When it comes to getting car financing, there are some different options available. One of the most common ways to finance a car is working with car finance lenders. These lenders offer various car loans, including secured and unsecured loans and personal and auto title loans.

Car finance lenders work with individuals and businesses to provide them with the financing to purchase a car. The loans they offer can be used for new or used vehicles. Car finance lenders will require collateral to approve the loan in most cases. This collateral may be in the form of a car, home equity, or another asset.

In addition to car finance lenders, there are also several other options available for car financing. These include banks, credit unions, and online lenders. Each lending institution has its own set of terms and conditions, so it’s essential to compare the options before choosing one.

The most important thing is to find a direct lender car finance that offers the best rates, terms, and conditions for your particular needs in car finance. By researching and comparing different car finance lenders, you can find a loan that works for you.

How to Get Car Finance with Bad Credit?

If you are looking to get car finance but have bad or refused credit, it can seem like an impossible task. Other lenders will deny your application or charge high-interest rates if you have poor credit histories. However, several options can help you get the car financing you need, even with bad credit.

One option is to work with a subprime lender. These lenders specialize in working with people with bad credit financial history and can offer competitive rates. It’s essential to compare different subprime lenders to find the best deal.

Another option is to get a cosigner for your new, used, or next car personal loan. A cosigner is someone who agrees to sign the loan that needs to provide personal data with you, and is responsible for making the payments if you can’t. It can be a family member or friend with good credit. Having a cosigner can help you get approved for a loan and get better interest rates.

If you’re looking to finance a car, several options are available, even with bad credit. Car Finance Market are one of the best car finance companies in the UK that is an excellent choice for you.

What Credit Score Do You Need for Car Finance?

When financing a car, your credit score is one of the most critical factors. A responsible lender will use your credit score to determine whether you’re eligible for a loan and what annual interest rate you’ll be charged.

Generally, you’ll need a credit score of 620 or higher to qualify for a loan. If your credit score is below this threshold, you may still be able to get a loan, but it will likely come with higher interest rates or other restrictions.

You can do several things to improve your credit score and increase your chances of getting car financing. These include paying your bills on time, avoiding excessive debt, and disputing any errors on your car credit report.

If you’re looking to get car financing, it’s essential to understand what kind of credit score you need and what steps you can take to improve your credit rating or score. The best car finance company and a reputable lender like Car Finance Market can help you find the best car personal loans for your needs, even with a less-than-perfect credit history.

What Happens If You Crash a Car on Finance?

Several things can happen if you are involved in an accident while on car finance. In most cases, the car insurance coverage you have on your car will cover any damage to the car itself.

However, if the car was totaled or deemed a total loss, you may be required to make a payment for the difference between the car’s value and the amount you still owe on loan.

If you don’t have car insurance or your policy doesn’t cover the total cost of the damage, you may be responsible for paying for the repairs yourself. In some cases, direct lenders may require you to purchase collision or comprehensive coverage if you don’t already have it.

Another issue can arise if you cannot make payments on your car loan due to the accident. It can lead to late fees, higher interest rates, or even repossessing your car. It’s important to work closely with your lender and maintain reliable car insurance coverage to avoid these consequences.

How to Get Out of a Car with Negative Equity?

If you’re struggling to make car payments and are worried about getting stuck with negative equity, there are several things you can do. One option is to try negotiating a lower car price with the car dealers or car sellers. It can reduce the amount you owe on your car loan, making it easier to manage your payments.

Another option is to refinance your car loan. Refinancing allows you to take out a new car loan at a lower interest rate, which can help you manage your payments more easily. You may also be able to reduce the term of your car loan, resulting in smaller monthly payments.

It’s also important to stay organized and make all of your payments on time. It can help you avoid late fees, penalties, and other issues that make getting out of negative equity harder.

What is Voluntary Termination on Car Finance?

Voluntary termination is a car financing option that allows you to pay off your car loan early and end your car finance agreement. It can be a good choice if you want to get out of negative equity or if you need to reduce your car payments for any other reason.

Before choosing voluntary termination on car finance, consider several things, including the impact on your credit score and any costs associated with ending your car finance agreement early.

You will also need to research different lenders and car financing options to find a leading lender that offers voluntary termination or look for car dealerships that offer this option directly.

Ultimately, it is vital to understand all of the terms and conditions associated with voluntary termination on car finance to decide whether this option is the best choice for your needs.

