It is a question that many car buyers ask themselves. Car financing and paying for a car in cash are pros and cons.

Paying for a car in cash has its advantages. You will own the vehicle outright and not have to make PCP monthly payments. Therefore, it can save you money in the long run. However, you will need a lot of money saved to pay for the car in cash.

Car finance can also be a good option. You will not need as much money upfront and can spread the car’s cost over time. However, you will have to make lower monthly repayments and may pay more for the vehicle in the long run.

It is essential to weigh all the options before deciding whether to buy your dream car through car finance or pay for it in cash. Consider your financial situation and what will work best for you.

What Is Guaranteed Car Finance?

Guaranteed car finance is a type of financing that allows you to buy a car without a credit check. It means that even if you have bad credit, you can still get approved for funding.

With guaranteed car finance, the lender agrees to cover the cost of the vehicle regardless of your credit score. It makes it easier to get approved for financing and can help you get a better interest rate.

However, guaranteed car finance comes with some risks. First, you may pay more for the vehicle because of the higher interest rates. Second, if you default on the personal loan, the lender can repossess the car.

Before considering guaranteed car finance, weigh all your options and understand the risks involved.

This financing can be a good option for those with bad credit, but it is not suitable for everyone.

When considering guaranteed car finance, shopping around and comparing offers from multiple lenders is essential. It will help you find the best deal and avoid overpaying for your vehicle.

Guaranteed car finance can be a good option for those with bad credit looking to finance a car. However, compare offers from multiple lenders and understand the risks before signing any loan agreement.

How Do You Qualify For A Quick Car Finance?

When you are looking to finance a car, there are a few things that you will need to do to qualify. The first thing is that you will need to have a job. The lender will want to see that you have a steady monthly income so that they know you can make the monthly payments.

Another thing the lender will look at is your credit score. You will likely qualify for a lower interest rate if you have good credit. However, even if you have bad credit, options are still available.

Finally, the lender will also want to see how much money you have for a down payment. A down payment shows the lender that you are serious about buying the car and are willing to put some money down upfront.

Qualifying for a quick car finance plan is not difficult if you have a steady income and a good credit score. However, there are still options available if you have bad credit. Shop around and compare offers from multiple lenders to get the best deal possible.

When Is It Better To Finance A Car Than Pay It In Cash?

It depends on your circumstances. Cash may be the better option if you have saved money and can pay for the car outright. Then, you will not have to make monthly payments and will own the car outright.

However, financing a finance car may be better if you do not have all the money saved. You can spread the cost of the vehicle over time and will not have to come up with a large sum of money upfront.

Consider your financial situation and what will work best for you before deciding. Then, weigh each option’s pros and cons to decide which is best for you.

