If you’re looking to finance a car, there are a few things you’ll need to consider. Here’s what you need to get car finance.

-Your credit score: This is one of the essential factors in getting car finance. Make sure you check your credit score before applying for finance.

-Your income: Lenders will want to see proof of income to assess your ability to repay the loan. Be sure to have payslips or tax returns on hand when you apply.

-Your assets: You’ll need to provide collateral for the loan, so lenders will want to see what assets you have that can be used as security. It could be property, savings, or investments.

-Your car: Of course, you’ll need to have a car in mind that you’re looking to finance. Be prepared with the make, model, and desired loan amount.

With these things in mind, you’ll be on your way to getting car finance. Be sure to compare different lenders to get the best deal possible. CarFinanceMarket.co.uk can help you with all your car finance needs.

Is it a Good Idea To Finance a Car?

When you finance a car, you’re essentially taking out a loan to pay for the vehicle. It can be a good idea if you don’t have the cash on hand to pay for the car outright or if you want to keep your savings intact.

There are a few things to consider when you finance car. First, you’ll need to have a good credit score. Another thing to consider is your income. You’ll also need to provide collateral for the loan, so lenders will want to see what assets you have that can be used as security. Lastly, you’ll need to have a car in mind that you’re looking to finance.

Comparing different lenders is also important to get the best deal possible. CarFinanceMarket.co.uk can help you with all your car finance needs.

What Are The Best Rates For Car Finance?

The best car finance rates will depend on a few factors, such as your credit score and the type of car you’re looking to finance. It’s essential to compare different lenders to get the best deal possible.

