Car finance on benefits can sometimes be challenging, especially if you receive government benefits or other forms of financial assistance. However, there are several things that you can do to improve your odds of securing car finance and making your car purchase more affordable.

One key factor to consider when seeking car finance is your credit score. Most lenders will want to check your credit score before approving you for car financing, so it is vital to make sure that this number is as high as possible.

In addition, to boost your credit score, focus on paying off any outstanding debts or bills promptly, and avoid taking on additional debt or making large purchases that may affect your rating negatively.

Another essential thing to keep in mind when attempting to secure car finance is the down payment. Many lenders will require a down payment to approve you for car financing, and the larger the down payment, the better your chances of being approved. Therefore, if you have saved up money for a down payment, let your lender know to consider this when deciding.

If you are receiving government benefits or other forms of financial assistance, it is essential to let your lender know so that they can work with you to find a car finance option that will work for your situation.

Many car finance companies specialize in helping people with bad credit or receiving financial assistance. As a result, they may be able to offer guaranteed car finance and more flexible terms or a lower interest rate.

Finally, remember that car financing is not always easy to obtain, but it is possible to provide car finance benefits if you take the time to research your options and work with a lender willing to help you.

If you are having trouble securing car finance, consider talking to a financial advisor or car dealer to see if they have any advice or resources that can help you. With a bit of effort, you should be able to find the car finance options that best suits your needs and budget.

What Does Guaranteed Car Finance on Benefits Means?

Car finance on benefits is a type of financing specifically designed to help people receive government benefits or other financial assistance to obtain affordable car financing. To increase your chances of getting guaranteed car finance, it is essential to maintain a good credit score, save up a down payment, and work with lenders who specialize in working with people with bad credit history or financial assistance.

Guaranteed car finance on benefits can sometimes be challenging to obtain. Still, by taking the time to research your options and work with a lender who is willing to help, you can find an affordable financing option that best suits your needs and budget.

How Does Car Finance for People on Benefits Work?

Car finance for people on benefits can be more challenging to obtain than car financing for people with good credit. However, several options are available to those receiving government benefits or other financial assistance.

To increase your chances of getting car finance deal, it is essential to maintain a good credit score, save up a down payment, and work with lenders who specialize in offering car financing to people on benefits.

The first step in getting car finance for people on benefits is to check your credit score and make any necessary improvements. Many lenders will look at your credit score before approving you for car financing, so it is vital to ensure that this number is as high as possible.

You can improve your credit score by promptly paying off any outstanding debts or bills and avoiding taking on additional debt or making large purchases that could negatively impact your rating.

Next, you will need to save up for a down payment. Many car finance companies require a down payment before they approve you for financing, and the larger the down payment, the better your chances of being approved. You can save up for a down payment by putting aside a portion of your income each month or selling any unused items you no longer need.

Finally, it is essential to work with car finance companies that specialize in helping people on benefits obtain car financing. These lenders may be able to offer you more favorable terms or a lower interest rate than traditional lenders. You can find car finance companies specializing in helping people with benefits by searching online or talking to a financial advisor.

By following these steps, you can increase your chances of getting car finance for people on benefits. However, it is essential to remember that car financing is not always easy to obtain.

You may need to spend some time researching your options and working with different lenders before finding an affordable car financing option that suits your needs. However, with a bit of effort and patience, you should be able to find the car finance option that best meets your needs and budget.

