Assuming you would like a van for personal or business use, there are two ways to obtain one: financing and leasing. Both have pros and cons, so it’s essential to understand the critical differences between them to make the best decision for your needs.

With van finance, you will be required to take out a loan to purchase the van outright. You will then make monthly repayments on the loan, plus interest until it is paid off. Once the loan is repaid, the van will be yours to keep.

With leasing, you will effectively be renting the van from a leasing company. You will make monthly payments for an agreed period, after which you will need to return the van to the leasing company. However, leasing can be a more flexible option as it may be possible to upgrade to a new van after a few years rather than being stuck with the same vehicle for the duration of the loan.

What are the Pros and Cons?

The critical difference is that you will eventually own the van outright with van finance, while with leasing you will not. If you opt for financing, you may need to sell the van or trade it in when you come to upgrade, whereas, with leasing, you can hand the van back to the leasing company.

There are some key pros and cons of each option before making your decision.

Van on Finance, pros, and cons,

Pros:

- You will eventually own the van outright.

- You may be able to get a lower interest rate on a loan than you would with a lease.

- You can sell the van or trade it in when you come to upgrade.

Cons:

- You will need to take out a loan, which may be difficult if you have a bad credit history.

- You will need to make monthly repayments on the loan, plus interest.

- You may be tied to the same van for several years.

Leasing, pros and cons,

Pros:

- You can upgrade to a new van after a few years.

- You will not need to take out a loan.

- Your monthly payments may be lower than with finance.

Cons:

- You will not own the van outright.

- You may need to give the van back to the leasing company at the end of the lease period.

- You may have to pay more in the long run if you buy the van at the end of the lease.

How Many Years Can You Finance a Van?

The typical van loan term is around five years, although you may be able to extend this to seven years in some cases. Leasing terms are usually shorter, typically about three years. This means that you may upgrade to a new van more often if you lease rather than van finance.

The best option for you will depend on your circumstances and needs. For example, leasing may be the most tax-efficient option if you need a van for business purposes and can claim back the VAT. On the other hand, if you need a van for personal use and can afford to make higher monthly payments, financing may be the best option as you will eventually own the van outright. Consider all of your options carefully before making a decision.

Does Van finance company check your employment record in UK?

Your employment record is a history of your past and present employment. The van finance company will use this to assess your financial situation and whether you can afford the monthly repayments on the loan. They may also check your credit history to see if you have any outstanding debts. If you have a bad credit history, it may be more challenging to get van finance.

What Credit Score is Needed to Finance a Van in the UK?

In the United Kingdom, there is no minimum credit score required to finance a van. If you have a solid credit history, getting van financing may be easy. It may be more challenging to obtain funding if you have a poor credit history. When reviewing your application for financing, the van finance business will look at your financial condition and work history.

Bad credit van finance is hard to be approved for. Arranging finance options will need a guaranteed van finance company and a great offer. Personal contract hire and personal contract purchase also offer guaranteed van finance.

