PCP car deals, or personal contract purchase plans, are a type of financing option that allows you to take control of your vehicle without paying a large lump sum upfront. With these deals, you typically make monthly payments for an agreed-upon period. Then, you can either buy the car outright or walk away and return it to the dealership at the end of that period.

Depending on your credit situation, Personal Contract Purchase PCP car deals can be a great way to get behind the wheel of a new or used vehicle without breaking the bank. However, it’s important to carefully consider all of the terms and conditions before signing on the dotted line, as PCP car deals can sometimes include hidden fees or other unexpected costs.

Additionally, if you decide to purchase the vehicle at the end of your contract, additional charges may be associated with transferring the title and registering it in your name.

If PCP car deals seem like a good fit for you, do your research and shop for the best deal. With time and effort, you can find a PCP car deal that gives you the flexibility, affordability, and peace of mind you need to get behind the wheel and hit the road!

How Do PCP Car Deals Work?

PCP car deals work by allowing you to finance your vehicle over an agreed-upon time. You make monthly payments during this time, and at the end of the contract, you can either purchase the car outright or return it to the dealership.

If you decide to return the car, you will need to pay any outstanding balance and any fees associated with the return. These fees can vary depending on the dealership and the terms of your contract, so be sure to read over everything carefully before signing.

If you choose to purchase the car, you will need to pay a balloon payment, which is typically the outstanding balance of the loan plus any additional fees. In addition, to own the vehicle entirely, you may also need to pay additional charges, such as transfer fees and registration costs.

Overall, PCP car deals can be an excellent option for those who want to finance a new or used vehicle without paying a large lump sum upfront.

However, it’s essential to carefully consider all of the terms and conditions before signing on the dotted line, as there can be hidden costs. Nevertheless, with time and effort, you can find a PCP car deal that meets your needs and helps you get behind the wheel of the vehicle you want!

What is the Best PCP Car Deals?

Different consumers may have other preferences when it comes to PCP car deals. Factors influencing which deal is best for you include your budget, credit history, and preferred terms and conditions.

Some key considerations to consider when evaluating potential PCP car deals include the interest rate, the length of the contract, and any associated fees or additional charges. Additionally, it’s essential to research different dealerships and compare their offers to find a deal that fits your needs and gives you the most value for your money.

Ultimately, there is no one “best” PCP car deal. It all comes down to what is most important to you and what works best for your situation. So if you’re looking for a great PCP car deal, do your research, shop around, and find the option that meets your needs and helps you get behind the wheel of the vehicle you want!

What is PCP Finance Cars?

PCP or Personal Contract purchase Finance Cars is a type of financing that allows you to finance your vehicle over an agreed-upon time. You make monthly payments during this time, and at the end of the contract, you can either purchase the car outright or return it to the dealership.

If you decide to return the car, you will need to pay any outstanding balance and any fees associated with the return. These fees can vary depending on the dealership and the terms of your contract, so it’s essential to read over everything before signing carefully.

Overall, PCP Finance Cars or PCP Finance deals are a popular option for those who want to finance a new vehicle or used vehicle without paying a large lump sum upfront.

However, it’s essential to carefully consider all of the terms and conditions before signing on the dotted line, as there can be hidden costs on PCP deals on cars. Nevertheless, you can find a PCP Finance Cars option that meets your needs and helps you get the vehicle you want with time and effort!

Can a PCP Car Deal Only be Used for Finance for a Brand New Car?

There is no one answer to this question, as the best PCP car deal will depend on your individual needs and preferences. Factors that can influence which car deal is right for you include your budget, credit history, and preferred terms and conditions of a car dealership.

When evaluating potential car deals on the PCP finance agreement, it’s essential to consider critical considerations such as the interest rate, length of the contract, and any associated fees or additional charges. Additionally, it can be helpful to research different dealerships and compare their offers to find a car deal that fits your needs and gives you the most value for your money.

Ultimately, there is no one “best” car on PCP deals. Therefore, it is up to you to do your research, shop around, and find the best car finance deals or PCP finance deal that meets your needs.

What Does PCP Mean in Cars?

PCP stands for “personal contract purchase,” which refers to the financing offered by car dealerships to help consumers purchase new or used vehicles. This type of financing typically requires you to pay a small upfront lump sum and make monthly payments over an agreed-upon period. Then, you can either keep the car by purchasing it outright or return the vehicle to the dealership at the end of the contract.