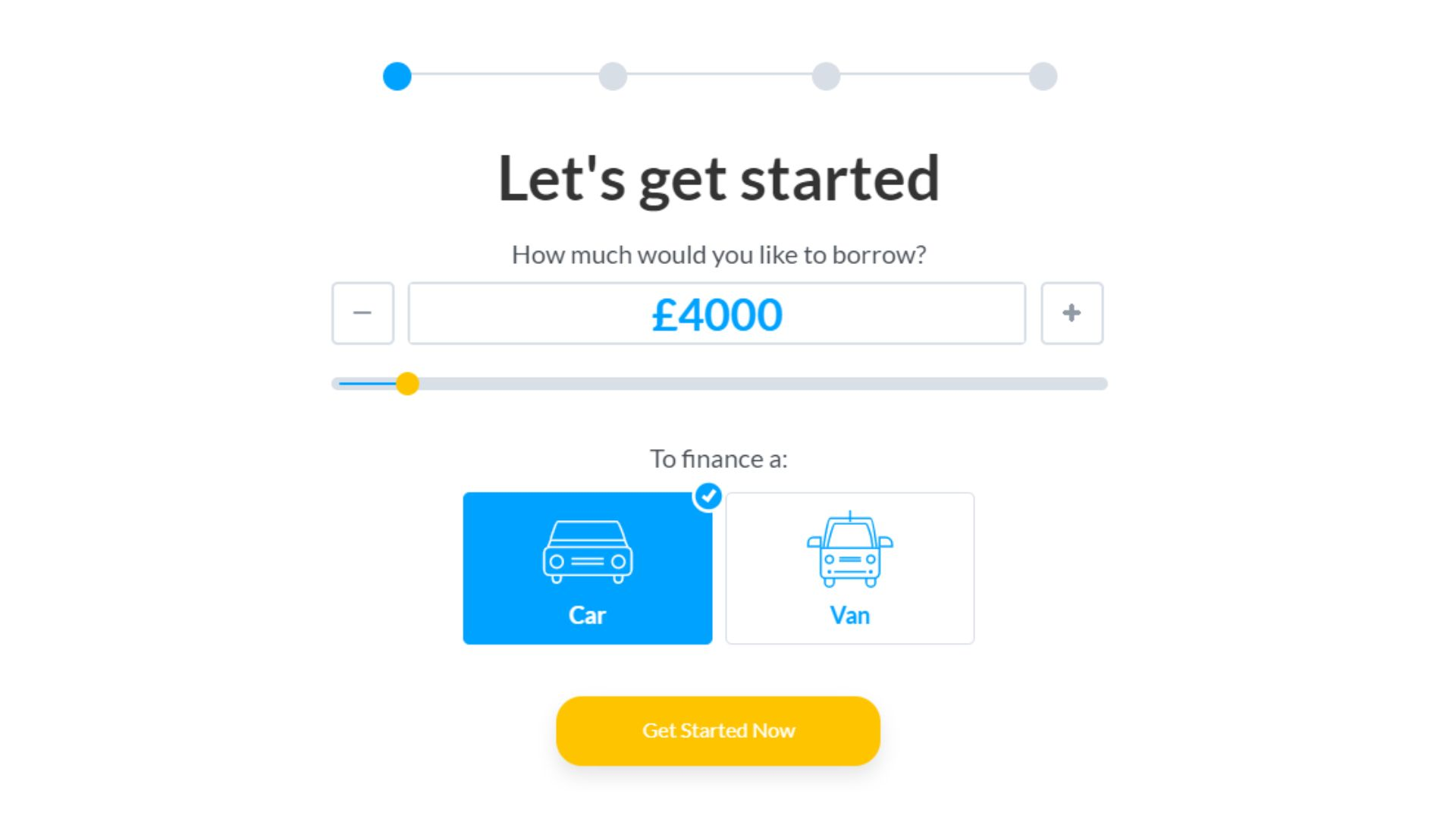

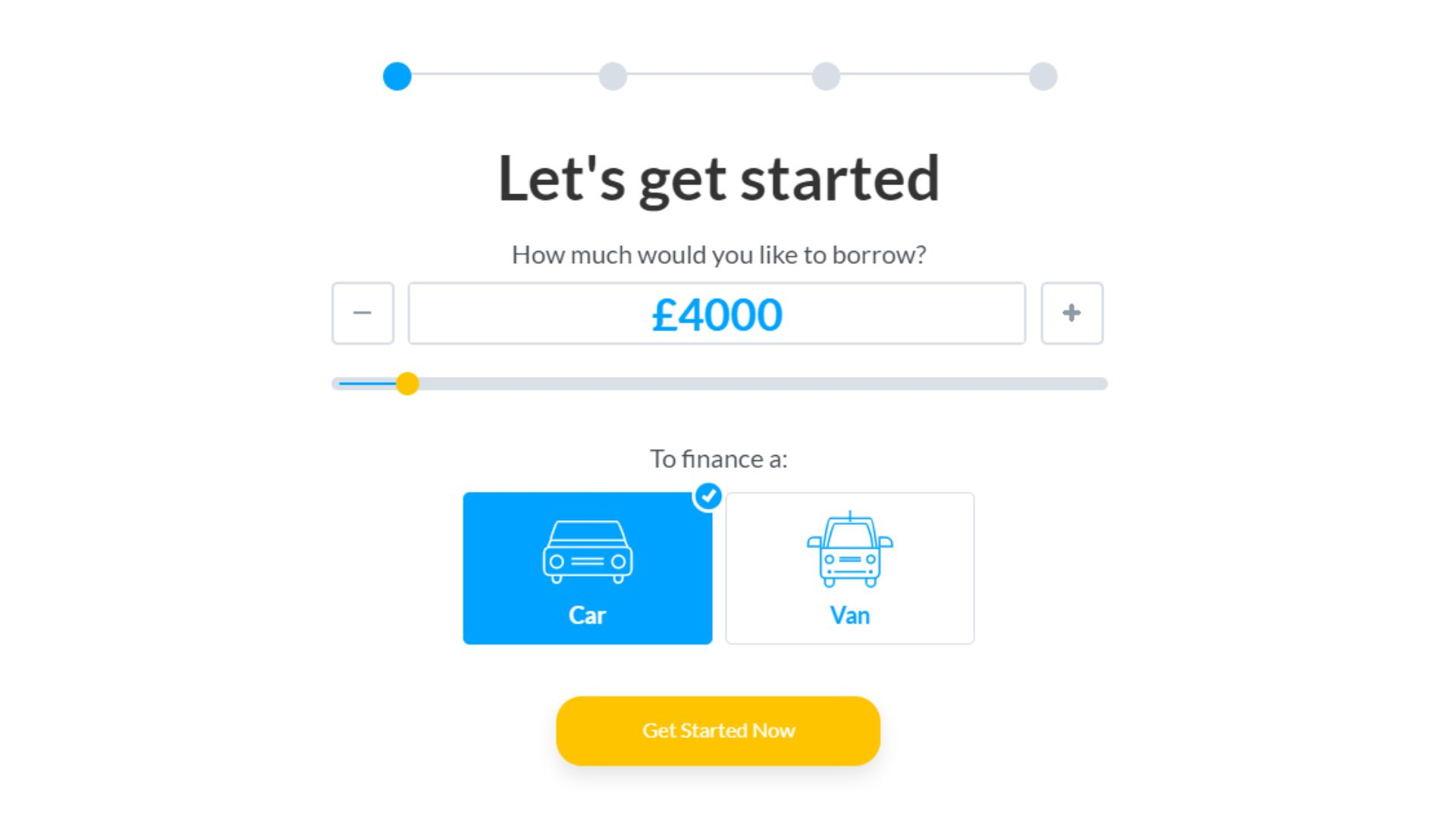

At CarFinanceMarket.co.uk, we can help you find the best car finance deals with a reputable dealer. We work with a panel of lenders to find you the most competitive rates. We also offer a car finance calculator to see how much you could borrow and what your monthly repayments could be.

