Most car finance durations are between two and five years long, and what occurs after this time is one of the essential variations between the various forms of loans. The loan is paid off in certain circumstances, leaving the borrower with no debt. However, in some cases, decisions must be made that are not easy.

Once you have made all of your car finance payments and the loan period has ended, you will own your vehicle outright. You will no longer have a monthly car payment but will be responsible for all future maintenance and repair costs. If you decide to sell your car, you will keep any proceeds from the sale.

How Long Can You Get Car Finance on Used Cars in the UK?

In the United Kingdom, you can finance a used car for five years. The shortest loan term is usually 12 months, but some lenders may extend loans for used vehicles to six or nine months. Used car purchasers can choose from various financing options, including hire purchase (HP), personal contract plans (PCPs), and personal or fixed-sum loans. The term length for all these options is typically 12 to 60 months (one to five years).

Although the industry guideline for financing vehicle or a used car financing is no more than 60 months, more than half of all new loans are funded for 84 months. A five-year loan gives you enough time to repay the loan at a moderate payment without incurring excessive interest rates.

Before granting you a certain length of term on your auto loan, banks and finance providers will consider your circumstances and credit history. They need to know you’ll be able to repay the loan throughout the term. Paystubs or a copy of your bank records indicating your income will be required to prove your regular earnings.

How old of a used car will the bank finance?

A lot of the evidence suggests that a credit union would be a better option for financing a car over ten years old. The car must be at or below book value, including taxes and fees, to qualify for credit from a credit union for an older vehicle. The borrower is on the hook for the difference if it isn’t

In addition, their credit score must be strong (670-or-more) to qualify. If you have bad credit, your chances of getting a direct loan, not only for an older used car, are minimal.

What Documents Do I Need for Financing Vehicles?

The following documents are typically required when applying for vehicle financing:

- A valid driver’s license

- Proof of income (pay stubs or tax returns).

- The Social Security number

- Residence proof (utility bills or lease agreement)

- Car insurance information

- Referrals for auto loans

- Down payment (if applicable)

Depending on the lender, these requirements may differ. If the borrower has bad credit, specific lenders may need a cosigner. Car finance companies will want the original copy of your verification documents. You must resubmit your application for car financing using the originals if you used photocopies or scans of the papers. Send them first class to ensure that you receive your documents as soon as possible. The exact shipping method will be used to return your documents to you.

What is a Good Car Financing Rate for a Used Car?

The interest rate is one of the most important factors when taking out a car finance whether a new or used car. The reason is that the interest rate will determine how much you’ll end up paying in interest over the life of the loan. The higher the interest rate, the more you’ll pay in interest.

The best auto loan rates for used cars are currently 2.74% APR(annual percentage rate) for a 36-month term, 3.19% car average APR for 48 months, and 3.59% APR for 60 months. The average used car loan rate is 4.21% APR, which is higher than the current new car loan rate of 3.21% APR. To get the best car financing UK rates, you need to have a strong credit score (700 or above). Lenders view borrowers with excellent credit as less of a risk and, as a result, offer them lower interest rates. If you don’t have perfect credit, you can still get a decent loan rate by shopping around and comparing offers from multiple lenders. Make sure you have no current auto loan, you are able to pay the monthly payment for refinance loan approval.

What are the advantages of choosing Best Financing for a Car?

The best financing for a car offers several advantages, including A wide range of options you can choose from various loan products, including hire purchase (HP), personal contract plans (PCPs), and personal or fixed-sum loans.

- Flexible terms: The term length for all these options is typically 12 to 60 months, but some lenders may offer longer periods with an estimated monthly payment from auto lenders.

- Best Financing for a Car offers some of the lowest interest rates on the market, starting at just 2.74% APR.

- You don’t need to put down a deposit when taking out a loan with Best Financing for a Car. This makes it an ideal option if you don’t have the cash to put down or want to use online banking.

- Fixed monthly payments: With Best car Financing UK, you’ll know exactly how much your monthly repayments will be from your minimum loan amount. This makes budgeting easier and gives you peace of mind.

- A wide range of vehicles: you can finance vehicle any make or model of car with Best Financing for a Car.

