When you are looking for a new car, one of the most important things to consider is the interest rate. This is especially true if you are financing your purchase. Luckily, Car Finance Market offers some of the best interest rates in the industry! In this blog post, we will discuss what HP Finance has to offer and how you can get the best interest rate on your next car purchase.

Does Hire Purchase Have High Interest?

One of the most common questions we get at Car Finance Market is whether or not hire purchase has high interest. The answer is no! We offer some of the lowest interest rates in the industry on all of our HP finance options. So, if you are looking for a new car and want to finance your purchase, Car Finance Market is the place to go! We can help you get the best interest rate on your next car purchase. Contact us today to learn more about our Hire Purchase finance options and how we can help you save money on your next car purchase!

How is Hire Purchase Interest Rate Calculated?

When shopping for a new car and examining the many financing options, it’s critical to understand how each is priced. This is done so that you may make an informed decision about which loan agreement is best for you. It will also provide complete transparency, as you should always be aware of what you are paying for.

Hire Purchase, sometimes known as HP, is a finance deal that is calculated differently than a leasing contract (such as Contract Hire).

You will agree to pay a deposit at the start of a Hire Purchase HP Finance. This might be as little or as much as you desire. You will also be given the option of making a balloon or final payment. This is a larger payment made at the end of your contract to pay off any leftover finance. The price of a car hire purchase is often determined as follows:

- Calculate the interest on the amount you are borrowing

- Divide the interest rate by the total number of payments.

Customers typically have access to far more discounts with a lease agreement such as Contract Hire than with a finance deal such as a Hire Purchase. At Car Finance Market, we have access to fleet discounts that are not normally available to private individuals, allowing you to receive a better deal on your Hire Purchase arrangement. There is also the possibility that the manufacturer will provide a deposit contribution.

The interest rate on HP finance is calculated based on a number of factors, including the amount of money you are borrowing, the length of time you need to repay the loan, and your credit score. Car Finance Market offers some of the lowest interest rates in the industry, so you can be sure that you are getting a great deal on your next car purchase! Contact us today to learn more about HP finance and how we can help you save money on your next car purchase!

What Are The Benefits of Hire Purchase Car Finance?

Before we answer this question let’s have a brief overview on how does hire purchase work? A deposit will be paid at the commencement of the agreement; often, you will pay upfront, part exchange your old vehicle, or a mix of the two. The smaller the monthly payments, the bigger the initial deposit. The fixed monthly payments and contract length will then be agreed upon.

Hire purchase car finance is a great way to finance your next car purchase. There are many benefits to HP finance, including the following:

- You can get a new car for a low monthly payment.

- You can choose the length of time you want to finance your car.

- You can pay a balloon payment at the end of your finance term to lower your monthly payments.

- You can get a great interest rate on HP finance.

- You can obtain newer, higher-specified vehicles.

- You can split the cost over a set period of time.

- The interest rate is set in stone.

- At the end of the contract, you will own the car.

- Possibility of paying off the hire purchase agreement early.

- There are less constraints.

How Does APR Affect Hire Purchase Price?

The APR on a Hire Purchase may vary depending on your credit score. If you have a perfect or nearly perfect credit score, you will most likely receive the ‘typical APR.’ Around 51% of people receive average APR, which implies you have a 1 in 2 chance of qualifying.

In any case, if you have a less-than-perfect credit score, your APR will rise since you are viewed as a somewhat higher risk.

This is not a part of a Personal Contract Purchase or Contract Hire deal, although it can happen on Hire Purchase.

The more the amount borrowed and the longer the duration, the higher the interest rate. Though calculating the interest rate (the APR) is difficult, if you know the flat rate, you can calculate the monthly payments. Normally, the flat rate on a new automobile (assuming you have excellent credit) would be between 2.5 percent and 4 percent. Of course, if you have a less-than-perfect credit score, the flat cost will be slightly higher. If you have less-than-perfect credit, the flat rate may be closer to 5% to 8%. If your credit score is low, the flat rate will be greater once again.

How To Get a Hire Purchase Loan?

If you’re interested in getting a Hire purchase loan, the first step is to fill out an application. You can do this online or in person at a dealership. Once you’ve submitted your application, a decision will be made based on your credit score and other factors. If you’re approved for financing, you’ll then need to choose the length of time you want to finance your car and make a down payment. Once you’ve made these decisions, you’ll be ready to sign the loan agreement and drive off in your new car!

What Are The Risks of Hire Purchase?

Before you enter into a Hire Purchase finance agreement, it’s important to understand the risks involved.

As previously stated, failure to make monthly payments means that the vehicle may be repossessed, as it is used to secure the loan by the credit finance company. You do not own the automobile until the final instalment – plus any final transfer cost – is paid.

Furthermore, hire-purchase clients incur more of the risk of depreciation than PCP customers: if the vehicle’s value depreciates quicker than predicted, the customer must continue making the pre-agreed monthly payments and eventually gain ownership of the automobile. Taking ownership of the vehicle at the end of the loan period is optional with PCP.

