PCP finance is a great way to get a new car without having to pay the whole amount upfront. You can spread the payments over a number of years, which makes it more affordable.

PCP finance is a type of car finance that allows you to pay for your car in monthly installments. You don’t have to pay the whole amount up front, and you can choose how many years you want to spread the payments over. This makes it a more affordable option than buying a car outright. If you’re looking for a new car, PCP finance is definitely worth considering. It’s a great way to get behind the wheel of your dream car without having to break the bank account.

With PCP car finance, you can choose the length of your contract between 1 and 4 years and how many miles you plan on driving per year. You also have the car finance option to trade in your car for a new one at the end of your contract, or keep it and pay off the remaining balance.

What is a PCP Car Finance Agreement?

A PCP car finance agreement is a type of loan that allows you to finance the purchase of a car. With this type of car loan, you agree to make monthly payments for a set period of time, usually between two and five years. At the end of the loan term, you can either pay off the remaining balance in full or trade-in your car for a new one.

PCP car finance agreements are popular because they allow you to spread the cost of your vehicle over time, making it more affordable. When choosing a PCP car finance agreement, it is important to compare PCP deals interest rates and terms from different lenders to find the best finance deal. Be sure to read the fine print carefully before signing any contracts.

At the end of the agreement, you can either choose to hand the car back and pay nothing more, or you can pay off the remainder of what’s owed on the car and keep it. If you choose to keep the car, then you will need to pay off any outstanding finance plus interest and fees.

What Do I Need For Car PCP Finance?