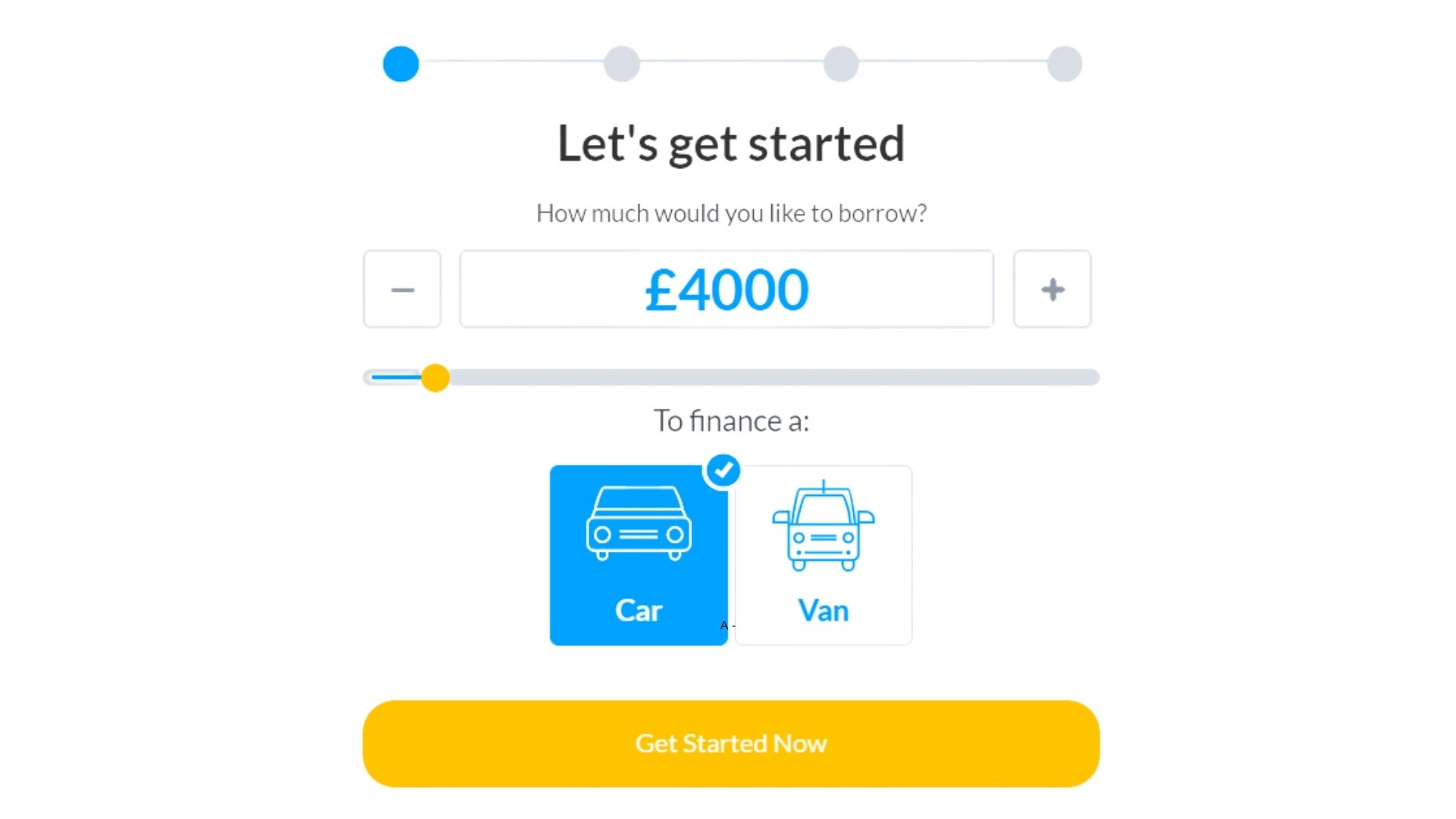

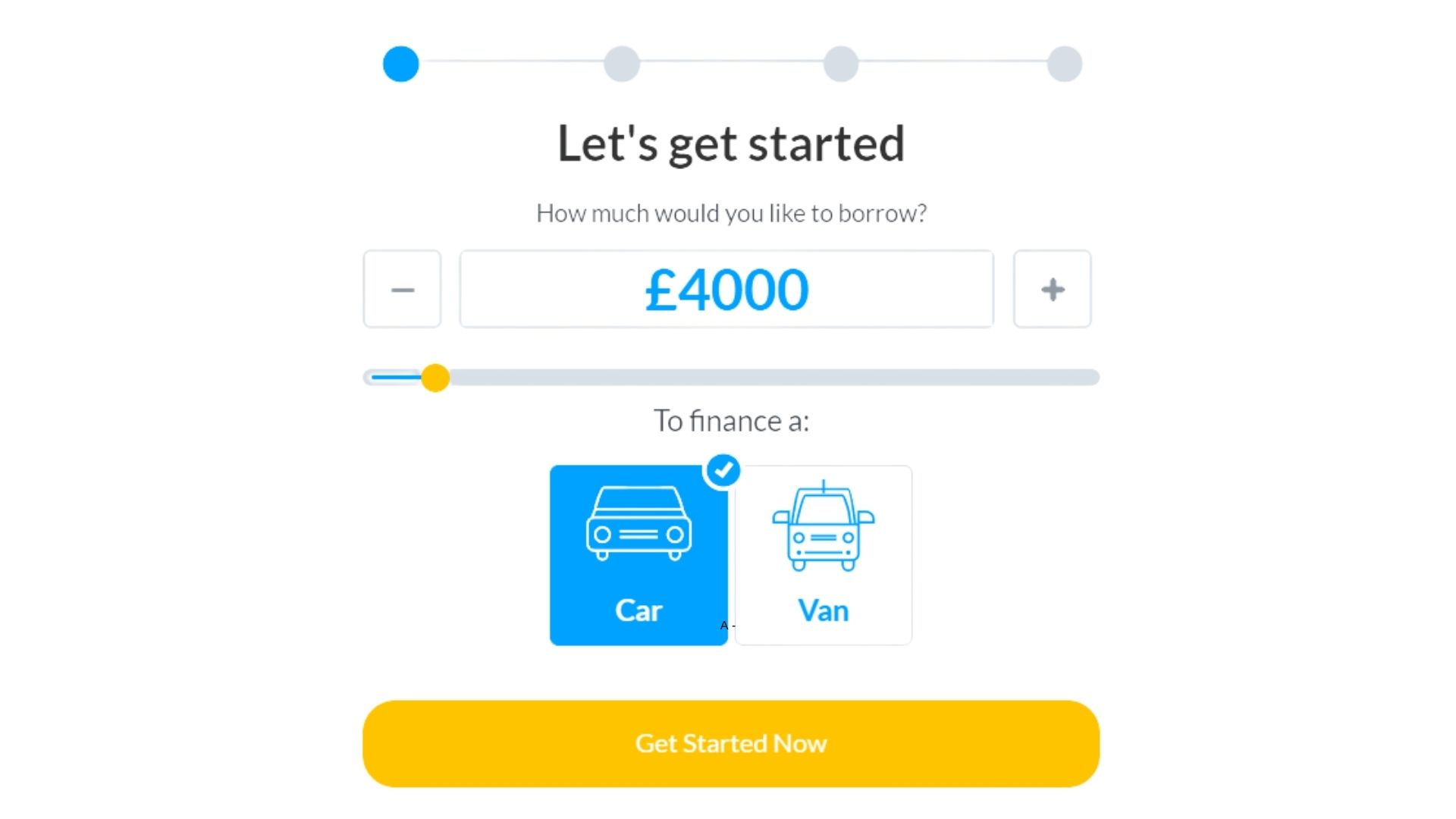

