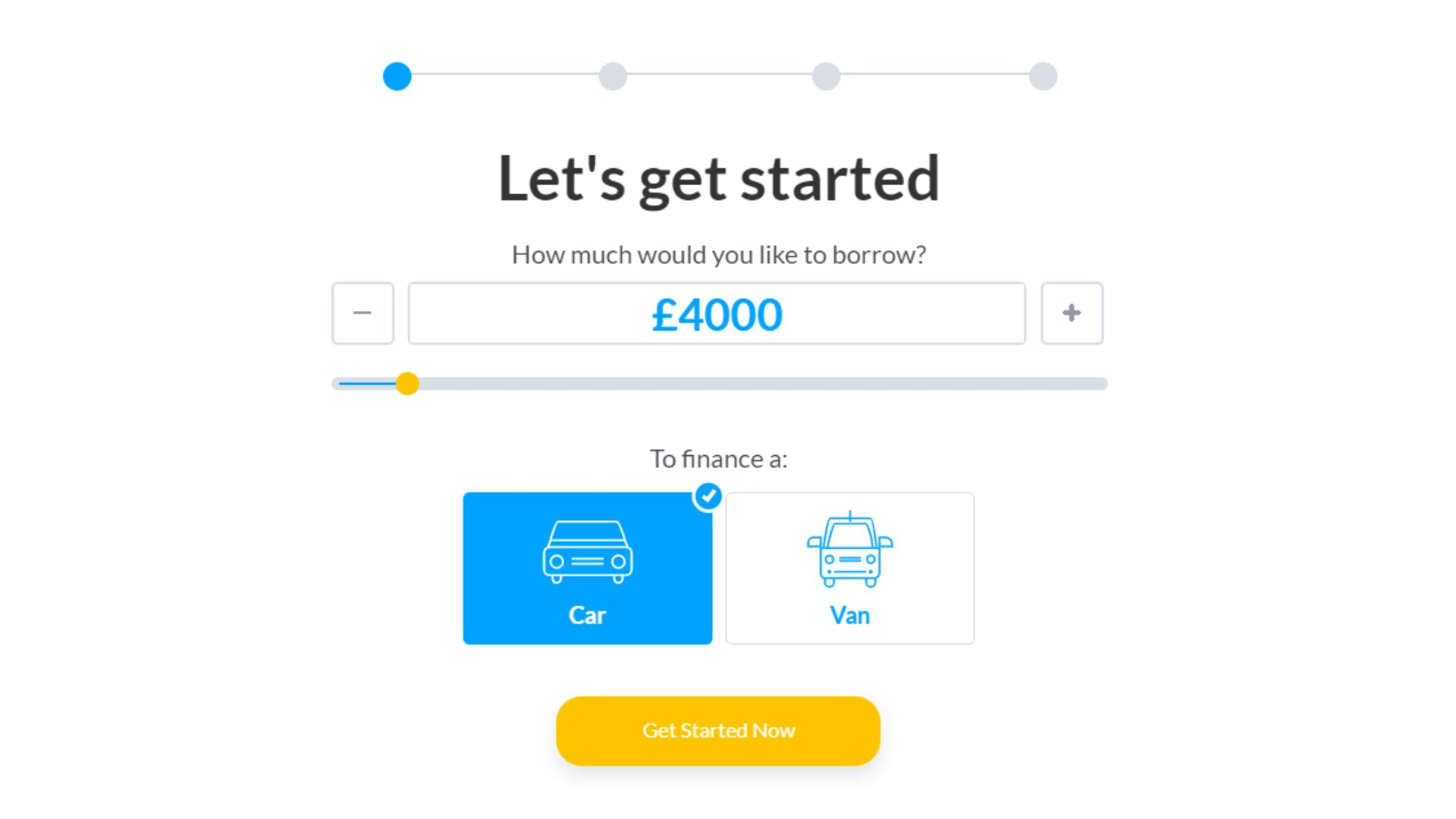

Instant car finance is basically what it sounds like – financing that you can get almost instantly, without having to go through a lot of the hassle and paperwork that comes with traditional car loans. There are a few different ways to get instant car financing, but the most common is probably through online lenders.

These online lenders specialize in providing fast and easy loans, and they can often get you the money you need within 24 hours or less. The car finance application process is usually pretty simple, and you can often get pre-approved for a loan before you even start shopping for a car.

Of course, instant car financing isn’t always ideal. Because it’s so easy to get, it can sometimes come with higher interest rates than other car financings.

How Does Instant Finance Work?

Instant finance is a type of short-term lending that allows you to borrow money against your next paycheck. The loan is typically due on your next payday, and the amount you can borrow depends on your current income and financial situation. Instant finance can be a helpful way to cover unexpected expenses or get through a tough financial period, but it’s important to understand the terms and conditions of your loan before signing a car finance agreement.

There are a few different types of instant finance, including payday loans, personal lines of credit file, and online lenders. Payday loans are typically small loans that must be repaid within a short period of time, usually two weeks. Personal lines of credit allow you to borrow against the value of your home or another asset, and usually have much lower interest rates than other types of loans. Online lenders are companies that offer loans completely online, and often have flexible repayments.

