In order to finance a PCP, you’ll need to have a few key components in place. First, make sure you have a good credit score. This will give you the best chance of qualifying for PCP financing. You’ll also need a down payment; typically, the larger the down payment, the lower your interest rate, and monthly payments will be.

Finally, shop around for lenders who offer competitive rates and terms on PCP financing. By doing your research and taking advantage of all available options, you can ensure you get the best deal possible on your PCP financing.

The great thing about PCP finance is that it gives you the option to change your car every few years. This is perfect if you like to keep up with the latest trends, or you want to trade in your car for a new one every few years.

To be eligible for PCP finance, you’ll need to be over 18 years old and have a good credit history. You’ll also need to be able to afford the monthly payments.

How Does PCP Car Finance Work on a Second-Hand Car?

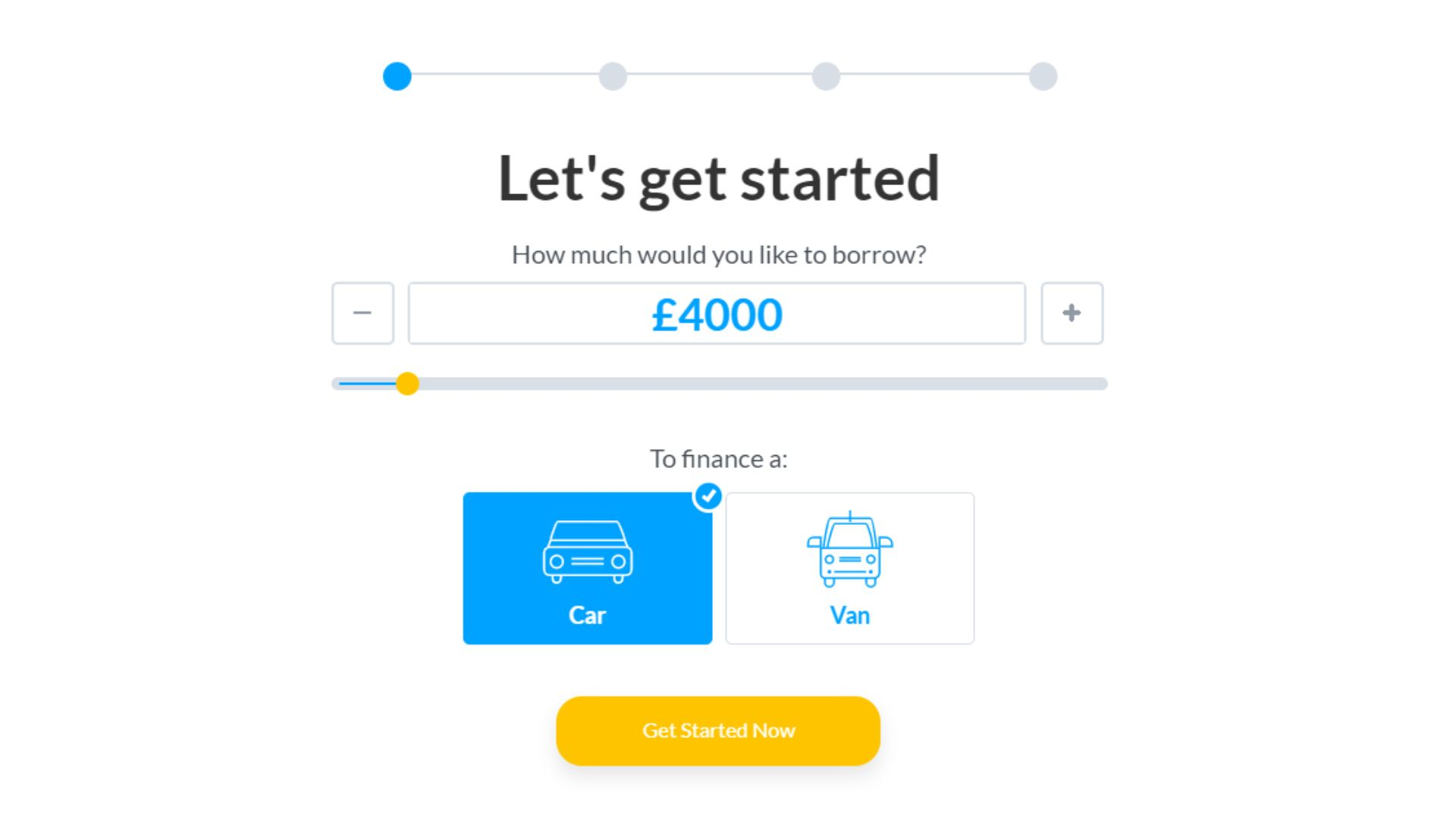

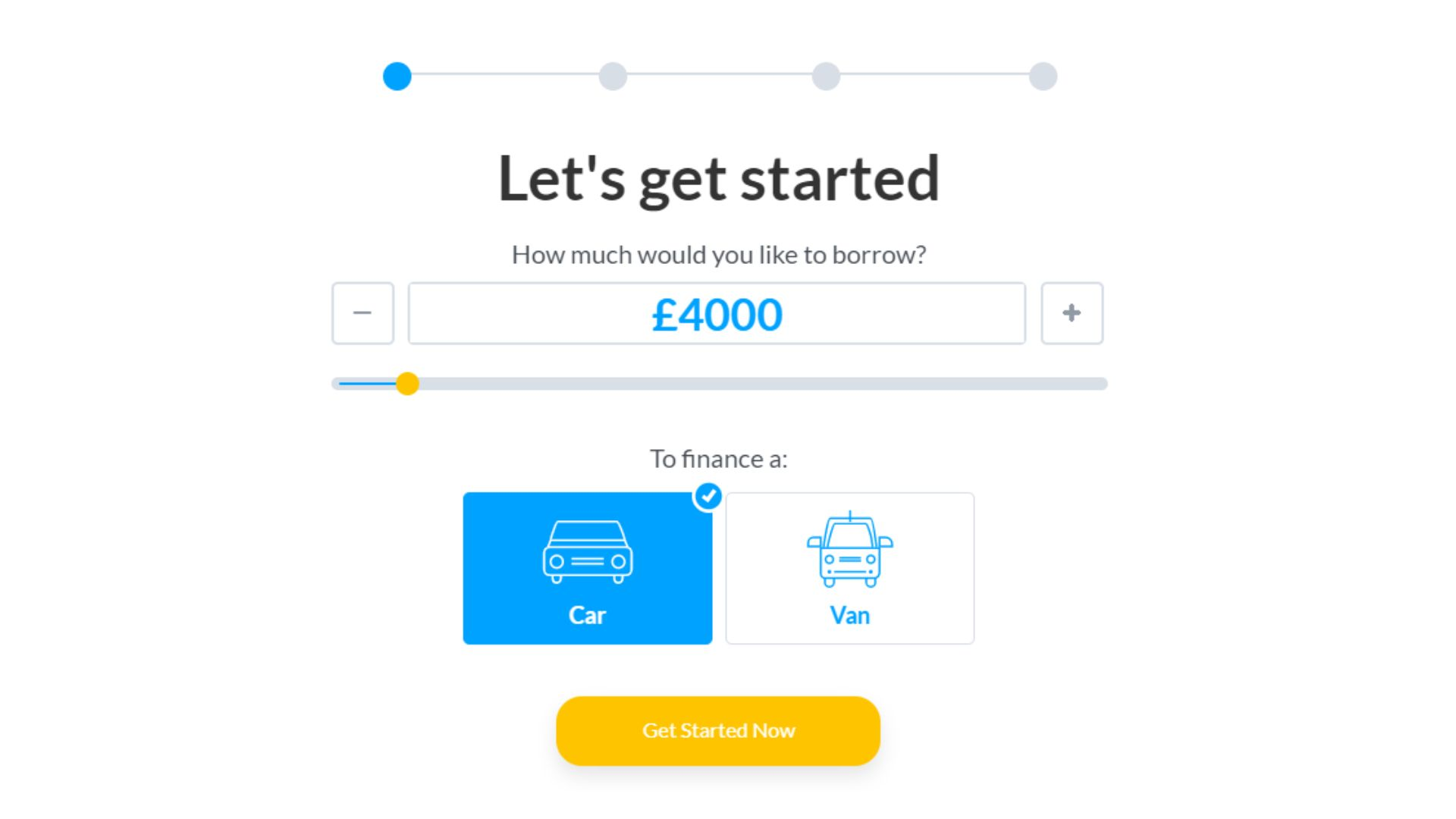

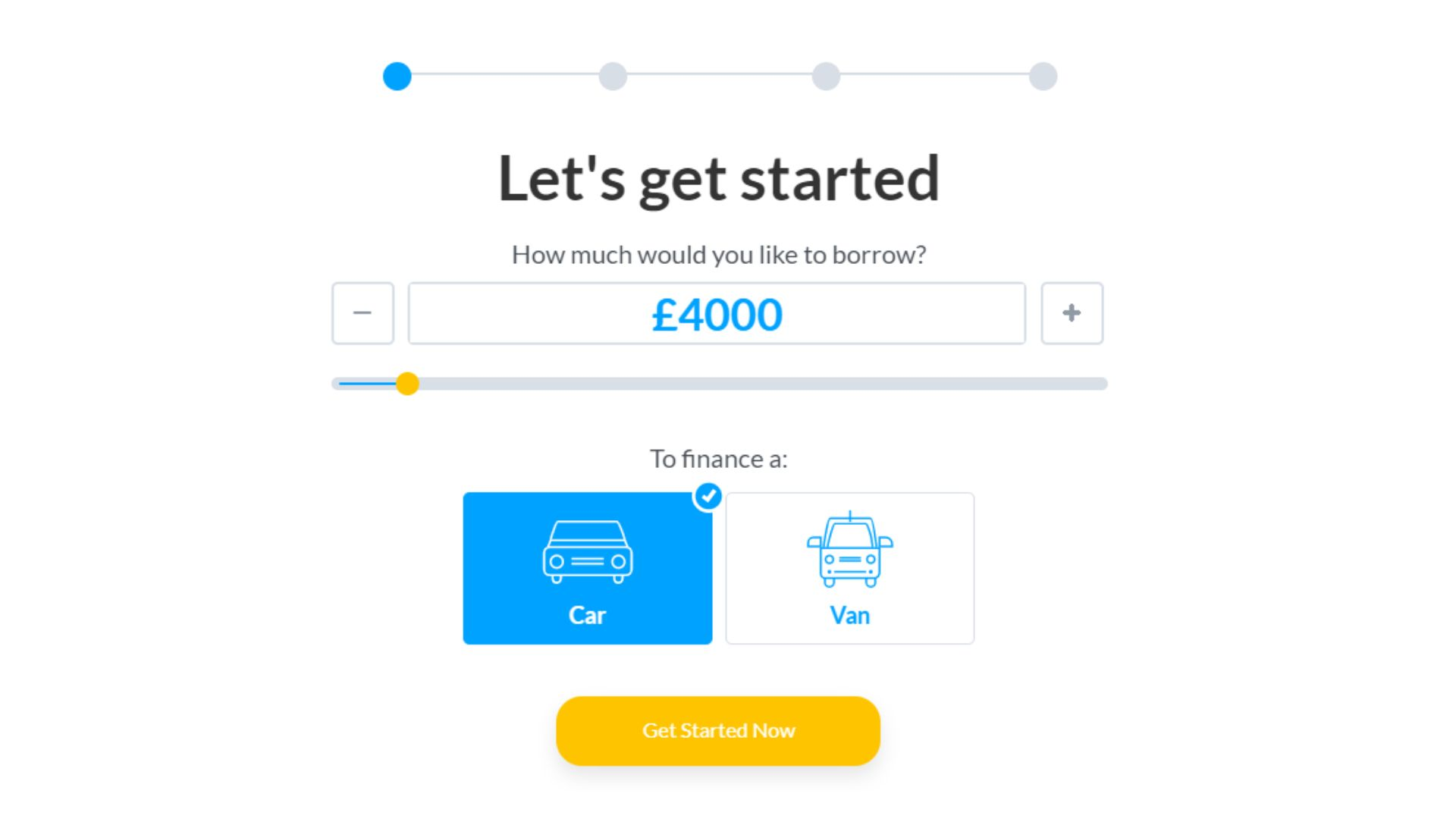

PCP car finance allows you to have a new car every few years by leasing it from the dealer. You make a small initial deposit and then pay fixed monthly payments for the duration of the car finance agreement.

The beauty of PCP is that at the end of the agreement you can either hand the car back to the dealer or trade it in for a new model. The dealer will give you a fair price for your old car, which can be put towards your next PCP agreement early.

PCP car finance works by allowing the buyer to pay a deposit usually between 10 and 20 percent value of the car, followed by monthly payments over an agreed period of time. At the end of the agreement, the buyer has three car finance options:

- Hand back the car and walk away;

- Pay off the remaining balance and keep the car;

- Trade in their old car for a new one.

PCP agreements are popular because they offer buyers much more flexibility than traditional hire purchase agreements, and they can be used to finance both new and second-hand cars.

Are PCP Car Deals Worth it?

Generally speaking, PCP car deals can be a great way to get a brand new car. You don’t have to worry about putting any money down, and the monthly payments are often lower than what you would pay for a car outright. In most cases, you also have the option to trade in your car for a new one at the end of the contract.

