A credit score of at least 640 is usually needed to be approved for PCP finance. This is because a credit score of 640 or above is generally considered to be a good credit score, and indicates that you’re likely to be approved for financing and have a low risk of defaulting on your payments.

PCP finance is a type of loan that can be used to buy a car. It’s similar to a lease in that you make lower monthly payments and then eventually own the car. But unlike a lease, with PCP finance you have the option of either returning the car at the end of the contract or buying it outright for a set price.

If your credit score is below 640, there’s still a chance you may be approved for car finance if you can provide evidence of other factors that demonstrate you’re a low-risk borrower, such as a stable job and high income. However, the interest rate you’re offered will likely be higher than someone with a credit score of 640 or above.

What is a Good Credit Score For PCP Car Finance?

A good credit score for PCP car finance is usually around 700 or above. This will ensure that you’re offered the best interest rates and terms on your car loan.

If your credit score is below 700, don’t worry – there are still financing options available to you. You may just have to pay a higher interest rate or put down a larger down payment. Contact a PCP car finance specialist to learn more about your car finance option.

A credit score is important when securing any type of car loan, but it’s especially important when financing a car. This is because the interest rates on car loans are typically much higher than the interest rates on other types of loans. So if you have a low credit score, you may end up paying hundreds or even thousands of dollars more in interest over the life of your normal personal loan. The personal contract hire usually includes a deposit, monthly payment, and a final payment known as the final balloon payment.

