If you’re looking for a no deposit car finance deal, there are a few options available to you. One option is to securitize your car’s value through a company. This means that you’ll use your car as collateral for the loan, and the lender will determine the value of your vehicle based on market conditions at the time of purchase. There are also no down payment auto loans available from some lenders, though these typically come with higher interest rates.

You can also consider car leasing a vehicle, which generally requires less money up front than financing a purchase. Whatever route you decide to take, be sure to do your research and compare offers from various lenders before signing any contracts. Speak with a financial advisor or representative from your chosen dealership to learn more about your options and make the best decision for your needs.

What Cars Are Available if I Choose a No Deposit Car Finance Plan?

There are a few different no-deposit car finance options available, and the type of car deals you can get will usually depend on the finance company you choose. You may be able to get a small or medium-sized car with some basic features for a moderate monthly payment, or you may be able to invest in a slightly more luxurious car as long as you’re willing to make slightly higher payments each month. Of course, the final price of the car will also Contributions to the cost of the vehicle.

Some people choose no initial deposit finance because it keeps their options open; they may not have the full purchase amount available up front but they don’t want to tie themselves into ownership until they’re sure they can afford it.

There are three main types of no deposit car finance agreements: personal contract purchase deal, personal contract purchase, and lease purchase.

Personal contract purchase is where you agree to pay a fixed monthly amount for the use of the car, along with an optional final payment (the ‘balloon’) which owns the car at the end of the finance agreements.

Can I Get a Used Car For Car Finance With No Deposit?

It is certainly possible to get used car finance with no deposit. However, it is important to keep in mind that the interest rates on such loans are typically quite high. This is because lenders view new or used cars loan as being higher risk than new car loans. As such, you may want to consider other financing options before taking out a loan with no deposit.

One option might be to save up for a larger down payment, which will help reduce the amount of interest you’ll pay over the life of the loan. Another car finance option might be to look for a less expensive used car that fits your monthly budget. Whatever you decide, be sure to shop around and compare interest rates from different car finance lenders before making a decision.

How Long Will I Have To Pay off a Car on Finance With No Deposit?

Car finance deals without a deposit are not as common as they used to be, but there are definitely 0% interest cars out there. The big thing to remember is that if you do have to pay any money upfront, it’s likely that your monthly payments will be higher.

The other major factor here is the length of the loan. Most car dealerships will give you the option to pay off your car over 3 years, 5 years, or even 7 years. Of course, the longer you take to pay off your car, the more interest you will end up paying in the end. So if you can afford it, it’s always best to try and get a shorter loan term.

Can I Finance an Automatic Car With No Deposit?

You can finance a car with no deposit, but there are a few things you need to know before doing so. First, realize that financing a car without a down payment will likely result in you paying more interest over the life of the loan. Second, be sure to shop around for the best financing terms before signing on the dotted line.

Third, keep in mind that an automatic car may cost more to insure than a manual transmission car. fourth, make sure you are comfortable with the monthly payments before committing to financing an automatic car with no deposit. By following these tips, you can successfully finance an automatic car with no deposit and avoid any financial pitfalls along the way.

There are still plenty of affordable financing options available for those with less than perfect credit history. Shop around and compare offers from multiple lenders to find the best deal for your situation.

What Are The Benefits of Choosing To Get Car Finance With No Deposit?

There are a few benefits to choosing to get car finance with no deposit. One of the main benefits is that you can get into a nicer car than you would be able to afford if you had to put down a deposit. Another benefit is that you won’t have to worry about saving up for a deposit finance deal, which can be difficult especially if you’re on a tight budget.

For one, you don’t have to stress about coming up with a large chunk of money upfront. This can be especially helpful if you’re on a tight budget or if you’re still paying off other debts. Second, by not putting any money down, you can actually increase your chances of being approved for car finance. This is because the lender taking less of a risk by loaning you money, and so they may be more likely to say “yes” if your credit score is good.

Does a Car on Finance With No Deposit Deal Take Longer To Process?

The speed of processing a car on finance with a no deposit deal depends on the lender you choose. Some lenders may process the deal within a few days while others could take weeks. If you’re in a hurry, it’s best to check with the lender ahead of time to see how long they expect the process to take.

Keep in mind that some lenders may require additional documentation or information before they can finalize the loan, so be prepared to provide anything they need as promptly as possible.

When you submit an application for a car on finance with no deposit, the lender will ask for your proof of income and proof of address. They will also want to know how much debt you currently have. This is because they want to make sure that you can afford the monthly payments on the car loan.

If you can provide proof of income and proof of address, and if you do not have any debt, then the lender may approve your application within minutes. However, if you do have debt, then the lender may need more time to review your application.

Can I Get a New Car Finance With No Deposit Deal if I’m Under 21?

Yes, there are a number of lenders who offer new car finance deals with no deposit for people who are under 21. However, it’s important to remember that you will likely have to pay a higher interest rate than someone over 21.

