Car finance is a loan or lease that allows you to purchase a new or used car without paying for it upfront. Depending on the car financing option you choose, car finance may require you to make fixed monthly payments or monthly instalments using a car finance calculator over a set period or allow you to defer payment until your car has been paid off entirely.

Several car finance options are available to suit different budgets and needs, so it’s important to compare your options before deciding on the best option.

Some car finance options may also include additional features such as balloon payment or trade-in value, so read the fine print before signing any car finance contract.

Balloon payments, for example, are a feature of car leases that require you to pay off the car in one large sum at the end of your lease period or final payment. And if you’re hoping to trade in your car at some point during your car finance term, it’s essential to be aware of any potential early termination charge fees or penalties.

Ultimately, car finance is an excellent option for those looking for a car purchase or hire purchase without paying for it upfront. Whether you’re looking for an affordable car loan early or a flexible car lease, many car finance options can help meet your needs and budget.

So if you’re thinking about hire purchase car, be sure to do your research and explore all of your car finance deals to find the best car financing option.

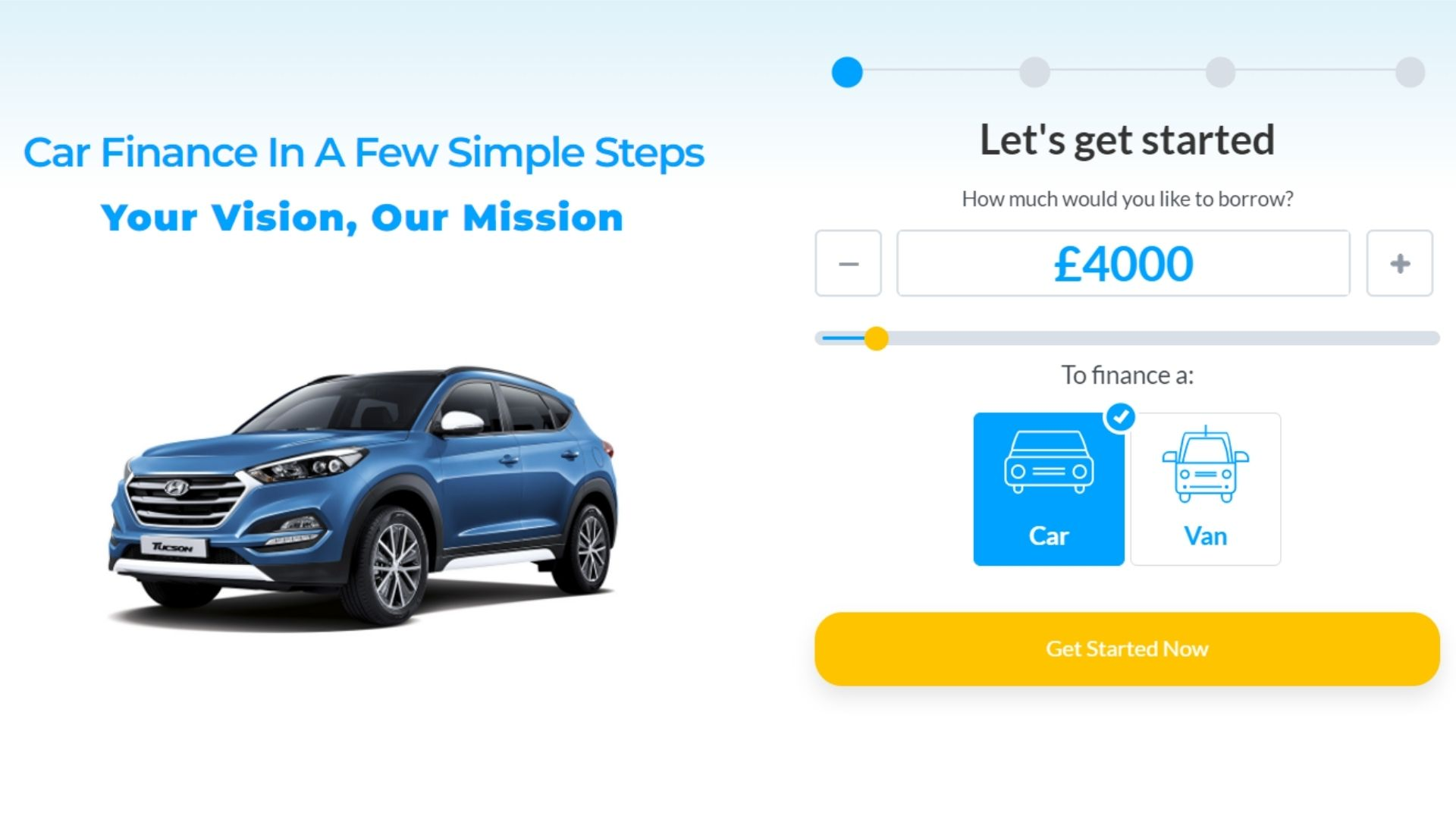

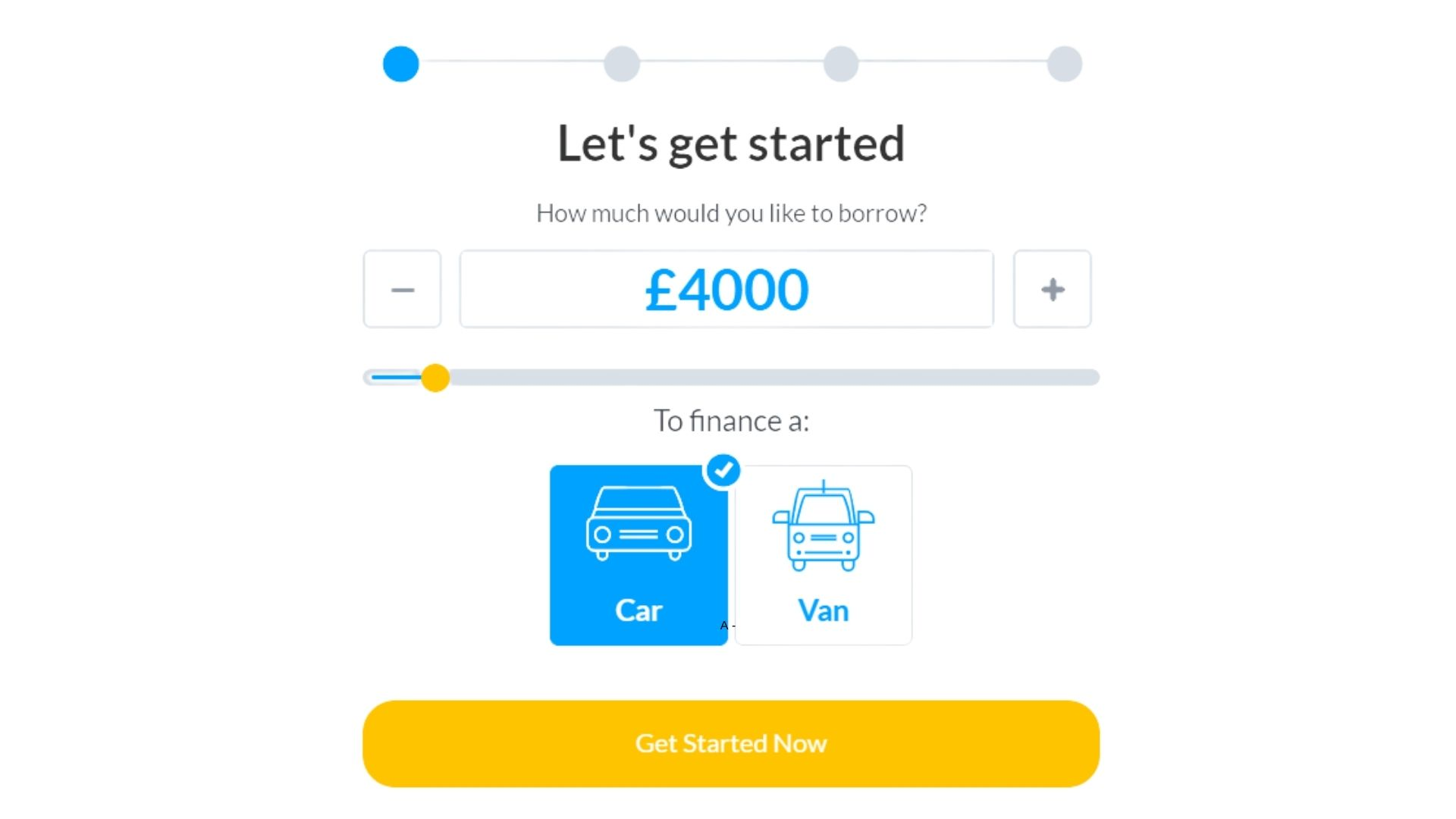

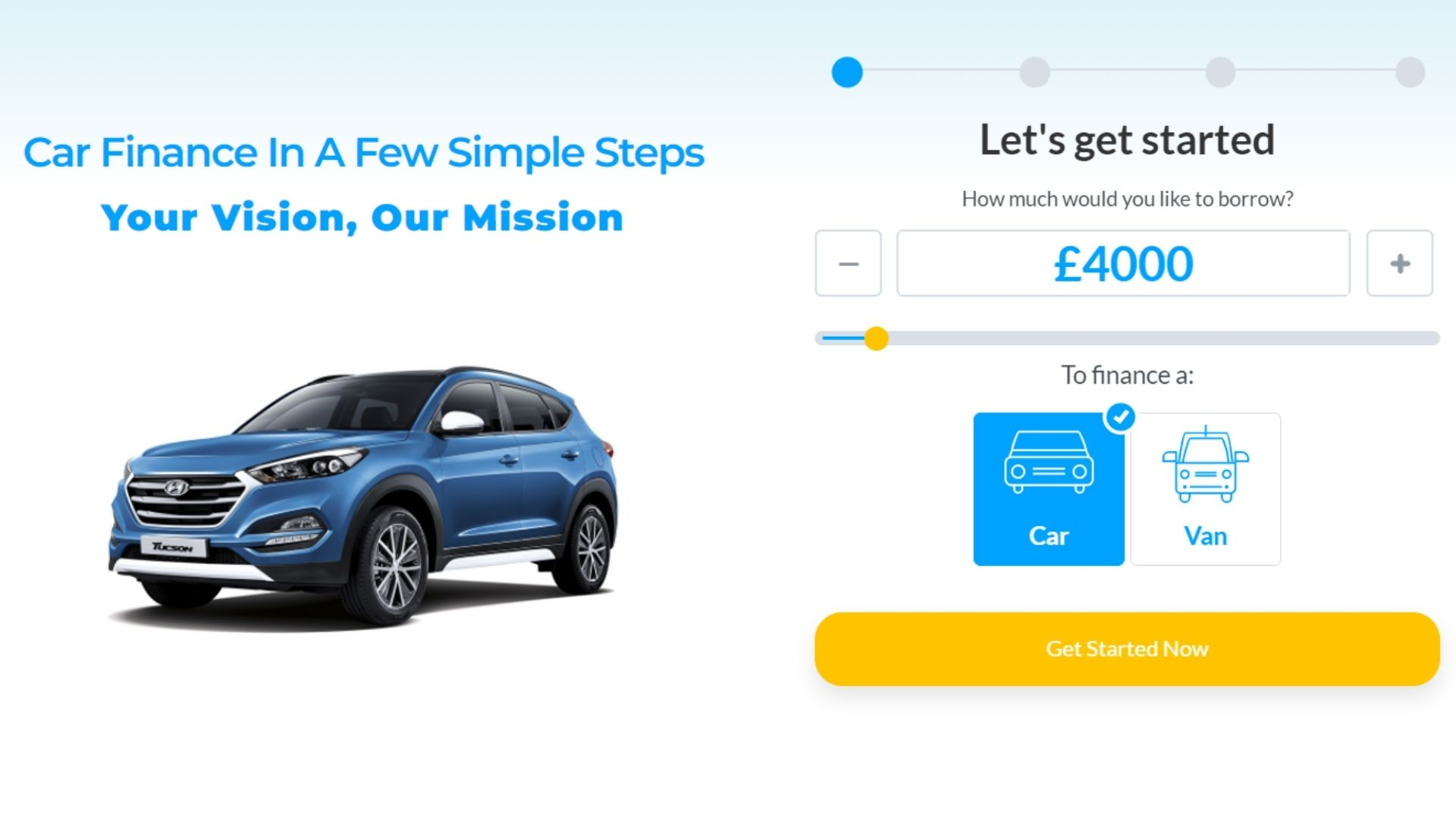

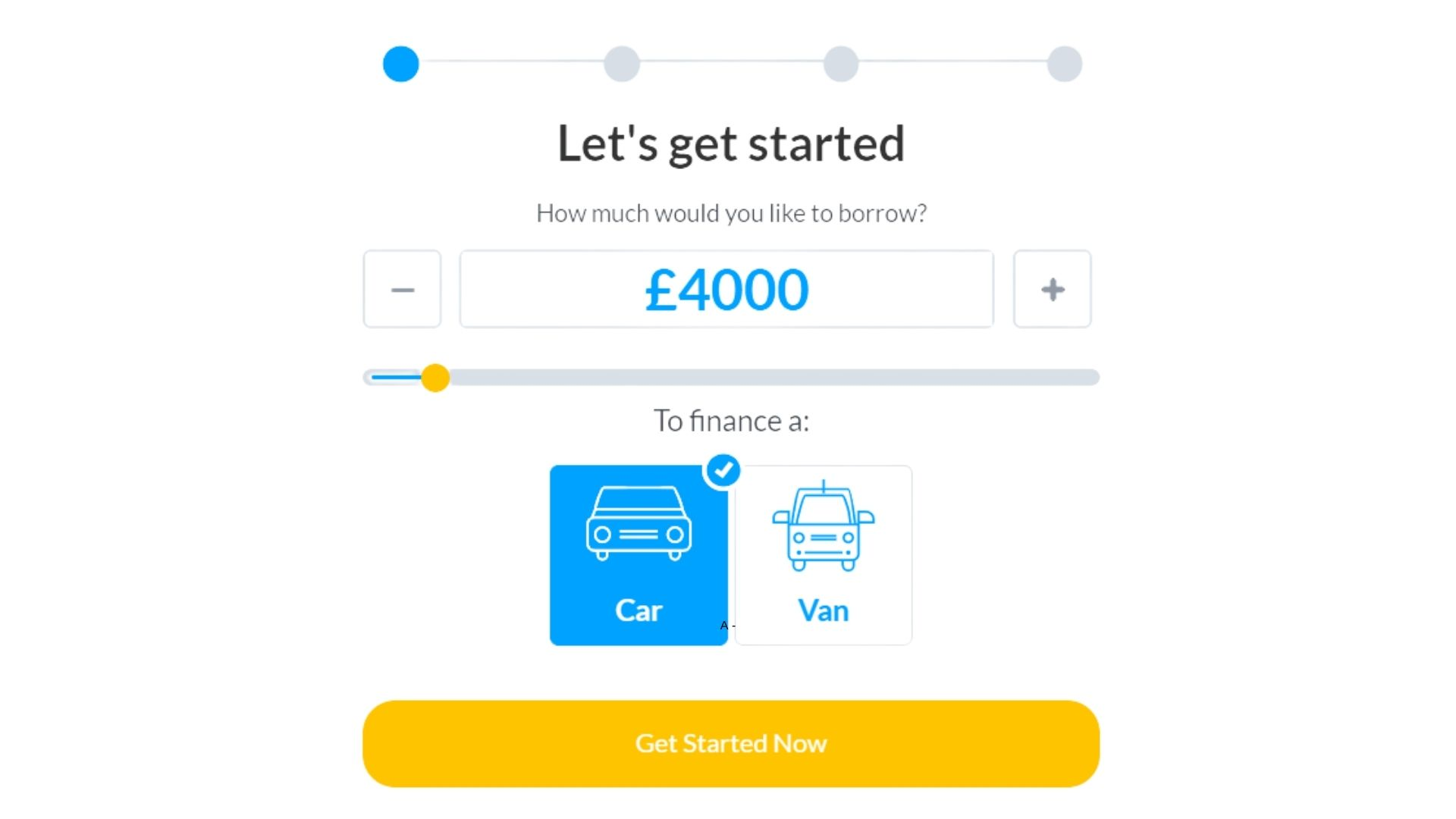

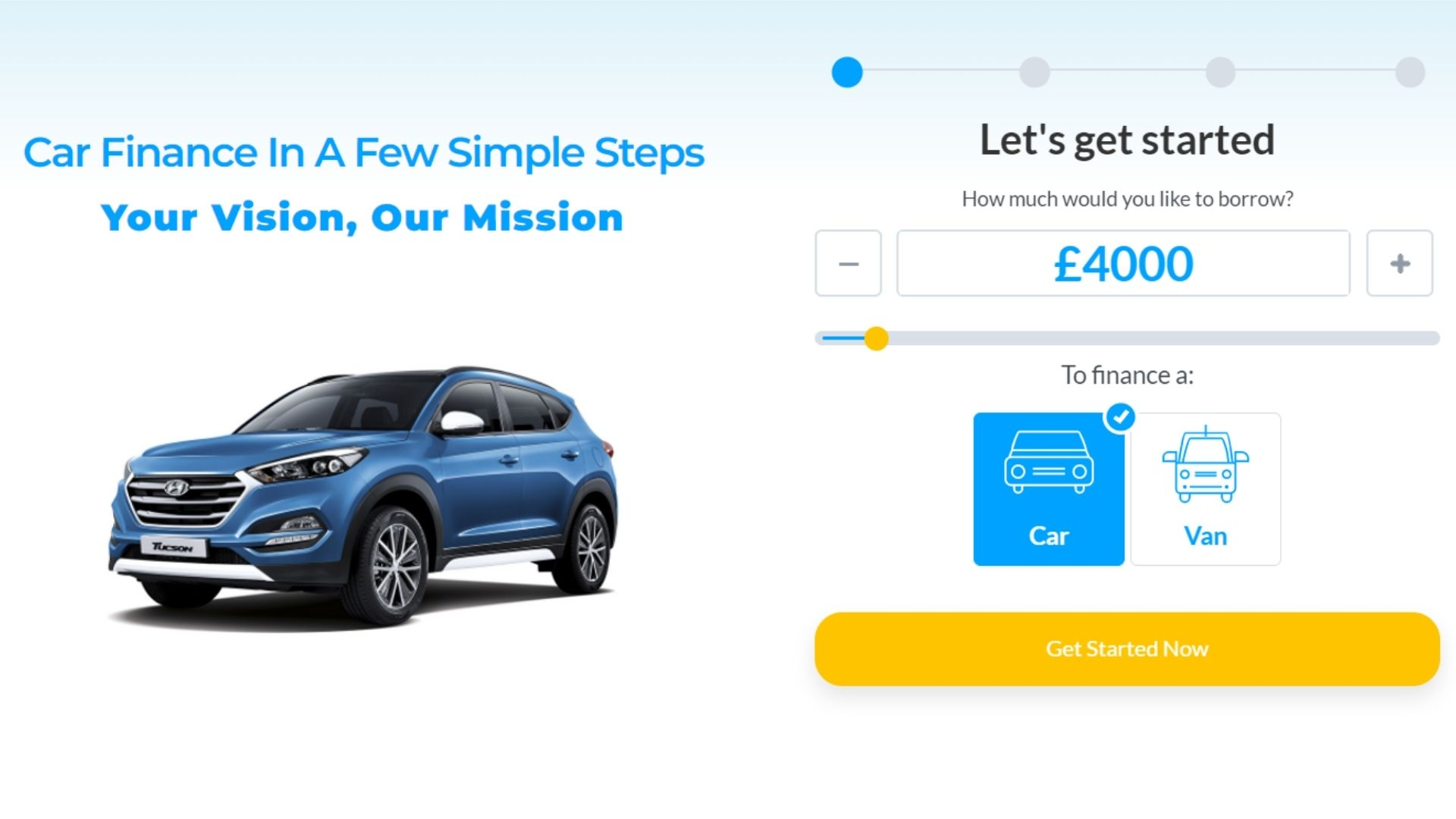

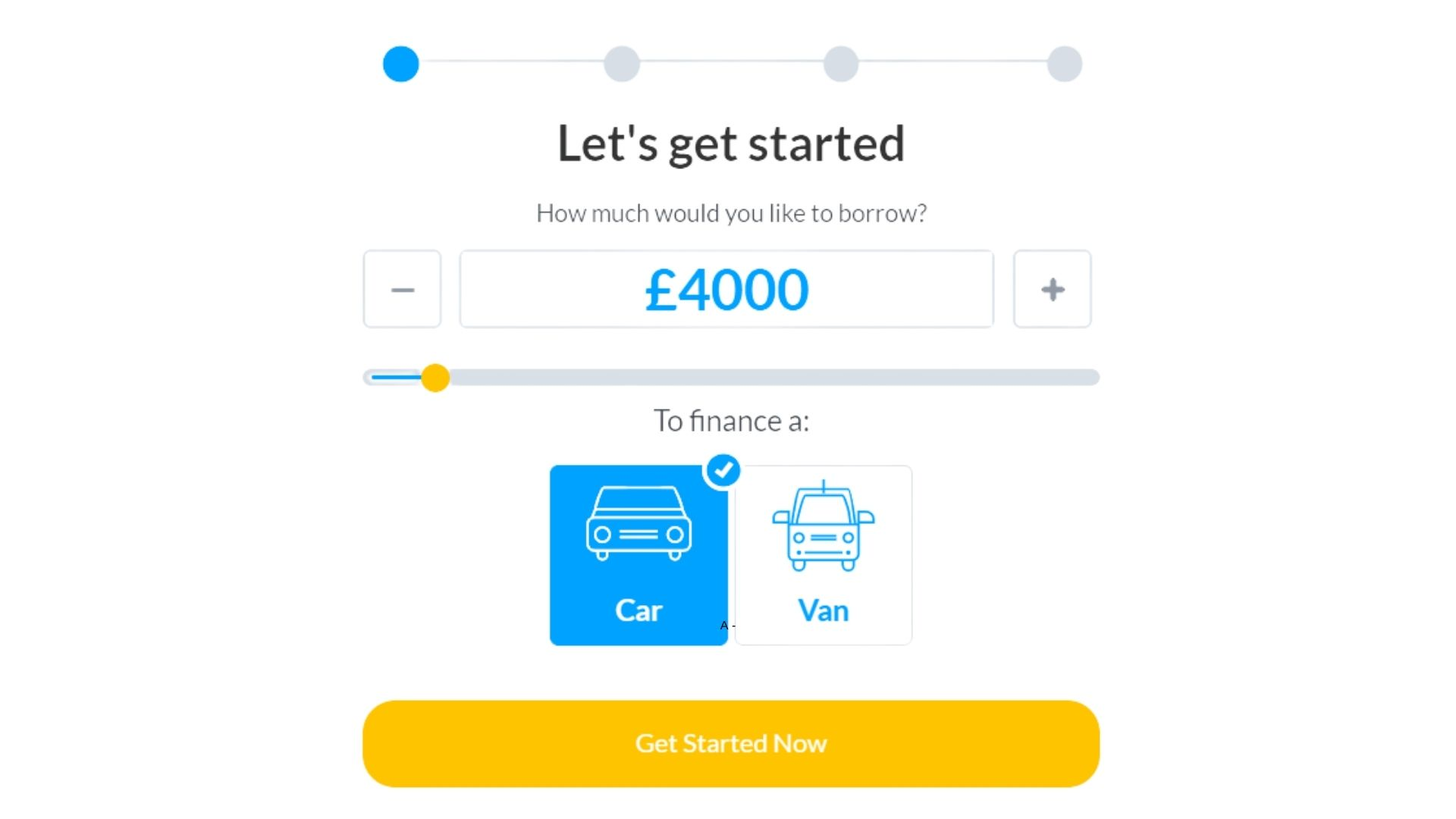

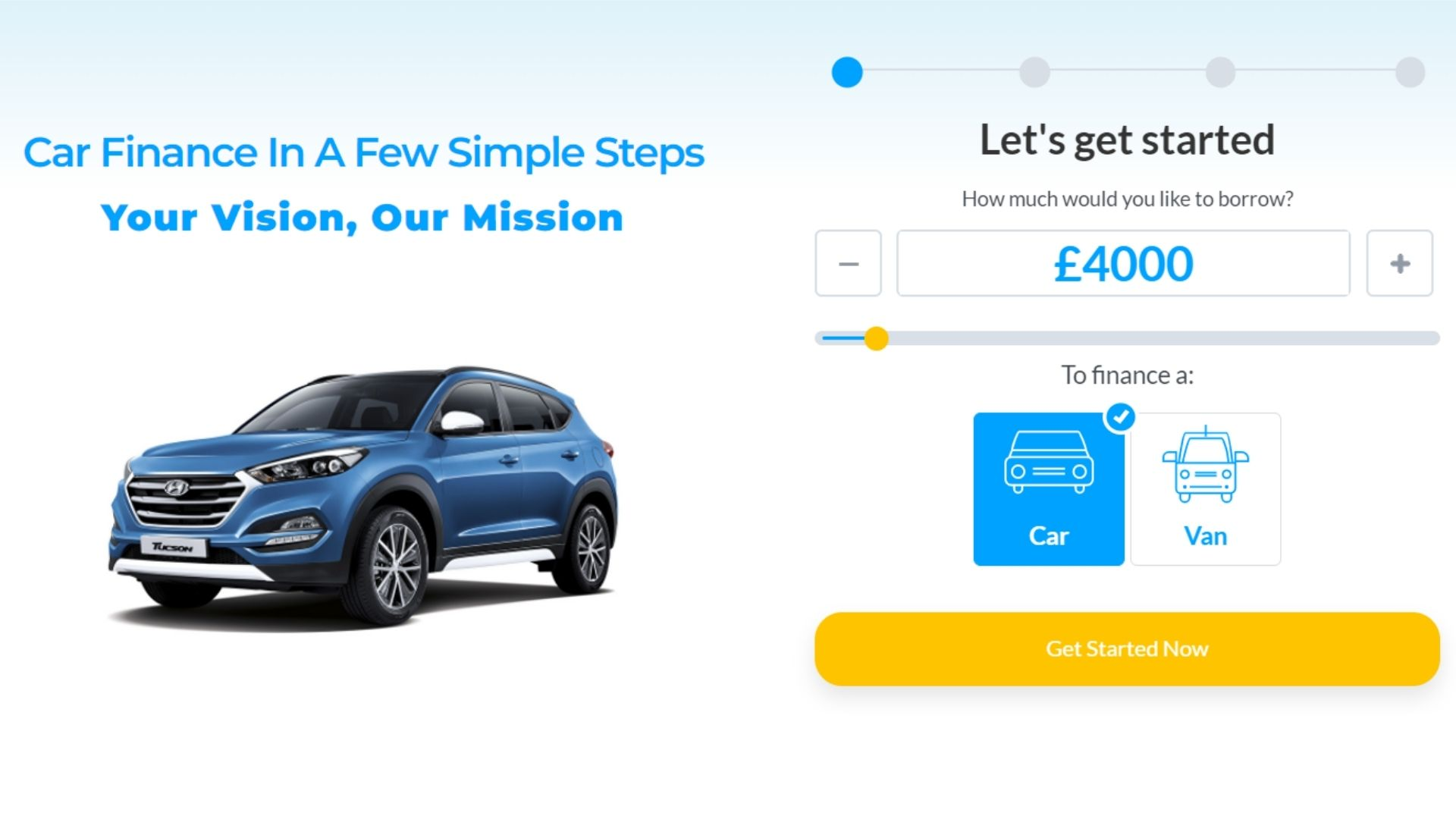

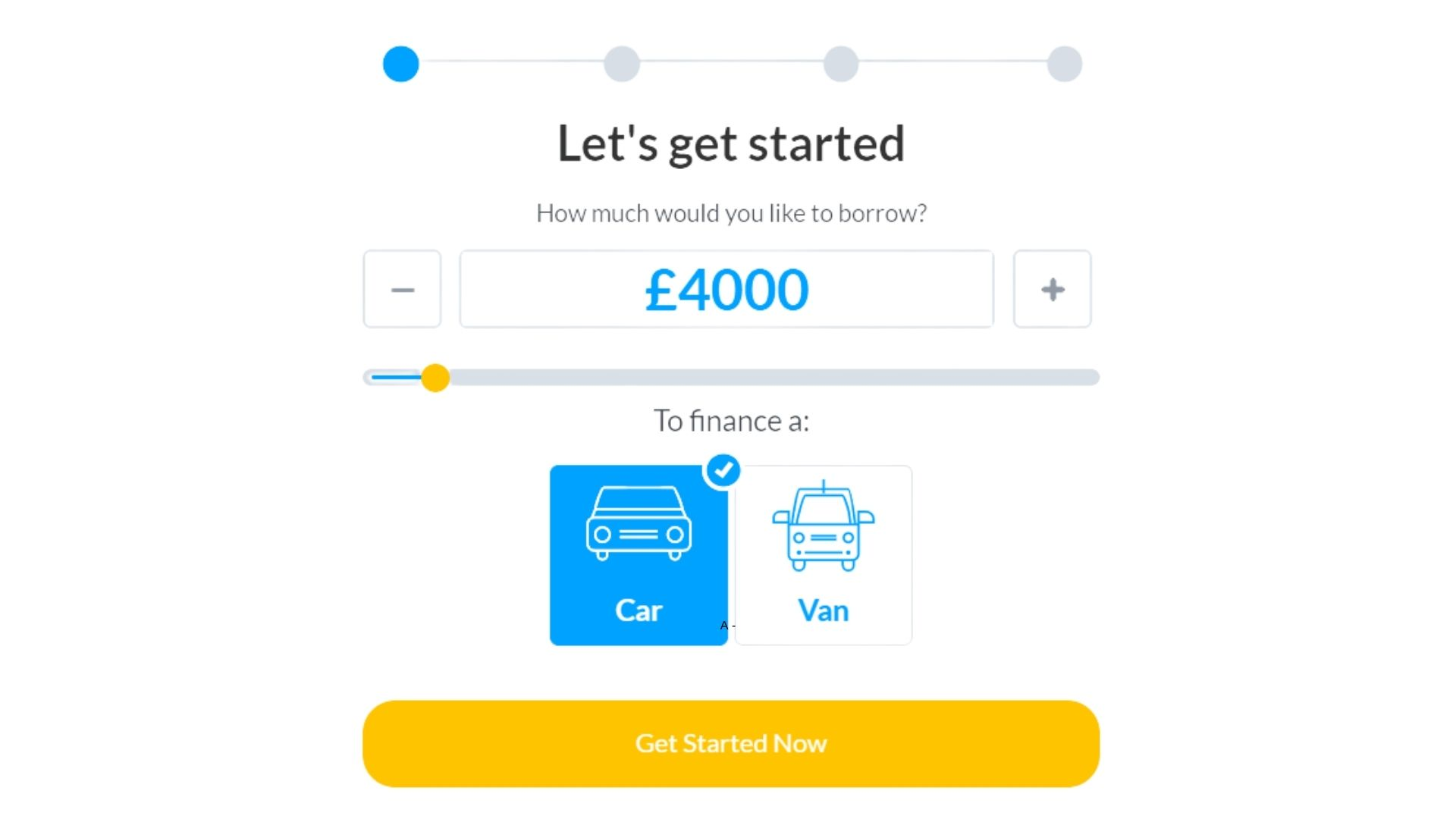

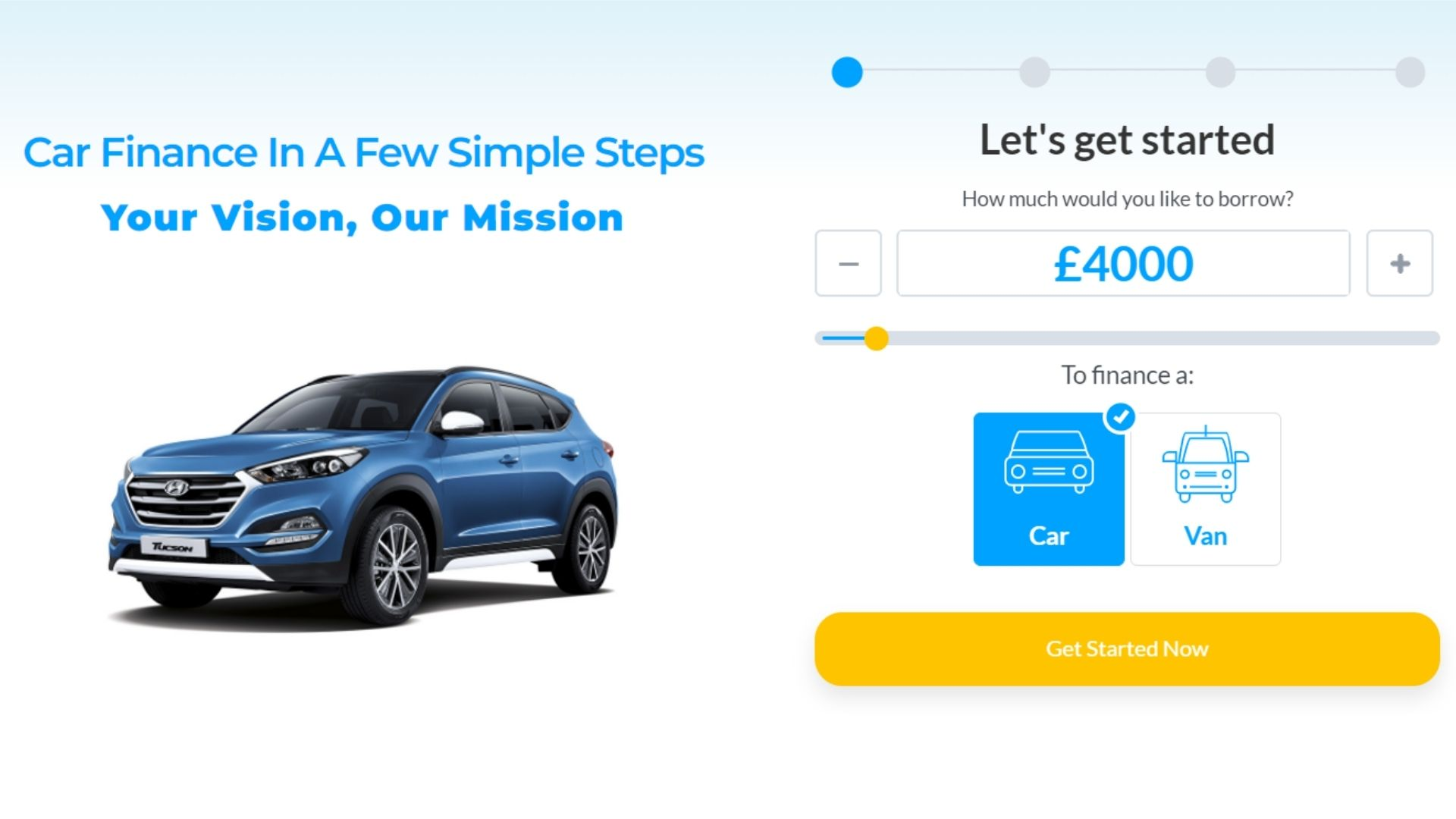