Contact us today to learn more about the best car finance rates.

Can You Get Car Finance on Used Car?

Yes, you can get car finance on used cars. The process is similar to financing a new car, but there are a few things you’ll need to keep in mind.

First, your credit score is still one of the essential factors in getting used car finance. So make sure you check your credit score before applying.

Second, you may need to provide a larger down payment for a used car. Again, it is because used cars are considered riskier by lenders.

Third, you’ll need to find a used car that falls within your loan amount. Be sure to factor in the cost of repairs and maintenance when budgeting your used car.

Fourth, you may need a used car loan from a private lender. Again, it is because some banks and credit unions don’t finance used cars.

Get in touch with CarFinanceMarket.co.uk to learn more about used car finance. We can help you find the best deals and rates.

How Do Car Finance Companies Check Affordability?

Car finance companies will assess your affordability in a few different ways. First, they’ll look at your credit score. It is one of the essential factors in getting car finance. So make sure you review your credit score before applying for finance.

Second, car finance companies will look at your income. Lenders will want to see payslips or tax returns to assess your capability to repay the loan.

Third, car finance companies will look at your assets. You’ll need to provide collateral for the loan, so lenders will want to see what assets you have that can be used as security. It could be property, savings, or investments.

Fourth, car finance companies will look at your car. You’ll need a car because you’re looking to finance one. Be prepared with the make, model, and preferred loan amount.

Can You Finance a Car on Finance?

Yes, you can finance a car on finance. The process is similar to financing a new car, but there are a few things you’ll need to keep in mind, like your credit score, income, and assets. You’ll also need to have a car in mind that you’re looking to finance.

Comparing different lenders is also important to get the best deal possible. CarFinanceMarket.co.uk can help you with all your car finance needs. We work with a panel of lenders to find you the most competitive rates, and we also offer a car finance calculator so you can see how much you could borrow and what your monthly repayments could be.

Get in touch with us today to learn more about car finance. We can help you find the best deals and rates.

What is a Good Rate For a Car Finance Loan?

The best car finance rates will depend on a few factors, such as your credit score and the type of car you’re looking to finance. It’s essential to compare different lenders to get the best car finance loan and to avoid an unsecured personal loan.

Car finance loan rates can vary depending on your credit score. You’re more likely to get a lower interest rate if you have a good credit score. But you may have to pay a higher interest rate if you have bad or poor credit.

The type of car you’re looking to finance will also affect your car finance loan rate. New cars are typically easier to finance than used cars. And if you’re looking to finance a luxury car, you can expect to pay a higher annual interest rate than if you were funding a more modest car.

Contact CarFinanceMarket.co.uk to learn more about the best car finance rates. We can help you find the best deals and rates.

Where Can I Get Good Car Finance Deals?

There are a few things to keep in mind when looking for good car finance deals, such as your credit score, the type of car you’re looking to finance, and your income. It’s also essential to compare different lenders to get the best car finance deal possible.

Car finance deals can vary depending on your credit score. You’re more likely to get a lower interest rate if you have a good credit score. But you may have to pay a higher interest rate if you have a bad credit rating or credit report and finance through a subprime lender.

What Is The Best Car Finance Company Near Me?

The best car finance company is the one that best suits your needs. You’ll need to keep a few things in mind when looking for the best car finance company, such as your credit score, the type of car you’re looking to finance, and your income.

CarFinanceMarket.co.uk can help you find the best car finance company for your needs. We work with a panel of lenders to find you the most competitive rates. We also offer many resources on our websites, like a car finance calculator and articles with tips on getting the best car finance deal. So we can help you find the best deals and rates.

Thoughts

Do you have any questions about CarFinanceMarket.co.uk or car finance in general? We’re here to help. CarFinanceMarket.co.uk has a reputable UK dealership that can help you find the best deals and rates on car finance.

The types of car finance we offer depend on your credit history, credit score, and credit report. You can avail of monthly instalments for your new or used car finance.

Check the Personal Contract Purchase PCP, annual percentage rate, the monthly budget, the fixed monthly payments for your car finance cost, and the end of the agreement of the finance providers to avoid balloon payment. So get in touch with us today to learn more about how to finance a car near me and to have your next car finance option.