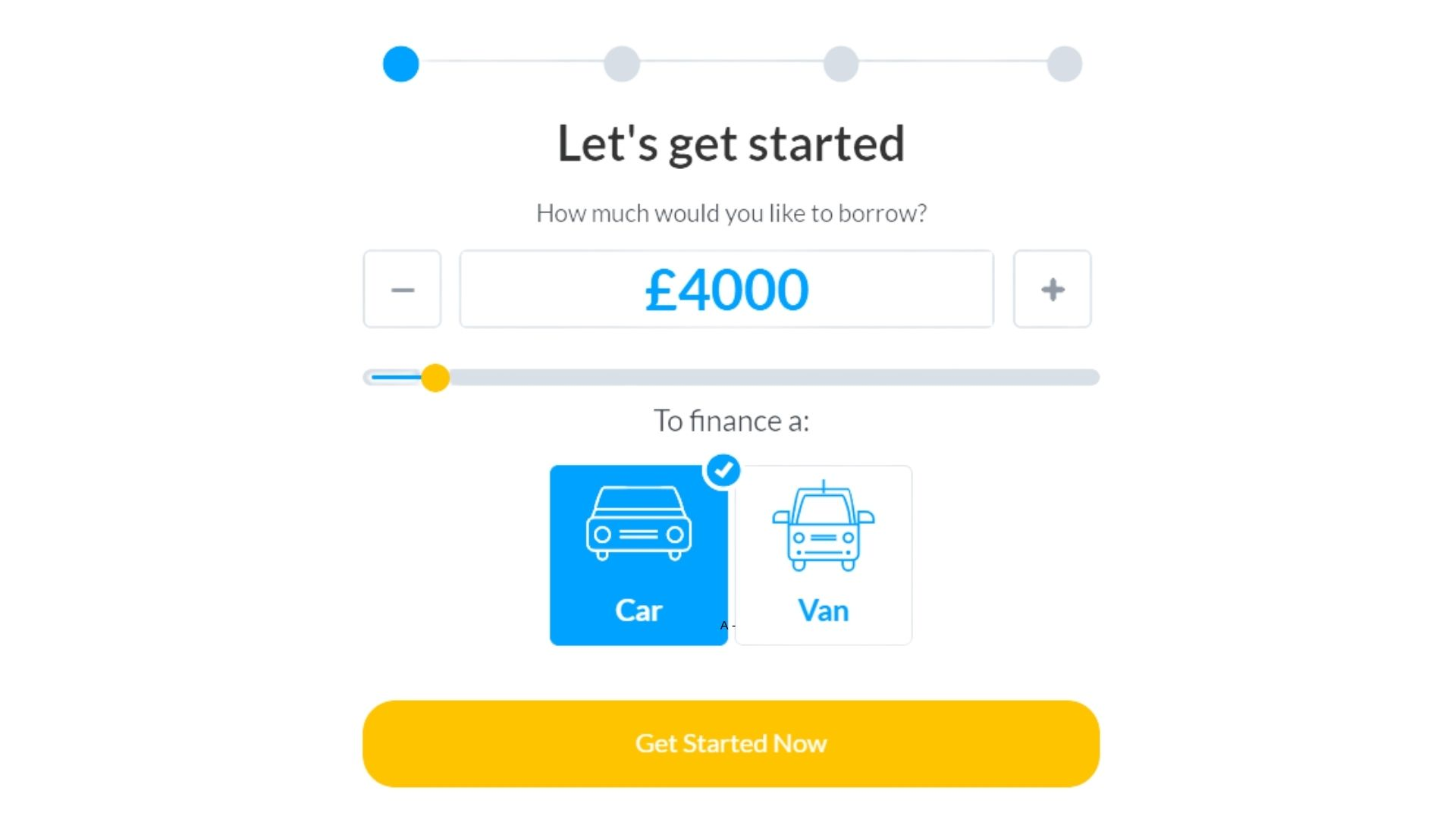

How Much Can I Borrow to Finance a Car?