There is no one “best” PCP car deal, as this will depend on your individual needs and preferences and other factors like your budget and credit history.

Therefore, it’s essential to research different dealerships and compare their offers to find the right PCP deal for you and the one that gives you the most value for your money. You can find great PCP cars that work for you with time and effort!

What is PCP on Used Cars?

PCP on used cars is a type of financing offered by dealerships to help consumers purchase pre-owned vehicles. This financing typically requires you to pay an upfront lump sum and make monthly payments over an agreed-upon period. Then, at the end of the contract, you can either keep the car by purchasing it outright or returning it to the dealership.

To find the best-used cars PCP deals, you will need to research, shop around, and consider the interest rate, length of the contract, and any associated fees or additional charges. Additionally, it can be helpful to compare different dealerships and their offers to find a PCP deal that fits your needs and gives you the most value for your money.

How Does PCP Work on Used Cars?

The best way for PCP financing on used cars will depend on your individual needs and preferences. Some key considerations that may impact which car deal is right for you include your budget, credit history, and preferred terms and conditions of a dealership.

When evaluating potential PCP financing options on used cars, you must be aware of critical details such as the interest rate, length of the contract, and any associated fees or charges. Additionally, it can be helpful to research different dealerships and compare their offers to find a car deal that fits your needs and gives you the most value for your money.

There are no one right PCP deals on cars that will be perfect for everyone. Therefore, it is up to you to do your research and find the car deal that works best for you. With time and effort, you can find an excellent PCP financing option on used cars that helps you get the vehicle you need at a price that works for you.

What Finance Company Offer Great PCP Car Deals?

When evaluating potential finance companies for great PCP car deals, it is vital to be aware of critical details such as the interest rate, length of the contract, and any associated fees or charges.

Additionally, it can be helpful to research different car finance dealerships and compare their offers to find a finance company that offers excellent PCP deals that meets your needs and gives you the most value for your money.