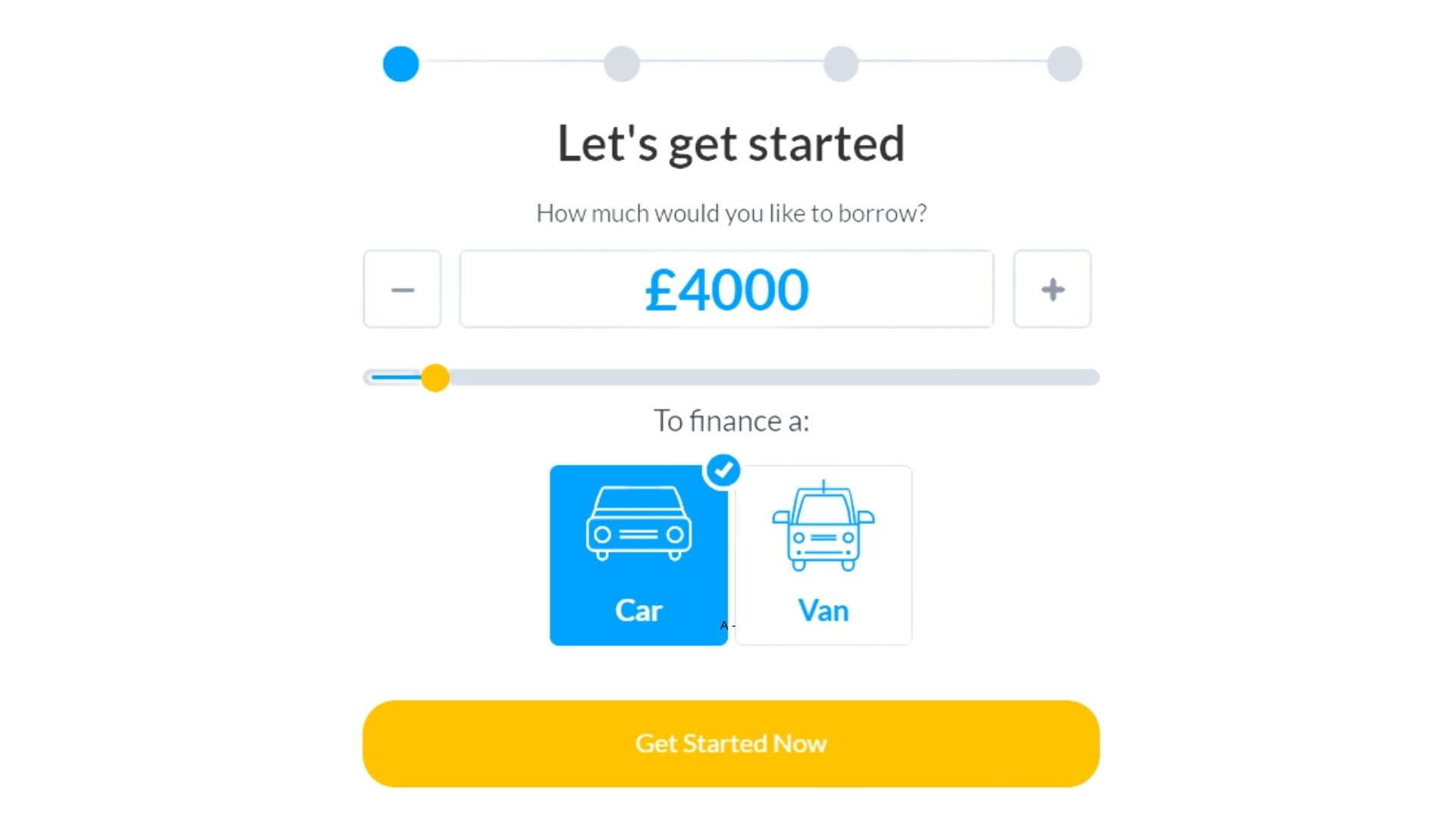

How to Apply for Car Finance?

If you’re interested in applying for car finance, the process is relatively straightforward. Most car dealerships will have their in-house financing team to help you with the application process. Alternatively, many online lenders offer car finance so that you can apply for finance from the comfort of your own home.

When applying for car finance, you’ll need to provide some basic personal and financial information. It will include your name, address, date of birth, contact details, and driving licence number.

You’ll also need to provide information about your current employment situation, income, and assets secured ownership. In some cases, you may also be asked to provide supporting documentation such as pay stubs, proof of residence, or bank statements.

You can typically apply online directly through a lender’s website or visit your local dealership to apply for car finance. If you apply for car finance online, most lenders will require that you provide some basic information about yourself to process your application.

Once you submit your application, a lender will typically review your information and contact you within a few business days to let you know whether or not your application has been approved.

Overall, applying for car finance is a quick and easy process that can help make your car-buying experience more affordable. Whether you apply online or in-person at a dealership, have all of the necessary information on hand before starting your application.

And if you have any questions about the process, be sure to ask your lender or dealer for more details. Then, with a bit of research and preparation, you can easily apply for car finance and get on the road to owning your dream car.

What Checks are Done for Car Finance UK?

When you apply for car finance UK, a lender will typically run a soft credit check and credit search as part of the application process. This is done to assess your creditworthiness and determine whether you’re eligible for a car finance plan. A credit check will also help a lender understand what annual interest rate to offer you on your car loan.

In addition to a credit check, car finance providers may also ask for proof of income or asset ownership to assess your financial situation. It could include pay stubs, tax returns, bank statements, or other supporting documentation.

