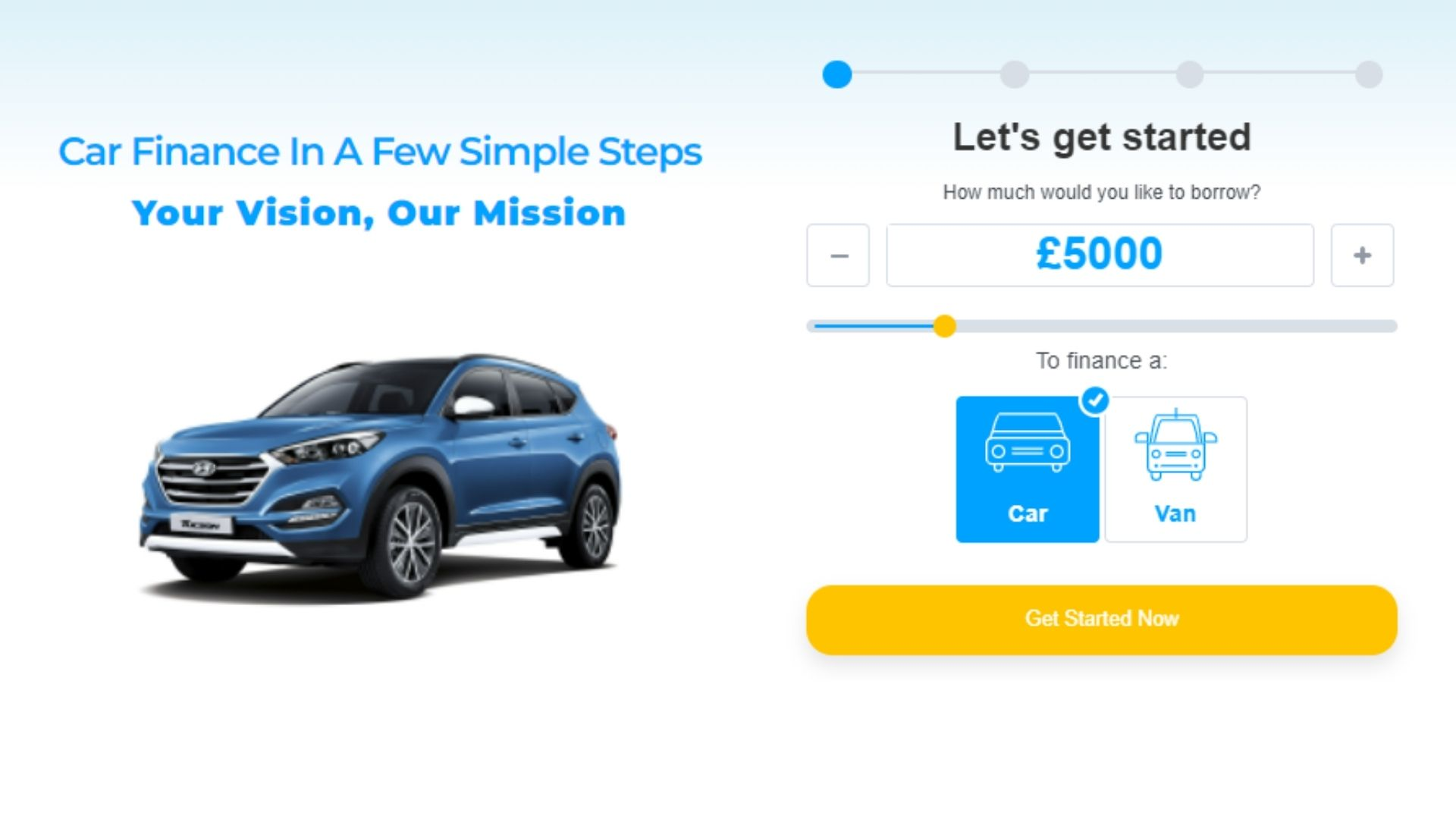

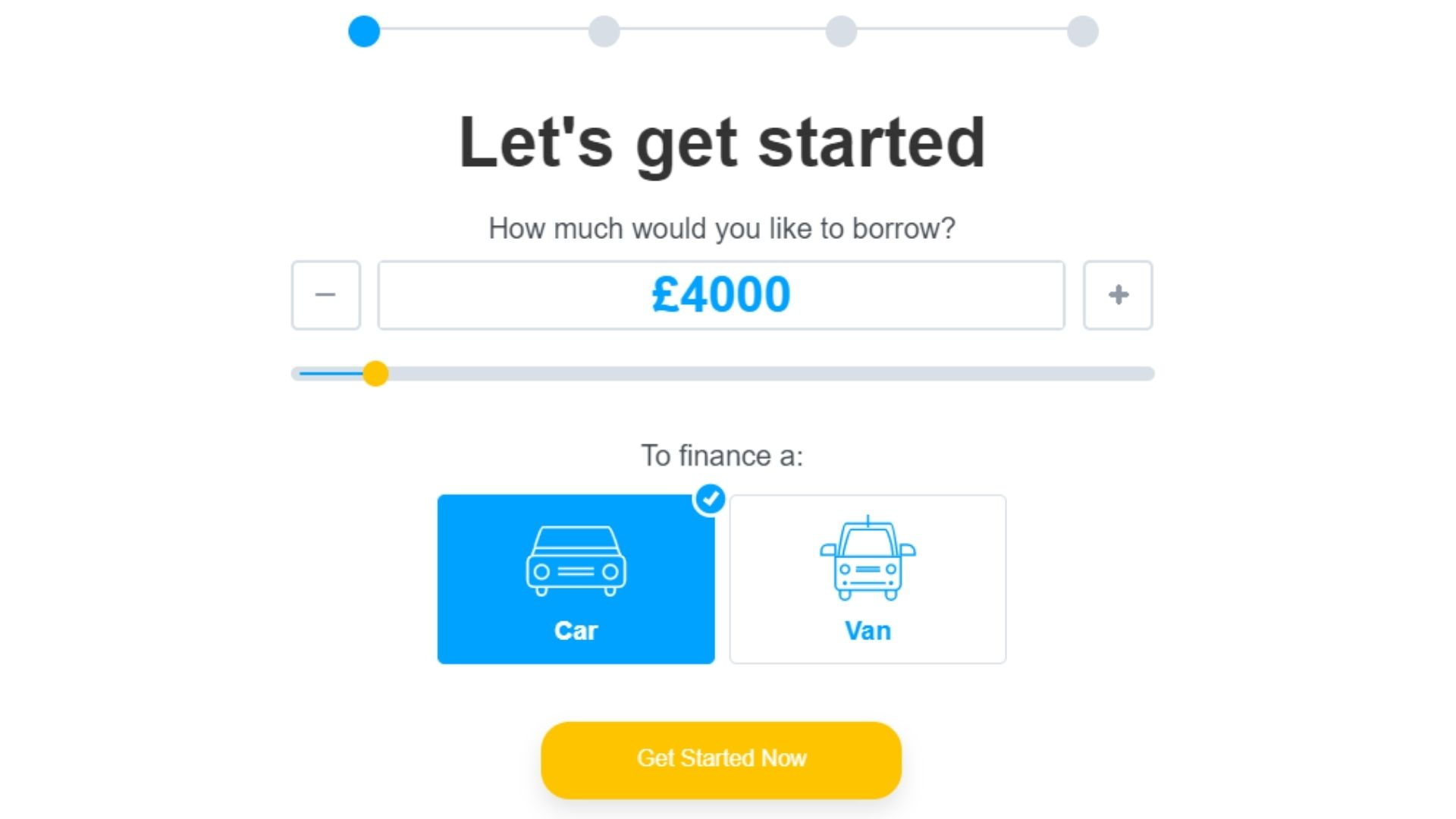

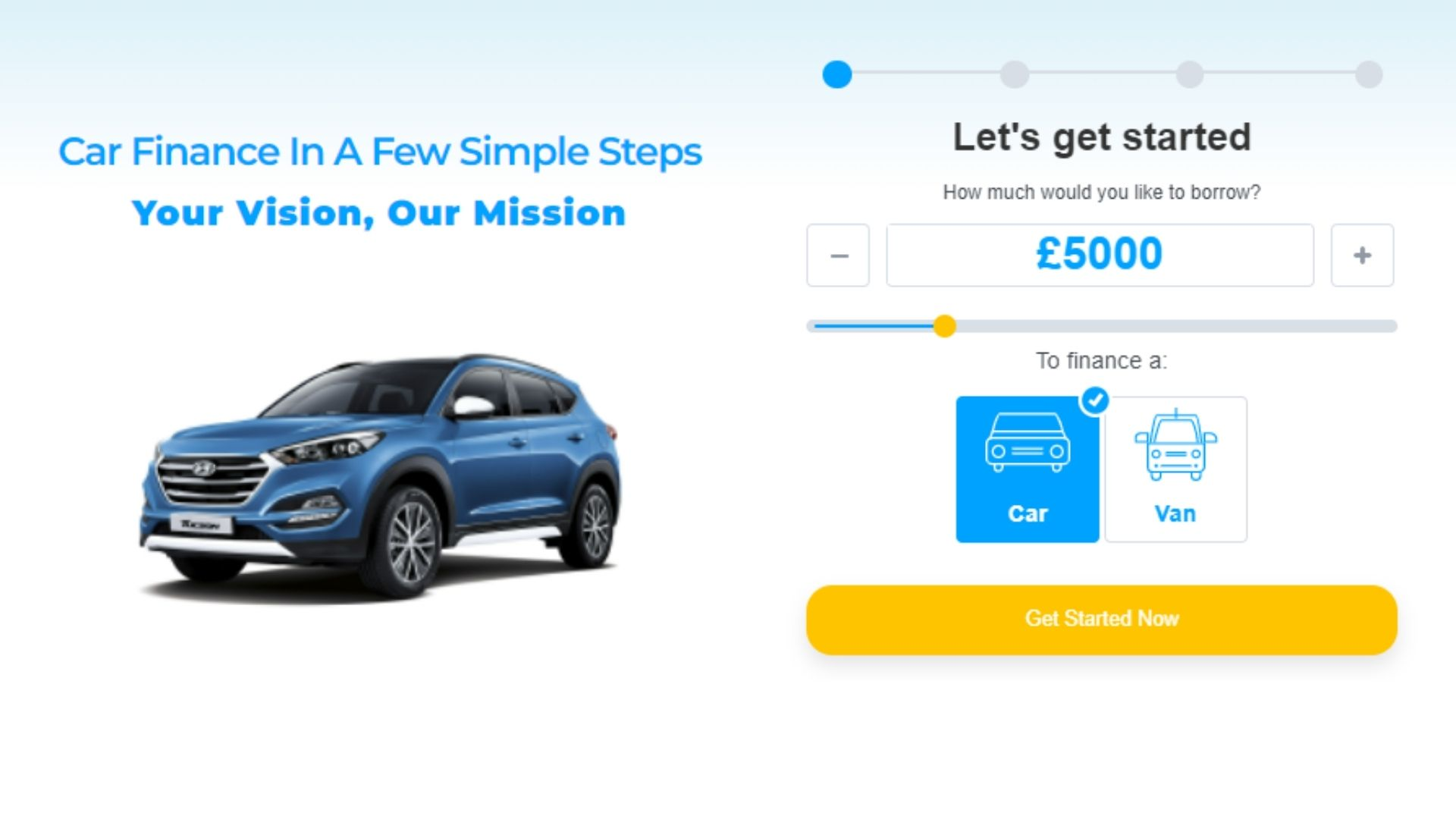

If you’re looking for a car, there are a few things you’ll need to take into account. One of the most important is how you’re going to pay for it. HP Finance offers a range of options when it comes to financing your new or used car. We offer both personal and business finance, so whether you’re buying a car for yourself or your company, we can help. In this article, we’ll give you an overview of HP Finance in UK and tell you what you need to know before applying.

