There are a few key differences to be aware of when it comes to van financing vs. owning a van. First, with van financing, you typically pay a fixed monthly rate to lease your van from the lender. It means that you will have access to a van without worrying about the upfront costs of purchasing one outright.

On the other hand, owning a van lets you thoroughly control your van and its features. With this option, you will own your van outright and be responsible for all maintenance costs and repairs. Additionally, owning a van can provide you with tax benefits since it is considered an asset.

Which van financing option is right for you will ultimately depend on your needs and budget. If you need van finance, compare rates and terms from multiple lenders to find the best deals. And, if you decide to purchase a van outright, be sure to factor in all of the associated costs so that you can make an informed decision.

Is Van Finance Available for Both Businesses and Individuals?

Van loan is a type of van finance available to businesses and individuals. You typically pay a fixed monthly instalments rate to lease your van with a van loan from the lender. This option can be a good choice if you need van financing but don’t want to worry about the upfront costs of purchasing a van outright.

However, it’s important to compare van loan rates and terms from multiple lenders before deciding. Additionally, be sure to factor in all of the associated costs with van ownership, such as maintenance and repairs, when making your decision.

Van finance is an excellent option for businesses and individuals who need a van but don’t want to purchase one outright. By comparing van finance options from multiple lenders, you can find the best deal that meets your needs and budget.

Additionally, when making your decision, it’s essential to factor in all of the associated costs with van ownership, such as maintenance and repairs.

With van finance, you can get the van you need without worrying about the upfront costs of purchasing one outright. So whether you’re looking for van finance to buy a van for your business or a commercial van loan to lease a van for personal use, there are plenty of options to choose from. Just be sure to compare van financing rates and terms from multiple lenders before deciding.

What are the Benefits of Van Finance?

Some of the main benefits of van finance include lower upfront costs, more accessible access to a van and more flexibility in van ownership. As a result, Van financing can be ideal for businesses or individuals that need a van but don’t want to make a significant upfront investment.

Additionally, van financing can provide you with tax benefits since it is considered an asset under most circumstances. And if you decide to hire purchase your van outright at the end of your loan term, you will have complete control over its features and maintenance requirements.

So whether you’re looking for van loans for personal use or van finance deals for business needs, there are plenty of options available to help meet your needs. Just be sure to compare van loans or van finance rates and terms from multiple lenders before deciding on getting a new van.

When Should I Apply for a Van Finance?

If you’re considering van finance, it’s vital to compare van finance rates and terms from multiple lenders before deciding—Additionally, factor in all of the associated costs with van ownership, such as maintenance and repairs. Once you’ve researched different van finance guides and decided that van financing is right for you, the next step is to apply for van financing.

