One of the most popular ways to finance a new car is through PCP (Personal Contract Purchase) finance. But what are the benefits of this type of finance, and why is it so popular?

The main benefit of PCP finance is that it can help you spread the cost of a new car over a more extended period. It means that you can afford a more expensive car than you might otherwise be able to afford if you were paying for it in one lump sum.

Another benefit of PCP finance is that it can give you greater flexibility when upgrading your car. With most PCP deals, you can trade in your old car and use the equity towards purchasing a new one. In addition, it can be a great way to keep up with the latest models and technology.

Finally, PCP finance can help you budget for your motoring costs. With most deals, you will know how much your fixed monthly payments will be, making it easier to plan your finances.

PCP finance could be the right option if you consider buying a new car. To find out more, speak to your local car dealer today.

How Is Personal Contract Purchase Different To Other Types Of Car Finance?

While personal contract purchase (PCP) is one of the most popular ways to finance a car, there are a few key differences that you should be aware of before you commit to this type of finance.

Firstly, with PCP finance, you will usually only have to pay a deposit upfront. The remainder of the cost is spread out over an agreed period, typically between 2-4 years. Then, you can buy the car outright at the end of the term or trade it in for a new one.

Secondly, PCP deals often come with mileage restrictions. It means you will agree to a maximum number of miles you can drive over the finance agreement. You may be charged a penalty fee if you go over this limit.

Thirdly, PCP finance can be more expensive in the long run than other types of car finance. It is because you will pay interest on the car’s total value rather than the borrowed amount.

Personal contract purchase (PCP) is a type of finance that allows you to spread the cost of a new car over an agreed period. To know more about how PCP works and whether it is the right option for you, talk to your local car dealer today, and they will be able to advise you.

How To Choose Between Used And New Cars On PCP Finance?

When you are looking for a PCP finance deal on a new car, one of the big decisions you will have to make is whether to buy a used or new car. Both options have pros and cons, so weighing up all the factors before deciding is essential.

One of the main benefits of buying a used car is that it will be more affordable. You can often get a great deal on a used car, especially if you are willing to haggle with the seller. In addition, used cars often hold their value better than new cars, so you may not lose as much money if you decide to sell them after a few years.

However, there are also some advantages to buying a new car:

- You will be the first owner, so you can be sure that the car has been well looked after.

- New cars often come with manufacturer warranties, so you will be covered if anything goes wrong.

- New cars usually have the latest technology and safety features, giving you peace of mind when driving.

To decide whether a used or new car is correct, you must consider your budget and what you are looking for in a car. A used car may be the best option if you are on a tight budget. However, a new car may be worth the investment if you want the latest technology and safety features.

Talk to your local car dealer if you are unsure which option to choose. They will be able to advise you on the best choice for your circumstances.