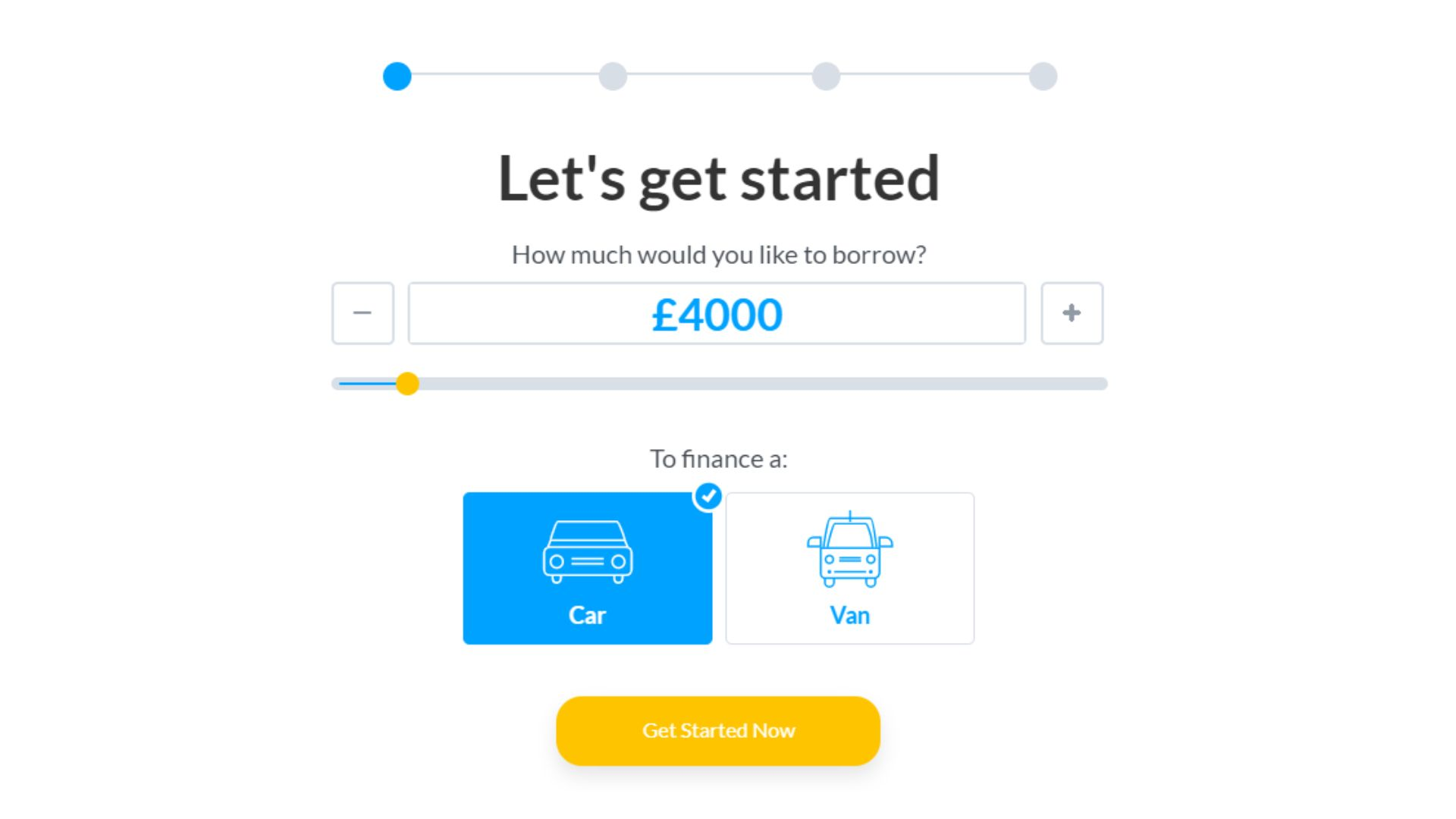

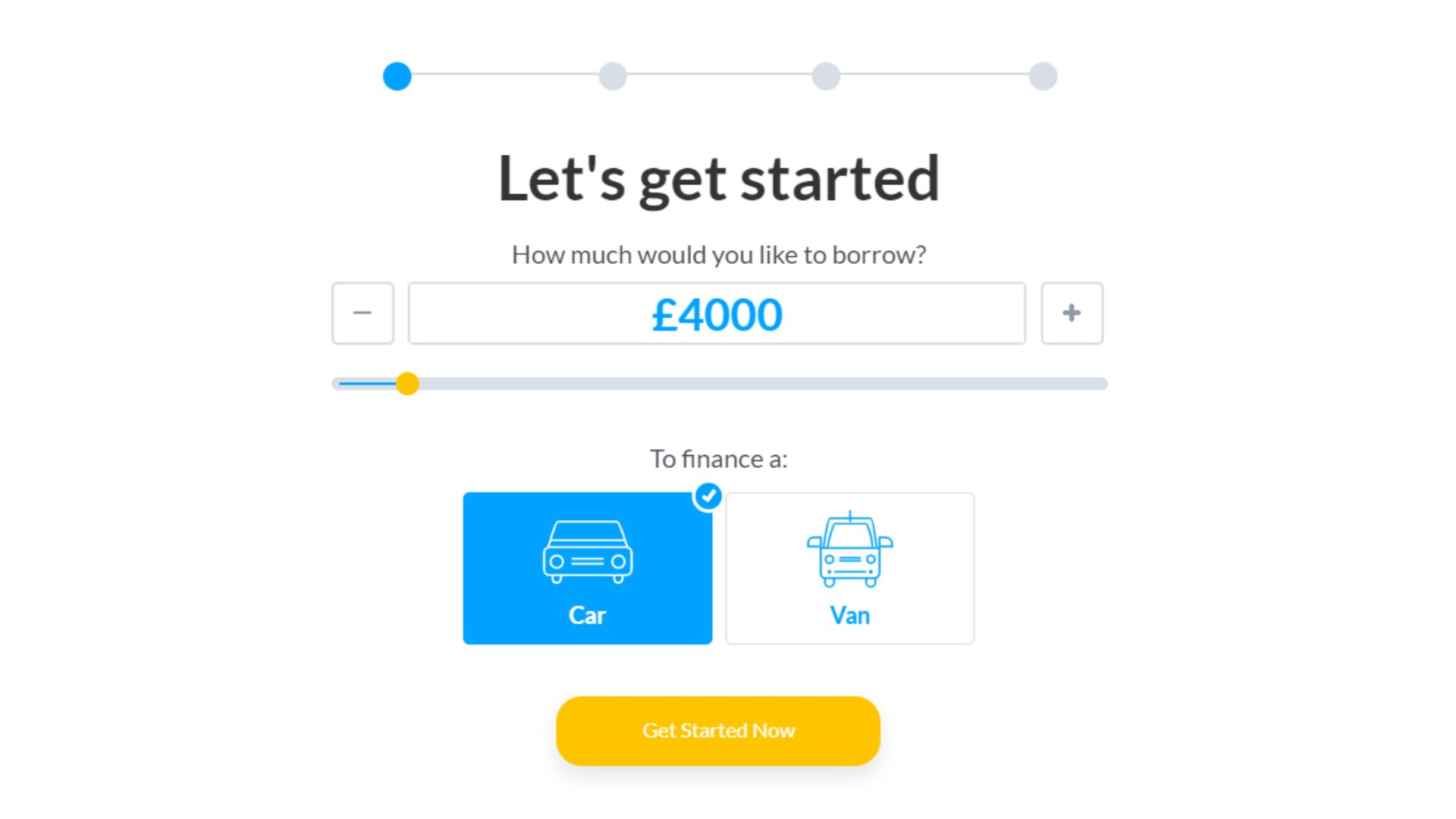

If you’re looking to finance a car purchase, you may be considering a Personal Contract Purchase agreement. Here’s what you need to know about this type of financing before you get started.

A PCP agreement is a type of car finance that allows you to spread the cost of your vehicle over an agreed period of time, usually two to four years. At the end of the term, you then have the option to either return the car and make no further payments or pay a lump sum (known as the “balloon payment”) and keep the car.

