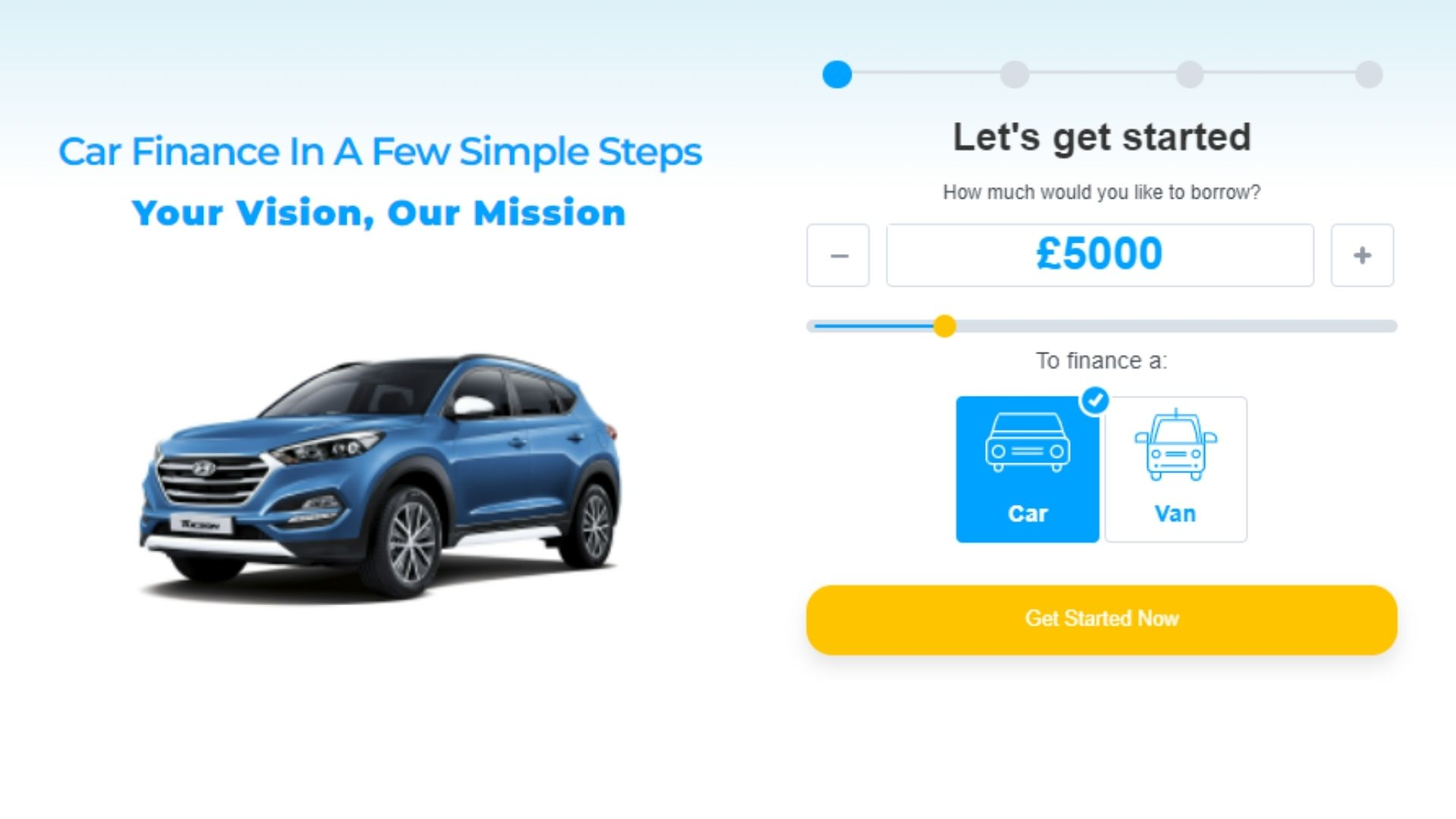

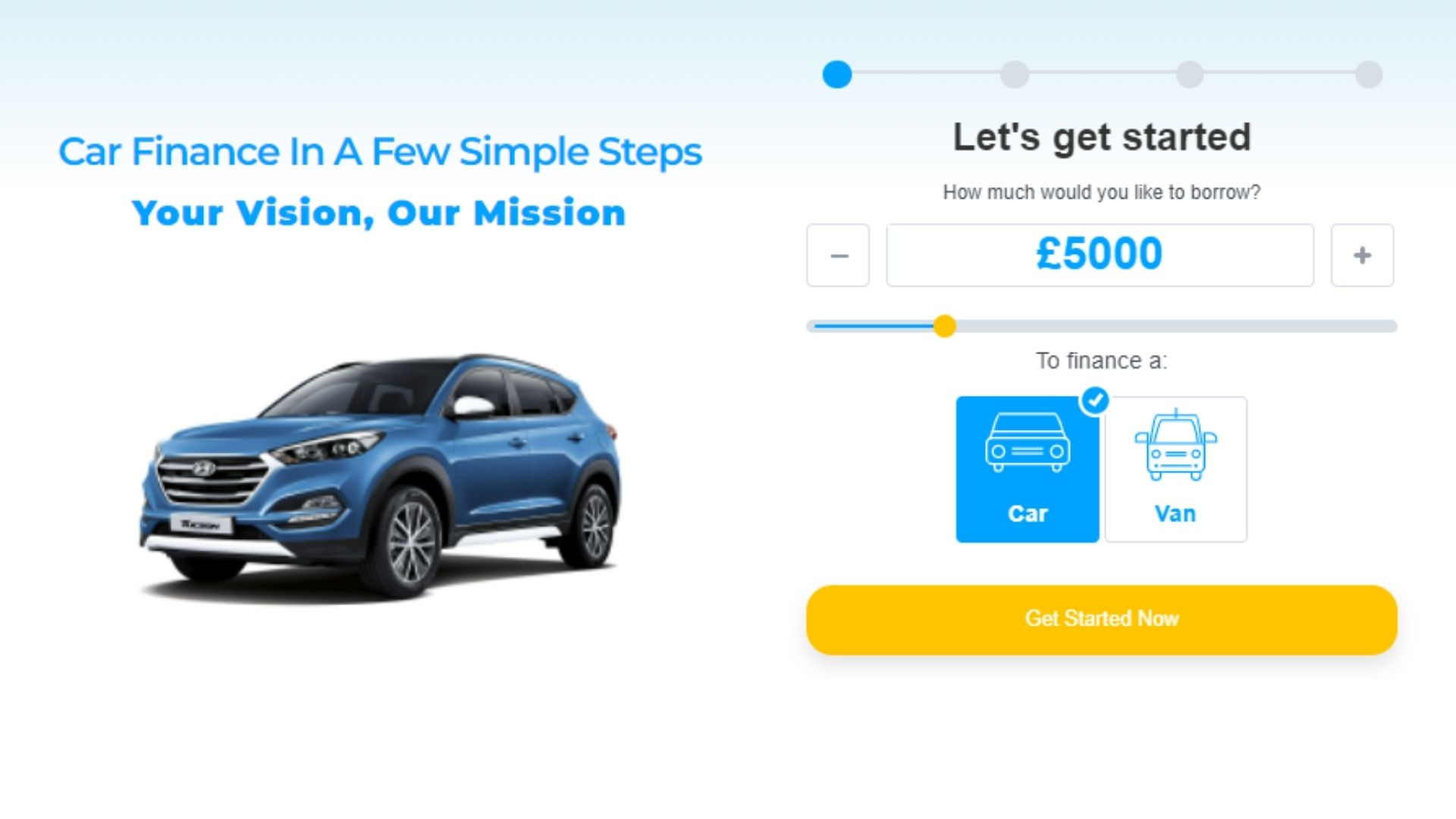

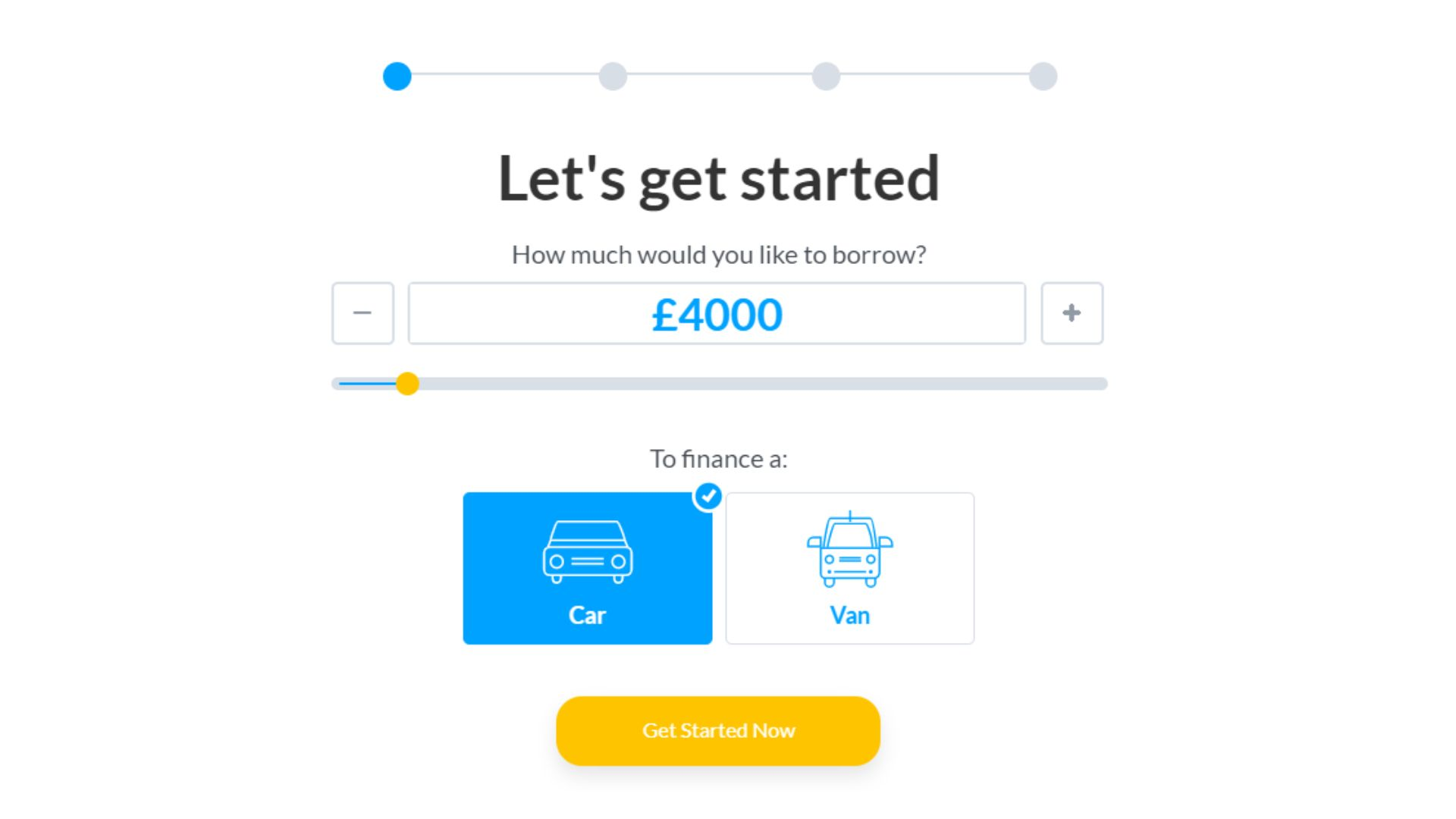

There are a few things to consider when thinking about getting instant car financing. The first is the process may take a bit longer since most banks want to finalize everything before signing off on a loan. Documents may need to be Notarized and mailed in, however, this can be done quickly with the new technology available.

The second thing is that your interest rate may be higher than if you went through a traditional lender. This is because lenders see you as a high-risk borrower, meaning they’re more likely to charge you more for the loan in order to protect themselves.

Instant car finance is a type of financing that allows you to get your car loan approved quickly, without having to go through a traditional lender. Instead, the decision is made based on your credit