Is Hire Purchase a Good Idea?

Hire purchase is a type of finance that allows you to spread the cost of your car over an agreed period of time. You’ll make monthly payments, and at the end of the term, you’ll own the car outright. This can be a good option if you’re looking to keep your monthly payments low, as you won’t have to pay for the full cost of the car upfront.

One of the benefits of HP finance is that you can often get a lower interest rate than if you were to take out a personal loan. This is because the finance is secured against the value of your car. However, it’s important to remember that if you miss a payment, you could lose your car.

If you’re thinking of applying for HP car finance, make sure you compare different offers to find the best deal for you. At Car Finance Market, we offer a range of options and can help you find the right one for your needs. Get in touch with us today to discuss your options.

How Does HP Finance Work on Cars?

HP finance works by spreading the cost of the car over an agreed period of time. You’ll make monthly payments, and at the end of the term, you’ll own the car outright. This can be a good option if you’re looking to keep your monthly payments low, as you won’t have to pay for the full cost of the car upfront.

A Hire Purchase arrangement can be carried out for a period of time that is convenient for you. You can choose to pay extra per month for a shorter period of time, such as 12 months, or up to 60 months. Just keep in mind that the longer the term, the higher the interest rate.

One of the benefits of Hire Purchase Finance is that you can often get a lower interest rate than if you were to take out a personal loan. This is because the finance is secured against the value of your car. However, it’s important to remember that if you miss a payment, you could lose your car.

Does HP Car Finance Do Monthly Payments?

HP Finance Cars or Hire Purchase work by spreading the cost of the car over an agreed period of time. You’ll make monthly payments, and at the end of the term, you’ll own the car outright. This can be a good option if you’re looking to keep your monthly payments low, as you won’t have to pay for the full cost of the car upfront.

At Car Finance Market, we offer a range of HP finance options to suit your needs. We can help you spread the cost of your car over a period of time that is convenient for you, such as 12 months or up to 60 months. Just keep in mind that the longer the term, the higher the interest rate.

Is it Better To Hire Purchase a Car?

There are a few things you’ll need to take into account when deciding whether HP finance is the right option for you. One of the most important is your credit score. If you have a good credit score, you’re more likely to be approved for Hire purchase car finance and get a lower interest rate. However, if you have bad credit, HP finance might not be an option for you.

Another thing to consider is how much you can afford to pay each month. HP finance typically requires you to make monthly payments, and the amount will depend on the term of your loan. The longer the term, the lower your monthly payments will be. However, keep in mind that if you choose a longer term, you’ll end up paying more in interest over the life of the loan.

How to Finance Cars Using Hire Purchase?

HP finance is a popular way to finance cars in the UK. It allows you to spread the cost of your car over an agreed period of time and can be a good option if you’re looking to keep your monthly payments low.

A deposit is usually required when purchasing an automobile through hire purchase. The deposit is normally at least 10% of the car’s worth, but individual lenders may accept a lower amount.

However, keep in mind that the lower your deposit, the more you will have to repay and the more expensive your entire finance agreement will be.

After paying the deposit, you will then pay off the remaining value of the automobile, plus interest, via monthly instalments, to the finance provider. Hire purchase terms often range between 12 and 60 months.

During the hire purchase contract, you will be registered as the vehicle’s “keeper,” but the loan provider will be the legal owner of the vehicle. This implies that if you fall behind on your payments, the supplier may repossess the vehicle.