Who Offers The Best HP Car Finance Deals in UK?

If you’re looking to the best HP car finance deals in the UK, Car Finance Market is the place to go. We offer competitive interest rates and can help you save money on your next car purchase! Contact us today to learn more about our HP finance options. and to help you compare hire purchase deals. We look forward to helping you get the car of your dreams!

What is The Difference Between a Lease and a Hire Purchase Agreement?

The following facts explain the distinction between hire purchase agreement and lease financing:

- Hire Purchase is a financing arrangement in which one party pays consideration to the other party in periodic instalments to finance the use of an asset. Leasing is a business transaction in which one party purchases an asset and offers the other party the right to use it in exchange for lease rentals.

- The Accounting Standard for Leasing is AS – 19, however there is no specific Accounting Standard for Hire Purchase Finance.

- A down payment is required for hire-purchase but not for leasing.

- Leasing has a longer period than hire purchase.

- Leasing can involve assets such as land and buildings, plants and machinery, and so on. Cars, trucks, tempos, vans, and other assets, on the other hand, are sold on hire purchase.

- In hire purchasing, the instalment comprises both the principal and interest. In contrast to leasing, where the lease merely pays for the cost of using the item.

- Ownership is transferred to the hirer only if all outstanding instalments are paid in

full. In contrast, in a finance lease, the lease has the opportunity to purchase the

asset at the end of the term for a small purchase fee, whereas in an operating lease,

the lease has no such option.

Thoughts

In comparison to a lease arrangement, there is less that can affect the cost of a Hire Purchase because it is a financial deal. Overall, this is due to the fact that at the end of the agreement, you own the vehicle, so you don’t have to worry about mileage or general wear and tear, etc. However, it is critical that you understand how the price is calculated and the factors that can influence what you pay.