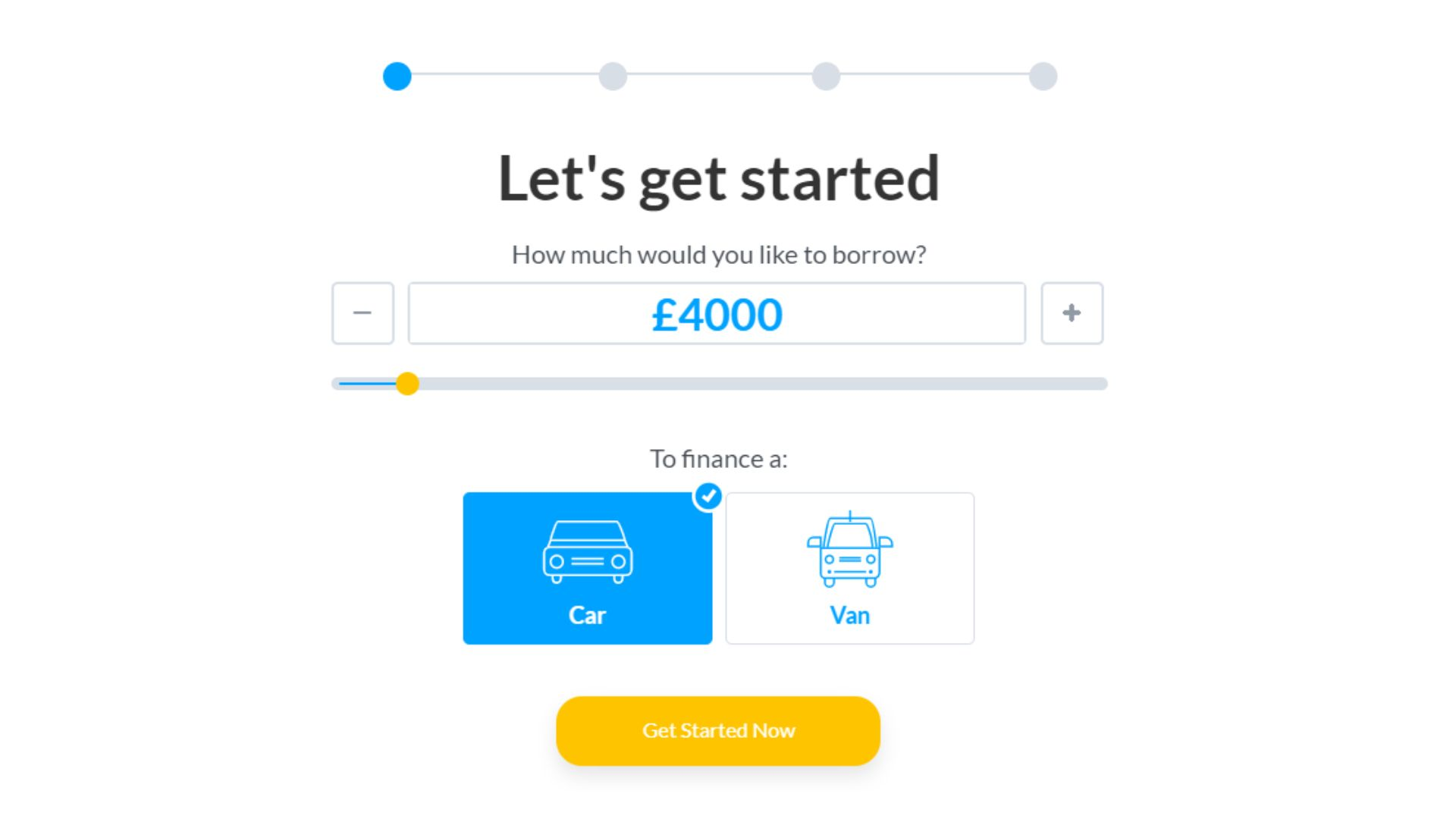

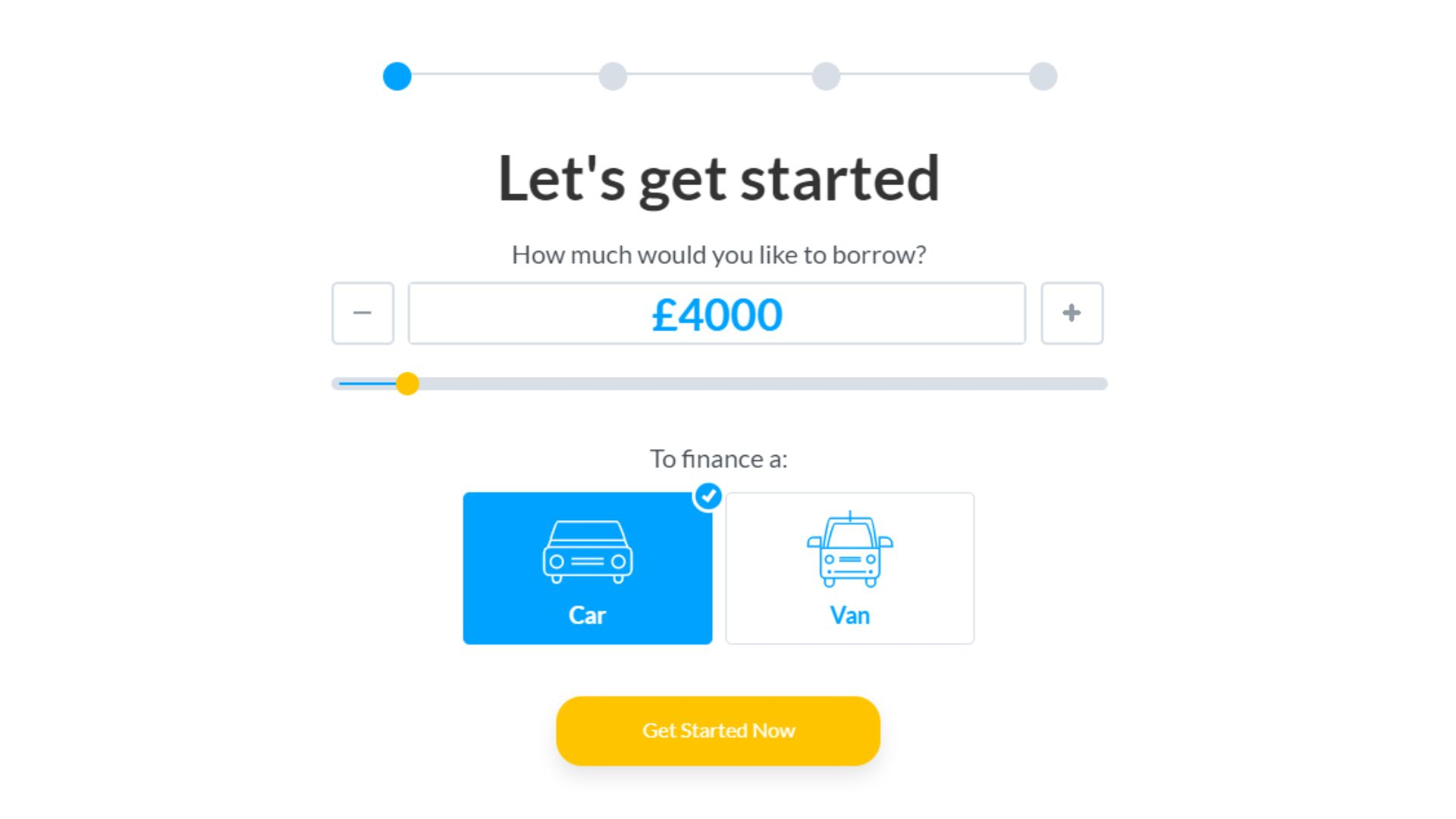

If you are considering finance for your next car, compare offers from multiple lenders to get the best deal possible. Then, use our finance calculator to see how much you could borrow and what your monthly repayments could be.

Paying for a car in cash may be the best option if you have saved money. However, a finance car may be a better option if you do not have all the money upfront. Consider your financial situation and decide which option is best for you.

When finance is an option for a car buyer, it can be challenging to know whether to finance or not. Many things need to be considered when making this decision, such as credit score, interest rates, and the length of the loan. To help you make this decision, we have put together a list of pros and cons for each option.

Paying in cash:

Pros:

-You will own the car outright and not have to make monthly payments.

-There is no interest to pay, so that you will save money in the long run.

-It may be easier to get a discount on the purchase price if you pay in cash.

Cons:

-You will need to have a large sum of money saved to pay for the car outright.

-You may miss out on other investment opportunities as you will tie up all your cash in the car.

Financing:

Pros:

-You can spread the cost of the car over a more extended period.

-You can get a lower interest rate if you have a good credit score.

-You will not need to have a large sum of money saved upfront.

Cons:

-You will have to make monthly payments and may pay more for the car due to interest charges.

-Your credit score may be affected if you miss any payments.

-You may be required to provide collateral as a down payment.

When deciding between finance and cash, weighing all the pros and cons is essential. So first, consider your financial situation and what will work best for you before deciding. Then, use our finance calculator to see how much you could borrow and what your monthly repayments could be.

What’s The Cheapest You Can Finance A Car?

It depends on a few factors, such as your credit score, interest rate, and loan length. The best way to get an accurate estimate is to compare offers from multiple lenders.

If you have good credit, you may be able to finance a car at a lower interest rate. However, even if you have bad credit, options are still available. The lender will also want to see how much money you have for a down payment. A down payment shows the lender that you are serious about buying the car and are willing to put some money down upfront.

Qualifying for quick finance is not difficult if you have a steady income and a good credit score. However, there are still a few things to consider before you finance a car.

The first thing is the interest rate. The lower your credit score, the higher the interest rate is likely to be. The second thing to think about is the length of the loan. A longer loan will mean lower monthly payments, but you will pay more interest over time.

Once you have considered all these factors, you can use our finance calculator to see how much you could borrow and what your monthly repayments could be. Then, compare offers from multiple lenders to get the best deal possible.

How Can I Check The Remaining Balance On My Car On Finance?