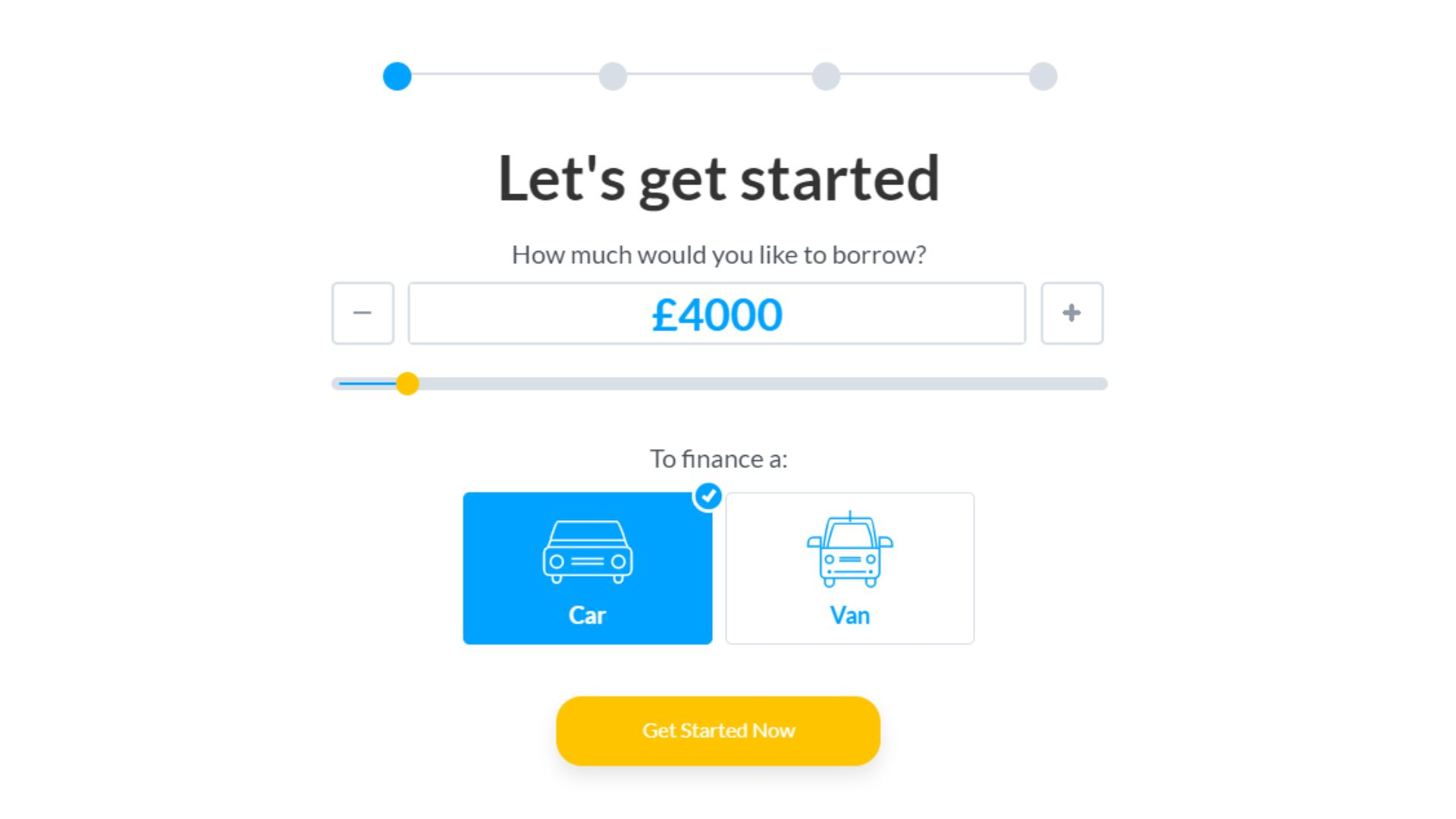

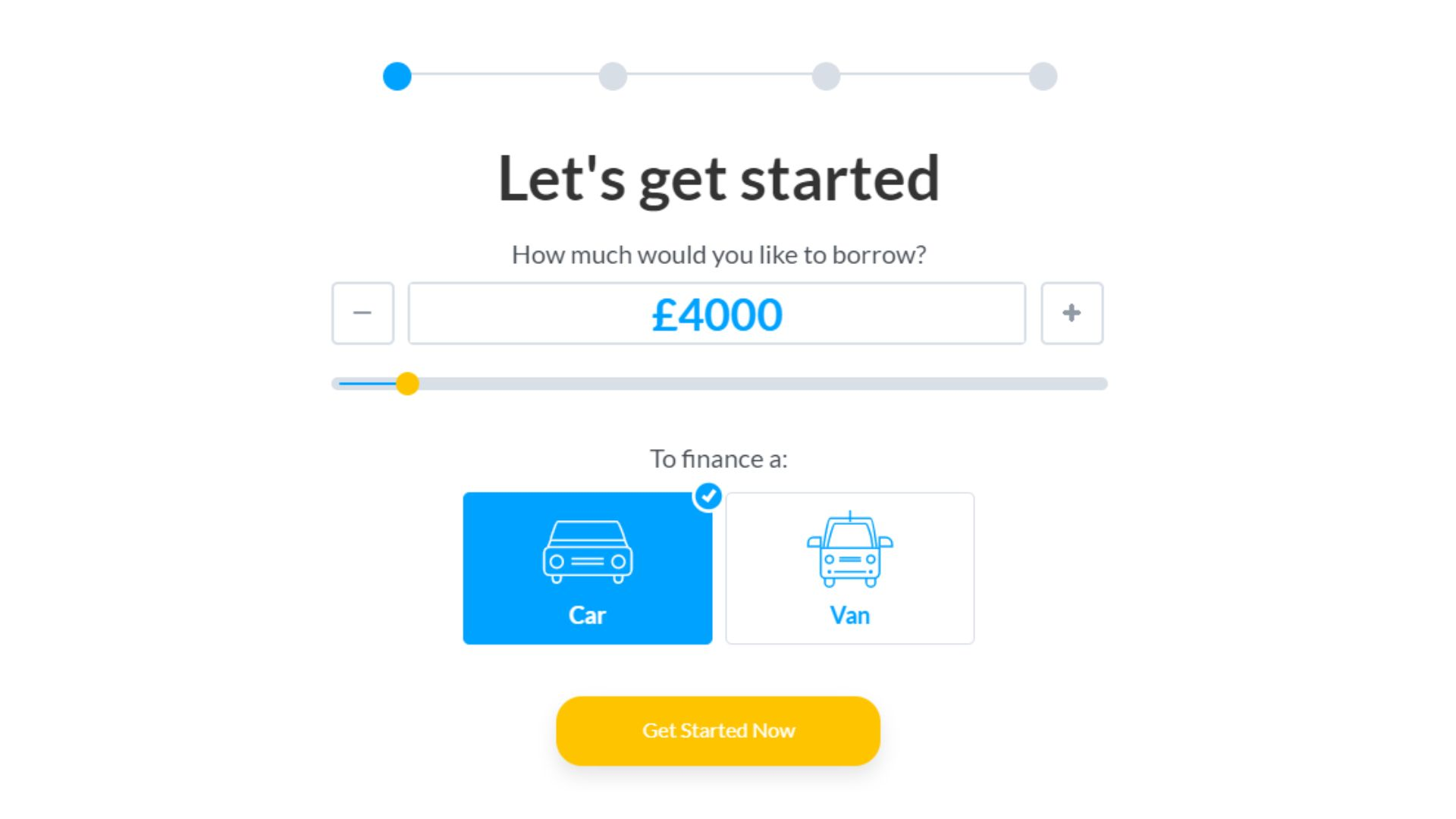

How To Check PCP Finance Deals Online?

There are a few things to keep in mind when shopping for PCP finance deals online. First, it’s important to compare interest rates from different lenders. Additionally, down payments and monthly payments will vary depending on the lender, so be sure to compare those numbers as well. Finally, make sure you understand all the terms and conditions of the loan before signing anything. With that being said, here’s a quick overview of how to find and compare other car finance deals online:

Start by searching for PCP finance or car loans online. This should give you a list of different lenders who offer this type of financing.