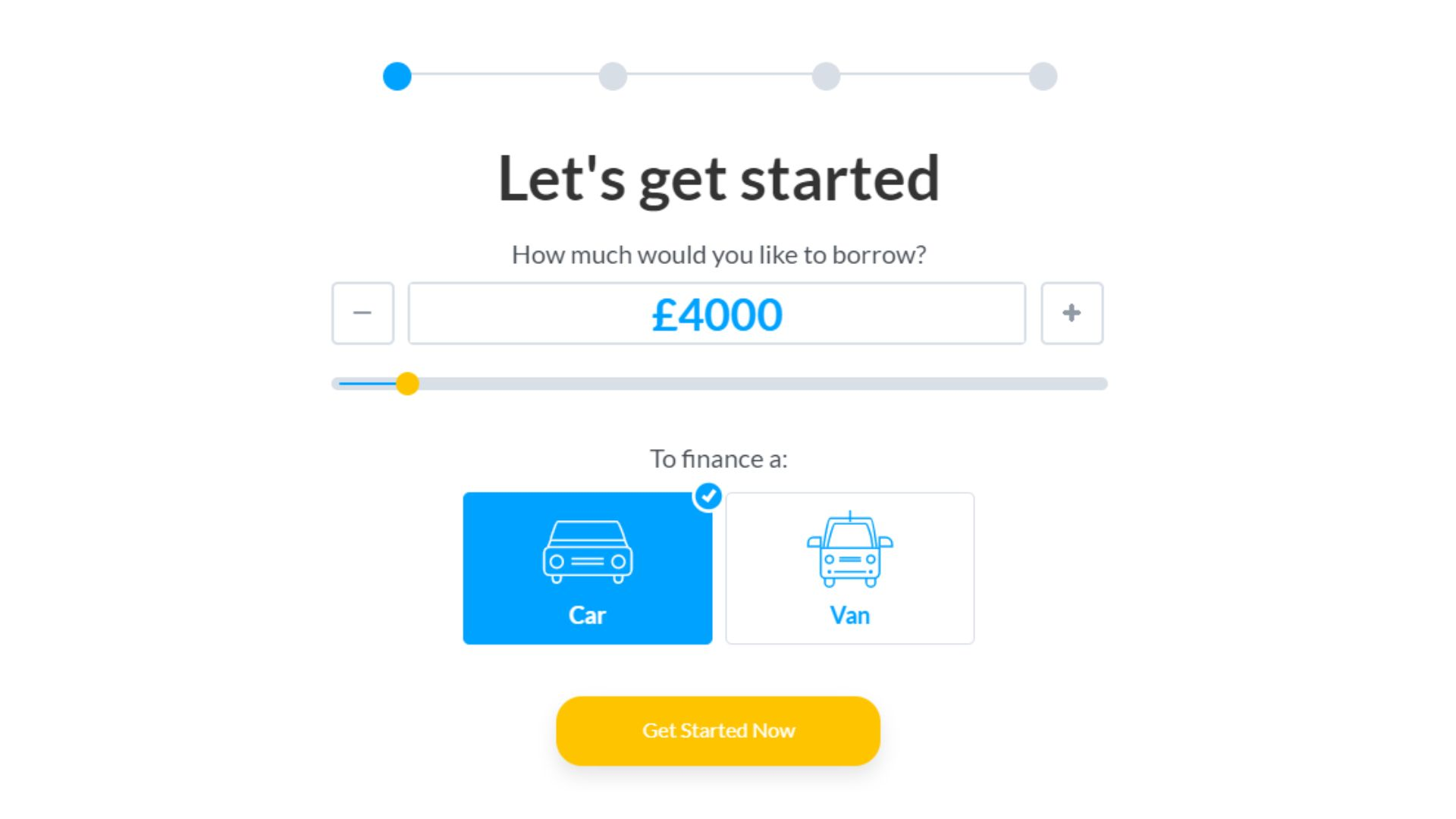

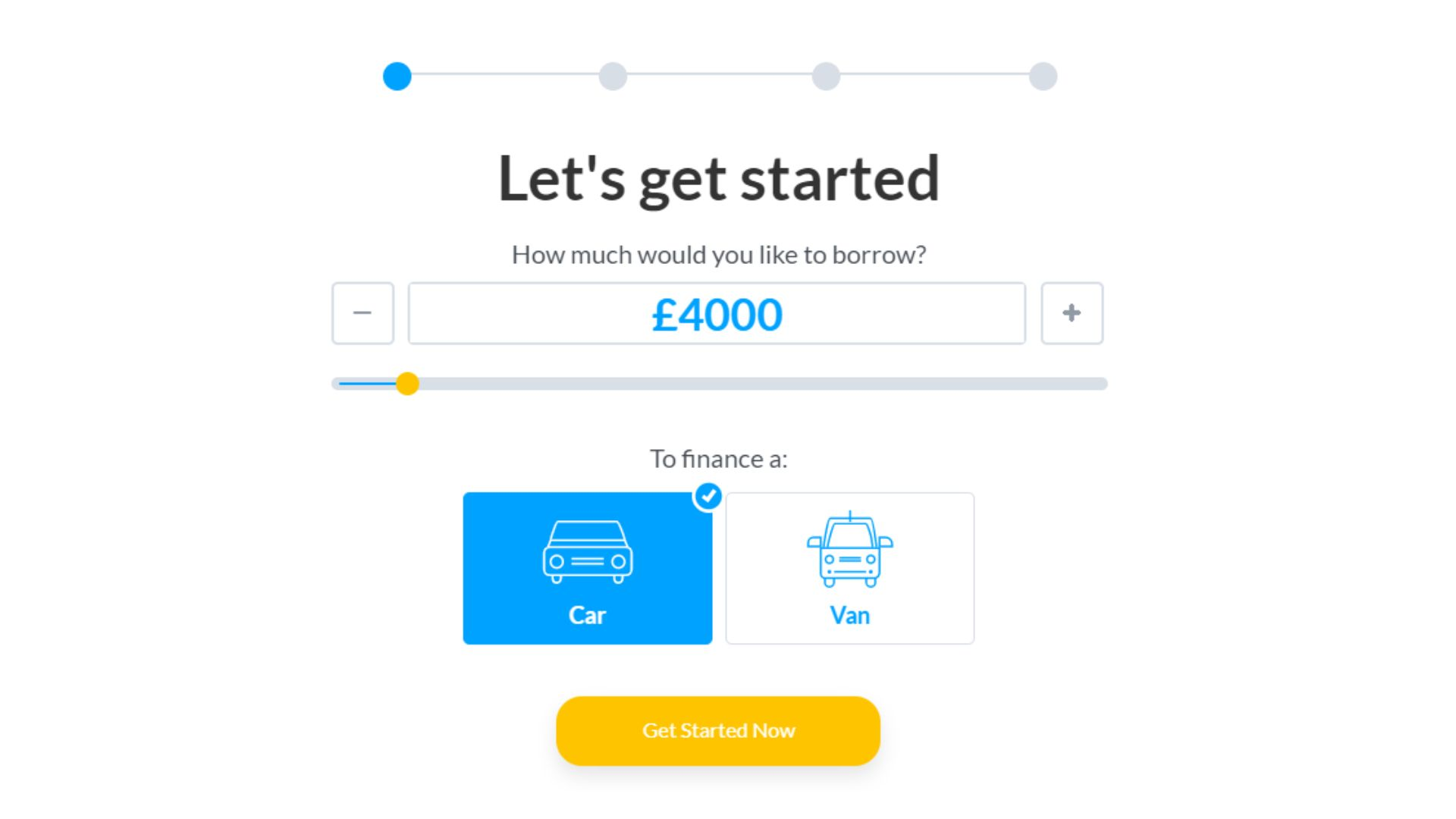

Does PCP Car Finance Provide Flexible Loan Terms?

Yes, PCP car finance can provide flexible loan terms. You can choose a repayment period that suits your budget and needs. The most common repayment periods for PCP finance are 2-4 years, but some lenders may offer longer terms.

One of the benefits of choosing PCP car finance is that you can often trade in your old car and use the equity towards purchasing a new one. In addition, it can be a great way to keep up with the latest models and technology.

PCP car finance could be the right option if you consider buying a new car. To find out more, speak to your local car dealer today, and they will be able to advise you.

Can I Provide Affordable Deposits With Cars On PCP?

One of the benefits of cars on PCP is that you can often only have to pay a deposit upfront. The remainder of the cost is spread out over an agreed period, typically between 2-4 years. It can make financing a car more affordable for many people.

Another advantage of cars on PCP is that you can trade in your old car and use the equity towards purchasing a new one. It can be a great way to keep up with the latest models and technology.

Cars on PCP can provide flexible and affordable financing options for many people. If you are considering financing a car, speak to your local car dealer today, and they will be able to advise you on the best option for your needs.

How Can I Stretch My Budget For Car Finance PCP?

There are a few things that you can do to make car finance PCP more affordable. One option is to trade in your old car and use the equity towards the cost of the new car. You can also try to get a more extended repayment period, reducing your low monthly payments.

Another way to make car finance PCP more affordable is to choose a lower-priced car. It will reduce the amount you have to borrow and, as a result, the amount of interest you will pay.

Talk to your local car dealer today if you consider car finance PCP. They will be able to advise you on the best option for your needs and budget.

What Are The Potential Risks Involved With Car PCP Finance?

There are a few potential risks involved with car PCP finance. One is that you could end up owing more than the car is worth if the vehicle doesn’t hold its value over the repayment period.

Another risk is that you could miss payments and damage your credit score. It could make it difficult to get finance in the future.

Finally, car PCP finance can be more expensive than other types of car finance deals if you decide to settle the loan early.

