need a van but have a limited budget. If you’re considering cheap van finance, make sure to compare rates and terms from multiple lenders before deciding.

And, be sure to consider your monthly budget carefully to ensure that you can afford the payments. But, with careful planning and research, cheap van finance can be a helpful tool to get the reliable van you need.

How Long Can I Finance Van for?

The length of time you finance van will depend on the finance company’s policies and the type of van you’re financing. For example, some finance companies may only finance vans for an agreed period, such as three or five years.

Others may finance vans for up to seven years. And, some finance companies may have different policies for new and used vans. For example, they may finance new vans for up to seven years, but only finance used vans for three or five years.

When considering how long to finance van, it’s essential to think about your needs and budget. For example, if you need a van for work or business purposes, you may want to finance it for a more extended period to pay off the van loan amount over time and continue to use the van.

However, if you only need a van for personal use, you may want to finance it for a shorter period to own it outright more quickly.

Ultimately, the length of time you finance van will depend on your individual needs and financial situation. But regardless of how long you finance van for, compare rates and terms from multiple finance companies to get the best deal.

Do Van Finance Include Insurance UK?

No, van finance does not include insurance in the UK. You will need to purchase van insurance separately to insure your van. There are many van insurance companies in the UK, so compare rates and coverage options before choosing a policy. And, be sure to read the policy carefully to understand what is and is not covered.

Ultimately, van insurance is an essential part of owning and operating a van in the UK, so make sure to budget accordingly. In addition, Van finance can be a helpful tool to get the van you need without breaking the bank. But, remember that van insurance is not included in the van finance deal, so be sure to purchase a policy separately.

Who are Eligible for Van Finance?

Some factors can influence whether you are eligible for van finance, including your credit history, income level, and financial situation. Generally speaking, those with good to excellent credit will be more likely to qualify for van finance. Additionally, those with high incomes and substantial assets may also have an easier time getting approved.

Other factors that may impact your eligibility for van finance include the type of van you wish to finance and your current employment status. Getting approved for financing may be more challenging for self-employed people or someone who owns a small business. Additionally, those who work in industries or professions considered riskier may also have difficulty qualifying.

Ultimately, there is no one-size-fits-all answer regarding eligibility for van finance. However, those with a good credit rating, good credit history, high incomes, and little debt are typically more likely to be approved.

Additionally, employed individuals who work in low-risk industries are commonly seen as good candidates for financing. If you are unsure about your eligibility for van finance, it is best to speak with a trusted financial advisor, van finance specialists, or lender like CarFinanceMarket.co.uk to get more guidance.

