Car finance is one of the most popular ways to finance a car in the UK. However, before you can apply for car finance, you must have a good credit score.

A good credit score is essential because it shows lenders that you are a responsible borrower and are more likely to repay your loan on time. A bad credit score, on the other hand, could mean that you will be refused car loan finance or offered a higher interest rate.

So, what credit score do you need for car finance in the UK?

Generally speaking, you will need a credit score of at least 700 to qualify for car finance. However, It is not set in stone. There are many factors that the panel of lenders will take into account when assessing your application, such as your employment history and income.

If you have a bad credit score, options are still available. For example, you may be able to get cars for finance from a specialist lender or by putting down a larger deposit. Alternatively, you could consider taking out a personal loan to finance your car.

Whatever option you choose, make sure that you compare interest rates and terms before taking out any loan. It will help you to find the best deal for your personal circumstances.

What is a Good Credit Score For Car Loan Finance?

A good credit score for car loan finance meets the minimum requirements of most lenders. Generally, you will need a credit score of at least 700 to qualify for car finance. However, there are many factors that lenders will take into account when assessing your application, such as your employment history and income.

If you have a bad credit score, options are still available. For example, you may be able to get car finance from a specialist lender or by putting down a larger deposit.

Alternatively, you could consider taking out a personal loan to finance your car. Whatever option you choose, make sure that you compare interest rates and terms before taking out any loan. It will help you to find the best deal for your circumstances.

Does Car Finance Company Check Your Employment Record in UK?

Most car finance companies in the UK will check your employment history as part of their assessment process. Your employment status is a good indicator of your ability to repay the loan. If you are self-employed, you may still be able to get car finance. However, you may need to provide additional information, such as your latest tax return.

It is always a good idea to check your credit score before applying to a car finance company UK based. It will give you an idea of where you stand and what kind of interest rates you can expect to pay. You can get your free credit score from several different providers.