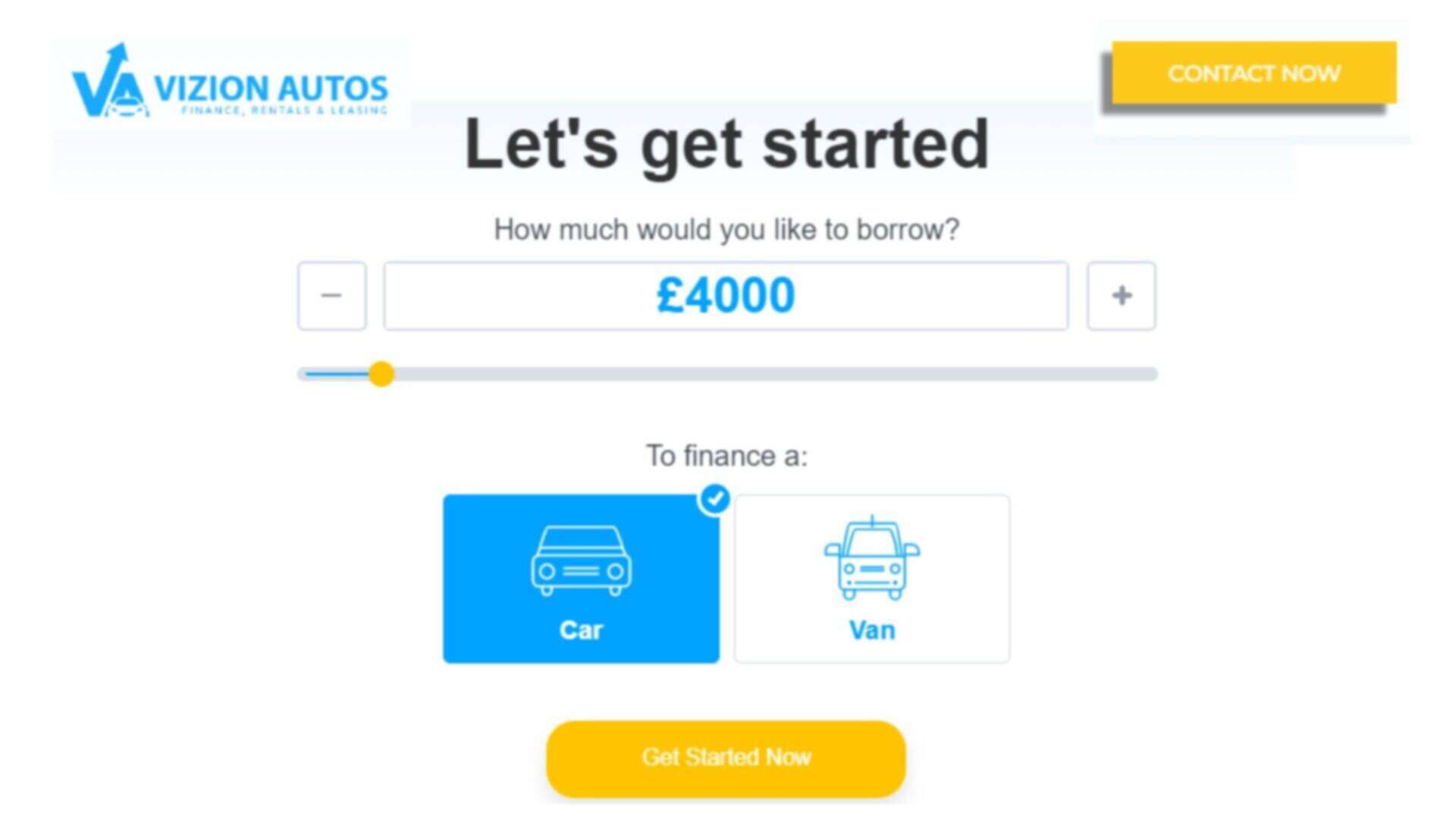

How Can I Get A Quote For Van Finance?

You can contact a financial institution or broker to get a quote for van financing. You will need to provide personal and financial information, such as your name, address, date of birth, and employment history. The lender will use this information to assess your creditworthiness and determine whether you are eligible for financing. Once you have been approved for financing, you can choose a repayment plan that suits your budget for outstanding van on finance.

What Documents Do I Need to Finance a Van?

When you apply for van financing, you must provide personal and financial information. This includes your name, address, date of birth, and employment history. You may also need to provide proof of income, such as payslips or tax returns for not a lender finance deals of documentation. The lender will use this information to assess your creditworthiness and determine whether you are eligible for financing.

If you do not meet the requirements for van financing, you may still be able to get financing from another lender. However, it is essential to compare different lenders to find the best van finance deals. You should also be aware that if you have a bad credit history, you may be required to pay a higher interest rate of your brand new vehicles with a good credit rating.

How Old Do You Have To Be To Get Vans on Finance?

There is no minimum age requirement for van financing in the United Kingdom. However, you must be 18 or older to apply for financing. The lender will also assess your creditworthiness and employment history to determine whether you are eligible for funding. In addition, the law requires that you be of legal age to enter into a contract. This protects you from being taken advantage of by someone older and more experienced.

When you apply for van finance, you enter into a contract with the lender. This means that you are responsible for making the monthly payments on the loan. If you default on the loan, the lender can take legal action against you. This is why you must be of legal age and understand the terms of the contract before you sign it.

Conclusion

To sum up, the critical difference between van finance and van leasing is that you will eventually own the van outright, while with leasing, you will not. Before making your decision, each option has some key pros and cons. The best choice for you will depend on your circumstances and needs. Consider all of your options before making a final decision.

A van loan is a loan that enables you to buy a van outright. Compared to van leasing, monthly costs are usually lower. However, you will eventually be required to repay the entire loan amount plus interest. You will not own the van at the end of the lease time, but you will not be required to make monthly payments. You must instead return the van to the leasing company.