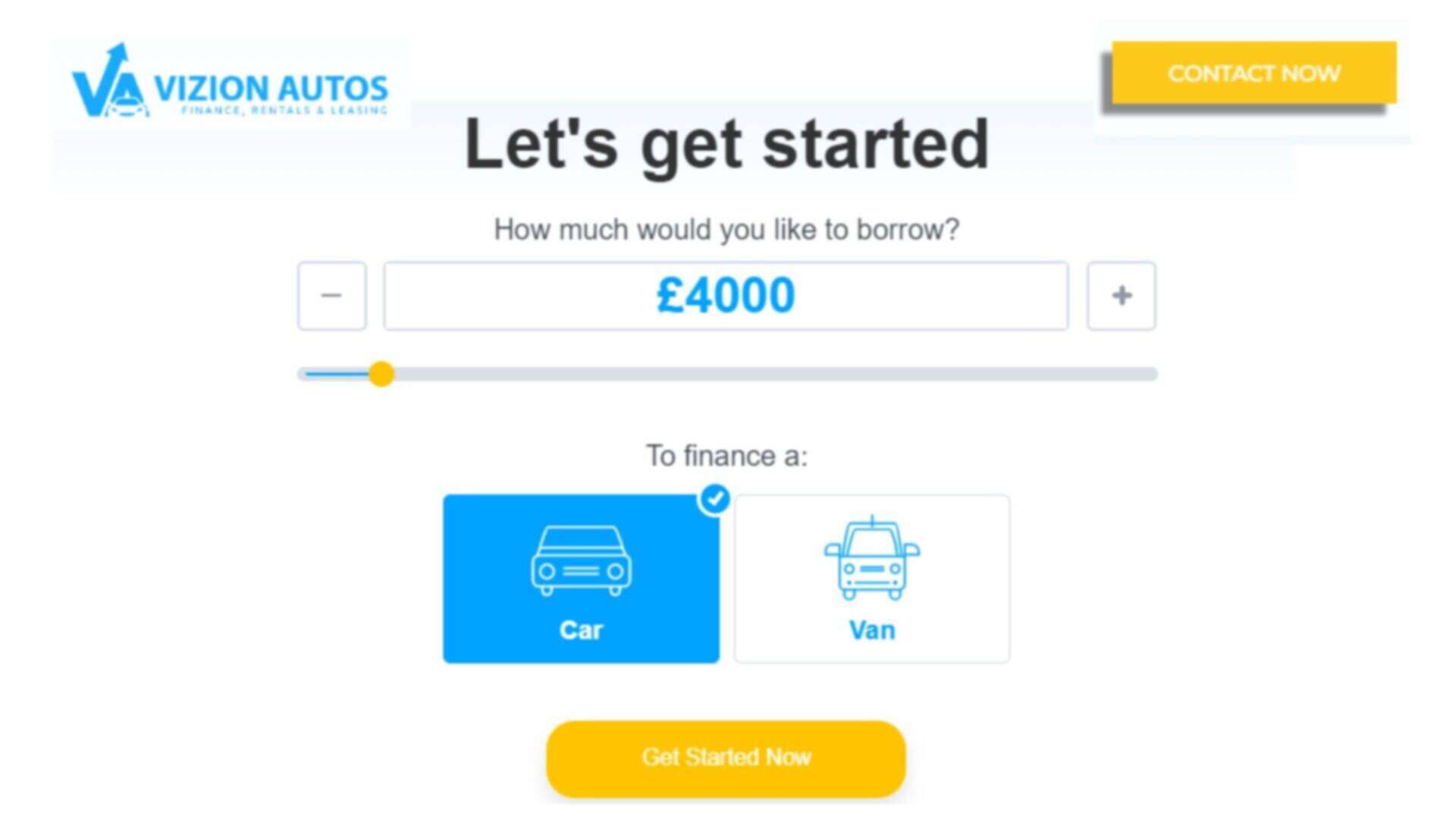

What’s the Process of Applying for Best Car Financing?

Applying for Best Car Financing is quick and easy. Simply fill out an online application form and provide some basic personal and financial information. Once your application is approved, you’ll be able to choose from a range of loan products. Once you’ve selected a loan product, you’ll be able to choose your repayment term and interest rate. After that, all you need to do is make your monthly repayments on time and you’ll be well on your way to owning your dream car. Additionally, there are no fees or charges for applying for Best Car Financing

How Old Do You Have To Be To Get Car Financing in UK?

Age is one of the factors that lenders will consider when you apply for a car loan. The reason is that age is generally seen as a reflection of financial responsibility. As a result, younger borrowers may be regarded as more of a risk than those who are older and, as a result, may be offered higher interest rates.

If you’re a senior citizen, you may be able to get a car loan with a lower interest rate. The reason is that lenders view seniors as less risky than younger borrowers. Additionally, some lenders may offer special financing deals for seniors. To qualify for a senior citizen discount, you’ll typically need to be 60 years of age or older. Some lenders may also require that you have a good credit score.

There is no minimum age requirement for getting car financing in the UK. However, most lenders will only approve loans for applicants who are 18 years of age or older. Additionally, some lenders may require you to have a full-time job or a regular income before approving your loan.

Thoughts

A car finance is a great way to finance a new or used vehicle. However, one must understand how car loans work before applying for one. Additionally, knowing what will happen at the end of your loan term is essential. When you take out a car loan, you’ll be required to make monthly repayments. The amount you’ll need to repay each month will depend on the size of your loan, the interest rate, and the term of your loan.

Using an auto loan calculator, you will be able to calculate the term of your loan. Loan terms typically range from 12 to 60 months. Once your loan term ends, you’ll need to either pay your loan in full or refinance your loan. However, it’s important to remember that you’ll still be required to make monthly repayments on your loan even after your original loan term ends. Therefore, it’s essential to budget carefully and make sure you can afford the monthly repayments on your loan before you apply for one.