The amount you can borrow to finance a car will depend on several factors, including your credit score, income, and the dream car you’re looking to purchase. In general, car buyers with higher incomes and better credit scores will be able to borrow more money.

If you’re looking to finance a car with a bad or poor credit file, you may still be able to get a car loan, but you may need to pay a higher interest rate or put down a larger down payment. Additionally, some car finance lenders may have restrictions on how much you can borrow based on the car’s age and other factors.

It’s best to compare multiple car finance options from multiple lenders to determine how much you can borrow for your car purchase fee. It will help you find the best car loan for your needs and budget.

What Happens If I Don’t Pay My Car Finance in the UK?

If you financed a car and then failed to make the payments, there would be several potential consequences that you could face. These might include late fees, subject to status, repossession of your vehicle, or even legal action.

To avoid these consequences and manage your car finance successfully, staying organized and keeping up with your payments is essential. Additionally, it is crucial to maintain reliable car insurance coverage and work closely with your lender to find the right solutions for your situation.

To avoid these negative consequences, you may want to consider refinancing your car loan or finding other options to help you get out of negative equity. By doing your research and speaking with your lender, you can find the best solution for your needs.

What is the Best Car Finance Checker?

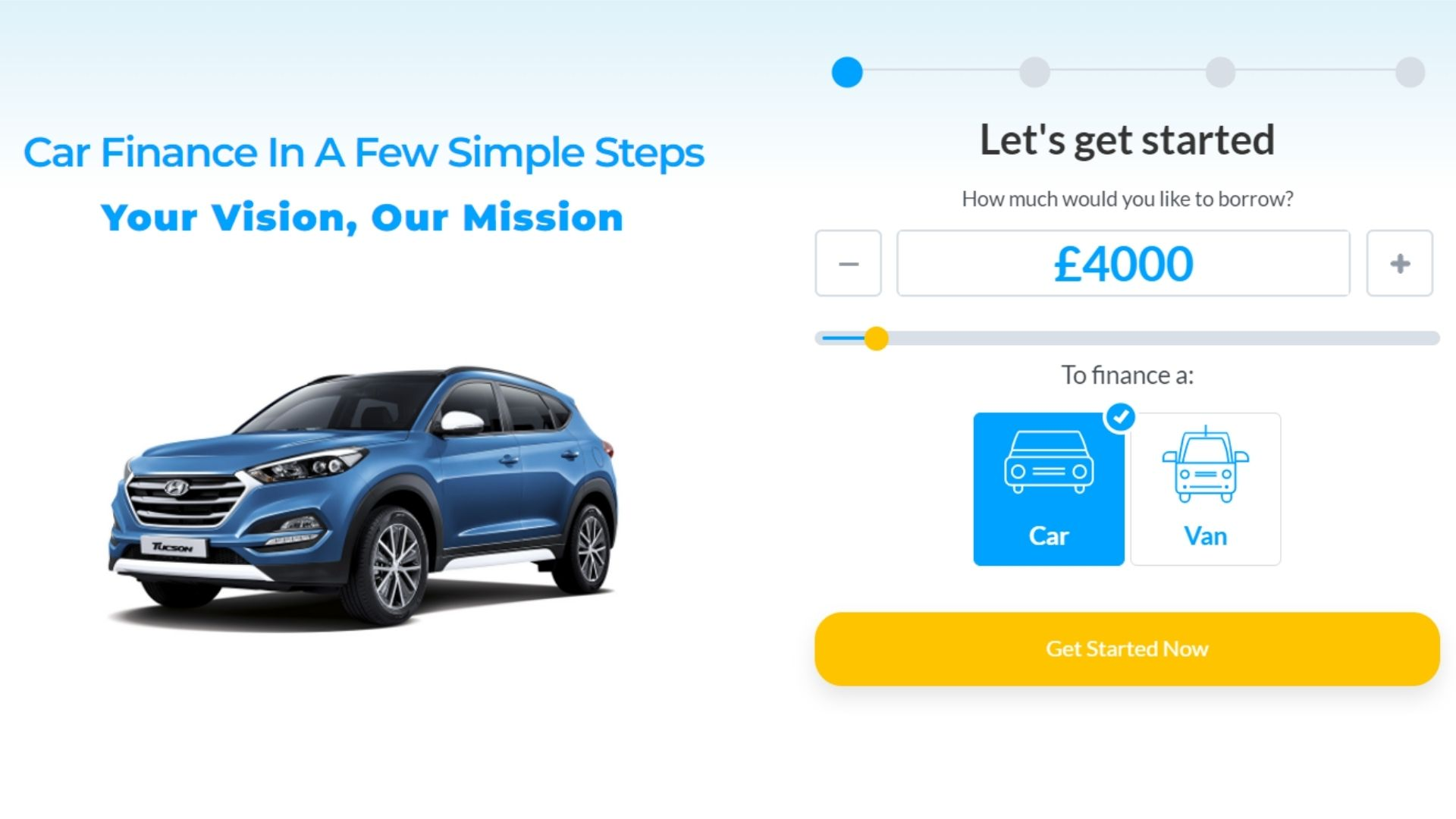

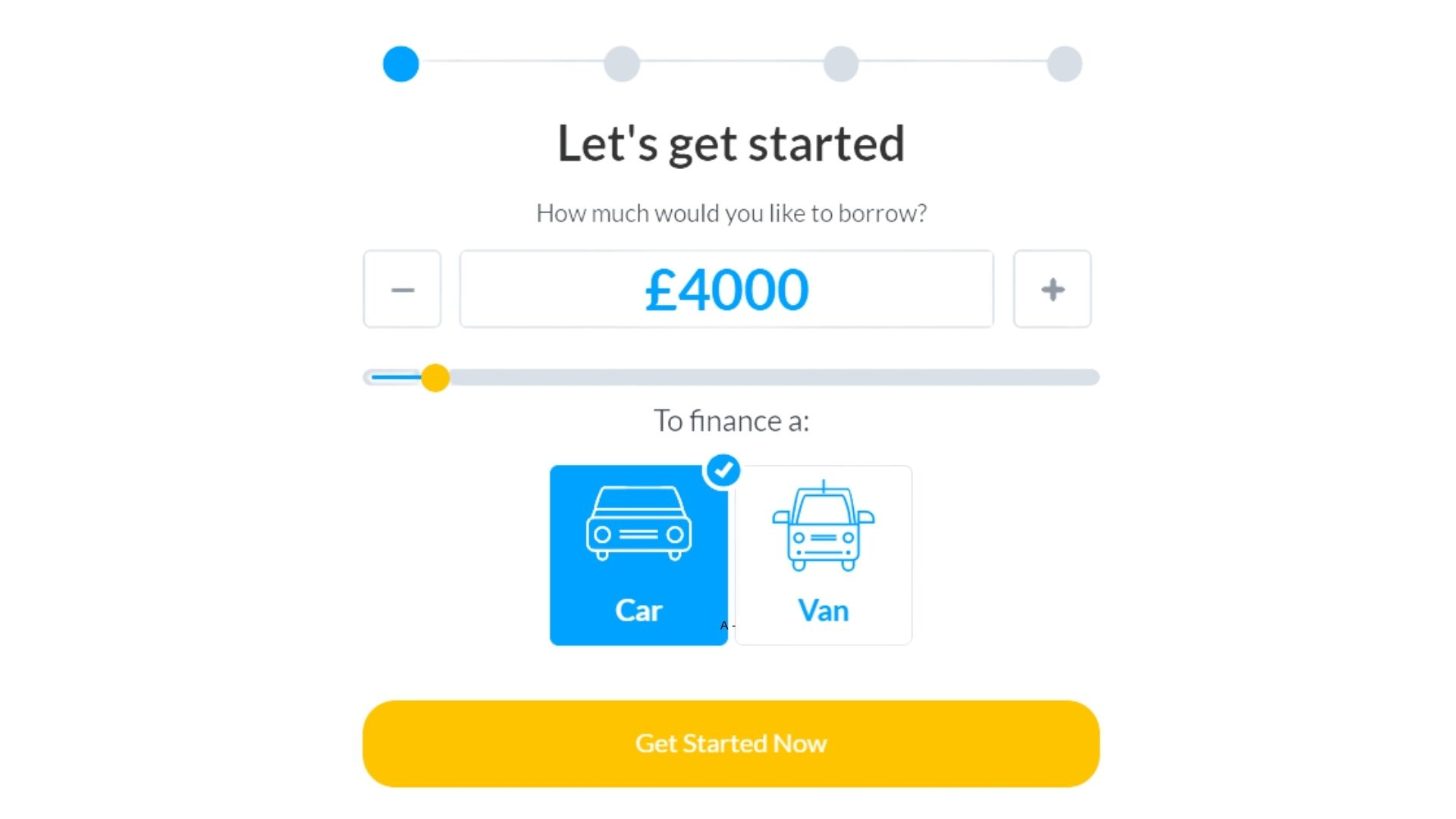

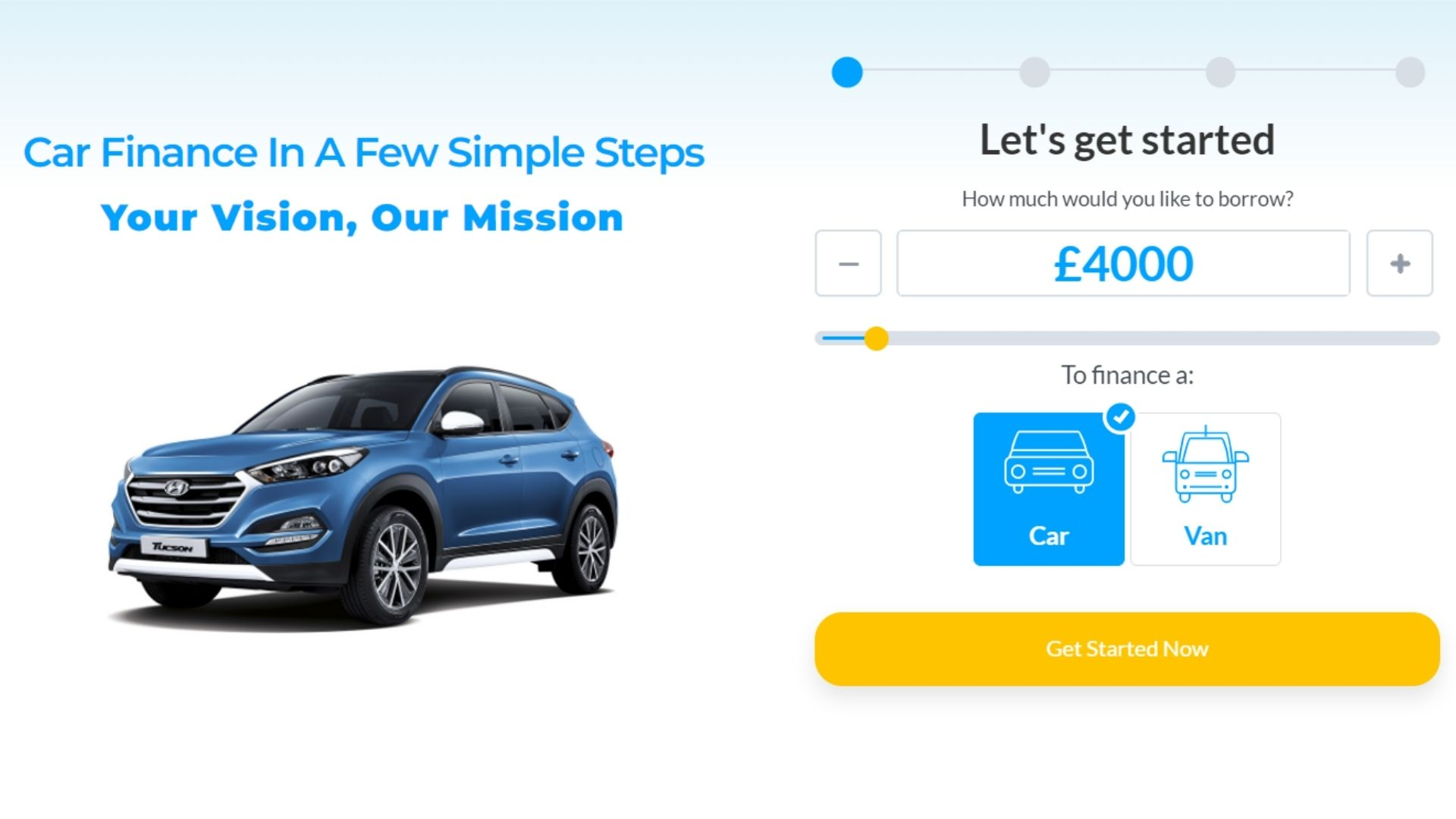

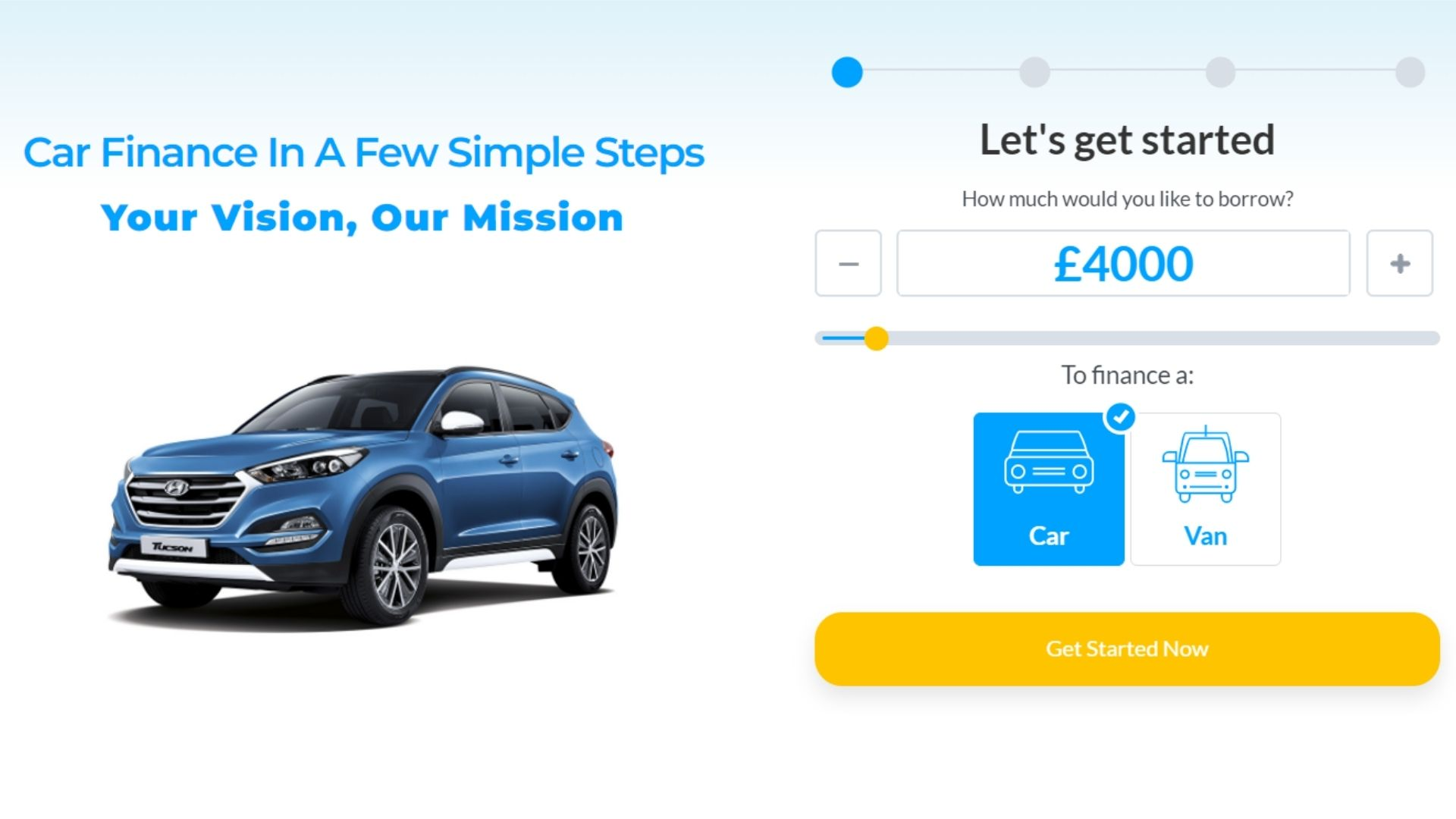

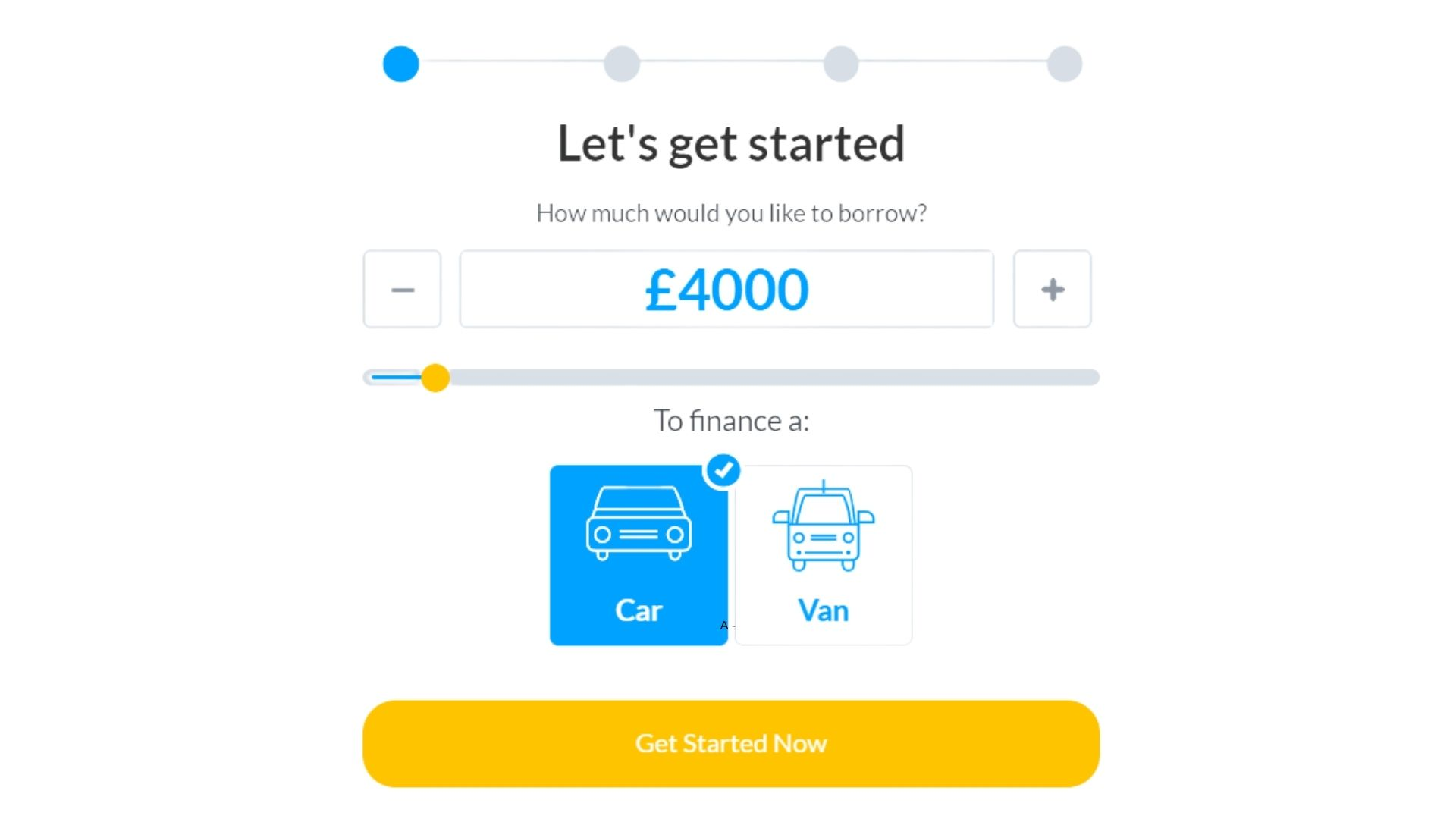

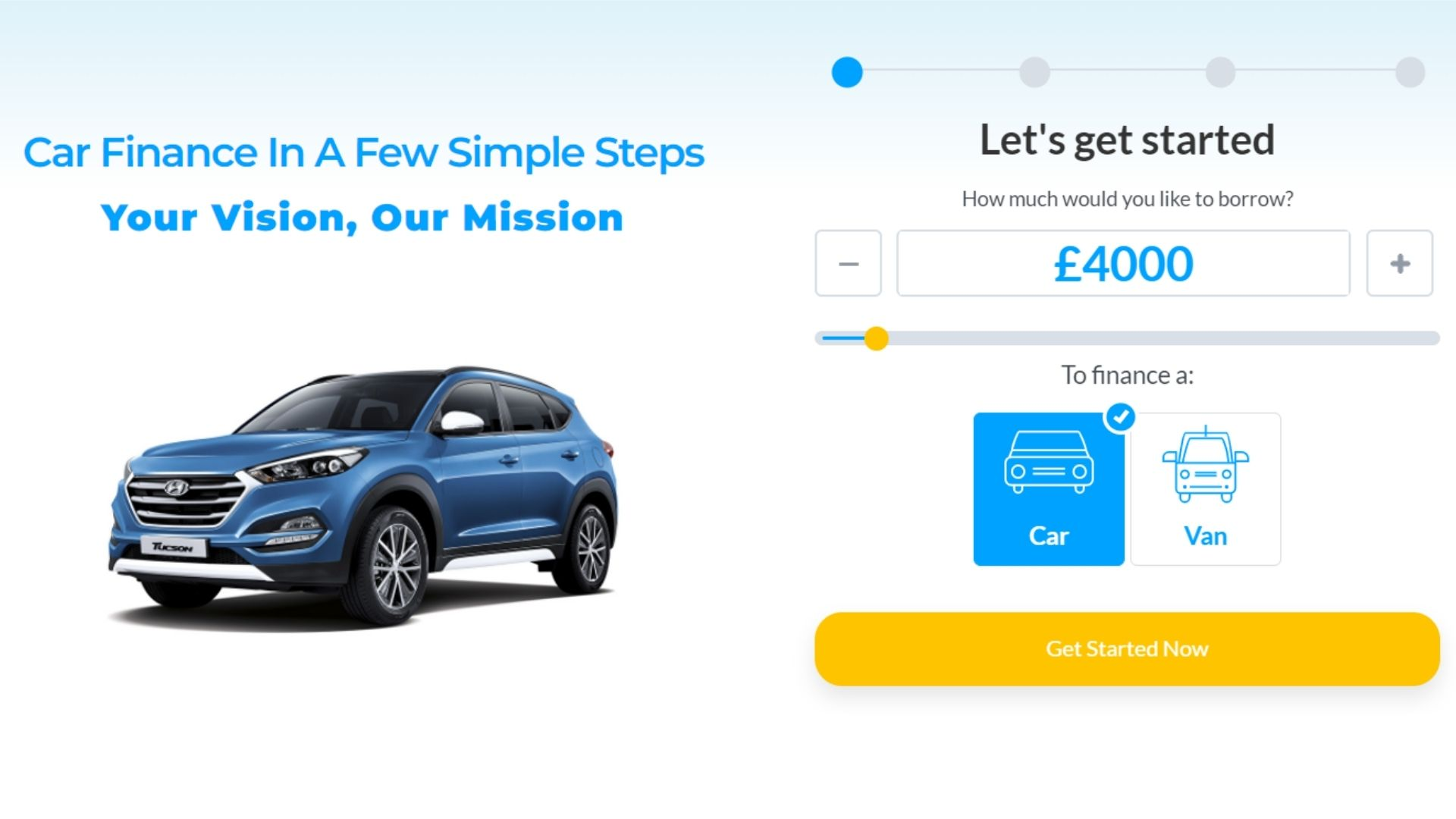

The best car finance checker is CarFinanceMarket.co.uk. CarFinanceMarket.co.uk offers a free tool to compare car finance options from multiple lenders. It can help you find the best car loan for your needs and budget.

Additionally, CarFinanceMarket.co.uk offers a wide range of resources to help you understand all aspects of car finance. These resources can help you learn about the different types of car loans, how to get approved by a loan provider, and what to do if you’re struggling to make your monthly payments or fixed fee.

If you’re looking for a reputable car finance solution, CarFinanceMarket.co.uk is the best choice. All our cars are in great condition with an elegant style. With our fast and easy online tools and expert support, you can get the car financing you need to drive off in your dream financed car today.

Summary

Car finance is a type of loan that allows you to borrow money to purchase a car. Car finance options vary depending on your credit score, income, and the car you’re looking to buy. In general, a car buyer with a higher income and has perfect credit score will be able to borrow more money.

To avoid some negative consequences and manage your car finance successfully, staying organized with your hire purchase, personal contract purchase, and keeping up with your payments and purchase agreements is essential. Additionally, it is necessary to maintain reliable car insurance coverage and work closely with your lender to find the right solutions for your financial situation.

If you’re looking for a comprehensive finance cars solution, one option to consider is CarFinanceMarket.co.uk. With our free online comparison tool, car finance calculator, car finance option, car finance offers, and expert support, you can get the car financing you need to drive off in your dream vehicle today.