That said, it’s important to read the terms and conditions of any PCP deal before you sign up. There may be hidden fees or other costs that you weren’t expecting. So make sure you understand everything before you agree to anything.

There are pros and cons to PCP car deals. On the plus side, you can drive a nicer car for less per month than if you were to buy it outright. You also don’t have to worry about depreciation, as the car will be worth the same amount at the end of the term as it was when you started.

On the downside, you’ll typically have to pay a large deposit upfront, and you’ll need good credit to be approved. If you decide to hand back the car at the end of the term, you’ll also likely have to pay a penalty.

What Happens if PCP Car is Written off?

If a PCP car is written off, the finance company technically becomes the owner of the car. This is because when you take out a PCP agreement, you’re actually borrowing money from the finance company in order to buy the car.

When you hand back the car to the finance company, they will either sell it on or write it off as a loss. If they sell it on, they will usually do so at a very low price in order to get their money back quickly. If they write it off as a loss, then this will be reflected in your credit score and may make it harder for you to borrow money in the future.

If you have PCP on your car, you will need to contact the finance company and arrange for them to either come and collect the car or for you to hand it back. They may also be able to offer you a settlement if you still owe money on the car.

If you have fully paid off your PCP agreement, then you will be able to keep the car and either sell it or trade it in for a new one.

Who Pays For Repair on PCP Cars?

There are a couple of different types of PCP cars warranty out there, and it’s important to be clear on which one you have before we start talking about who’s going to foot the bill for repairs. The most common type is called a Manufacturer’s Warranty, or Factory Warranty. This is typically something that comes bundled with new car purchases, and it covers repairs and replacements that are needed as a result of manufacturer defects.

There’s also something called a Powertrain Warranty, which is a bit more specific than a Manufacturer’s Warranty; it only covers maintenance and repairs that are associated with the engine, transmission, and other essential parts of the vehicle. These parts are generally more expensive to repair or replace.

Many lenders will also require that any repairs be made at an authorized dealership or service center. This ensures that your car is getting repaired by qualified professionals using quality parts.

When Can I Change My Car on PCP in the UK?

You can change your car on PCP in the UK as soon as you have completed your minimum period of the contract and paid your final settlement figure. This usually happens after two or three years, but it may depend on the car dealership and the specific PCP agreement that you have signed up for.

It’s worth noting that you may face some penalties if you decide to switch cars before the end of your contract. For example, you may have to pay an early termination fee or be liable for depreciation costs on the car. Make sure you read through your finance agreement carefully and understand all of the terms and conditions before signing up.

What is The Best PCP Car to Buy?

There is no definitive answer to this question since it depends on individual circumstances and preferences. However, we can provide some guidelines to help you choose the best PCP car for your needs.

First, consider what kind of car you need and what your budget is. If you need a large car or one with specific features, you’ll naturally be looking at higher-priced models. You’ll want to consider how much you can afford to put down as a deposit as well as your monthly payments. it all comes down to what you need and want from your car. Talk to your local dealer or do some research online to figure out which model would be the best fit for you.

Is PCP New Car Deals Better Than HP?

Yes, PCP’s new car deals are often better than HP’s. This is because PCP financing involves lower monthly payments and often comes with a large balloon payment at the end of the loan term. This can make it easier to budget for your personal contract new car purchase, and can also help you avoid being upside down on your loan ( owing more than the car is worth).

Another thing to keep in mind is that interest rates on PCP loans are often lower than those for conventional loans. So, if you’re looking for a great finance deal on a new car, be sure to check out the PCP financing option.

HP is definitely not as good as PCP when it comes to buying a new car. With HP, you have to make a large upfront payment and then you’re stuck with the car for a fixed period of time. There are also very few options available through HP when it comes to choosing a new car financing option.

What is a good PCP APR?

If you are looking for the best PCP deals, you should compare the annual percentage rate of different lenders. The APR is the interest rate that is charged on a loan, and it includes all of the fees and charges that are associated with a loan.

When you are shopping for a personal loan, be sure to compare the APR of different lenders. Some lenders may have lower interest rates, but they may also have higher fees. Other lenders may have higher interest rates, but they may not charge any fees. Be sure to compare the total cost of the loan before you make a decision.

Thoughts

PCP car finance is a great way to get into a new car and there are many different deals available on the market. You can find the best PCP car deals near you, and you may be able to change your car sooner than you think. Be sure to do your research before signing up for a PCP deal, as some of them can be quite expensive in the long run. If you have any questions about PCP car finance or would like us to help you find the best deal for you.