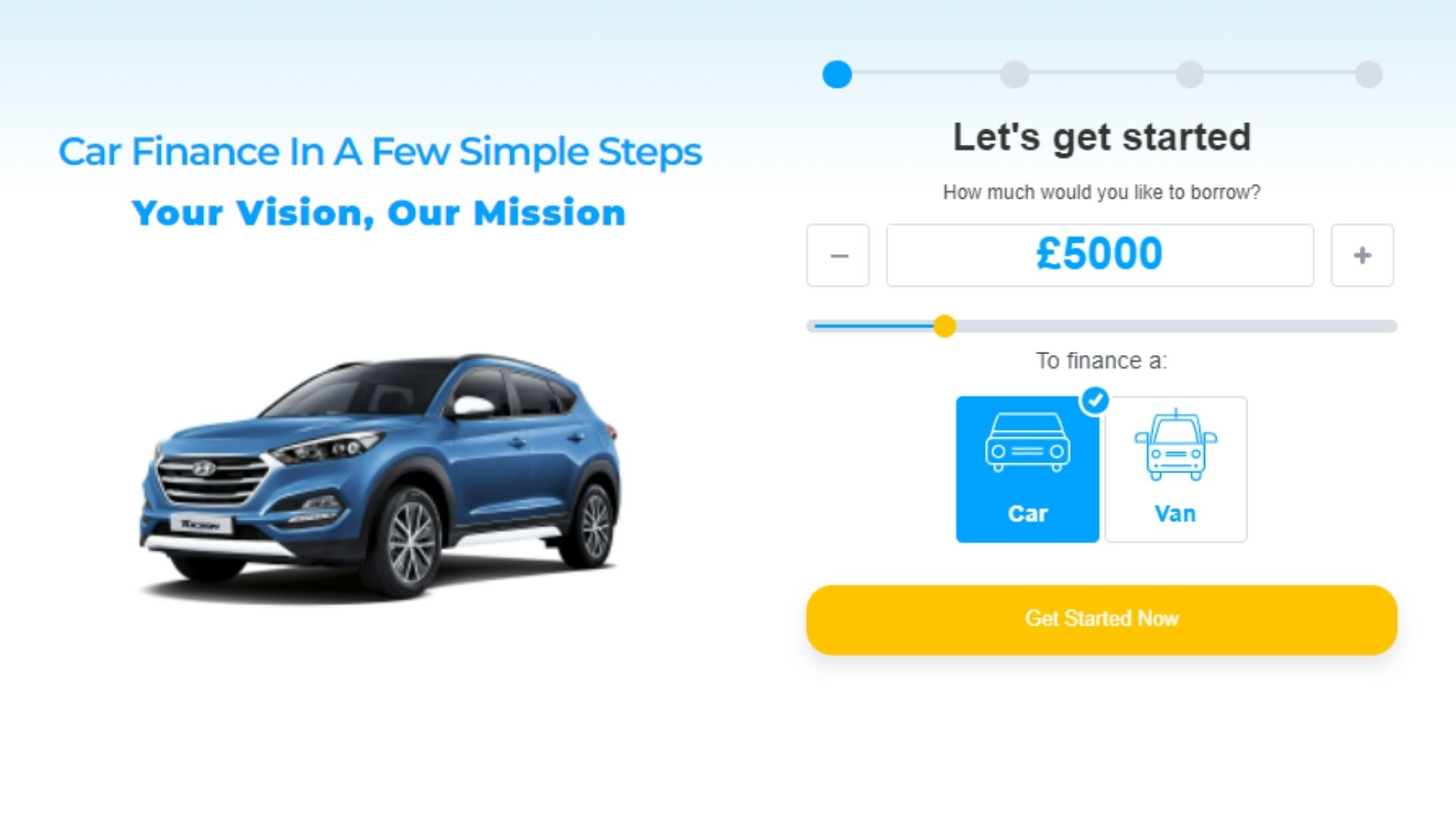

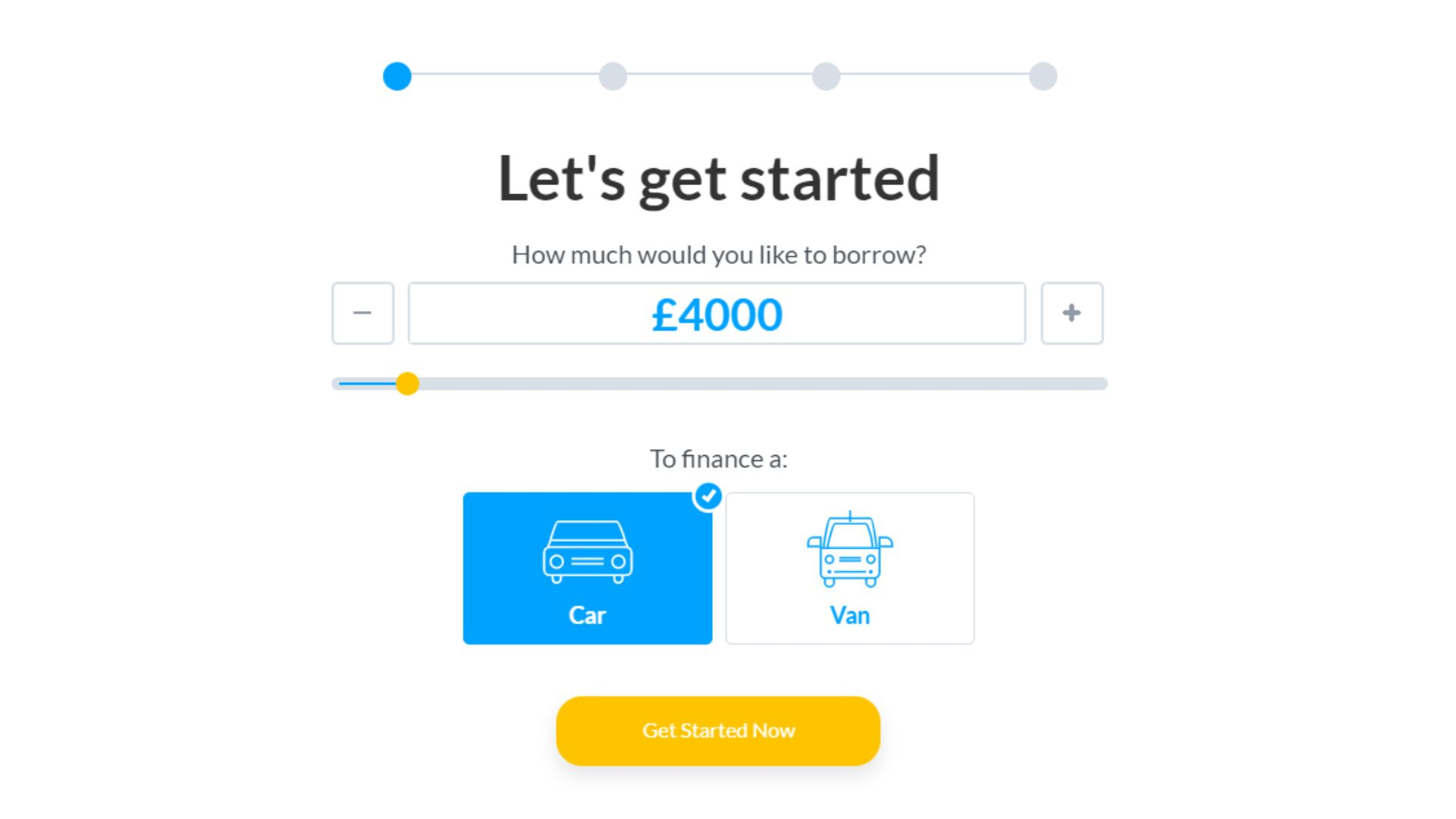

There are many options for car finance, and the best option for you will depend on your individual circumstances. Some common options include dealer financing, bank loans, and private loans.

Dealer financing is often the most convenient option, as you can arrange everything at the dealership when you purchase your car. However, it is important to compare interest rates and terms before signing any paperwork, as dealers typically mark up rates and offer less favorable terms than other lenders.

Bank loans are another popular option for financing a car. banks often offer both new and used car loans with competitive rates. However, it can be difficult to get approved for a loan if you have bad credit.

Is Car Loan Finance Hard To Get?

Car loan finance can be hard to get depending on your credit score and other factors. If you have good credit, you should be able to get your car loan with no problem. However, if you have bad credit, you may have to put down a larger down payment or get a cosigner in order to get the loan. Talk to your bank or credit union about getting a car loan and they should be able to help you figure out what option is best for you.

The market for car loans is very competitive, and lenders know that there are a lot of people who need car loans. So you’ll likely have to shop around for the best car finance deals. You can start by checking out car finance lenders, who often have lower interest rates than traditional banks. And be sure to compare the APR (annual percentage rate) rather than just the interest rate, as this will give you a better idea of the true car finance cost of the loan.

There are other factors that can affect your ability to get car loan finance, such as the type of car you want to buy and the amount of money you want to borrow. So it’s important to shop around and compare offers from different lenders before you decide which one is right for you.

What Do Car Finance Companies in UK Check To Get Accepted?