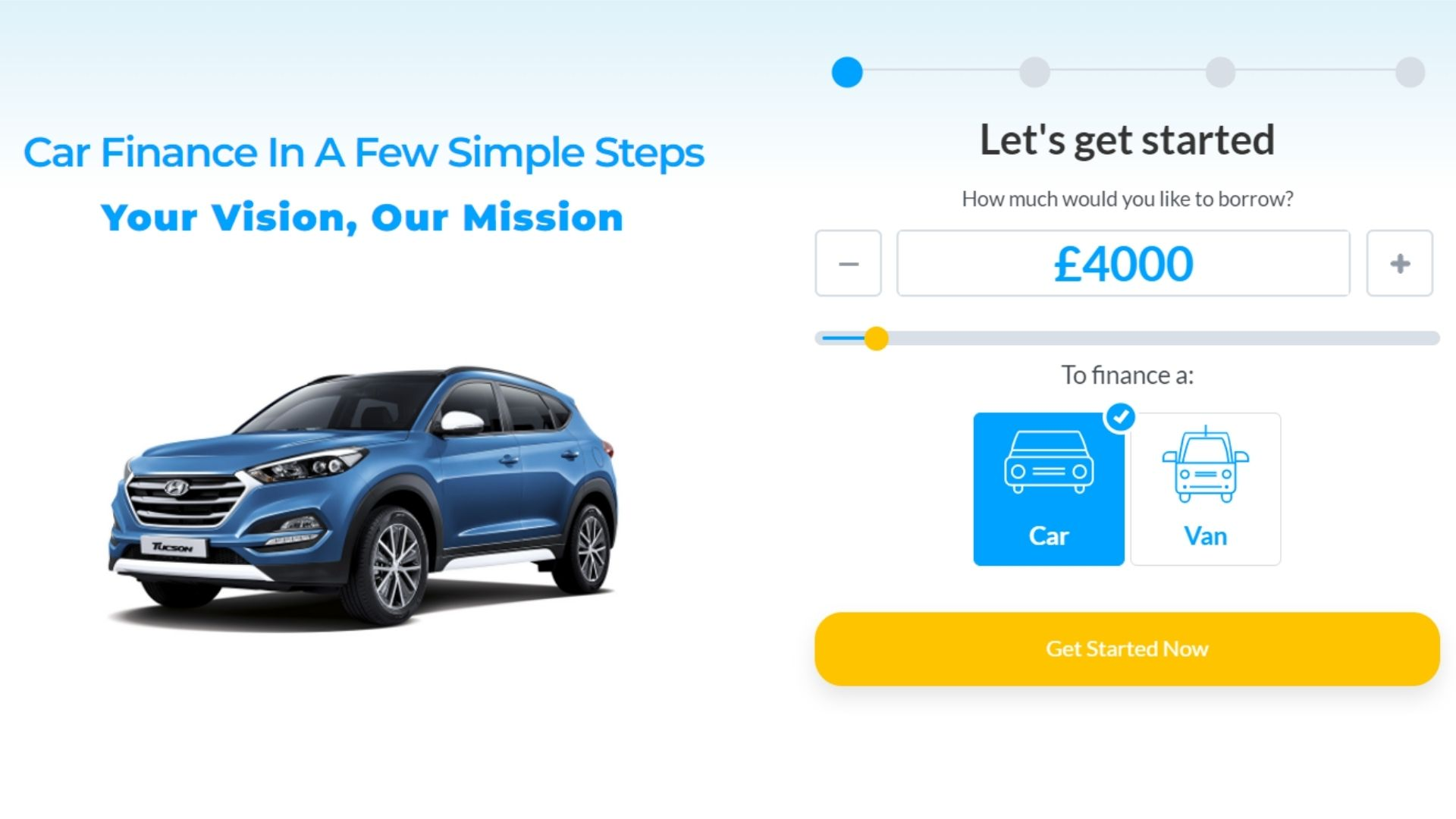

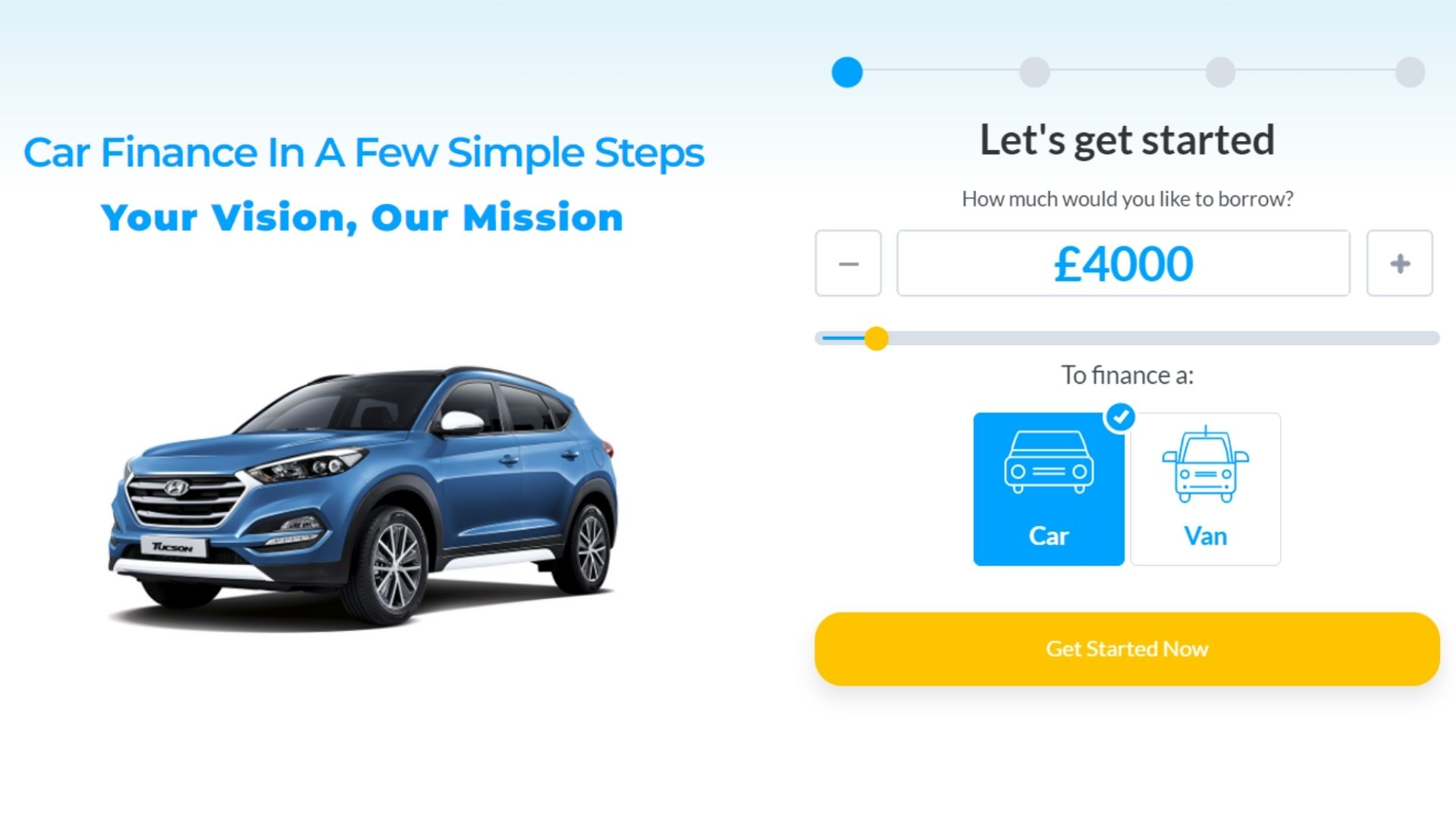

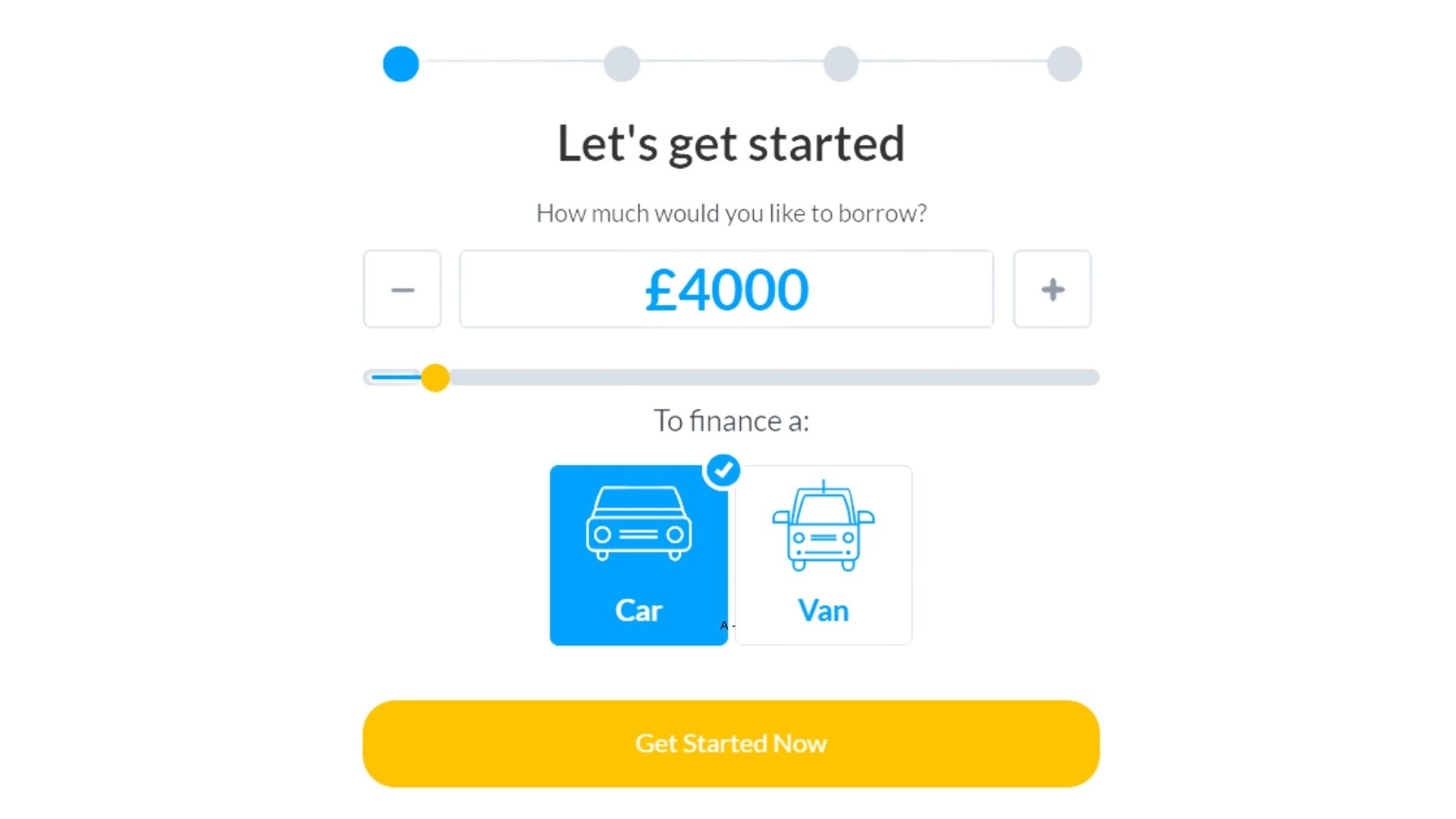

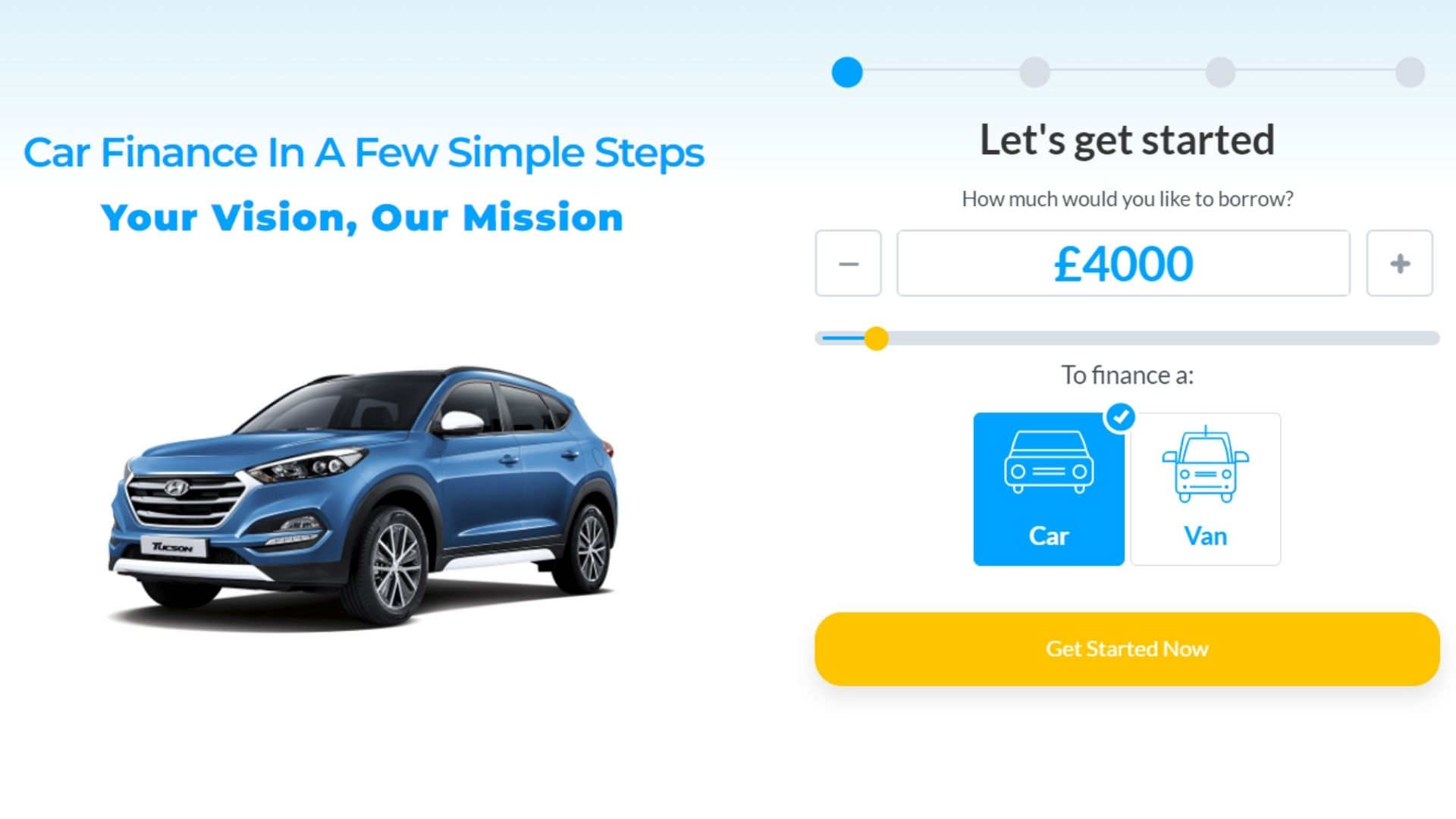