history and ability to repay the loan. This can be a good option if you’re looking to buy a car right away and don’t have time to go through the traditional lending process. It can also be helpful if you have bad credit history and may not qualify for a traditional loan.

Is it Hard To Get Instant Finance?

It really depends on what you mean by Instant Finance. If you need cash in hand immediately, then most likely the answer is no. However, if you’re asking about getting a loan or line of car credit quickly, then the answer is usually yes.

Banks and other lending institutions will usually take anywhere from 24 to 72 hours to process a loan application. So if you need money in a hurry, then it’s best to apply for a loan before you actually need it. That way, you’ll have time to fix any issues that may arise with your application.

One way to improve your chances of getting approved for a loan is to have a good credit score. You can improve your credit score by paying your bills on time and by not carrying too much debt. You can also get a copy of your credit report so that you can see where you stand and take steps to improve your credit score if needed.

How To Check For Companies That Provide Instant Decision Car Finance?

There are a few things you can do to check for companies that provide instant decision car finance. The first thing you can do is search the internet. A simple search should reveal a number of different companies that offer this type of financing. You can also ask friends or family members if they know of any good companies to recommend. Finally, you can check with your local bank or credit union to see if they have any recommendations. Once you have a few potential companies in mind, be sure to compare their interest rates and terms before making a final decision.