A car finance company in the UK will likely check your credit score, monthly income, and employment status in order to get a sense of whether or not you are a risky borrower. They may also look at your past borrowing history to get an idea of how likely you are to repay your loan.

The car finance company will also look at the amount you earn each month and how much debt you are currently servicing. They will also want to know what form of vehicle ownership you would like (PCP, HP, lease) and how long you would like the finance agreement to be for.

If you have a good credit score and a steady income, then you are likely to be approved for a car loan. However, if you have a low credit score or no credit history, then you may have difficulty getting approved. In this case, you may want to consider looking for a lender that specializes in bad credit loans.

What Happens If You Are Being Refused For Car Financing?

If you’re applying for a car loan and are being refused, it’s important to understand why. There are a few potential reasons for being turned down for car financing, including:

Poor credit history – One of the most common reasons for being denied a car loan is having a poor credit history. Lenders will pull your credit report to see if you have consistently made late payments or have any outstanding debts. If your report shows that you’re not financially responsible, the lender may be unwilling to offer you a loan.

Limited income – Another reason you may be refused car financing is if your income is too low. Lenders want to see that you have monthly payments, so if you have limited income it’s so hard to get approved.

Why Am I Being Refused For Car Finance in the UK?

There could be a number of reasons why you have been refused a car finance deal. It is important to get in touch with the lender who has refused your application and find out what their reasoning was.

Some of the most common reasons for being refused car finance include having a poor credit score, not having a job, or not earning enough money. If you have been refused for a car finance, it is important to work on boosting your credit score and improving your financial situation before reapplying.

If you’re looking for car finance in the UK, it’s a good idea to check your credit score first and see where you stand. You can get your credit score for free from Credit Karma or Experian. You can then work on building up your credit rating by paying your bills on time and maintaining a good credit history. You could also think about taking out a small loan and repaying it on time to improve your rating.

How To Apply For Car Finance With Bad Credit?

There are a few things that you need to know in order to apply for a finance car with bad credit. The first is that it’s important to have a down payment. This ensures that the lender sees you as less of a risk and may be more willing to approve your loan. Additionally, you’ll want to make sure that you have all of your financial documentation in order before applying. This includes things like your tax returns, bank statements, and proof of income. Finally, don’t forget to shop around! There are plenty of lenders out there who may be willing to work with you even if you have bad credit. So take the time to compare rates and terms before choosing one.

Be prepared to provide detailed information about your income and expenses, as well as your credit history. It may be helpful to have a co-signer on the loan who has good credit. Be sure to read all of the terms and conditions of any personal loan before you sign anything, and be sure you can afford the monthly payments.

How To Improve My Car Financing Application?

The most important factor when applying for car financing is your credit score. If you have a high credit score, you will be more likely to get approved for a loan with better terms and interest rates. You can improve your credit score by paying your bills on time, maintaining a good payment history, and keeping your credit balances low. Other factors that can affect your car financing application are the type of vehicle you are purchasing, the down payment you are making, and the length of the loan term. You can improve your chances of getting approved for financing by choosing a vehicle that is affordable and making a large down payment. You may also want to consider shorter loan terms in order to get lower interest rates.

What Happens If You Hand Back a Car on Finance in the UK?

If you’ve got car financing in the UK, then what happens if you hand the car outright back will depend on your particular contract. It’s important to read over your contract carefully to understand the terms and conditions before signing it. Some common possibilities are outlined below.

With some loans, you may be able to return the car and owe nothing more than what you’ve already paid. However, with other car loans, you may be responsible for paying off the entire loan amount, plus any car loan early repayment fees and charges. That being said, it’s always worth attempting to negotiate with your lender first – they may be willing to work with you to come up with a solution that works for both of you.

Who Can Be a Guarantor For Car Finance?

A guarantor for car finance is usually a parent, other relatives, or a close friend. They must be over the age of 21 and have a good credit history.

A guarantor is someone who agrees to take on responsibility for the debt if the borrower cannot repay it. This can be a useful option if you don’t have a good credit history or don’t meet the lender’s minimum income requirements.

If you’re thinking about becoming a guarantor, make sure you understand the risks involved. If the borrower defaults on the car loan, you will be responsible for repaying it. So only agree to become a guarantor if you’re confident that the borrower can repay the loan.

Conclusion

In the UK, there are a number of options for car finance. You can get a personal loan from a bank or credit union, take out a car lease, or use the best place for car finance. Car finance companies usually check your credit score and income to see if you’re eligible for financing. If you’re being refused car financing, there are things you can do to improve your application. You can also try applying with a guarantor or using a leasing company instead. When you hand back your car to finance in the UK, there are certain steps you need to follow. Make sure you know what they are so you don’t get into trouble with the lenders.