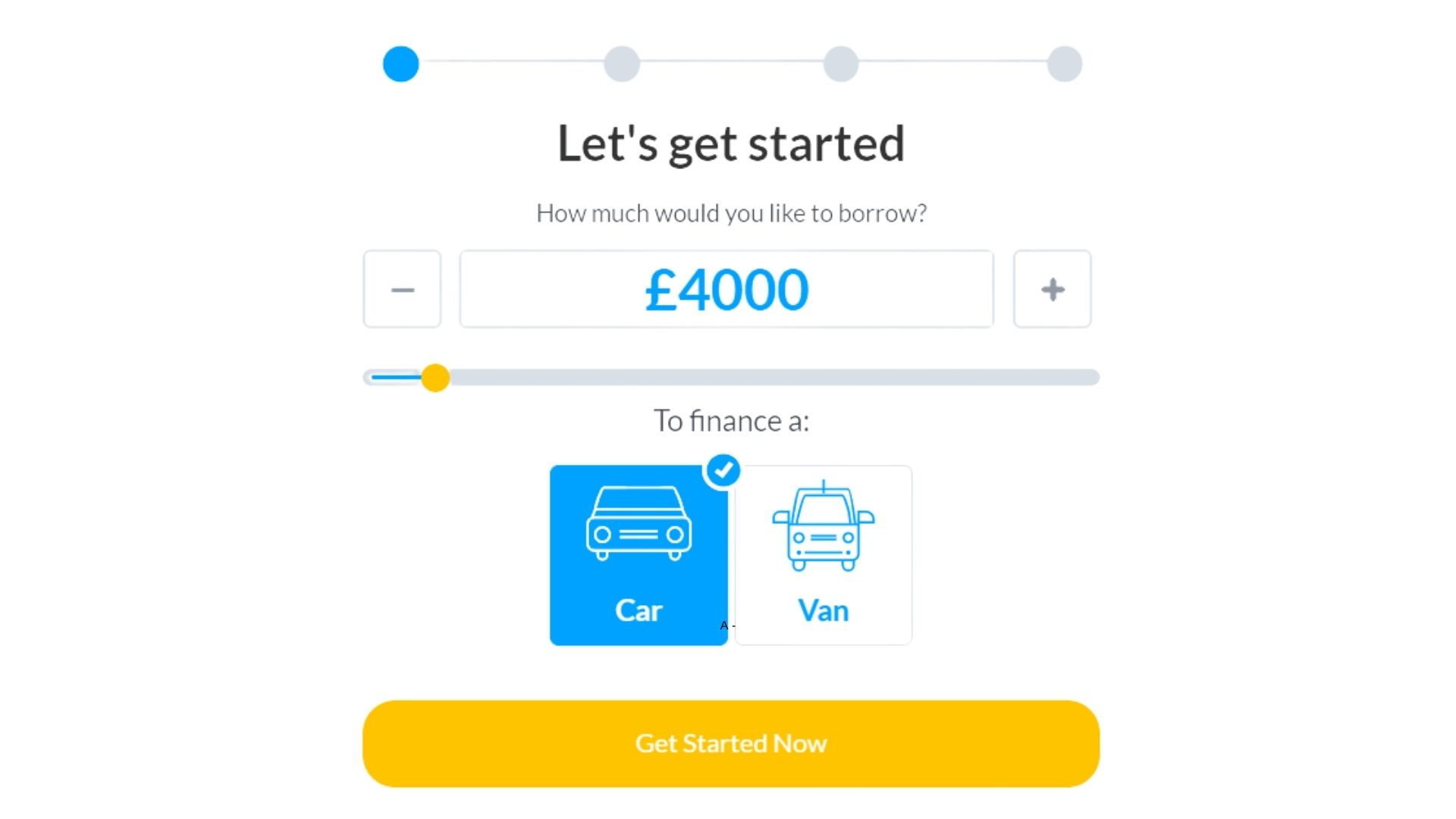

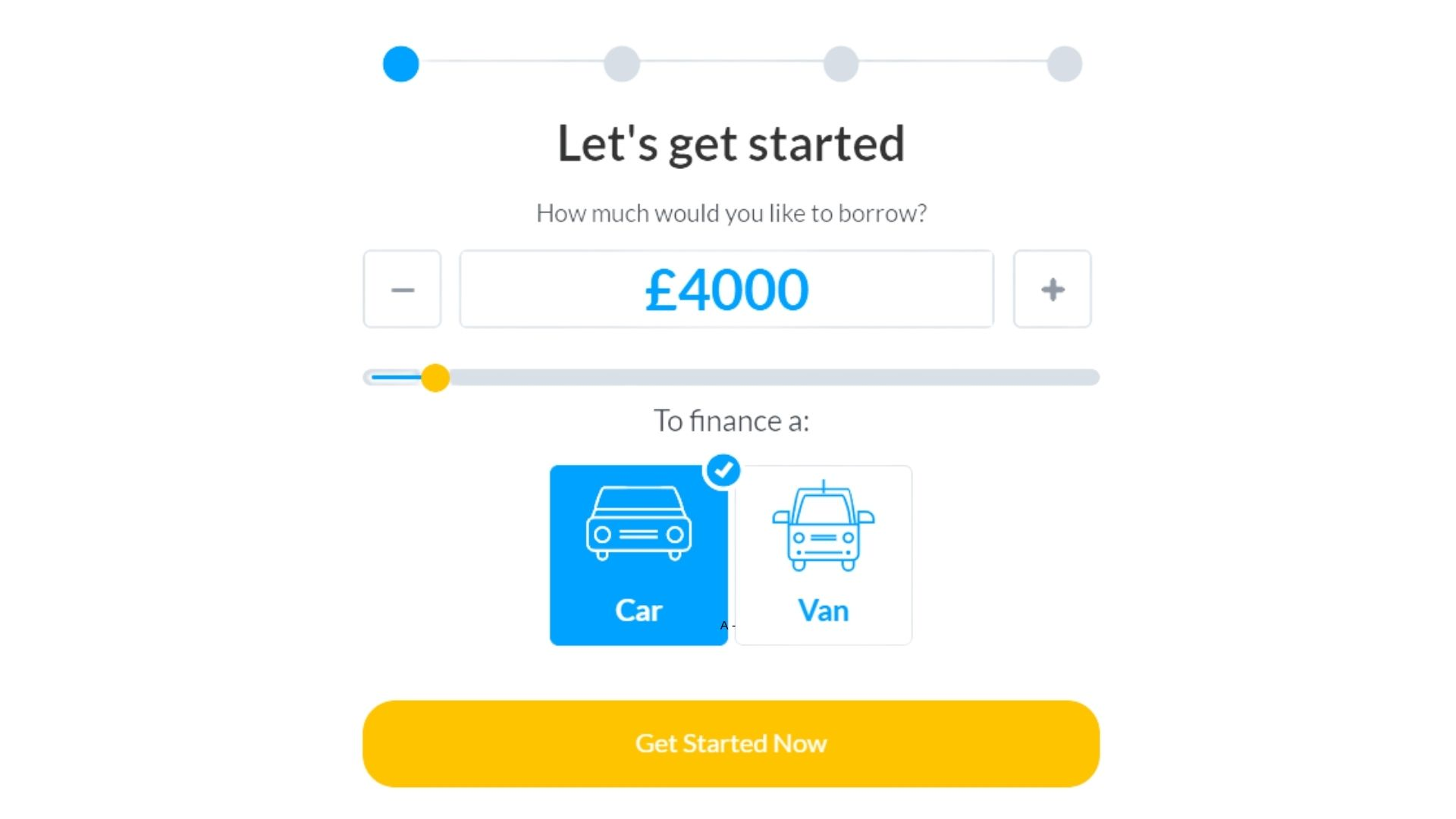

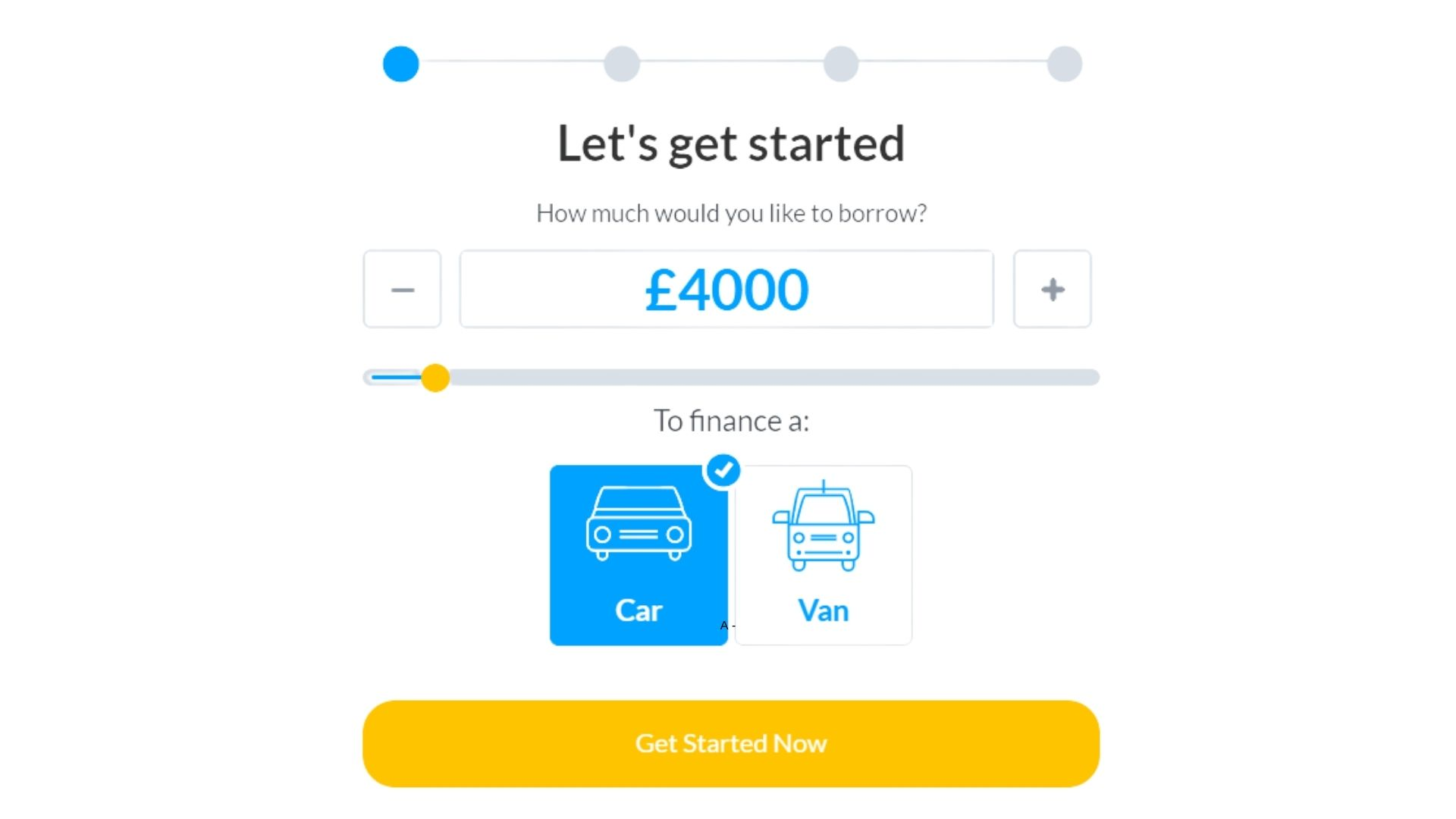

How to Apply for Car Finance on Benefits?

If you are receiving government benefits or other financial assistance, you may be wondering how to apply for car finance on benefits. While car financing can be more challenging to obtain when you receive benefits, several options are available to help you get the car financing you need.

Maintaining a good credit score is essential, saving up a down payment, and working with car finance companies that specialize in providing car financing to people on benefits.

The first step in getting car finance for people on benefits is to check your car credit score and make any necessary improvements. To afford car finance, lenders will do soft search credit check or credit checks before approving you, so it’s vital that this number stays high or improves even further with time!

You can do both by paying off debts promptly every month – avoiding taking new loan term altogether if possible-and staying away from large purchase fee, which could negatively affect how credit rating goes down over more extended periods of use.

Next, you will need to save up for a down payment. Many car finance companies require a down payment to approve you for car financing. The down payment size will vary depending on the lender and the type of car you are looking to finance.

However, it is essential to save up as much money as possible for your down payment to increase your chances of getting car finance on benefits.

Finally, you will need to find car finance companies specializing in car finance for people on benefits. There are several ways to find lenders who offer car financing to people receiving government benefits or other financial assistance.

You can search online, speak with a car dealer, or contact a financial advisor for help finding car finance companies that may be able to help you.

Getting car finance on benefits can be challenging, but finding lenders willing to work with you is possible. By improving your credit score, saving up for a down payment, and finding car finance companies specializing in car financing for people on benefits, you can increase your chances of getting the car financing you need.