Keeping track of your remaining balance is essential if you have a car in finance. That way, you can have a monthly budget accordingly and ensure you do not miss any payments.

You can check your car’s remaining finance balance in a few different ways. The first is to contact your lender directly. They should be able to give you an up-to-date credit.

Another option is to check your monthly statements. The balance should decrease each month if you have been making regular payments. You can also use an online car finance calculator to estimate your remaining balance.

Once you know your car’s remaining car on finance balance, you can budget accordingly and make sure you make all the necessary payments on time. That way, you can avoid any additional fees or charges.

Is It Worth It To Finance A Used Car?

When you finance a used car, there are a few things to consider. The first is the interest rate. Used cars often have higher interest rates than new ones because lenders see them as a higher risk.

That means you must ensure you can afford the monthly payments before signing any contracts like Personal Contract Purchase (PCP). APR stands for Annual Percentage Rate. It’s the amount of interest you’ll pay yearly on the money you’ve borrowed, including the various fees that apply, so that you can accurately determine and compare the overall annual cost of your agreement. APR will be shown on personal contract purchase (PCP), hire purchase (HP), and conditional costs. It is also essential to factor in the possibility of repairs and maintenance. With used car finance, there is no warranty, so you may have to pay for unexpected repairs.

Another thing to consider is the down payment. With used car finance, lenders often require a larger down payment than they would for a new or used car because of the higher risks involved. That means you will need more money before you can finance a used car.

Weighing all the pros and cons is essential before deciding to finance a used car. It would be best if you used our finance calculator in CarFinanceMarket.co.uk to see how much you could borrow and what your monthly repayments could be. Then, compare offers from multiple lenders to get the best deal possible.

How Do You Qualify For Car Finance Deals?

When you finance a car, the lender will want to see how much money you have for a down payment. A down payment shows the lender that you are serious about buying the car and are willing to put some money down upfront.

The size of your down payment will also affect your monthly repayments. The larger the down payment, the lower your monthly repayments will be. However, you will need to have enough money saved for a significant down payment before qualifying for car finance deals. When you apply for a car loan with us, we’ll search our large panel of lenders to find the best deal for you and your personal circumstances. Auto Trader Limited is a credit broker and not a lender. Representative APR finance examples are for illustrative purposes only. You must have a long-standing credit history and make all your repayments on time.

This is a pre-agreed mileage limit imposed for the duration of the finance agreement, designed to protect the car’s value. The size of your deposit, monthly payments, and (if applicable) final payment will then be calculated based on this. You can read more about modifying a financed car finance deal on our site CarFinanceMarket.co.uk. If you’d like to pay off your car loan early you will need to contact your lender, as each lender is different. The coolest thing about CarFinanceMarket.co.uk is that you can apply for car finance online although many other lenders and brokers may claim they are online – they all require you to have phone conversations and follow up with paperwork which means it can take days to get your car finance sorted and complete the process.

You are able to choose a vehicle from any reputable UK dealership like CarFinanceMarket.co.uk. Another factor that lenders will consider is your credit rating. The higher your credit score, the better car finance deals you will be able to qualify for. Lenders use credit scores to assess risk, so a high score means you are a low-risk borrower.

You can check your credit score for free with our online tool. Simply enter your details, and we will give you an estimate of your credit score. Then, you can compare car finance deals to see which one is right for you.

Who Offers The Best Car Finance In UK?

There are many options available when it comes to car finance UK-based. The best way to find the right lender for you is to compare offers from multiple companies.

That way, you can see what interest rates are being offered and find the loan that best suits your needs. It is also essential to consider the down payment required and the length of the loan.

To help you understand the finance options provided by CarFinanceMarket.co.uk, we have created a finance calculator tool. Once you have considered all these factors, you can use our finance calculator to see how much you could borrow and what your monthly repayments could be. Then, compare offers from multiple lenders to get the best deal possible.

Thoughts

There are a few things to think about before you finance a car. The first is the interest rate. The lower your credit score, the higher the interest rate is likely to be. The second thing to think about is the length of the loan. A longer loan will mean lower monthly payments, but you will pay more interest over time.

Once you have considered all these factors, you can use our finance calculator to see how much you could borrow and what your monthly repayments could be. Then, compare offers from multiple lenders to get the best deal possible. For example, one of the car finance near me is CarFinanceMarket.co.uk. Contact us to get started!