Hire purchase finance is a type of car loan that allows you to spread the total cost of a big-ticket item over time. With hire purchase finance, you make regular payments on the item until you own it outright.

Hire purchase finance can be a good option if you’re looking to finance a large purchase, such as a car or home appliance, but don’t have the cash upfront to pay for it all at once.

With hire purchase finance, you can typically enjoy lower interest rates than other loans and flexible repayment terms to spread your payments over a more extended period. However, it’s essential to be aware that hire purchase agreements often require you to pay an additional “option fee” that is typically non-refundable.

Whether hire purchase finance is right for you will depend on your situation, so it’s essential to consider all of your options before deciding carefully. If you’re considering hire purchase financing, it’s good to speak to a financial advisor to learn how this type of loan works and whether it’s the right choice.

Who Offers Hire Purchase?

Some lenders and financial institutions offer to hire purchase financing, including banks, credit unions, and online lenders. The most popular providers include Car Finance Market, Wells Fargo, Bank of America, LendingTree, and SoFi. It’s essential to do some research and compare your options carefully to determine which lender is best suited to your needs.

When comparing hire purchase financing offers, look at the interest rate, repayment terms, and any additional fees that may apply. It’s also a good idea to read the fine print carefully to make sure you understand all of the finance term and condition of the loan agreement before signing anything.

If you’re considering hire purchase car finance deal, it’s a good idea to consult with a financial advisor or lender who can help you understand your options and make the best decision for your needs. Then, with the right hire purchase loan, you can enjoy peace of mind knowing that you can finance a big-ticket purchase without breaking the bank.

What are the Advantages of Hire Purchase?

There are several advantages of hire purchase financing, including the following:

– You can finance a large purchase without paying for it all upfront.

– Hire purchase agreements often come with lower interest rates than other types of loans.

– You can typically enjoy flexible repayment terms to spread out your payments over a more extended period.

– Some hire purchase agreements allow you to make a balloon payment at the end of the loan term to reduce your overall interest costs.

There are also some disadvantages of hire purchase financing to be aware of, including the following:

– You may be required to pay an additional “option fee” that is typically non-refundable.

– If you default on your payments, the lender can repossess the item you financed.

– Hire purchase agreements are often unavailable for items that depreciate quickly in value, such as cars.

– You may not be able to get out of a hire purchase agreement early without incurring a penalty.

Hire purchase finance can be a good option if you’re looking to spread the cost of a large purchase over time. However, it’s essential to be aware of the potential disadvantages before signing any loan agreement. Therefore, it’s important to compare hire purchase deals with hire purchase financing, read the fine print carefully, and consult with a financial advisor if you have any questions or concerns and know what hire purchase deals they offer.

How Does Hire Purchase Work on a Motorhome?

Hire purchase car finance agreement is a type of loan that allows you to pay for your motorhome in installments over an extended period. With hire purchase, you typically need to make a down payment upfront and then make regular monthly payments until the loan is paid off. It differs from traditional auto loans, which require you to pay for the value of the car in total cost upfront.

One of the main advantages of hire purchase is that it can help you finance a large purchase without paying for it. It can make hire purchase an attractive option if you’re looking to buy a more expensive motorhome but don’t have the cash on hand to pay for it outright.

Hire purchase car agreement typically come with annual fixed interest rate, which can help you budget affordable monthly payments. The terms of hire purchase loans vary depending on the lender, but you can typically choose to spread out your payments over two to five years.

It’s important to note that hire purchase agreements are not the same as leasing a motorhome. If you want the option to purchase your motorhome at the end of the loan term, a hire purchase may be a good choice for you.

However, leasing may be a better option if you temporarily plan to use your motorhome and do not intend to keep it once your hire purchase agreement is paid off.

What is a Hire Purchase Loan?

A hire purchase loan is a loan that allows you to finance a large purchase by making monthly payments over an extended period. With hire purchase, you typically need to make a down payment upfront and then make regular monthly payments until the loan is paid off. It differs from traditional loans, which require you to pay for your purchase in total upfront.

One of the main advantages of hire purchase is that it can help you finance a large purchase without paying for it. It can make hire purchase an attractive option if you’re looking to buy a more expensive item but don’t have the cash on hand to pay for it outright.

Hire purchase agreements typically come with fixed interest rates, which can help you with your monthly budget for your monthly payments. The terms of hire purchase personal loans vary depending on the lender, but you can typically choose to spread out your payments over two to five years.

What is Hire Purchase on a Car?