It’s also important to read the terms and conditions carefully before signing up for any finance deal. Make sure you know how much higher monthly repayments will be, and how long you will have to repay the loan. If you can’t afford the monthly repayments, you could end up in debt and struggling to make ends meet.

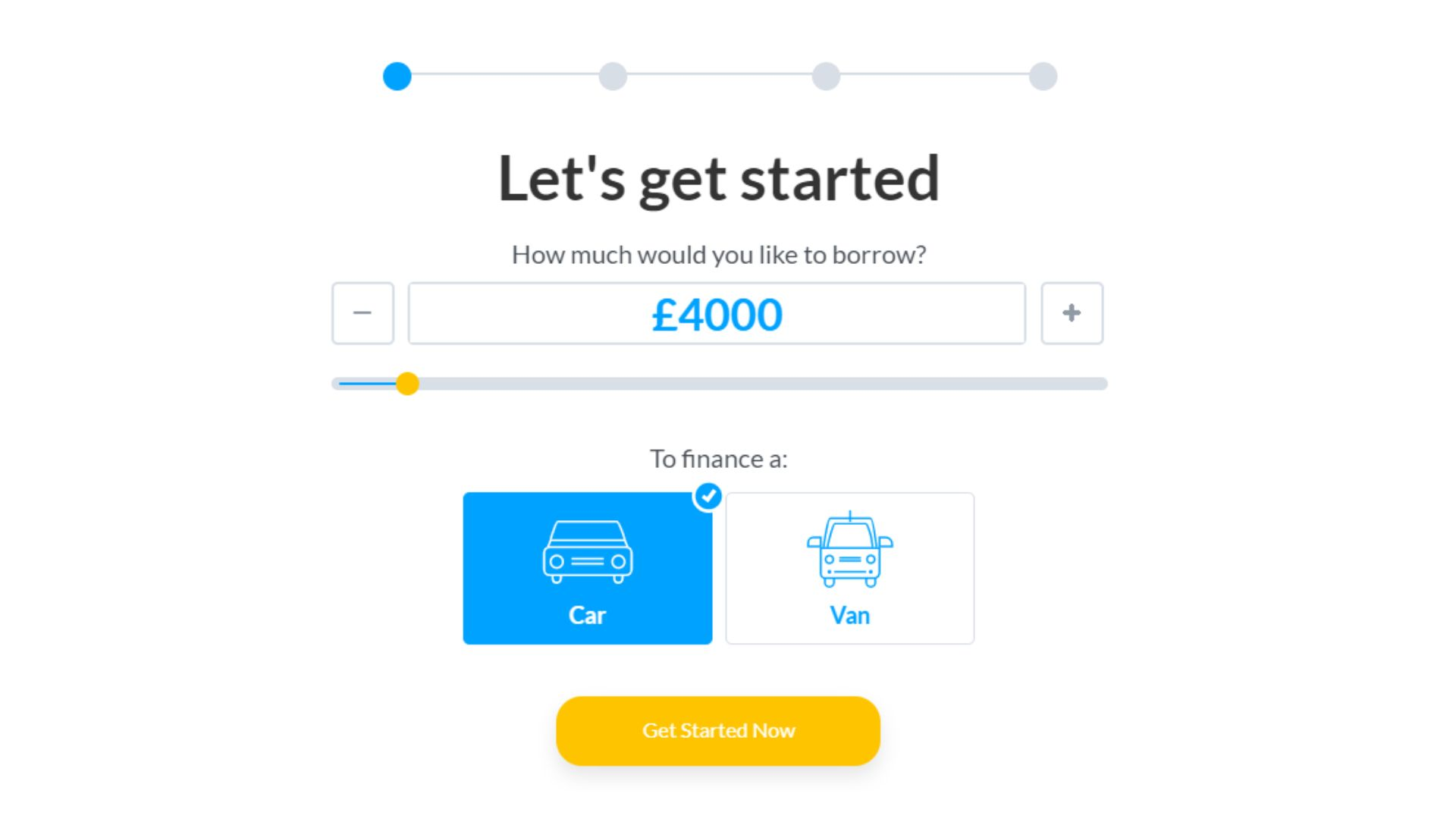

How Much Can I Borrow With 0 Deposit Car Finance?

There are a number of lenders who offer car finance deals with no deposit. However, the amount you can borrow will be limited by your credit score and the value of the car you want to buy.

If you have a good credit score, you may be able to borrow up to 100% of the purchase price of the car. This means you can drive away with a brand new car without having to put down any money yourself.

However, it’s important to remember that a high loan-to-value (LTV) car finance deal will come with higher interest rates. So be sure to compare quotes from different lenders to find the best 0 deposit car finance.

Conclusion

If you’re looking for a cheap car on finance with no deposit, what are your options? Well, first of all, you can choose from a wide range of cars that are available with this type of plan. You can also get a used car on finance with no deposit if you prefer.

And, finally, the benefits of choosing to get car finance with no deposit include not having to pay a big upfront payment and being able to spread the cost of the vehicle over a longer period of time.