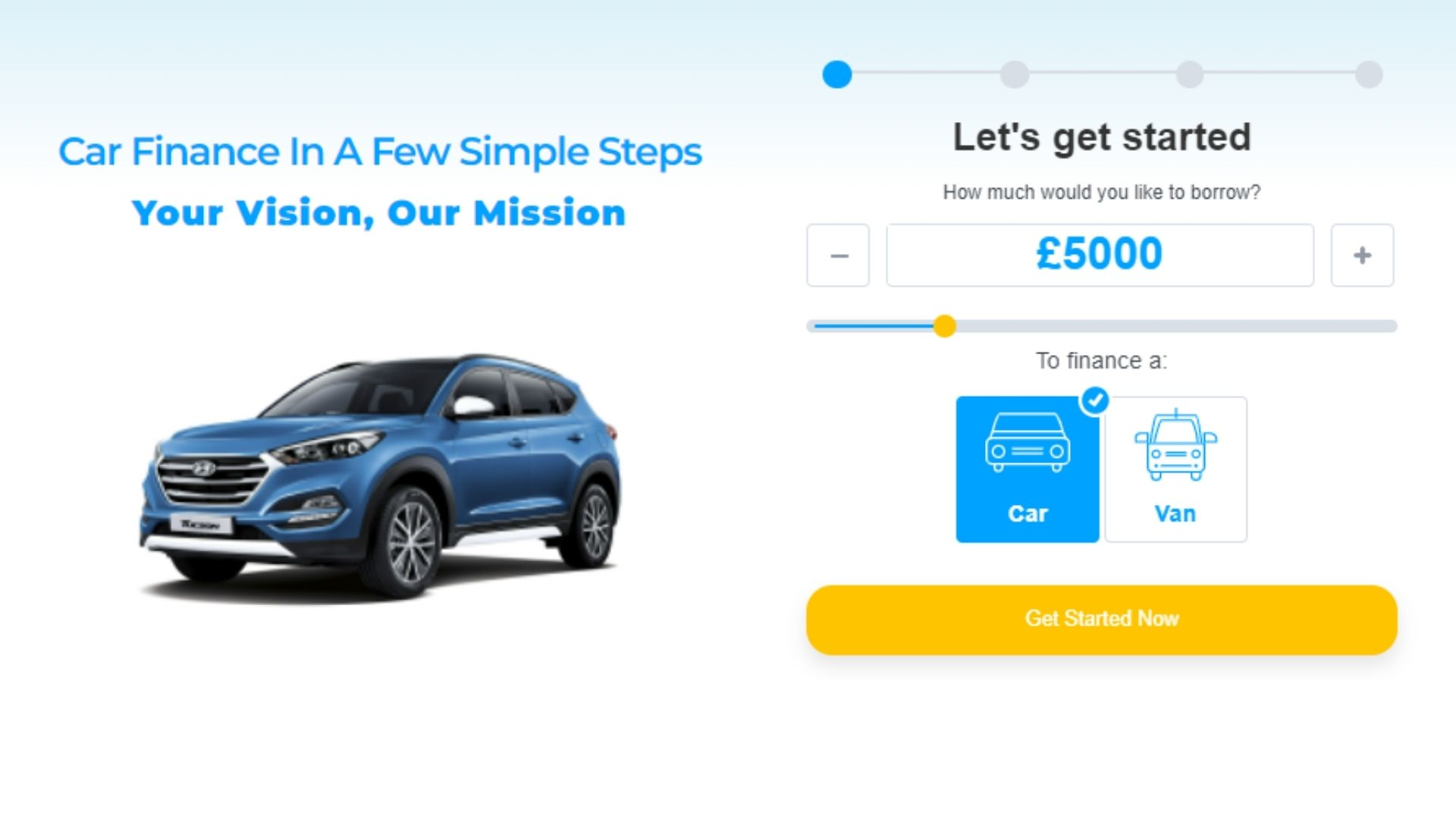

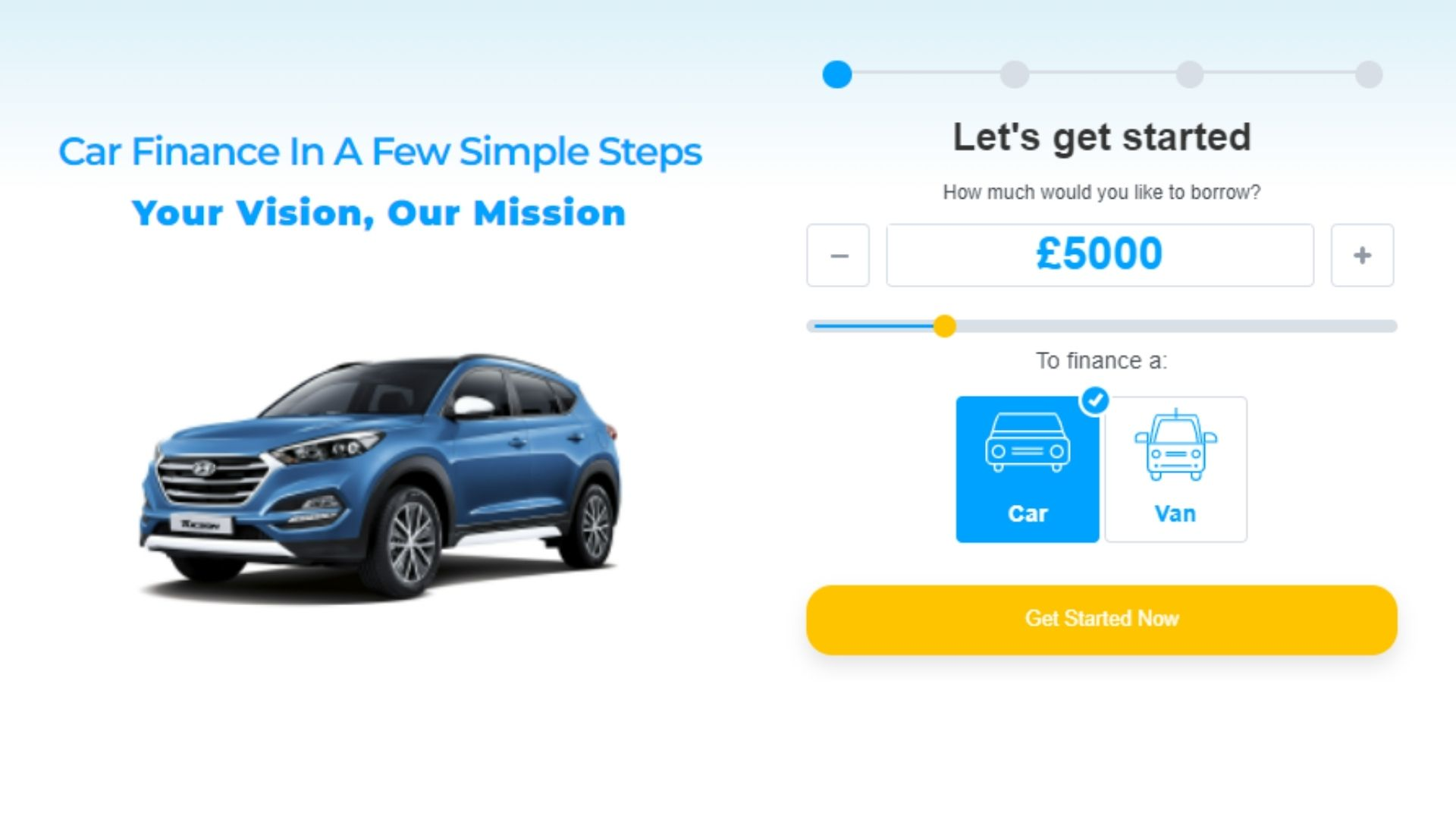

Car Finance Market, is not a lender but a group of highly professional brokers and we offer guaranteed van finance, competitive rates, flexible terms, and a variety of financing options. We work with a number of different lenders to make sure you can get the car you need. Arranging finance with us has never been easier so contact us today to get started.