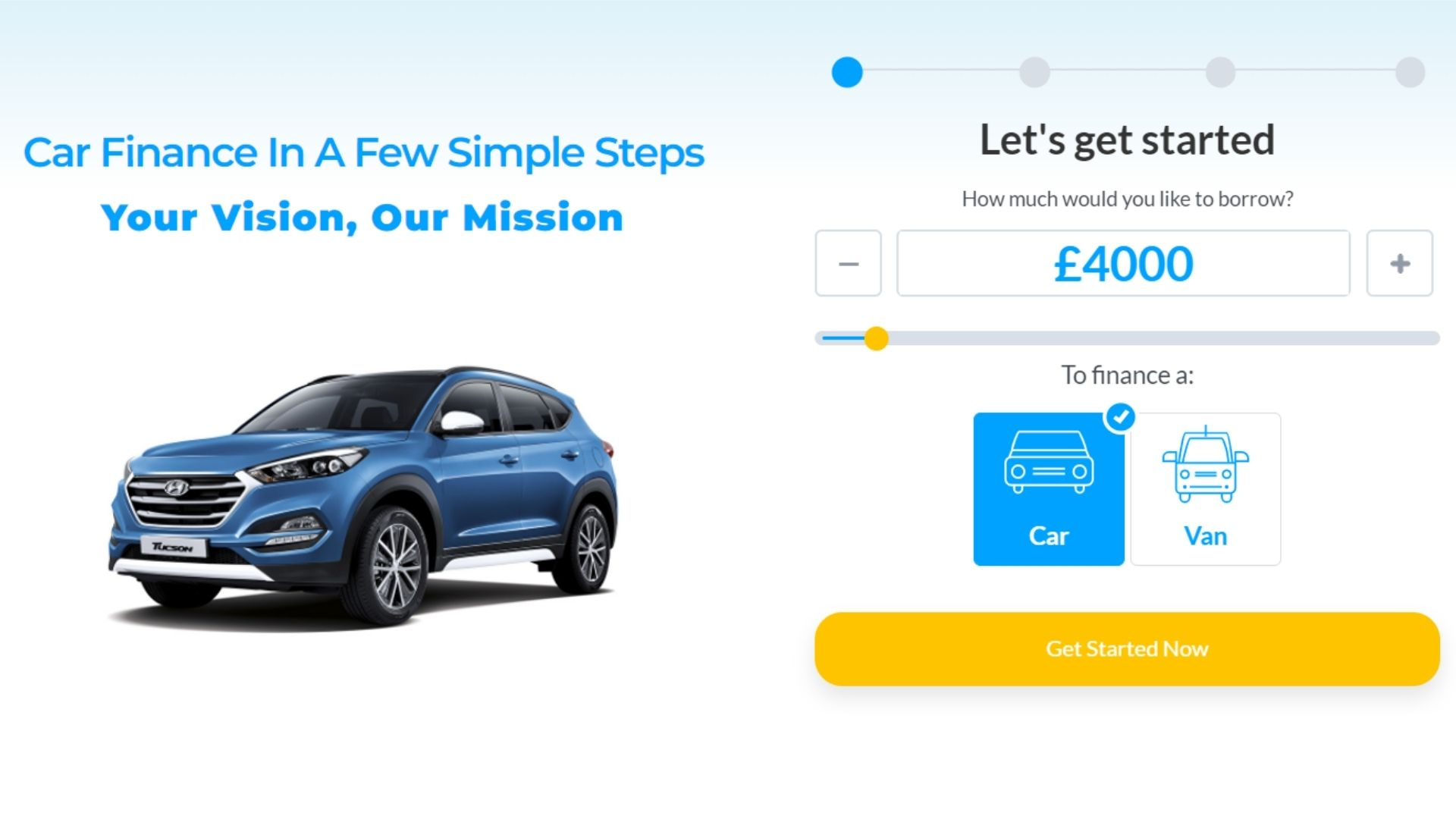

Apply for car finance on benefits today to get started on the road to car ownership.

Can You Get Car Finance on Universal Credit?

If you are claiming Universal Credit, you may be wondering if you can get car finance. While car financing can be more challenging to obtain when you are claiming benefits, several options are available to help you get the car financing you need.

Maintaining a good credit score and other credit agreements is essential, saving up a down payment, and working with car finance companies that specialize in providing car financing to people on benefits.

When applying for car finance on Universal Credit, you need to check your credit score and make any necessary improvements. Many lenders will look at your credit score before approving you for car financing, so it is essential to ensure that your credit score is as high as possible.

You can improve your credit score by promptly paying off any outstanding debts or bills and avoiding taking on additional debt or making large purchases that could negatively impact your rating.

What are the Requirements for Car Finance on Benefits?

To qualify for car finance on benefits, you will need to save up a down payment and maintain good credit. Additionally, it is vital to work with car finance companies that provide car financing to people on benefits. Some car dealerships and lenders may be willing to offer car finance on Universal Credit or other types of government benefits. However, it is essential to compare rates and terms to ensure that you get the best deal possible.

When searching for car finance on benefits, it is vital to keep in mind that the size of your down payment will vary depending on the lender and the type of car you are looking to finance. Many car finance companies require a down payment to approve you for car financing, so it is essential to save as much money as possible.

Additionally, you will need to find car finance companies specializing in providing car financing to people on benefits. There are several ways to find lenders who offer car financing to people receiving government benefits or other financial assistance.

You can search online, speak with a car dealer, or contact a financial advisor for help finding car finance companies that may be able to help you.

Getting car finance on benefits can be challenging, but it is possible to find lenders willing to work with you. By maintaining a good credit score, saving up for a down payment, and finding car finance companies specializing in car financing for people on benefits, you can increase your chances of getting the car financing you need.