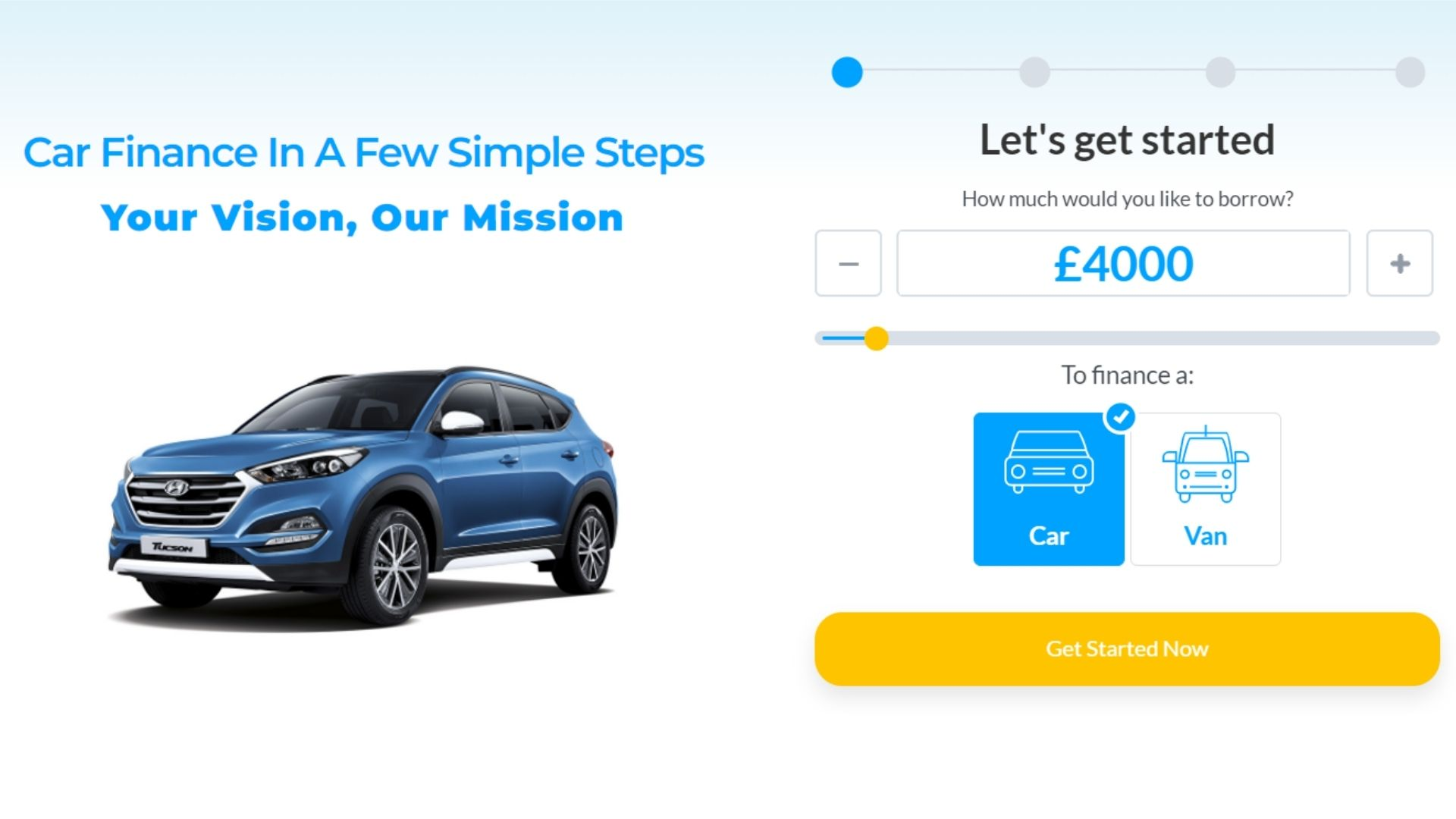

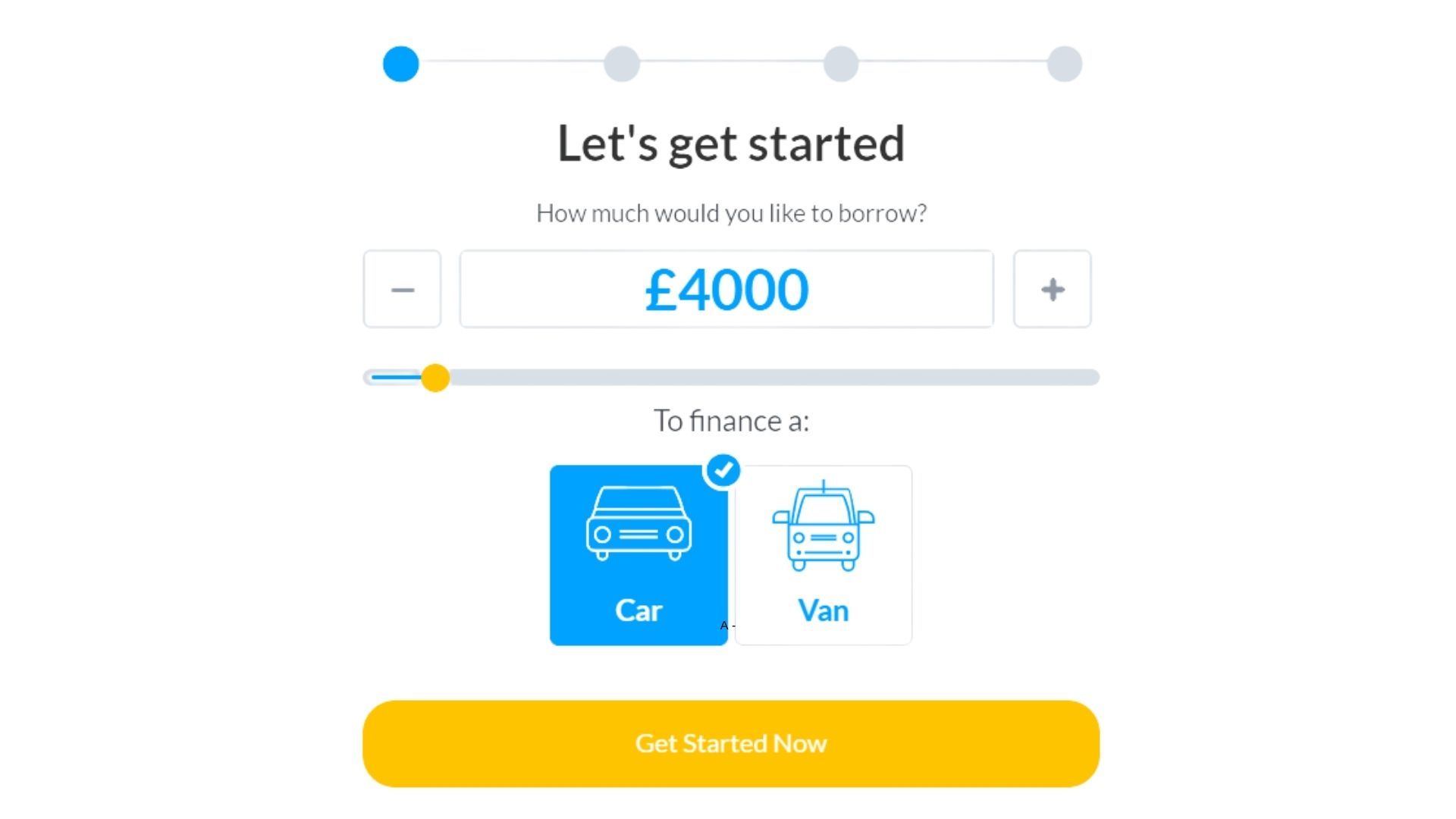

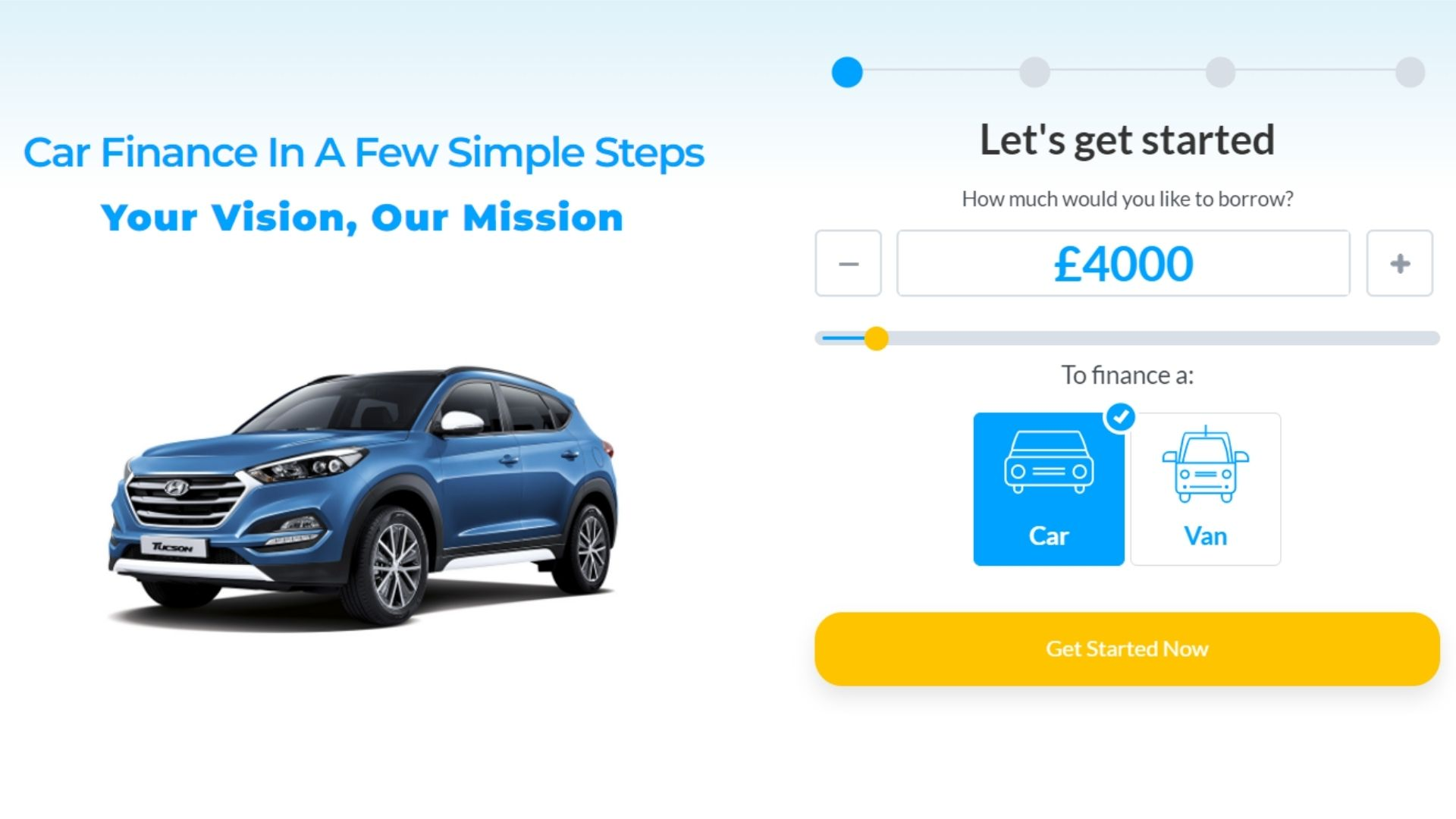

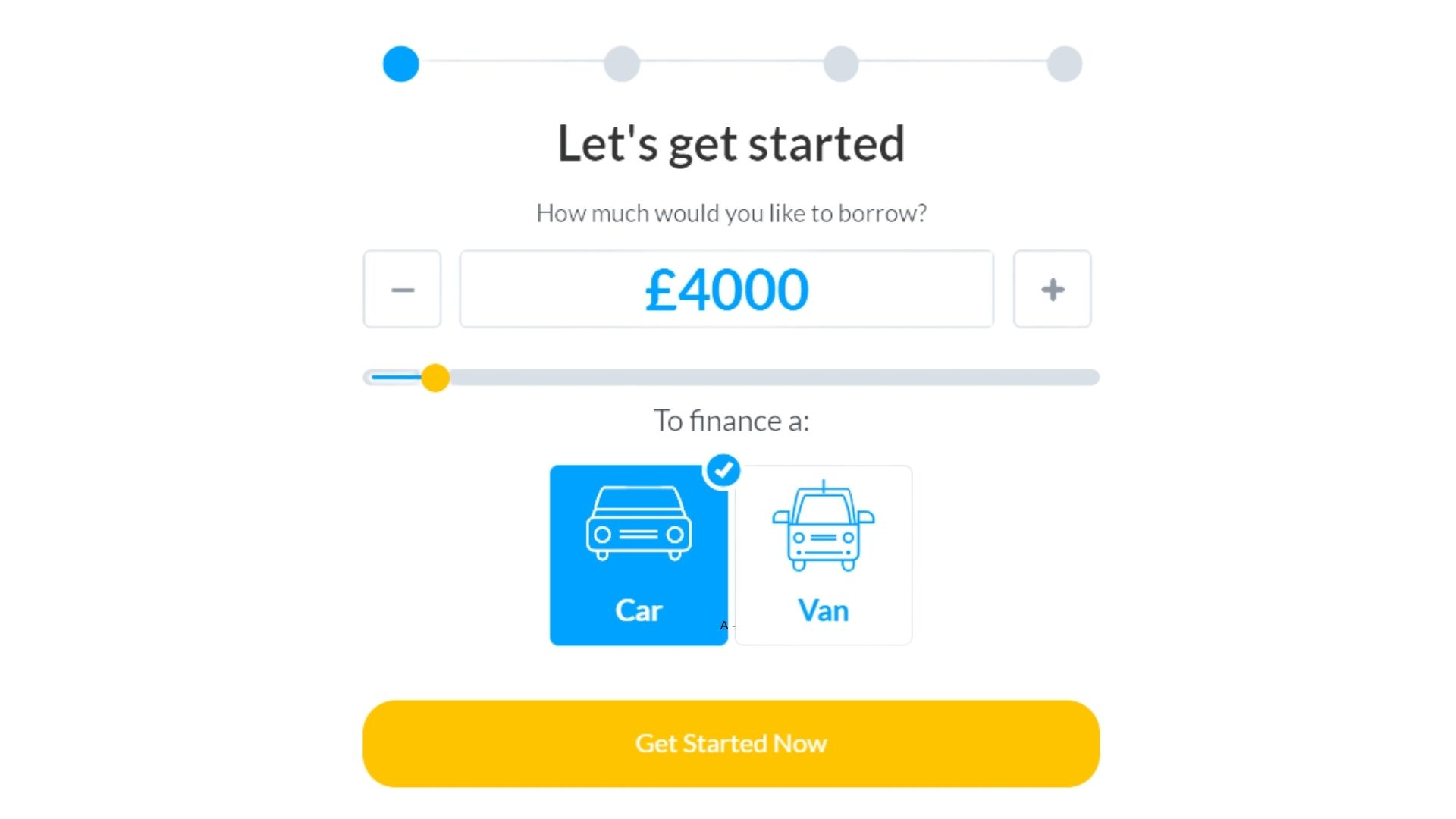

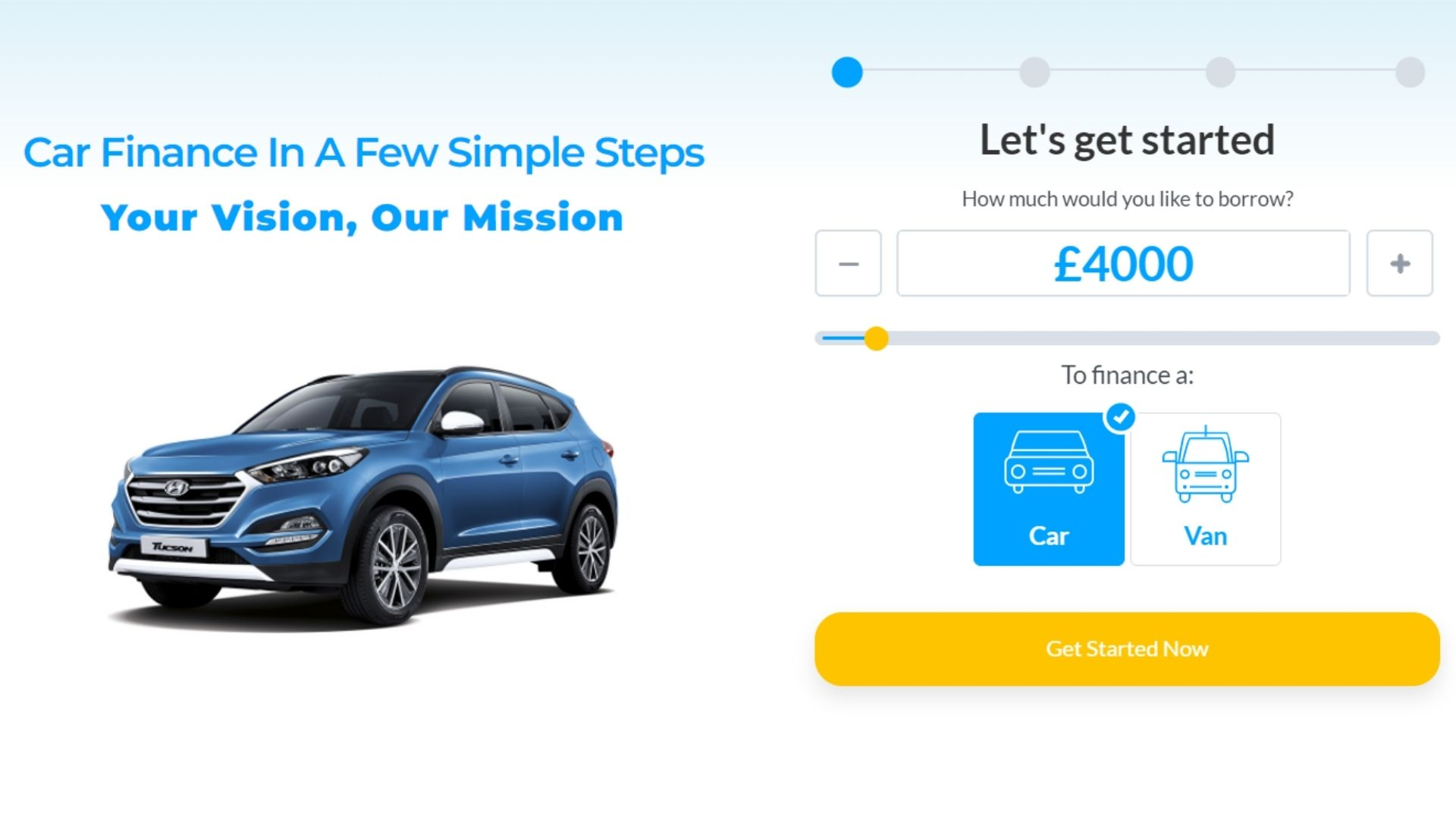