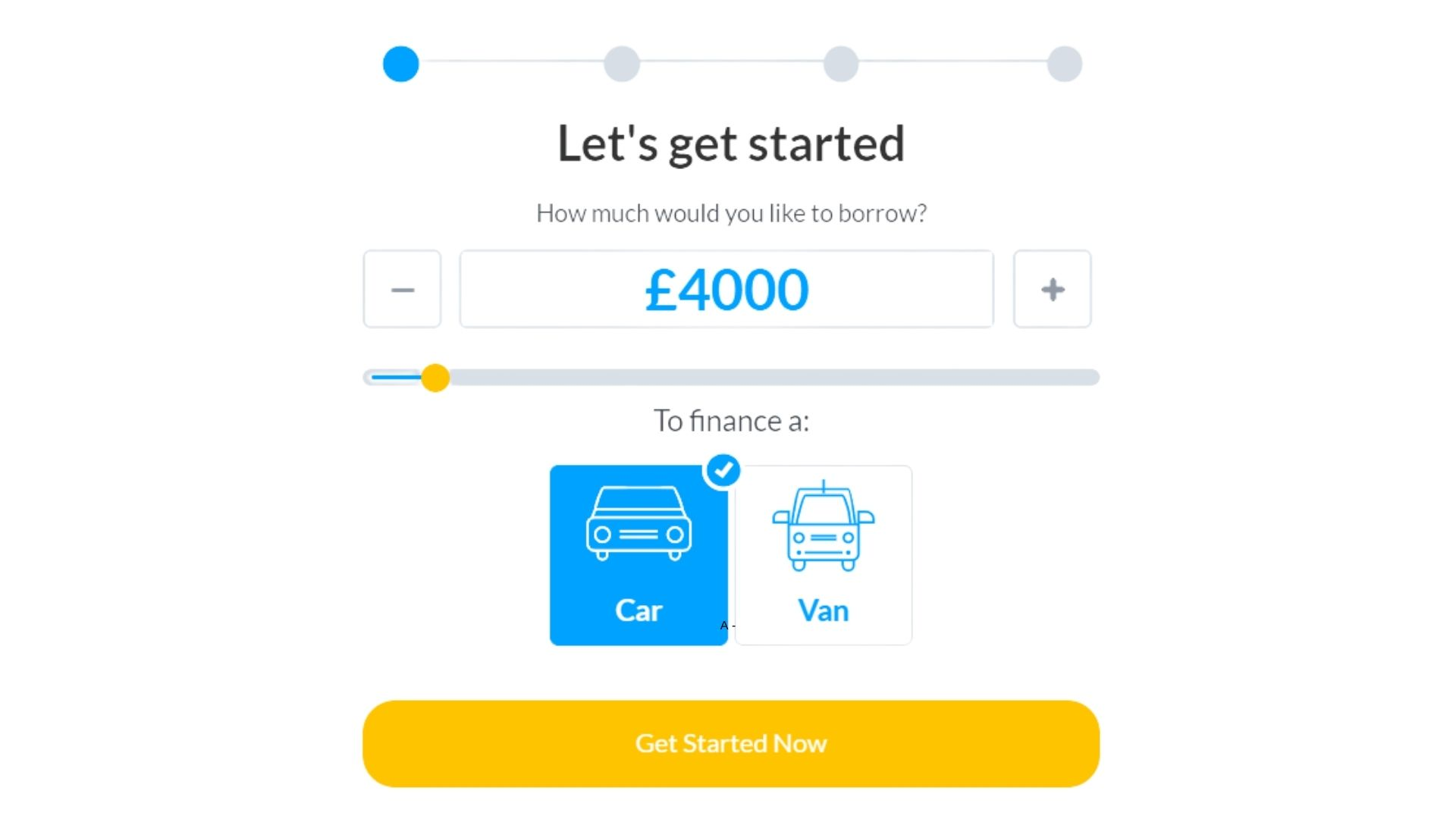

Fill out an online application form with your personal and financial information. Once you’ve been approved for van financing, you’ll be able to choose the van you want and begin making monthly payments. In most cases, van financing is available for both businesses and individuals. So whether you need a van for commercial use or personal use, there’s van financing to meet your needs.