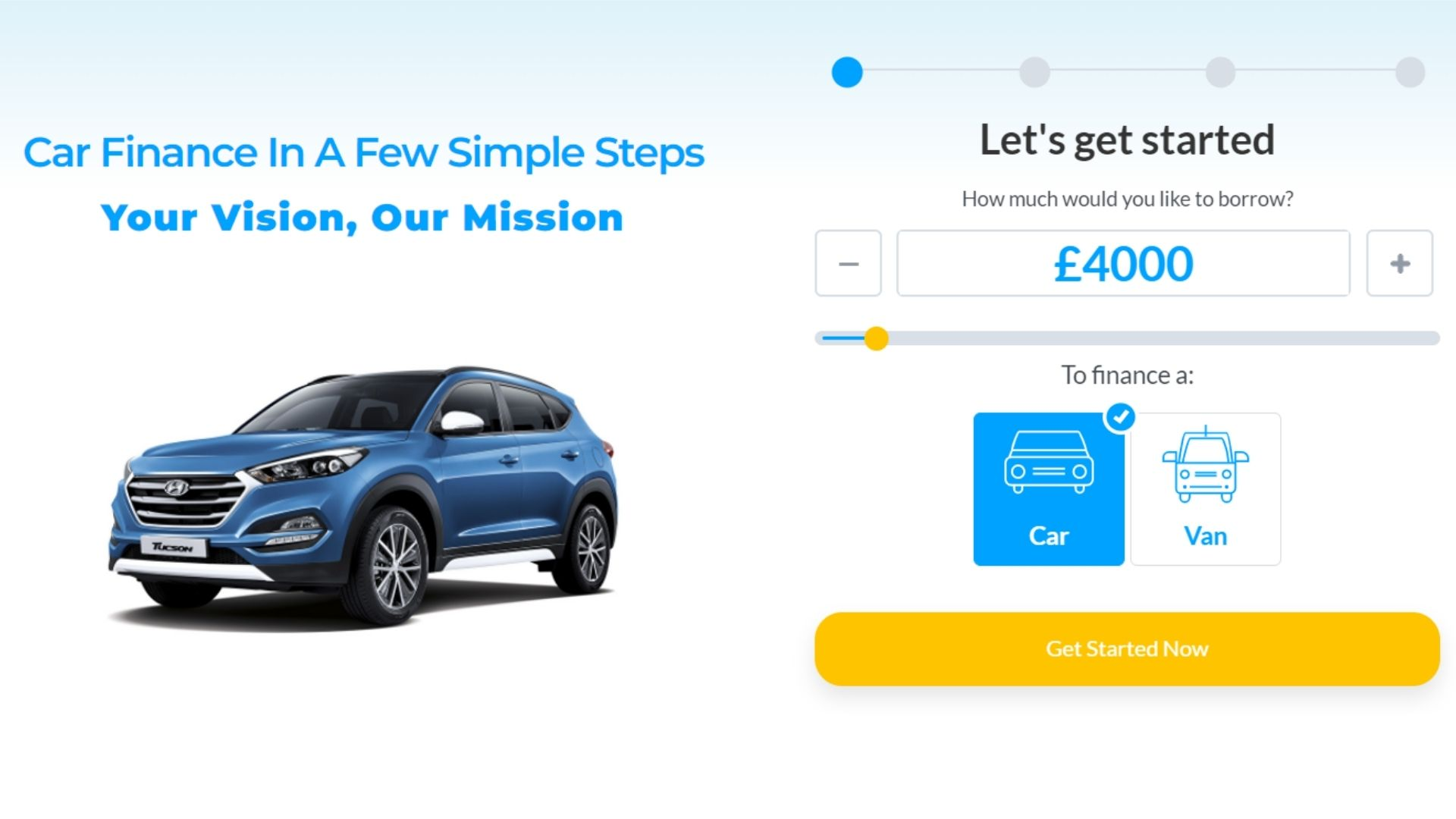

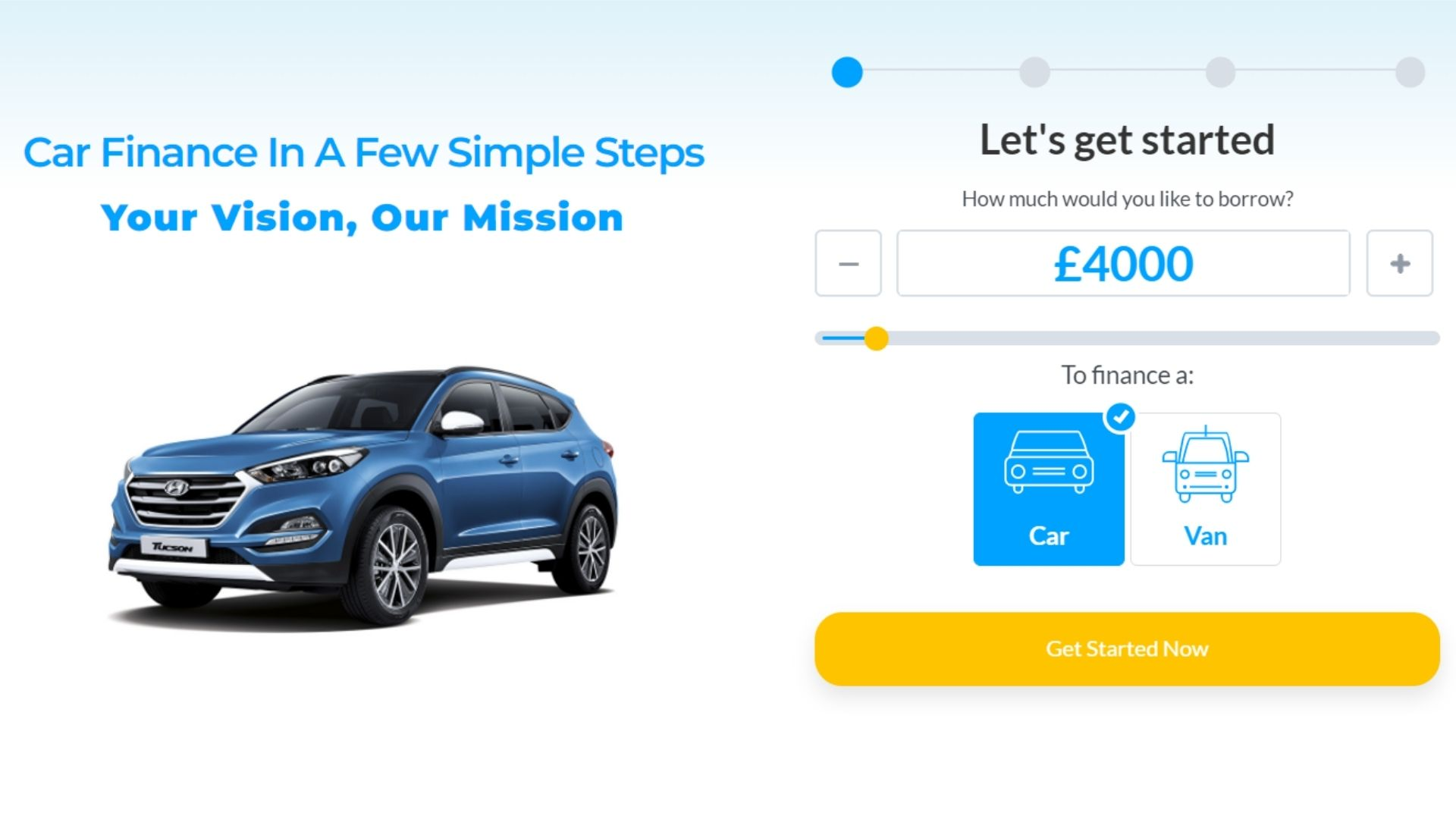

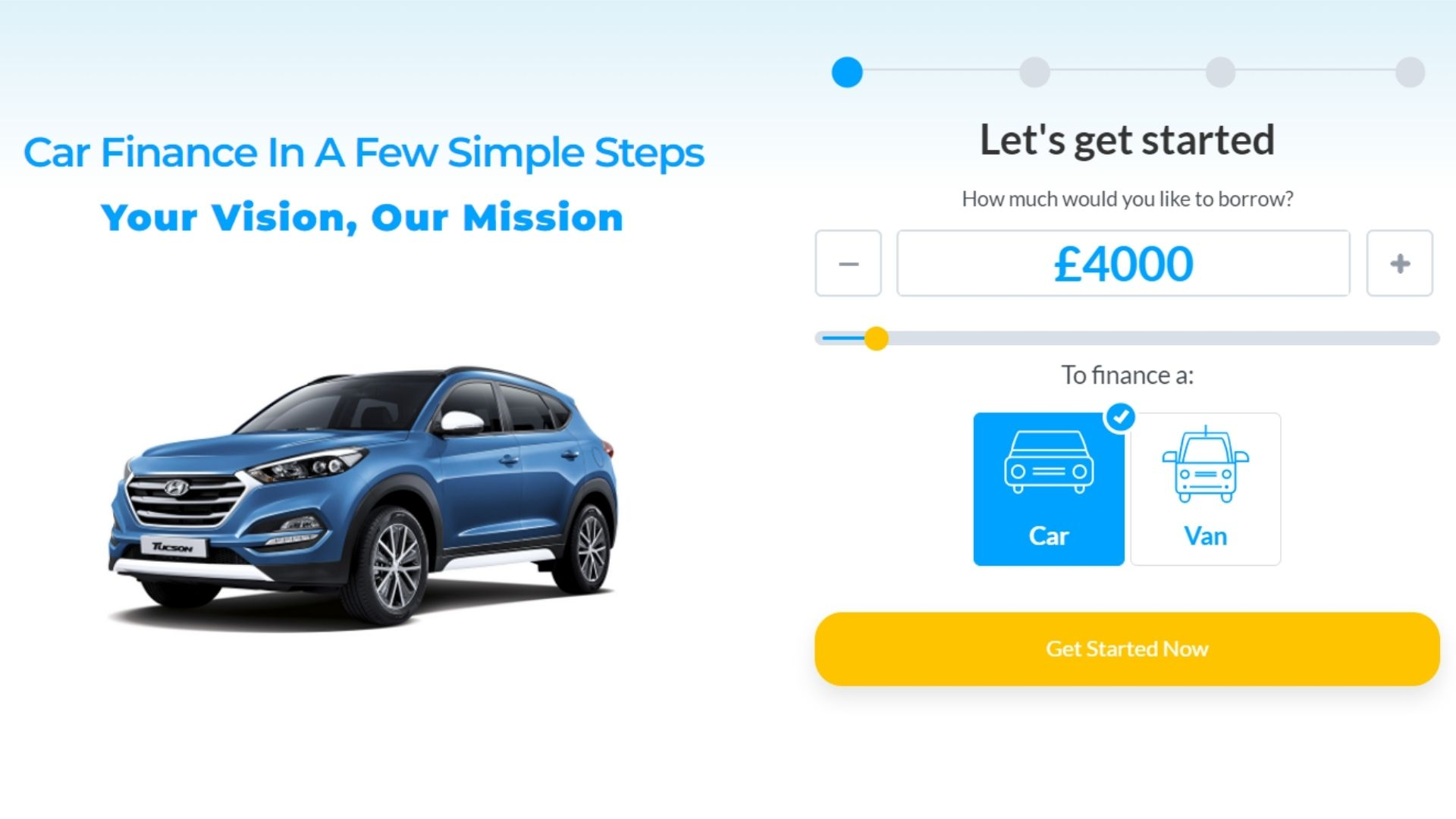

CarFinanceMarket.co.uk is an excellent choice in car financing for people on benefits.