A PCP finance deal is a form of vehicle financing that allows you to spread the cost of your car over an agreed period of time, usually two to four years. At the end of the car finance agreement, you can either pay off the remaining balance owing on the car, hand the car back to the finance company, or trade it in for a new car for a guaranteed future value.

How To Compare PCP Deals?

If you’re looking to buy a new car, you may be considering a Personal Contract Purchase PCP deal. But how do you know if you’re getting a good deal? Here’s what you need to know about how to compare PCP deals.

The first thing to consider is the interest rate. Many dealerships will try to entice buyers with low-interest rates, but it’s important to check the fine print. Some lenders will offer teaser rates that only last for the first few months of the car loan, after which the rate will jump up significantly. So be sure to ask about the interest rate and make sure you understand both the initial rate and any potential increases down the road.

Compare PCP deals by looking at the total cost of the car and the monthly payments. You should also look at how much money you will have to put down to get the car, and how long the contract is. Some dealerships will also offer free servicing and MOTs for the duration of the contract.

What is PCP 0 Finance?

CP 0 Finance is a financial product offered by banks and other financial institutions. It is a loan that is used for car purchases, and the repayment period is usually between two and four years. The interest rate on PCP 0 Finance is usually lower than the interest rate on a conventional car loan, making it an attractive option for many consumers. However, there is some finance and leasing association with this type of loan, so it’s important to understand how it works before signing up for one.

PCP 0 Finance loans are typically only available for new cars, not used cars. This means that you’ll need to have good credit in order to qualify for the loan. One of the key benefits of opting for PCP 0 finance is that it can help keep your monthly repayments lower. This can make it easier to stay on top of your repayments and avoid falling into arrears.

Is it Hard To Apply For PCP Finance?

It can be hard to get approved for PCP finance because the lender wants to make sure that you will be able to afford the payments.

Lenders will look at your income and credit score to see if you are a good candidate for PCP finance. They may also want to know what your current debts are and how much you can afford to pay each month. If you have a good credit score and a stable income, then it should not be too hard to get approved for finance PCP. However, if you have any late payments or high debts, then you may find it more difficult to get approved.

One way to improve your chances of being approved for PCP finance is to have a good credit history. You can also increase your chances by choosing a car that is within your budget. And finally, you can make yourself look more attractive to the lender by taking out a smaller amount of finance and by agreeing to a longer repayment term.

How Can I Find PCP Car Finance in The UK?

You can find PCP car finance in the UK through a number of different sources. One option is to go through a dealership, though this may be more expensive. Another option is to use a car finance broker, who can help you find the best deal on PCP financing. Finally, you could also try searching online for deals on PCP car finance.

When looking for PCP car finance, it’s important to compare different offers and make sure you’re getting the best deal possible. It’s also important to read the terms and conditions thoroughly so that you know what you’re agreeing to. Be sure to ask any questions you have before signing anything. Your best bet is to go online and search for providers who offer PCP car finance. This will give you a good overview of the various options that are available to you, and it will also allow you to compare rates and terms. Another option is to speak with your local bank or credit union. They may not offer PCP car finance specifically, but they may be able to refer you to a finance provider who does.

What Finance Company Offers PCP Car Finance?

When considering a PCP agreement, it’s important to compare offers from different finance providers in order to find the best deal. Be sure to read the terms and conditions carefully, as some finance companies may have hidden fees or other penalties.

PCP car finance can be a great option for those who want to buy a new car but don’t have the cash on hand. It can also be a more affordable way to drive a new car than buying a car outright. However, it’s important to be aware of the potential risks involved in PCP agreements before signing up. PCP car finance is a great option for those who want to budget their car purchase and have the flexibility to upgrade to a new model after a few years. If you’re thinking about financing your next car purchase, be sure to check out some of these great car PCP offers!

How To Choose a Reliable PCP Finance Broker?

There are a number of things to look for when choosing a reliable PCP finance broker. First and foremost, you should make sure that the broker is properly licensed and regulated by the appropriate authority. Second, you should check to see that the broker has a good reputation with both online reviewers and people you know who have used their services.

Third, you should always get quotes from multiple online brokers before making a decision. This will help ensure that you’re getting the best possible rate on your car financing. And finally, make sure to read all the fine print before signing anything! By taking these simple steps, you can help ensure that you’re choosing a reliable and reputable PCP finance broker.

Thoughts

It can be hard to know where to start when looking for PCP car finance. But don’t worry, we’re here to help! In this article, we’ll tell you everything you need to know about credit scores and PCP best deals. We’ll also give you some tips on how to compare PCP deals and find the best one for you. So, whether you’re a first-time buyer or just looking for a better deal, read on for all the information you need about PCP car finance in the UK.