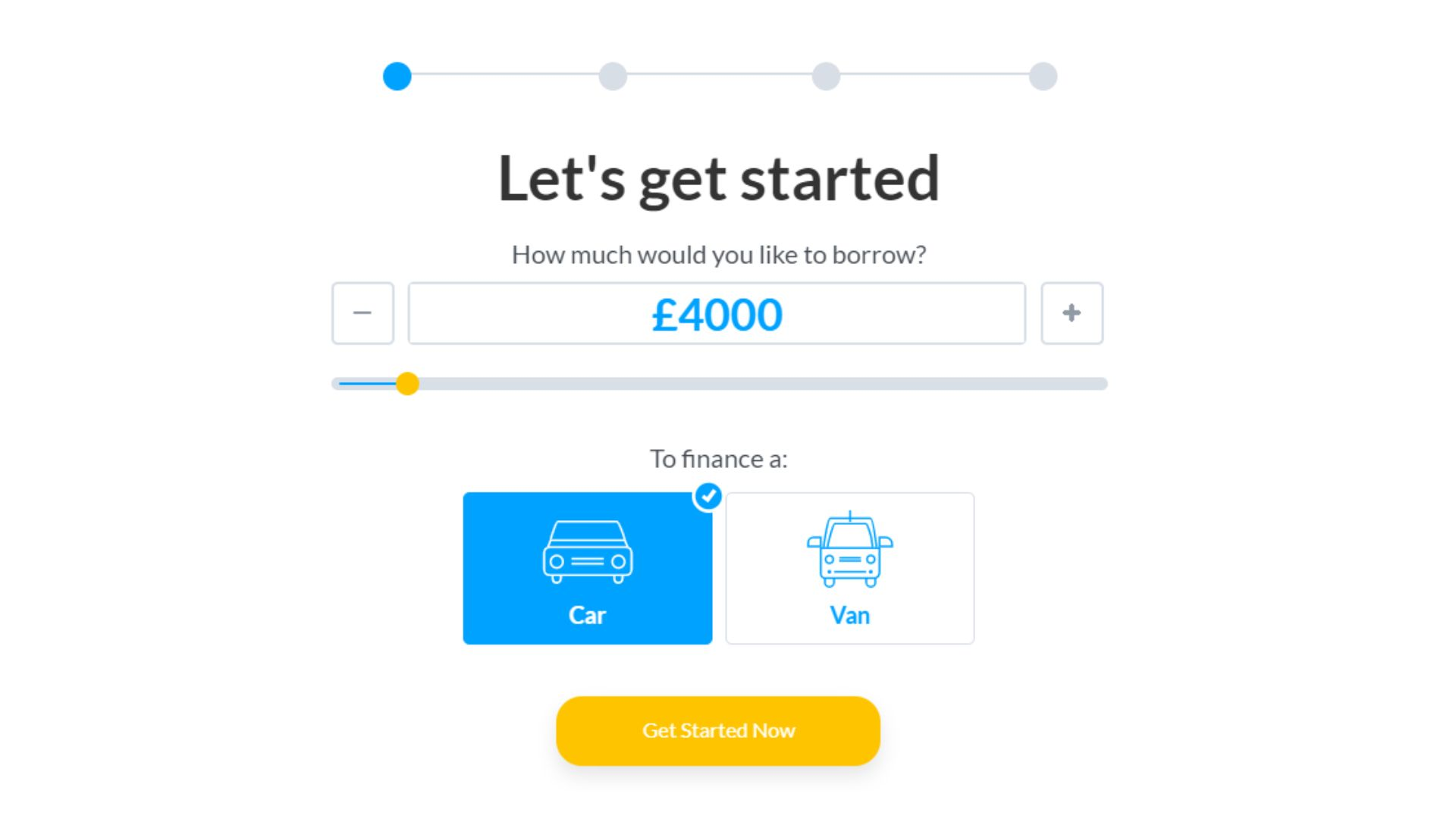

Once you know your credit score, you can start looking for the types of car finance deals. Make sure to compare interest rates and terms on the car finance calculator before applying for any loan. By doing this, you will be able to find the best deal for your circumstances.

What Cars Are The Best For Finance in UK?

There are several popular cars for finance in the UK. These include the Ford Focus, Volkswagen Golf, and BMW 3 Series. All of these cars are reliable and offer good value for money.

When looking for car finance, comparing interest rates and terms is essential before applying for any loan. By doing this, you will be able to find the best deal for your circumstances. CarFinanceMarket.co.uk is an excellent resource for comparing different car finance deals.

How Can I Find Car Finance in UK?

There are several ways to find car finance in the UK. You can approach a bank or other traditional lender, search online, or use a broker.

Banks and traditional lenders usually offer the lowest interest rates. However, they may also require a higher initial deposit. On the other hand, online lenders often have more flexible requirements.

For example, some may not require a deposit. All you need to do is to fill out your personal details on the personal contract hire purchase HP, show your credit report and they will conduct a soft credit check for your finance option.

Using a finance broker can be an excellent way to find the best deal on car finance. Brokers have access to many lenders and can help you find the best value for your circumstances. However, you should be aware that brokers may charge a fee for their services.

Comparing interest rates and terms is essential before applying for any loan. CarFinanceMarket.co.uk is an excellent choice for comparing different car finance deals.

Is it Hard To Apply For Car Finance?

No, it is not hard to apply for finance car. However, comparing interest rates and terms is essential before taking out any loan. It will help you to find the best deal for your circumstances.

You can apply for car finance from a bank or other traditional, online, or broker. Applying to Banks and traditional lenders usually offer the lowest interest rates. However, they may also require a higher deposit. On the other hand, online lenders often have more flexible requirements.

What Is The Difference Between Leasing And Financing a Car?

The main difference between leasing and financing a car is that, with car financing, you will own the car at the end of the term. However, you will need to return the car to the dealership with car leasing.

Another key difference is that, with car finance, you can usually negotiate the terms of the loan. It includes the interest rate, the length of the loan, and the monthly payments. With car leasing, the terms are usually set by the dealership.

Finally, car financing typically requires a higher down payment than car leasing. You are taking out a loan to purchase the car outright. With car leasing, you are only paying for the use of the car during the lease term. Contact CarFinanceMarket.co.uk for an excellent choice for comparing different car finance deals.

How Car Finance Works in UK?

Car finance UK based allows you to spread the cost of a car over an agreed period, usually two to four years. You will make fixed monthly payments, and at the end of the term, you will own the car outright.

The main advantage of car finance is that it can help you afford a more expensive car than you could with a cash purchase. It can also make budgeting for your car payments easier as they are a fixed fee each month.

Another advantage of car finance is that it can be easier to get approved than with a personal loan from a bank. But, again, it is because the car serves as collateral for the loan.

The main disadvantage of car finance is that you will pay more interest than a personal loan. Therefore, car finance deals are usually offered at a higher APR than personal loans.

Can I Get Car Finance Quote Online?

Yes, you can get a car finance quote online. Comparing interest rates and terms is essential before applying for any loan. CarFinanceMarket.co.uk is an excellent choice for comparing different car finance deals.

Getting car finance online has several advantages. The main advantage is that it can be easier to get approved than with a personal loan from banks because the car serves as collateral for the loan.

Another advantage of car finance online is that you can usually negotiate the terms of the loan. For example, it includes the annual interest rate or annual percentage rate, loan length, and monthly payments.

You must check the personal contract purchase PCP, finance representative APR, credit history, credit rating, and the end of the agreement before getting a car finance deal to avoid an unsecured personal loan. A reputable UK dealership offers the best new or used car finance options. UK residents believed that CarFinanceMarket.co.uk is a reputable dealer for their dream car finance deal.

Thoughts

If you are looking for the best place for car finance that suits your monthly budget, CarFinanceMarket.co.uk is an excellent choice. They offer a wide range of car finance deals and can help you find the best value for your circumstances. However, compare interest rates and terms before taking out any loan. It will help you to find the best deal for your needs.

Visit our site, CarFinanceMarket.co.uk, and get the best deals on car finance. We offer different options for financing your car to choose the best one for you. You can save money by availing of monthly instalments. Apply now and get pre-approved in just a few minutes!