When it comes to van finance, timing is everything. Applying for van financing as soon as you start shopping for a van can help you get the best rates and terms. Additionally, if you’re purchasing a van outright, factor in all of the associated total cost like the interest rate and exact rate to make an informed decision.

What to Consider in Applying for a van Finance Company?

There are a few things to keep in mind when applying for a van finance company. First, van finance rates and terms can vary significantly from lender to lender. As a result, it’s essential to compare van finance options from multiple lenders before deciding. Additionally, van financing can be an excellent option for businesses or individuals who need a van but don’t want to make a significant upfront investment.

When considering van finance, it’s also essential to factor in all associated costs with van ownership—such as maintenance and repairs. You can decide whether van financing is right for you by taking these factors into account.

And if you choose to apply for van financing, be sure to have all of the necessary information and documentation on hand, including your personal and current financial situation details. Then, with the right preparation and research, you can find van finance that fits your needs and budget.

How Can I Finance a Van?

There are many ways to finance a van, including van loans and van finance deals. For example, you could compare van finance rates and terms from multiple lenders to find the best deal for your needs. Additionally, you can look for incentives or special offers from dealers that may help reduce your upfront costs.

Another option is to consider leasing a van instead of purchasing one outright. Leasing can offer more flexibility in terms of usage and maintenance requirements, making it a good choice for individuals or businesses that want access to a van without all the responsibilities associated with owning one.

Ultimately, whether you’re looking for personal or business van finance, the key is to do your research and take the time to compare options before making a final decision. Then, with the proper preparation and planning, you can finance a van that meets your needs and budget.

Will I Have to Pass a Credit Check to Finance a Van?

In most cases, van finance companies will require a credit check as part of the application process for a van on finance. However, van financing may still be possible if you have bad credit. If you’re looking for van finance with bad credit, keep a few things in mind.

First, van finance rates and terms may be different than they would be for someone with good credit. Additionally, van financing may require a larger down payment or higher monthly payments. Therefore, it’s essential to compare van finance options from multiple lenders before deciding.

Additionally, van financing may be an excellent option for businesses or individuals who need a van but don’t want to make a significant upfront investment. When considering van finance, it’s also essential to factor in all associated costs with van ownership—such as maintenance and repairs.

You can decide whether van financing is right for you by taking these factors into account. With the proper preparation and research, you can find van finance on carefully selected credit providers that fit your needs and budget—even if you have bad credit.

How Long Can I Finance Van?

There is no definitive answer to this question, as the length of the finance van will depend on several factors. These might include your credit history, the type and value of the van you are financing, and the specific finance terms offered by your lender. As such, it’s essential to carefully review all of these details before signing any finance contract.

Some general guidelines can help give you an idea of what to expect regarding van or vehicle finance guides and terms. For example, if you have a good credit rating and purchase a used van or older van with little or no equity, most lenders may offer finance terms of up to 72 months.

On the other hand, if you have bad credit or need to finance a new vehicle, popular vans, or more expensive vans, finance terms may be shorter—usually 48 months or less.

What is the Most Reliable Van Finance Company?

There is no definitive answer to this question, as the reliability of a van finance company will depend on several factors. These might include the lender’s reputation and history, the types of financing they offer, and the terms and conditions of their contracts.

That said, one option for reliable van finance is CarFinanceMarket.co.uk. This lender is known for offering competitive rates and flexible financing options, and excellent customer service and support throughout the application process. So if you’re looking for reliable van financing that meets your needs and budget, Car Finance Market may be an excellent choice!

Summary

Van finance offers several benefits, from flexibility in usage and maintenance to lower upfront costs. Whether you’re looking for personal or business van finance, it’s essential to do your research and compare options before making a final decision.

And if you have bad credit, there are still options available—including CarFinanceMarket.co.uk, a reputable lender that offers competitive rates, flexible financing terms, offer guaranteed van finance, and brand new vehicles. With the right preparation and planning, you can find the right van finance that fits your needs and budget, no matter your credit history.

Car Finance Market is authorised and regulated by the financial conduct authority van finance company in the UK. We offer competitive rates and flexible financing terms. Car Finance Market is an excellent choice for a reliable and guaranteed van finance company in the UK that meets your needs and budget. For further information, contact us today at CarFinanceMarket.co.uk.

We will help you in arranging car finance products, bad credit van finance, personal contract purchase, personal contract hire, and find finance van loan for your personal use, and more.