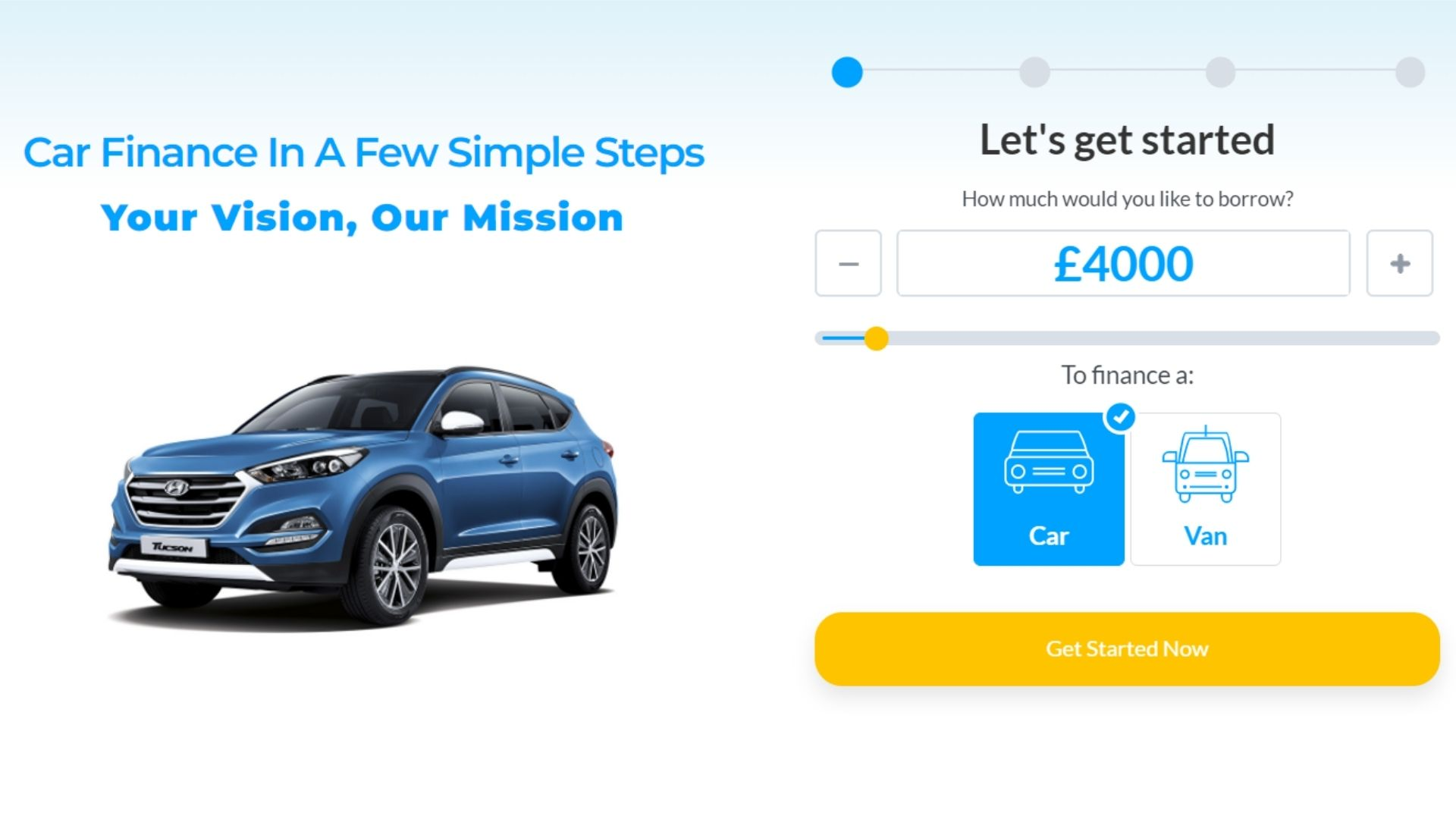

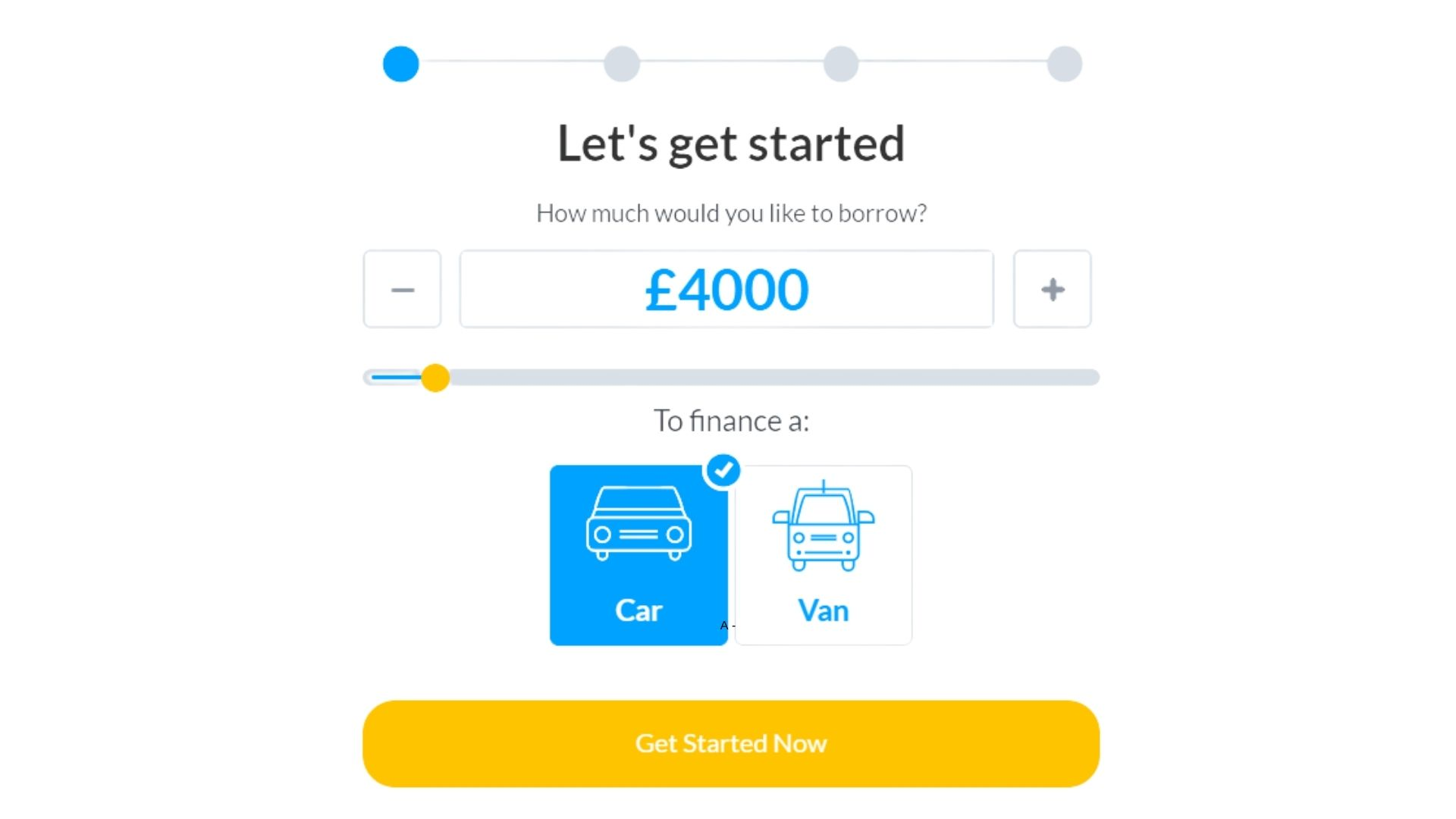

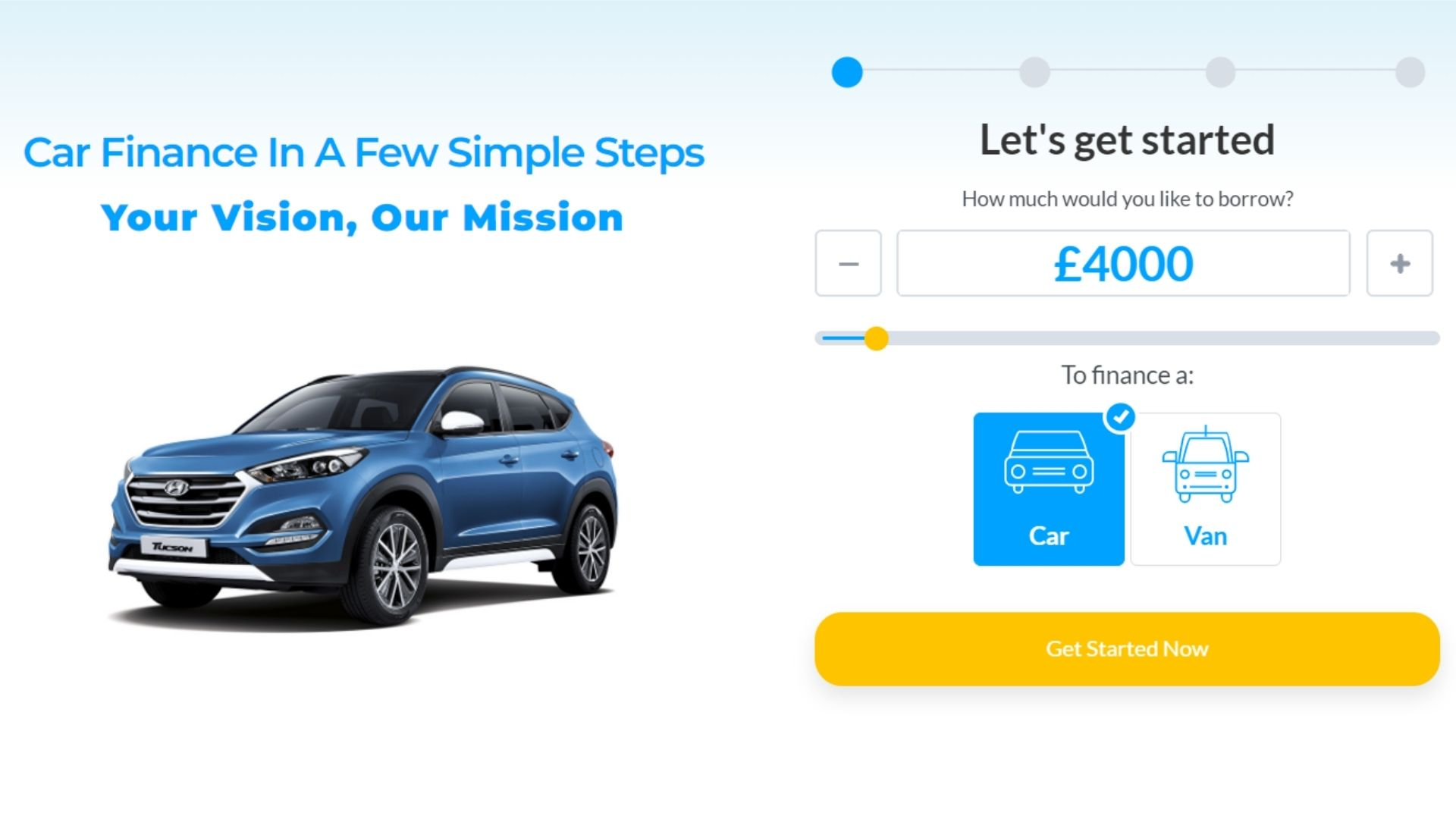

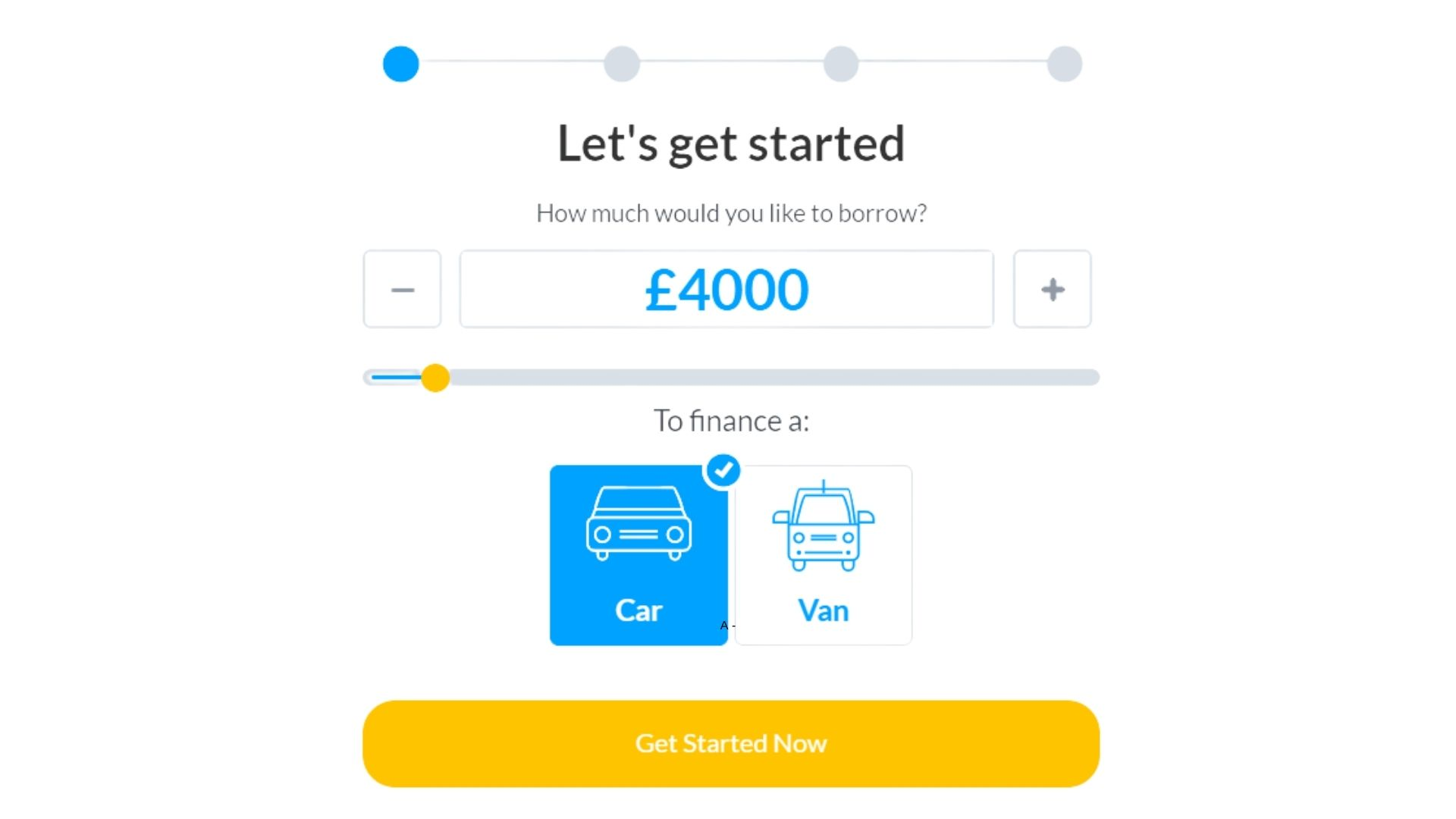

CarFinanceMarket.co.uk is a great place to start your search to apply for van finance online or in person. We can help you compare rates and terms from multiple lenders so that you can find the best deal for your needs.

CarFinanceMarket.co.uk is committed to helping UK consumers get the financing to purchase their used or new van and can offer guaranteed van finance. Contact us today to learn more about van finance and how we can help you get the financing you need with outstanding service.

Summary

Van finance can be a helpful tool to get the van you need without breaking the bank. But, remember that van insurance is not included in van finance, so be sure to purchase a policy separately.

CarFinanceMarket.co.uk is authorised and regulated by the financial conduct authority. We can help you compare rates and terms from multiple lenders so that you can find the best deal and perfect vehicle for your needs.

We offer popular vans, large vans, and even used van and new vehicle. CarFinanceMarket.co.uk is committed to helping UK consumers get the financing to purchase their dream vans.

You can apply online through CarFinanceMarket.co.uk. Contact us today for further information about van finance and how we can help you get the financing you need.