A hire purchase on a car is a type of loan that allows you to finance the purchase of a car by making regular monthly payments over a set period. It varies from traditional auto loans, which require you to pay for your brand new car in total upfront.

One of the main advantages of hire purchase is that it can help you afford cars on hire purchase that you might not otherwise be able to purchase. It can also allow you to spread out the cost of your vehicle over a more extended period, making it easier to manage your monthly expenses.

When signing up for a hire purchase on a car, it’s essential to carefully read all the terms and conditions of the loan agreement and understand any potential penalties or car’s price fees associated with the loan.

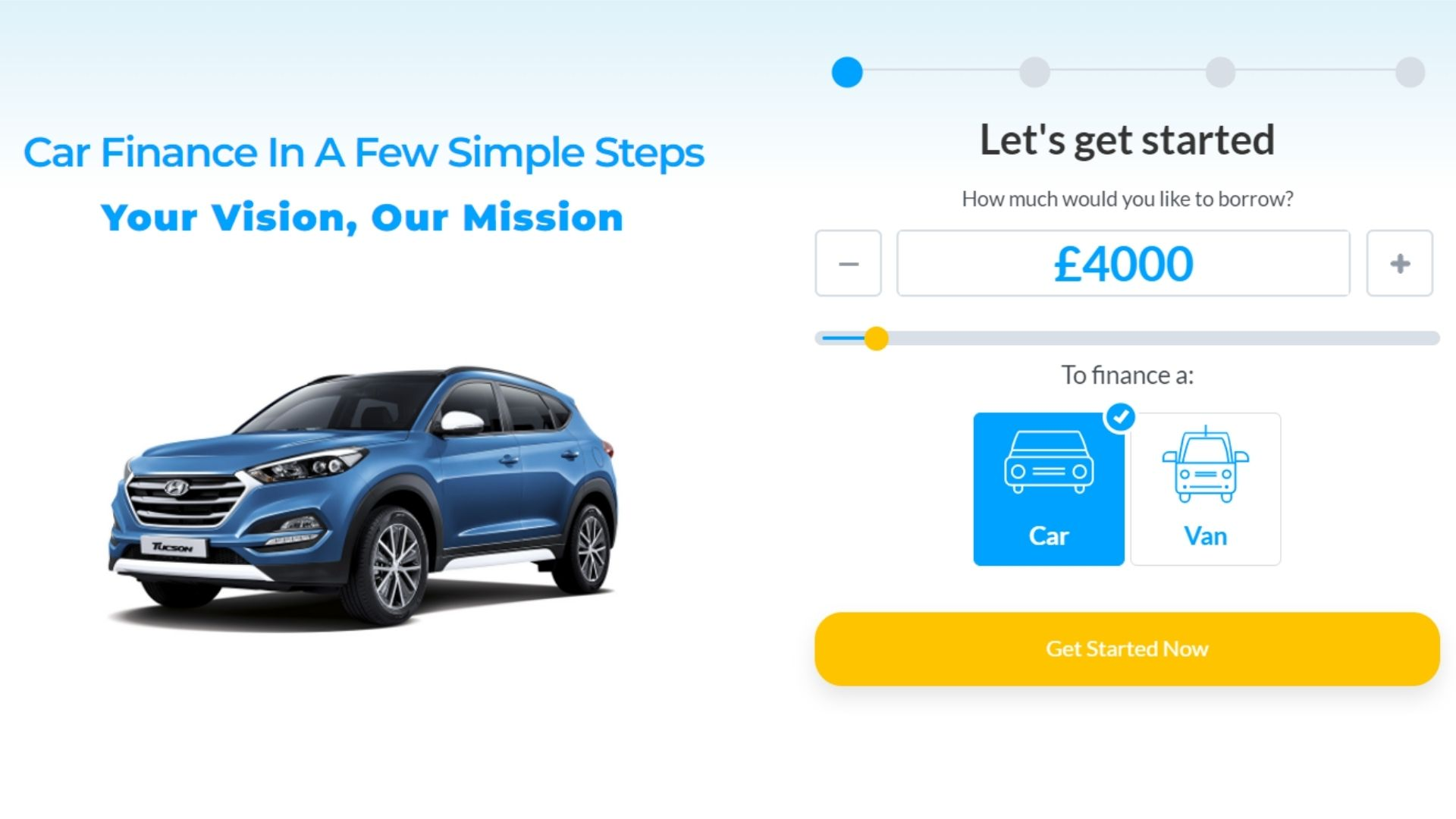

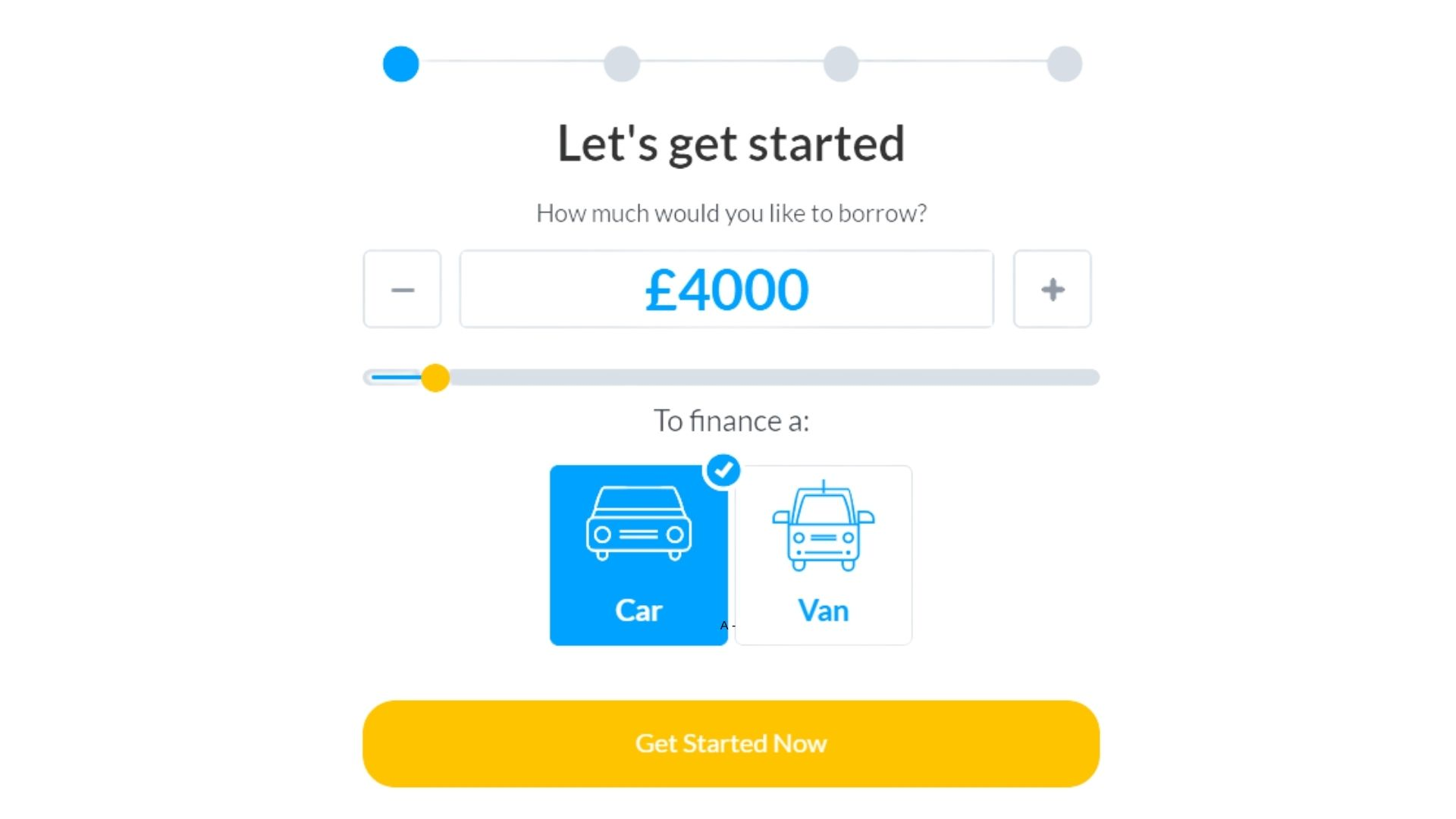

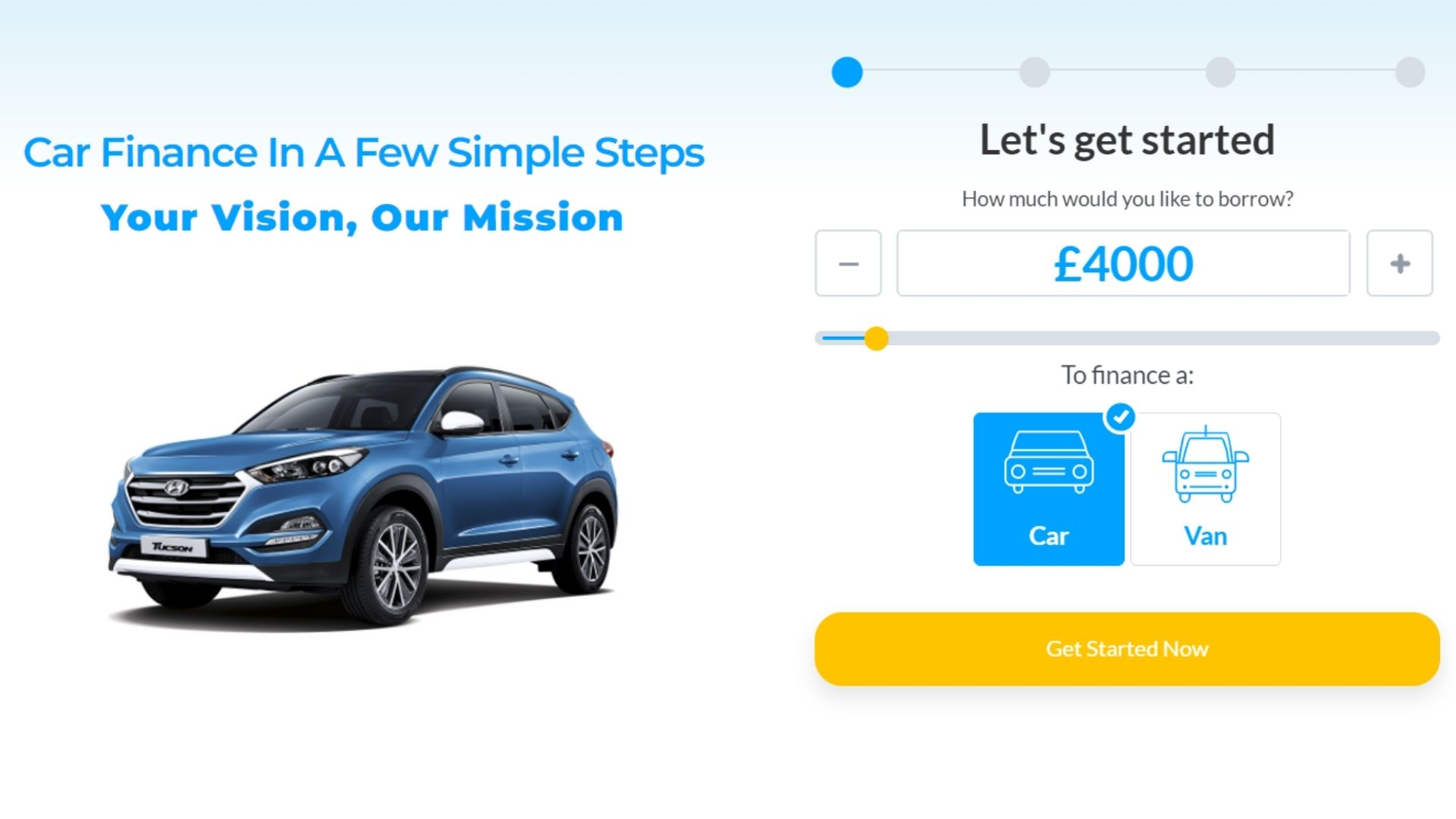

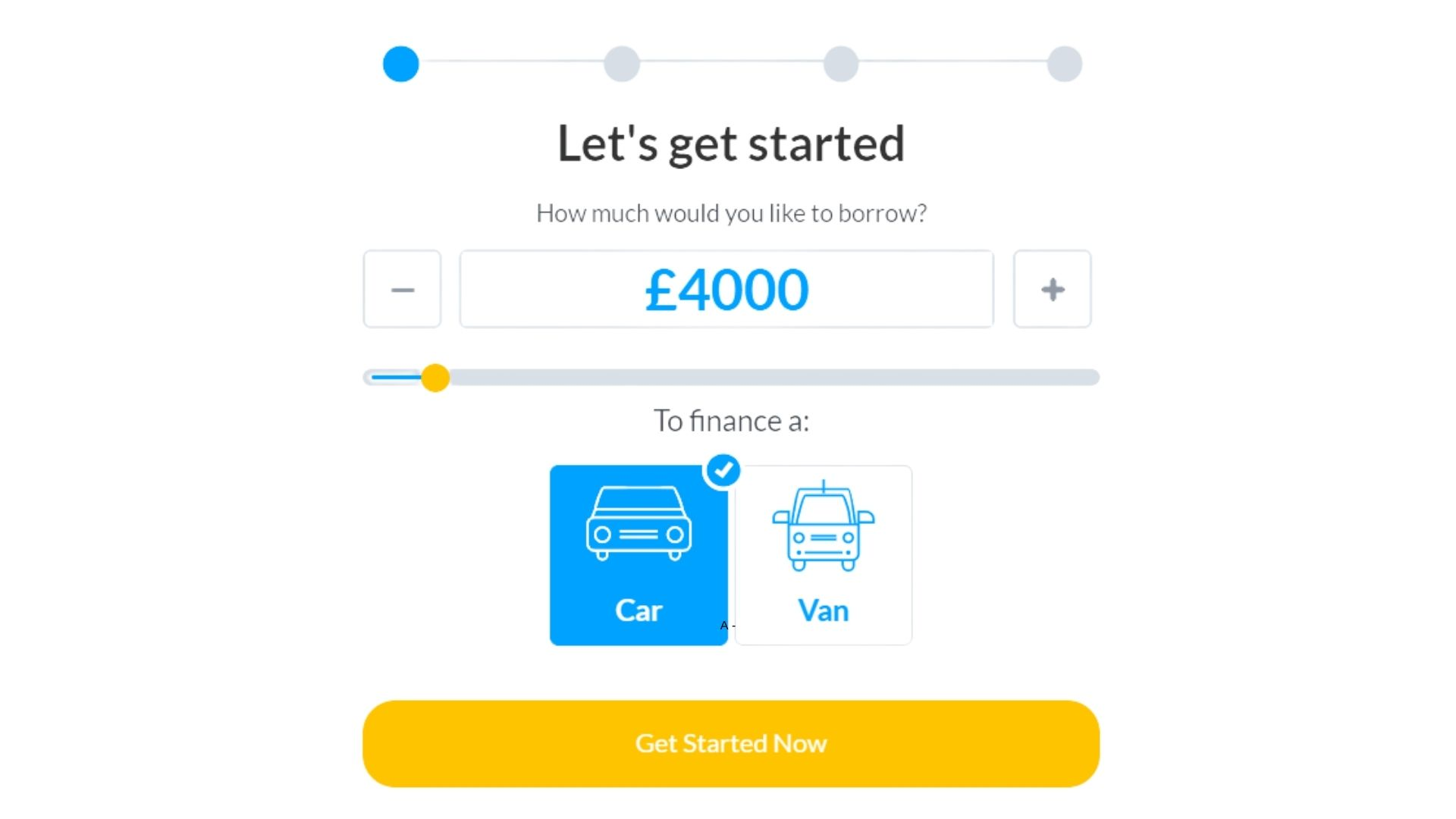

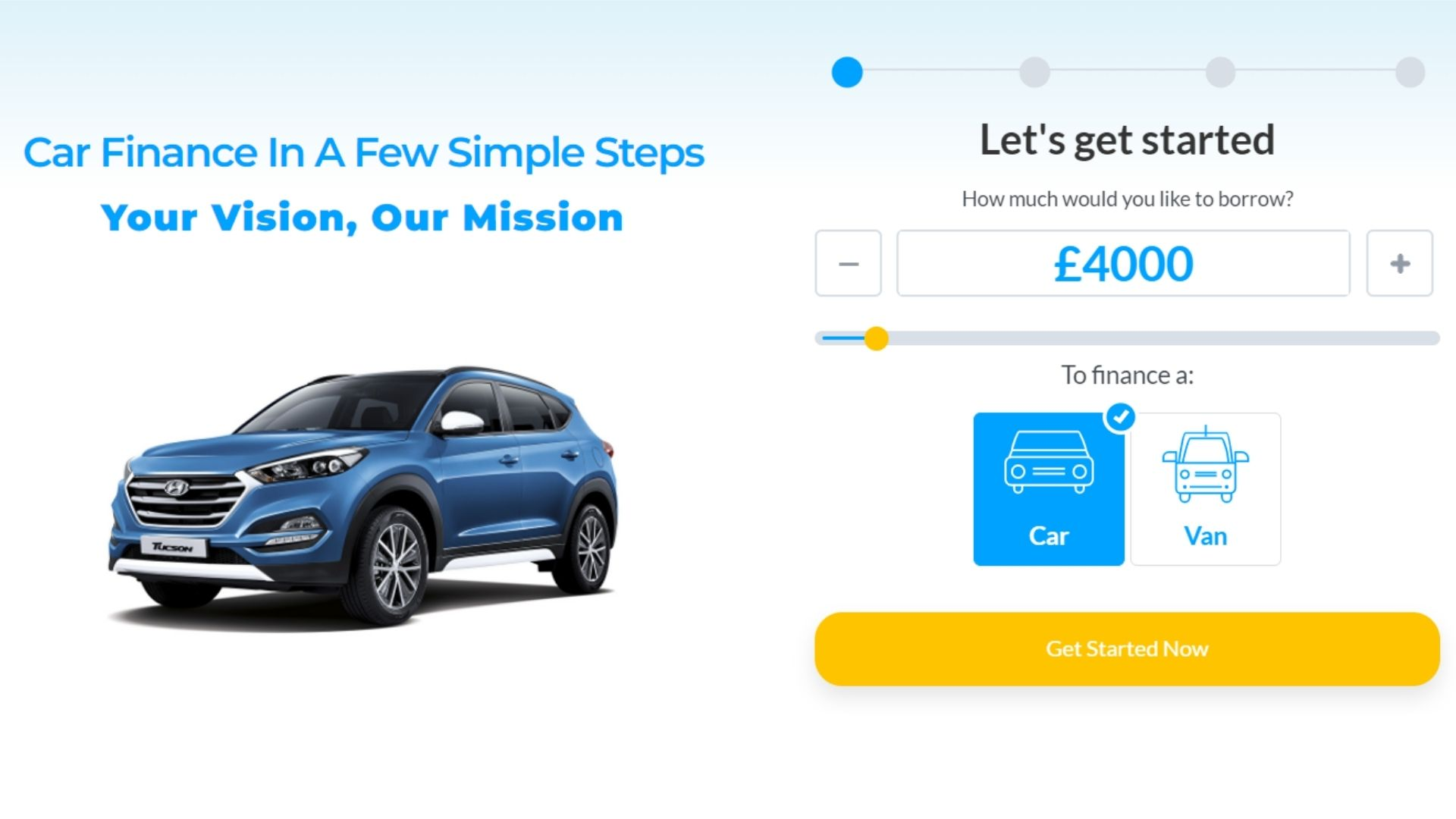

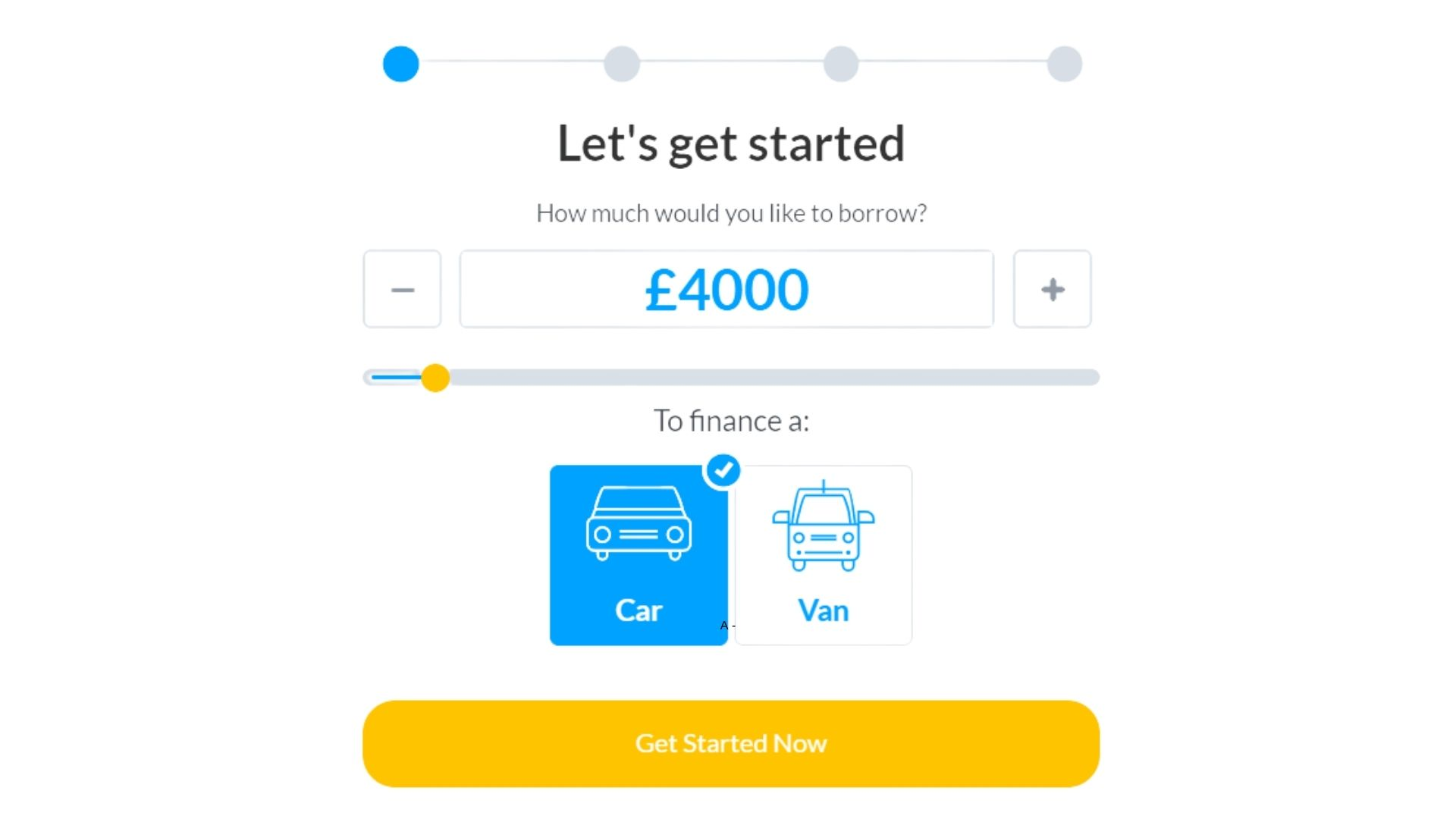

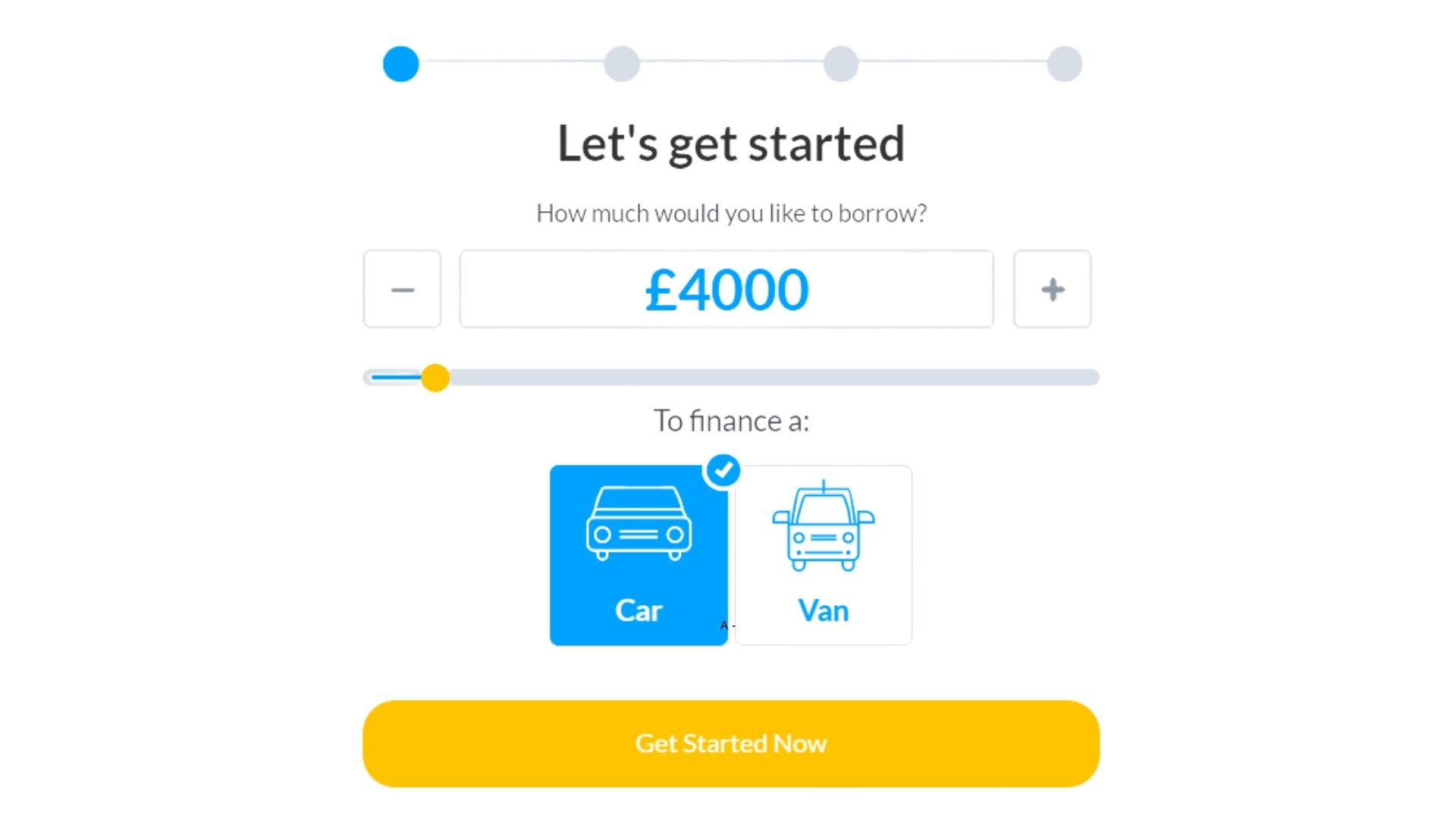

You may also wish to consult with finance providers or lenders to help you choose an appropriate repayment period and interest rate for your particular needs. CarFinanceMarket.co.uk is one of the best hire purchase finance companies in the UK. Contact us for more information.

What is a Hire Purchase Agreement UK?

A hire purchase agreement in the UK is a type of loan that allows you to finance the purchase of your ideal car or other large item by making