Can I Really Get Bad Credit Car Finance on Benefits?

If you are looking for bad credit car finance on benefits, you may wonder if it is possible to get the financing you need. While bad credit can make it more challenging to find lenders willing to work with you, there are several things you can do to increase your chances of getting the bad credit car finance that you need.

To get bad credit car finance on benefits, you will need to have a down payment, maintain a good credit score, and work with lenders specializing in bad credit car finance.

When looking for bad credit car finance on benefits, one of the most important things you can do is save up for a down payment. Many lenders will require a down payment before approving you for bad credit car finance, so it is essential to have this car loan amount saved up.

Additionally, good credit is critical when looking for bad credit car finance on benefits. Many lenders will check your credit score before approving you for bad credit car financing, so it is essential to work on any issues present in your credit report.

Another important factor to consider when looking for bad credit car finance on benefits is the type of lender you choose. Many lenders offer bad credit car financing, but not all specialize in working with people on government benefits or other financial assistance programs.

To increase your chances of getting bad credit car finance on benefits, it is essential to find lenders specializing in bad credit car financing for people receiving benefits from the government. You can search online, speak with a car dealer, or contact a financial advisor for help finding bad credit car finance companies that may be able to help you.

Bad credit score can make getting the bad credit car finance you need more complicated. Still, it is possible to find reliable lenders specializing in bad credit car financing for people on benefits.

Maintaining good credit, saving up a down payment, and working with reputable bad credit car finance companies can increase your chances of getting the bad credit car finance you need. CarFinanceMarket.co.uk is an excellent choice in bad credit car finance for people on benefits.

When Will my Car Finance on Benefits Get Approved?

If you are looking for car finance on benefits, one of the first things you may be wondering is when your car finance will get approved. The answer to this question depends on several factors, including your credit score, the amount of your down payment, and the car finance company you are working with.

One of the most important things to consider when wondering when your car finance on benefits will get approved is your credit score. Many car finance companies will check your credit score before agreeing to the car financing, so it is essential to make sure your credit report is in good shape.

If you have bad credit, you can still do several things to increase your chances of getting reliable car finance on benefits, such as saving up for a down payment and working with car finance companies specializing in bad credit financing.

Another factor to consider when wondering when your car finance on benefits will get approved is the car finance company you are working with. Some car finance companies are more willing to work with people on government benefits or other financial assistance programs.

In contrast, others may be less likely to approve car financing for people on benefits. To increase your chances of getting car finance on benefits, it is vital to look for car finance companies that specialize in bad credit car financing for people receiving government benefits or other forms of financial assistance.

How to Choose a Finance Company for Benefit Car Finance?

When looking for benefit car finance, choosing a reputable and reliable finance company is one of the most important things. There are many different options for finding a finance company to benefit car finance, so it is essential to research your options before carefully deciding.

One of the first things you should consider when looking for a finance company for benefit car finance is your credit score. Many finance companies will check your credit score before approving you for financing, so it is essential to work on any issues present in your credit report.

Another thing to consider when choosing a finance company for benefit car finance is the type of lender you choose. Many lenders offer bad credit car finance, but not all specialize in working with people on government benefits or other financial assistance programs.

To increase your chances of getting bad credit car finance on benefits, it is essential to find lenders specializing in bad credit car financing for people receiving government benefits.

You can search online, speak with a car dealer, or contact a financial advisor for help finding a reputable finance company for benefit car finance like CarFinanceMarket.co.uk. Ultimately, the choice is yours, but it is essential to do your research and decide what is right for you.

Summary

Looking for car finance on benefits can be a challenge, as many factors go into getting approved for financing. Maintaining good credit and saving up a down payment is vital. You are working with reputable lenders specializing in bad credit financing to increase your chances of getting approved for benefit car finance.

Some good places to start your search for a reputable lender include online directories, car dealerships, and financial advisors. Car Finance Market is an excellent option for finding reliable specialist lenders to help you get the financing you need.

We offer exceptional car finance deals providing car finance and an authorised and regulated car finance company in the UK. We will help you get an easy car finance application. For more details, contact us now through CarFinanceMarket.co.uk.