When it comes to car finance, there are a lot of options out there. It can be confusing trying to figure out what’s the best deal for you, but that’s where we come in. At Car PCP Finance Company, we’re experts in arranging car finance deals and we’ll make sure you get the best interest rate possible.

How Does PCP Work on Used Car?

When you take out used car PCP finance, the lender agrees to lend you a set amount of money in exchange for you making monthly payments. At the end of the loan term, you have the option to either hand back the car to the lender or buy it outright for a pre-determined car price.

PCP finance is a great way to spread the cost of buying a car over several months, and it can be especially useful if you don’t have enough money saved up to pay for a car outright. It’s also worth noting that PCP deals can be much cheaper than traditional car loans, so they’re worth considering if you want to get a good deal on your new vehicle.

Essentially, with a PCP you’re agreeing to make monthly payments on a vehicle over an agreed-upon period of time usually two to four years. At the end of that period, you have the option to either pay off the remaining balance and keep the car, trade it in for a new one, or return it entirely. That makes financing a used car much more flexible than other car finance options.

How To Compare Car PCP Offers?

When comparing car PCP offers, it’s important to consider the cost of the vehicle, the size of the deposit required, and the monthly payments.

Some dealers may ask for a large deposit, while others may not require a deposit at all. The cost of the vehicle is also important to consider; some dealers may offer lower monthly payments on more expensive cars, while others may offer low monthly payments on cheaper cars.

Finally, it’s important to read the small print! Some dealers may include hidden costs in their PCP deals (e.g. admin fees, vehicle insurance premiums). It’s always best to compare several PCP car offers before making a final decision.

Some finance companies will use the guaranteed future value of your car as part of their calculation. This is the predicted value of the car at the end of your contract, minus any excess agreed mileage limit or damage charges.

So, if you think there’s a good chance you’ll exceed the annual mileage limit or damage your car beyond what’s covered by your insurance policy, it might be worth going with a company that uses a lower GFV in its calculation.

How Easy is it To Get The Best PCP Deals?

It can be quite easy to get the best PCP deals, depending on where you live and what type of car you’re looking to buy. In general, it’s a good idea to compare prices at several car dealerships in your area before making a car purchase. You may also be able to find great deals online, especially if you’re willing to buy the car.

Keep in mind that not all cars are created equal, and not all dealerships offer the same deals. Do your research ahead of time and ask around for recommendations so you can find the best new PCP deal possible.

Can a PCP Deal Only Be Used For Finance For a Brand New Car?

Yes, a PCP deal can be used purely for finance on a brand new car. In fact, this is one of the most popular ways to finance a new vehicle purchase. PCP deals on cars tend to offer very attractive monthly payments and can often save you money in the long run compared to other financing options.

However, it’s important to remember that with a PCP deal you will still need to make an optional final payment known as the balloon payment in order to own the vehicle outright. So if you’re considering using a PCP deal to finance your next car purchase, make sure you understand all the terms and conditions before signing any agreements.

Now, while most PCP deals are used for buying brand new cars, there’s no reason why they can’t be used for purchasing second-hand vehicles too. In fact, plenty of people do just that – using their PCP deal as a way to finance an older car that they might not otherwise have been able to afford.

What Are The Benefits of PCP Car Finance?

Assuming you’re asking about the benefits of financing a car through a Personal Contract Purchase plan, there are a few key advantages that make this option attractive for many buyers.

First, with PCP financing you can often get a lower monthly payment than with other types of auto loans. This makes it easier to budget for your car payments and frees up more cash for other expenses.

Second, at the end of your PCP finance car term, you have the Option to Purchase the Vehicle outright if you wish. This gives you flexibility and control over your finances that you may not have with other types of loans.

Another big benefit is that you have flexibility at the end of the agreement. You can choose to hand back the keys and walk away, or alternatively, you can pay a lump sum (the balloon payment) and own the car outright. Or, if you’ve really fallen in love with your car, you may be able to arrange to finance it for a further period and keep it for longer.

How To Choose a Trustworthy PCP Finance Broker?

There are a few things you should consider when choosing a trustworthy PCP finance broker. Here are a few key points to remember:

Regulation and Financial Conduct Authority Approved: All financial activities in the UK must be authorized and regulated by the Financial Conduct Authority. This includes both lending and borrowing money. To check if your broker is FCA approved, you can look them up on the Financial Services Register.

Lending Criteria: A good broker will have robust lending criteria in place to ensure that only those who can afford to take out a normal personal loan are approved. This protects both the borrower and the lender from any financial difficulties further down the line.

Thoughts

Is PCP finance a good idea? The answer to this question largely depends on your personal circumstances and what you hope to get out of the agreement. That said, there are a number of benefits to PCP car finance near you that make it an attractive option for many drivers. If you’re considering taking out a PCP deal on your next car, our advice would be to shop around and compare offers from different brokers.