Before taking out car PCP finance, ensure you understand the risks involved. A Balloon Payment is the optional final payment at the end of a Personal Contract Purchase (PCP) agreement which must be paid if you would like to own a car. With PCP the amount you’ll borrow is decided by the finance company prediction of how much the value of the car will drop over the term of the deal (usually 24 or 36 months), they also subtract the deposit from this to give them the total amount you’ll owe. You’ll need to agree on an annual mileage limit at the start of your contract.

Personal contract purchase, or PCP for short, is a flexible car financing option that can offer lower monthly payments than a personal loan or hire purchase (HP) car finance agreement. Speak to your local car dealer today, and they will be able to advise you on the best option for your needs.

How Much It Cost To Cancel Your PCP Finance Agreement?

If you cancel your PCP finance agreement within the 14-day cooling-off period, you will not have to pay any fees. However, if you cancel after this time, the lender may charge a cancellation fee.

The amount of the fee will depend on the terms of your car finance agreement. Therefore, reading the small print before signing is essential to know potential charges.

If you consider canceling your PCP finance deals, speak to your lender first. They will be able to advise you on the best course of action and whether there are any fees involved.

How To Cut Your Monthly PCP Finance Car Payments?

PCP finance car is a great way to finance a car. It can provide flexible and affordable financing options for many people.

If you are looking to reduce your monthly PCP finance car payments, there are a few things that you can do. One option is to try and get a more extended repayment period. It will reduce the amount you have to pay each month.

Another way to reduce your monthly payments is to choose a lower-priced car. It will mean that you have to borrow less money and, as a result, pay less interest.

Finally, you could try and trade in your old car and use the equity towards the cost of the new one.

Speak to your local car dealer today to learn more about reducing your monthly PCP finance car payments. They will be able to advise you on the best option for your needs.

Summary

If you are looking for PCP car deals UK-based, CarFinanceMarket.co.uk is an excellent option. You can exchange your old car and use the equity towards purchasing a new one. Cars on PCP can provide flexible and affordable financing options for many people.

Before taking out car finance PCP, ensure you understand the risks involved. Speak to your local car dealer today, and they will be able to advise you on the best option for your needs. Contact us today for more information!