At the end of the contract, you have the option to keep the car and become its legal owner by paying a final “option to purchase” cost. This is usually less than your regular monthly repayments and can be as little as £10, but you should check the terms of your contract to see exactly how much you would need to pay.

If you have repaid more than half of the entire amount owed under your hire purchase agreement, you may terminate the contract and return the vehicle. This is referred to as voluntary termination. Ending the contract in this manner will not hurt your credit rating, but it may appear on your credit report, and certain lenders may see this poorly if it is done frequently.

HP finance can be a great option for financing a car, but it’s important to do your research and make sure you understand the terms of your loan before you sign on the dotted line.

Is it Worth it To Do Hire Purchase on Cars?

HP finance can be a great way to finance a car, but there are a few things you should take into account before you decide if it’s the right option for you. One of the most important is your credit score. If you have a good credit score, HP finance might be a good option for you. However, if you have bad credit, Hire Purchase cars finance might not be an option for you.

Another thing to consider is how much you can afford to pay each month. HP finance typically requires you to make monthly payments, and the amount will depend on the term of your loan. The longer the term, the lower your monthly payments will be. However, keep in mind that if you choose a longer term, you’ll end up paying more in interest over the life of the loan.

Where Can I Get Hire Purchase Cars Near Me?

You can utilize hire purchase car finance to acquire new and used automobiles from dealerships, as well as from individual sellers. However, different lenders will have different constraints and may not be able to provide financing in all circumstances.

Most vehicle dealerships provide hire purchase, but it is also accessible from independent brokers.

If you obtain car loan from a broker, you will typically be able to utilize the funds to purchase any vehicle from any approved dealer, as long as it satisfies their specific terms and criteria. Once all paperwork is completed, the broker will send the appropriate cash to the car dealer.

Before determining where to receive your car finance, compare offers from several sources, including dealerships and online brokers.

Many providers will let you verify your eligibility online without affecting your credit score, so you can see how much you could potentially borrow and at what rate. You can examine different hire purchase agreements and compare them with other loan choices by looking at the APR and total cost of different arrangements.

Car Finance Market is one of the best HP Finance company in UK that offers great deals on HP cars. We offer a wide range of hire purchase cars to suit your needs and budget. We also have a team of experts who can help you find the best car for you. Contact us today to learn more about our services!

Can I Buy a Second Hand Car on Hire Purchase?

Yes, you can buy a used cars on Hire purchase finance. However, there are a few things you need to take into account before doing so. One of the most important is the age of the car. Most HP finance companies will only finance cars that are less than five years old. This is because older cars are more likely to have mechanical issues and may not be as reliable.

Another thing to consider is the mileage of the car. HP finance companies typically have a maximum mileage limit, and if the car you’re looking at exceeds this limit, you may not be able to finance it.

Finally, you’ll need to take into account the condition of the car. Hire Purchase finance companies will typically only finance cars that are in good condition. This means that the car should have no major damage and should be free of any mechanical issues.

If you’re looking to buy a used car on HP car finance, make sure you do your research and take all of these things into account. Car Finance Market is one of the leading HP finance companies in UK, and we can help you find the perfect car for your needs. Contact us today to learn more about our services!

Thoughts

Hire Purchase (HP) is a sort of car finance that allows you to buy a car outright without having to pay the entire price at once. There is also no significant final payment, like with Personal Contract Purchase (PCP finance). The total cost of the vehicle is divided into a deposit and a series of set monthly payments that are often spread out over two to five years. Once you’ve made the final payment, you automatically own the automobile.

While PCP finance has cheaper monthly payments for the same automobile (assuming the same deposit and contract length), drivers who want to purchase the car at the conclusion of the contract will spend less overall with Hire Purchase. Drivers also don’t have to come up with a huge sum of money with Hire Purchase to make a large final payment – known as the optional final payment – that is required to purchase the car with PCP finance.