regular monthly payments over an extended period. It counters traditional auto loans, which require you to pay for your vehicle in total upfront.

One of the main advantages of hire purchase car is that it can help you finance a large purchase fee without paying for it. It can make hire purchase an attractive option if you’re looking to buy a more expensive car but don’t have the cash on hand to pay for it outright.

Hire purchase agreements typically come with fixed interest rates, which can help you budget for your monthly payments. The terms of hire purchase agreements vary depending on the lender, but you typically have the option to spread out your payments over two to five years.

To learn more about hire purchase loans and how they can help you finance your next car purchase, consult with a financial advisor or lender. CarFinanceMarket.co.uk is a reputable hire purchase company in the UK that can help you find the right hire purchase loan for your needs.

How to Get Out of a Hire Purchase Agreement?

If you are struggling to make your hire purchase car payments and are considering getting out of the agreement, there are several steps you can take. These may include negotiating with your car dealer or seeking help from a debt counseling service.

One option is to speak with your hire purchase lender directly about renegotiating your loan terms. It may involve extending the length of your loan or increasing your monthly instalments. If you can make these changes, it can help you avoid defaulting on your hire purchase agreement.

Another option is to seek help from a debt counseling service. These services can work with you and your lender to create a plan that allows you to repay your hire purchase loan without defaulting or falling behind on your payments.

Whatever approach you take, it is vital to act quickly if you struggle with your hire purchase agreement and want to get out of it. The sooner you take action, and the more options will be available to you.

Why Hire Purchase?

There are several reasons why a hire purchase can be a good financing option for your next car. One of the main advantages is that it can help you afford the cost of the car on hire purchase deal that you might not otherwise be able to purchase. It can also allow you to spread out the cost of your vehicle over a more extended period, making it easier to manage your monthly expenses.

Another benefit of hire purchase agreements is that they typically come with fixed interest rates, which can help you better budget for your monthly payments. When choosing a hire purchase car finance company or lender, it is essential to do your research to find one that offers terms and conditions that are right for your needs and budget.

If you’re considering a hire purchase for your next car purchase, CarFinanceMarket.co.uk can help you find the right loan option for your needs. We offer competitive rates and terms on all of our hire purchase agreements. Contact us today to learn more about how we can help you finance your next car.

Summary

A hire purchase finance in the UK is a type of loan that allows you to finance the purchase of both new or used cars or other large item by making regular monthly payments over an extended period. If you are struggling to make your payments or are looking to get out of your agreement, there are several steps that you can take, including negotiating with your lender or seeking help from a debt counseling service.

CarFinanceMarket.co.uk is a reputable hire purchase company in the UK that can help you find the right hire purchase loan for your needs. To learn more about hiring purchase loans and how they can help you finance your next car purchase, be sure to consult with a financial advisor or lender.