Not all finance companies are created equal, and some may be more reputable than others .another thing to keep in mind is the registered office address of the company. If the company is based in another country, it’s likely that you won’t be able to get your money back if something happens. One way to start your search is by checking out the Better Business Bureau website. This database includes information on businesses throughout the United States, so you can compare companies and find finance providers that are right for you.

What Are The Benefits of Getting Car Finance Instant Decision?

There are a few benefits of getting car finance instant decision. One is that you can get approved for a loan much faster. This is because the lender will not have to spend as much time reviewing your car finance application.

Another benefit is that you will know right away whether you have been approved or not. This can be helpful if you are in a hurry to buy a car. It can also help you avoid being scammed by dealers who promise you a car loan but do not follow through.

Finally, getting car finance instant decision can help you save money on interest rates. This is because the lender will be more likely to offer you a lower interest rate if your car finance application is processed quickly.

How To Get Approved For Car Finance Instant Decision With Bad Credit?

There are a few ways to get car finance with a bad credit instant decision. One option is to go through a dealership, which will likely have lower interest rates than going through a bank or other lending institution. Another option is to look into secured loans, which require you to put down some collateral (usually your car). This can help you get a lower interest rate and may make it easier to be approved for the loan.

If you have bad credit, it’s important to shop around for the best deal on car finance. Be sure to compare interest rates, fees, and terms of different loans before making a decision. And remember that it’s always important to read the small print!

What Are The Options For Immediate Car Finance?

When you need immediate car finance, there are a few options available to you. You could go through a dealership and get a new car loan, or you could apply for a car title loan. With a car title loan, you can borrow money against the value of your vehicle. This is an option for people who may not have good credit or who need money quickly.

Another option is to go through a peer-to-peer lending platform. With this option, you can borrow money from individual lenders who are looking to invest in small businesses and personal loans. This is an option for people who may want to avoid dealing with a bank or who need more money than they would be able to get with a car title loan.

What Are The Types of Instant Car Finance?

There are a few different types of instant car finance. The most common type is a loan, where you borrow money from a bank or other lender and then repay the loan over time. Another option is leasing, where you agree to rent a car for a specific period of time and then return it to the dealer.

A third option is called hire purchase, which is similar to leasing but typically has lower monthly payments. With the hire purchase, you don’t have to worry about returning the car at the end of the lease period – you simply pay off the remaining balance and own the car outright. Finally, some dealers also offer instant car finance through their own financing schemes.

Each option has its own benefits and drawbacks, so it’s important to do your research before deciding which type of instant car finance is right for you. Talk to your bank or credit union to learn more about the options on your car finance agreement.

What is The Best Finance Company For instant car Finance?

There are a number of reputable finance companies that offer instant car finance. It is important to do your research before you commit to a particular company, as you want to make sure you are getting the best deal possible.

Some things to keep in mind when looking for a finance company include their interest rates, terms and conditions, and loan approval process. Make sure you read the fine print and ask questions if there is anything you don’t understand.

Be sure to compare interest rates and terms before you commit to any loan, and always read the fine print. It’s important to know what kind of fees and payments you’ll be responsible for and to make sure you can comfortably afford the monthly payments.

There are quite a few companies that offer instant decision car finance in the UK. However, one of the best and most well-known is Car Finance Market. They have years of experience in helping people get the financing they need for their dream car, and they will work with you to make sure that you get the best deal possible. So if you’re looking for instant decision car finance, be sure to check out Car Finance Market!

Who Offers Instant Decision Car Finance in the UK?

If you’re looking for instant decision car finance in the UK, there are a few options available to you. First, you can apply for car finance through a dealership. Many dealerships offer instant decisions on car finance applications, so this is a good option if you’re looking to finance a new or used car purchase.

Another option for instant decision car finance is to apply for a personal loan through a bank or other lender. Personal loans can be used for any purpose, including car financing, and many lenders offer instant decisions on loan applications. You’ll need to compare interest rates and terms to find the best deal, but personal loans can be a good option if you have good credit.

Thoughts

When it comes to getting instant car finance, there are a few things that you need to take into account. The first is whether or not it’s hard to get instant finance. The second is how to check for companies that provide instant decision car finance. And the third is what the benefits of getting car finance instant decision are. If you have bad credit car finance instant decision, there are still options for you when it comes to immediate car finance. There are also different types of instant car finance, so you can find the right one for your needs and budget.