Another factor that car finance providers take into consideration is your employment status. If you’re applying for a car finance option and are unemployed, you may still be eligible for car finance. However, your annual percentage rate may be higher than someone employed.

When assessing your application, car finance providers will also consider your car-buying history and credit history. For example, if you’ve previously defaulted on car finance payments or had a car repossessed, this could impact your eligibility for car finance.

Overall, car finance providers will consider various factors when assessing your application for car finance. By understanding what’s involved in the process, you can be better prepared when applying for car finance. And if you have any questions about the process, be sure to ask your lender or dealer for more details.

What Do You Need to Finance a Car?

Financing a car requires providing basic personal and financial information to a lender or dealer. It typically includes your name, address, contact details, driver’s license number, employment status, income level, and asset ownership.

In addition to this basic personal and financial information, you may also need to provide supporting documentation when financing a car. It could include pay stubs, tax returns, bank statements, proof of residence, or other documentation.

If you’re financing a car through a dealership, they may also ask for your trade-in vehicle’s title and keys as part of the financing process.

Overall, financing a car is a relatively quick and easy process. By understanding what’s involved and having all of the necessary information on hand, you can easily finance a car. And if you have any questions about financing a car, be sure to ask your lender or dealer for more details.

How Easy is it to Get Car Finance?

Car finance is typically easy to obtain, especially if you have a good credit rating and credit file. Applying for car finance is a quick and easy process that can be done online or in person at a dealership. And most car finance providers will offer competitive interest rates to qualified borrowers.

You’ll need to provide some basic personal details and financial information to get car finance. It could include your name, address, contact details, driver’s license number, employment status, income level, and asset ownership.

In addition to this basic information, you may also need to provide supporting documentation when applying for car finance. It could include pay stubs, tax returns, bank statements, proof of residence, or other documentation. If you’re financing a car through a dealership, they may also ask for your trade-in vehicle’s title and keys.

What is the Best Way to Finance a Car?

Different factors such as your credit score, income level, and employment status can impact which type of financing might be right for you. However, some standard options include applying for car finance through a bank or credit union or working with a dealer to get auto financing.

If you have good credit, you may be able to get a low interest car finance loan from a bank or credit union. And if you’re financing a car through a dealership, they may be able to offer you competitive interest rates and terms.

No matter which option you choose, it’s important to compare interest rates and terms before agreeing to any car finance agreement. By understanding your options, you can select the best way to finance a car that meets your needs.

What Credit Score Do You Need for Car Finance UK?

Your credit score is one of the critical factors in getting car finance UK. You’ll need a credit score of 700 or higher to get the best car finance rates. If you have bad or poor credit, you may still be able to get a financed car with a higher interest rate.

It’s essential to work closely with your lender or dealer and understand the terms of your agreement to avoid defaulting on your car loan.

There is much different finance option, including applying for auto financing through a bank or credit union or working with a dealer or finance company.

Car Finance Market can help you finance your used or new car based on your unique needs, initial deposit, credit report, credit history, credit rating, address history, monthly budget, and financial situation.

We make it easy to get the right car finance for you. So get in touch with us today to learn more about our services and determine if car finance is the right option for you.

Whether you have good credit or bad credit, Car Finance Market can help you get the car financing you need to buy your new car. Our experienced car financing experts will work with you to find a loan that meets your needs and budget. So don’t hesitate – to contact us today to learn more about our car financing options and get started on buying your next car!

What Happens If I Can’t Pay My Car Finance?

If you can’t pay your car finance, it could lead to repossession. In addition, it could damage your credit score and make it more challenging to get a car finance deal in the future.

If you’re struggling to make your car finance payments, contact your lender or dealer as soon as possible. They may be able to offer you a different payment plan or car finance terms that can help make your payments more manageable.

By understanding your car finance agreement and talking to your lender, you can avoid defaulting on your car loan. Defaulting on a car loan can damage your credit score and make it more difficult to get car finance in the future.

If you’re struggling to make your car finance payments, contact your lender or dealer as soon as possible. They may be able to offer you a different payment plan or car finance terms that can help make your payments more manageable.

By understanding your car finance end of the agreement and working with your lender, you can avoid defaulting on your car loan and ensure that you continue to have reliable transportation. And if you have any questions about the car finance agreement or your credit score, be sure to ask your lender or dealer for more details.

What Is the Best Way to Finance a Car?

There is no single best way to finance a car, as different factors such as your credit score, income level, and employment status can impact which type of financing might be right for you. However, some standard options include applying for car finance through a bank or credit union or working with a dealer to get auto financing.

Comparing interest rates and terms is essential no matter which option you choose, as this can help you get the best deal on your car loan. Those with good credit may qualify for lower interest rates, while those with poor credit may still be able to get financing but at a higher interest rate.

If you’re unsure which option is best for you, it’s good to speak with a lender or reputable dealer like Car Finance Market. We can provide more information and help you determine the best way to finance your car based on your unique needs and financial situation.

Summary

Car finance can help you buy a car if you don’t have the total amount in cash or the total cost of credit. It’s important to compare interest rates and terms before agreeing to any car finance agreement. Your credit score is one of the essential factors in getting car finance UK.

Generally, you’ll need a credit score of 700 or higher to get the best car finance rates. If you have bad credit, you may still be able to get car finance with a higher interest rate.

It’s essential to work closely with your finance providers, lenders, or dealers and understand the fixed percentage, fixed fee, balloon payment, monthly repayments, credit rating, the total cost of credit, and finance agreement to avoid defaulting on your car loan.

There are many different options or types of car finance, including applying for auto financing through a bank or credit union or working with a reputable UK dealership dealer. Car Finance Market can help you finance your next car based on your unique needs and financial situation. We make it easy to get the right car finance cost for you. Get in touch with us today to learn more about our services. Car Finance Market is here to help you get the perfect car finance for your needs. With our expertise in the auto financing industry, we can help you find the right deal to meet your needs and budget. In addition, we provide an excellent customer service finance representative. So if you’re looking to buy a car, be sure to contact CarFinanceMarket.co.uk today!