When you need cash fast, instant finance providers are the option that can provide the funds you need within 24 hours or less. The application process is simple and easy, and there are no credit checks required for the application.

Can I Get Instant Decision Car Finance?

Instant finance is a type of car finance that allows you to get a decision on your loan application within minutes. This means that you can know straight away whether or not you’re approved for the loan, and it also means that you can get your car financed more quickly at the registered office address.

Generally, instant finance is available to people who have good credit ratings. If you have a poor car credit rating, you may still be able to get a car loan, but it may take longer to process and the annual interest rate may be higher.

When you apply for car finance, the lender will usually do a “hard check” on your credit rating. This means that your credit score will be affected if you are approved for the loan.

How Do I Get a Car Finance Instant Decision?

There are a few things you can do to get an instant decision on car finance. First, shop around and compare rates from multiple lenders. This will give you a good idea of what rates are available and help you narrow down your options. Second, make sure you have all the necessary documentation in order before applying for financing. This includes things like proof of income, employment history, and other financial information. Finally, apply for financing or through a lender that offers instant decisions. This way you can get an answer right away and begin the process of buying your new car.

Conventional lenders such as banks or credit unions typically have the lowest interest rates, but they may require a higher down payment and take longer to approve your loan. Online lenders are often more flexible on terms and may be able to give you a decision more quickly, but they may charge higher interest rates. Private parties usually have the best interest rates, but it can be more difficult to negotiate terms and get approved.

Can I Get Car Finance Instant Decision With Bad Credit?

When it comes to financing a car, there are a few different options to choose from. One option is to go through a bank or Credit Union. Usually, the interest rates will be lower and you may even get your monthly payments lowered. Another thing to keep in mind is the limit on how much you can borrow. The credit score will also affect how much you might be able to qualify for. If you have a bad credit history, there are still lending institutions that will give you an auto loan with a cosigner; however, the terms might not be as favorable. You could also look into dealer financing, in which case the dealership would be loaning you the money for the car.

There are also a number of factors to consider when looking for car finance, but if you have bad credit then an instant decision may be difficult to come by. That said, there are a few things you can do to improve your chances:

-Start by checking your credit score and making sure that it is as high as possible. The higher your credit score, the more likely you are to be approved for financing.

-Shop around for lenders who specialize in bad credit car loans. There are a number of these lenders online and they may be able to provide you with an instant decision.

-Make sure that you have all of the required documentation ready before you apply for financing.

How to Qualify For Immediate Car Finance?

If you are in the market for a new or used car and need financing to make the purchase possible, you may be wondering how to qualify for immediate car finance. The good news is that there are a number of lenders who offer loans for cars, even for people with less than perfect credit scores for purchase fees.

To qualify for immediate car finance, you will likely need to meet a few basic criteria. First, you must be at least 18 years old and have a valid driver’s license. You will also need to provide proof of income and residency, as well as evidence of your current credit score and credit history. If you can provide all of this information, you are likely to be approved for a loan fairly quickly.

How To Apply For Instant Car Finance?

When it comes to instant car finance, there are a few things you need to know in order to get the best deal possible. First, you should always shop around for the best interest rates and terms. This can be done by using an online auto loan calculator or by going directly to the websites of different lenders.

Second, you should be aware of the different types of loans available. There are secured and unsecured loans, as well as loans for new and used vehicles. each type of loan has its own advantages and disadvantages, so make sure you understand all the details before signing a contract.

What Are The Requirements for Getting Instant Car Finance?

In order to be eligible for instant finance, you must have a valid driver’s license, proof of insurance, and a recent pay stub or bank statement.

You will also need to provide information about your current car loan if you have one, and your credit score. The lower your credit score, the higher the interest rate you will likely be offered on instant car finance.

If you are approved for instant car finance, the money will be deposited directly into your bank account. You can use this money to buy a new or used car from a dealership or private seller. Other requirements may vary depending on the lender, but generally, you will need to be 18 years or older, have a bank account, and be able to provide proof of income. You may also need to provide proof of residency and insurance for your vehicle.

Where Can I Get Instant Decision Car Finance Near Me?

If you’re looking for instant decision car finance, there are a few things you need to keep in mind. First, make sure that you have a good credit score. The better your credit score, the easier it will be to get approved for financing. Second, make sure that you have all of the necessary documents required for approval. These documents include proof of income, proof that you are self-employed, and a valid driver’s license. Finally, make sure that you apply for financing through a reputable lender. There are many reputable lenders who offer instant decision car finance, so shop around and compare rates before making a decision.

If you follow these tips, you should be able to easily find instant decision car finance that meets your needs and budget.

Conclusion

Car finance instant decision is a process that can be completed in minutes, with the help of an online application. The requirements to qualify are not as stringent as other forms of financing. You may be able to get car finance instant decision even if you have bad credit. To apply for this form of financing, simply fill out an online application and provide the necessary documentation. If you are approved, the money will be deposited into your account immediately so you can go shopping for your perfect car for the best price.