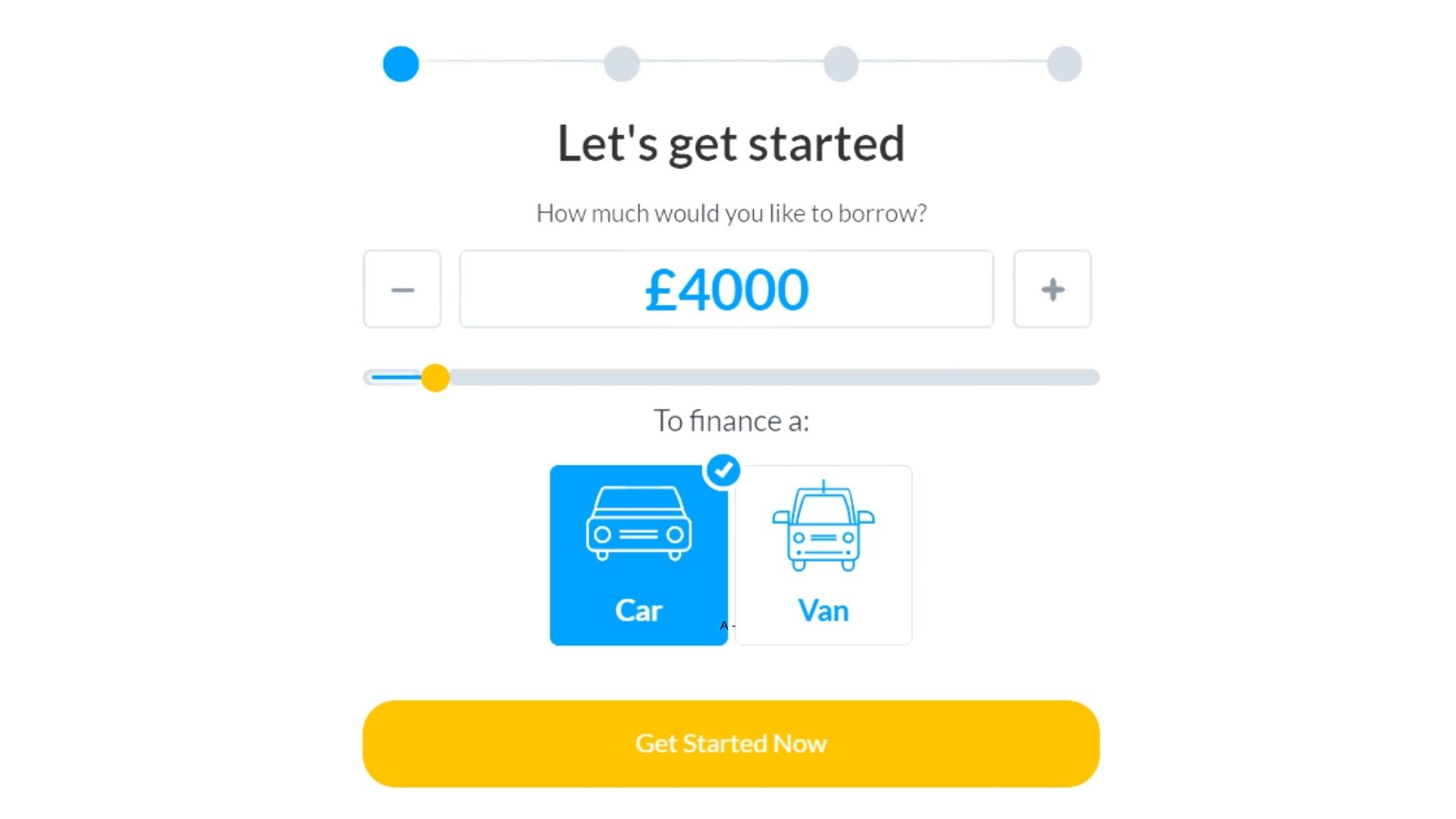

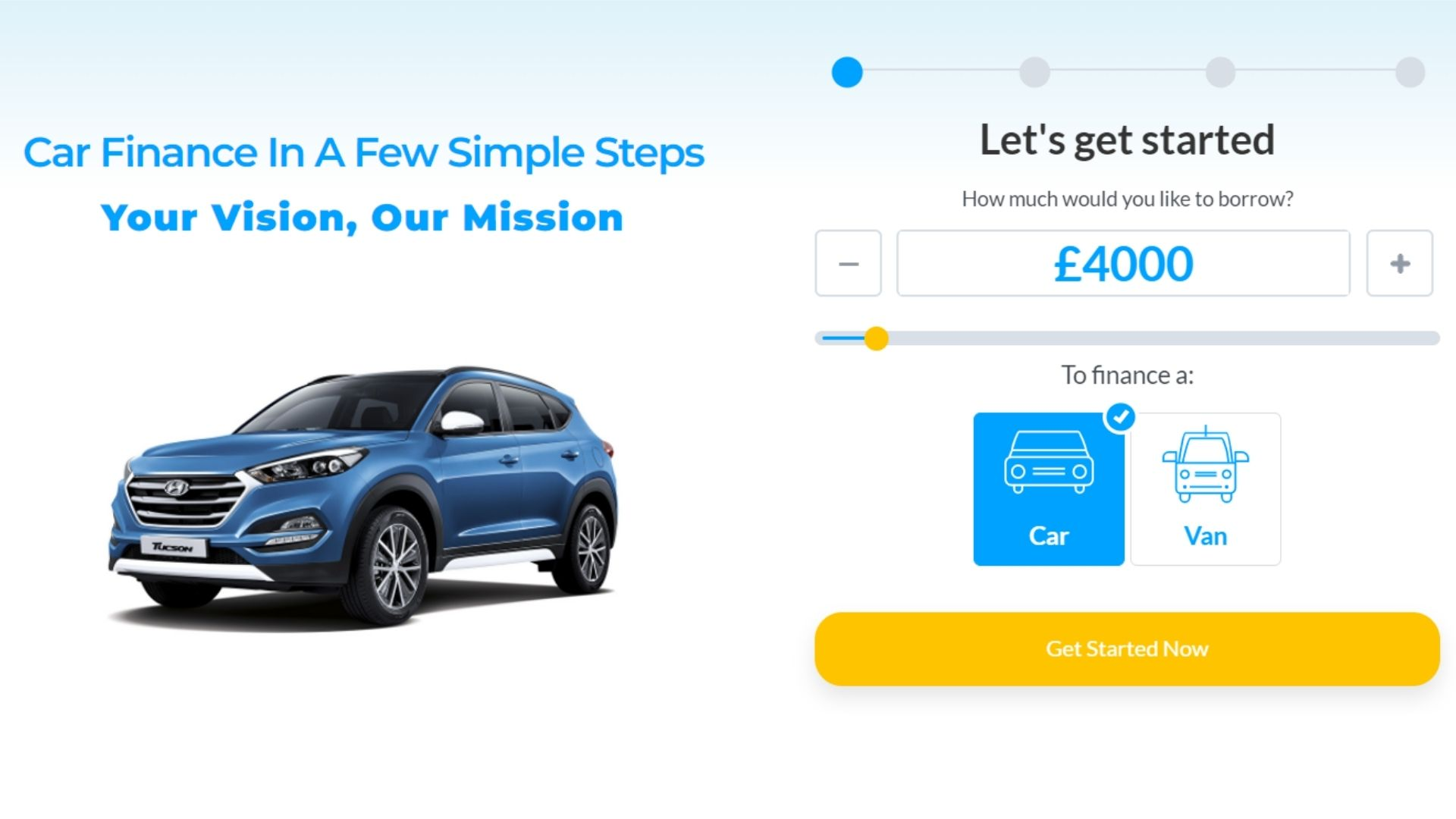

One option for great PCP car deals is CarFinanceMarket.co.uk, a finance company that offers competitive financing options on new and pre-owned vehicles. With a range of interest rates, contract lengths, and fees to choose from, Car Finance Market can help you find the perfect car deal that meets your needs and budget.

So whether you’re looking for a new car or a used one, Car Finance Market can help you find the best PCP deal to fit your needs and help you get on the road quickly and easily. So if you’re in the market for a great PCP car deal, check out CarFinanceMarket.co.uk today!

Summary

Are you looking for a great PCP car deal? Check out CarFinanceMarket.co.uk, a finance company that offers competitive financing options on new and pre-owned vehicles.

With a range of interest rates, contract lengths, and fees to choose from, Car Finance Market can help you find the perfect car deal that fits your needs and budget. So if you’re in the market for a great PCP car deal, Car Finance Market is an excellent option!